- Home

- »

- Advanced Interior Materials

- »

-

U.S. Timber Construction Market Size, Industry Report, 2033GVR Report cover

![U.S. Timber Construction Market Size, Share & Trends Report]()

U.S. Timber Construction Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Residential, Non-residential), By Timber Type (Softwood, Hardwood, Engineered Wood), And Segment Forecasts

- Report ID: GVR-4-68040-699-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Timber Construction Market Summary

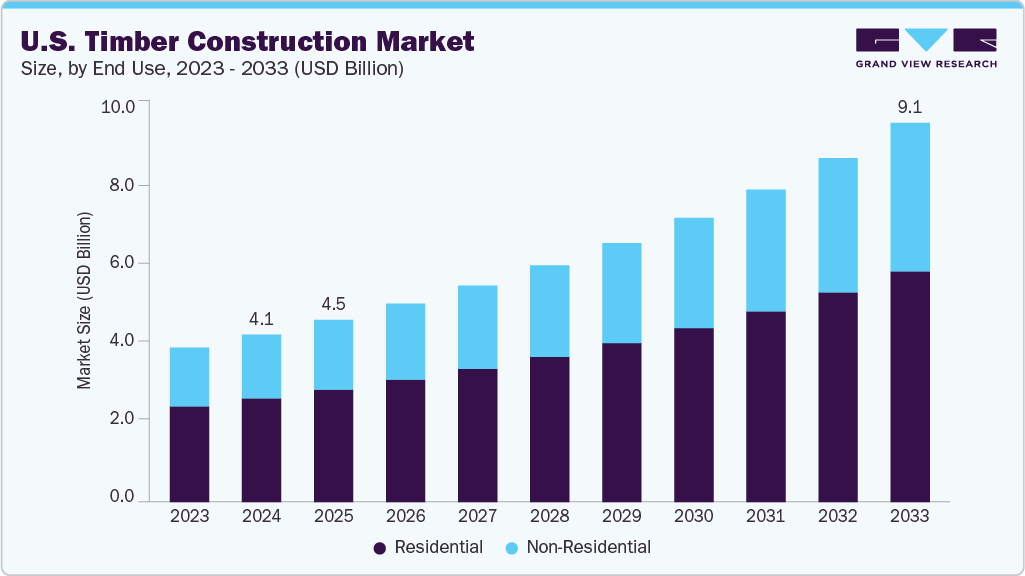

The U.S. timber construction market size was estimated at USD 4.12 billion in 2024 and is projected to reach USD 9.08 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The industry is driven by a growing emphasis on sustainable and eco-friendly building practices.

Key Market Trends & Insights

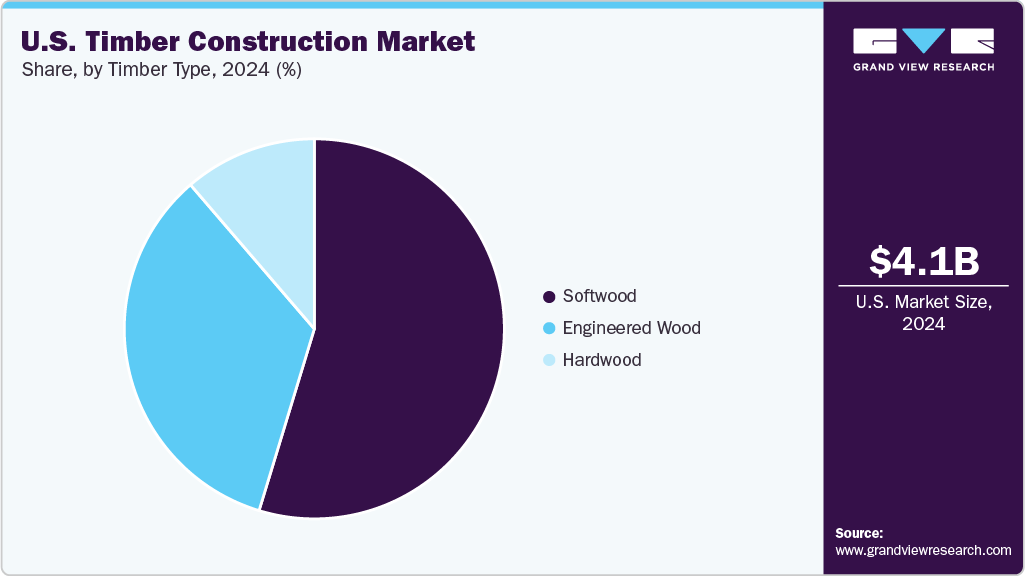

- By timber type, the engineered wood segment is expected to grow at the fastest CAGR of 9.8% over the forecast period.

- By end-use, the non-residential segment is expected to grow at the fastest CAGR of 9.6% over the forecast period.

- The U.S. timber construction industry is driven by increasing adoption of green building practices, a growing preference for prefabricated and modular wood structures, and rising investments in residential and commercial infrastructure development using sustainable materials.

Market Size & Forecast

- 2024 Market Size: USD 4.12 Billion

- 2033 Projected Market Size: USD 9.08 Billion

- CAGR (2025-2033): 9.3%

As environmental regulations tighten and awareness of carbon emissions increases, timber-especially engineered wood products such as cross-laminated timber (CLT)-is gaining popularity for its lower environmental impact compared to traditional construction timber types like steel and concrete. This shift is supported by green building certification systems such as LEED, which further incentivize the use of renewable resources in construction. Urban developers and architects are increasingly favoring timber for its versatility and aesthetic appeal, particularly in mid-rise and multi-family housing projects. Advancements in mass timber technology have enabled timber to meet stringent structural and fire-resistance standards, making it a viable option for more complex and larger-scale developments. This appeal is especially prominent in cities promoting modern, sustainable urban infrastructure.

Government policies and incentives are also playing a critical role in promoting timber construction in the U.S. Federal and state-level initiatives that support the use of renewable timber types, along with funding for research and pilot projects, are driving adoption. The U.S. Department of Agriculture, through its Wood Innovation Grant Program, continues to fund projects that explore the structural and environmental benefits of timber in commercial and public buildings.

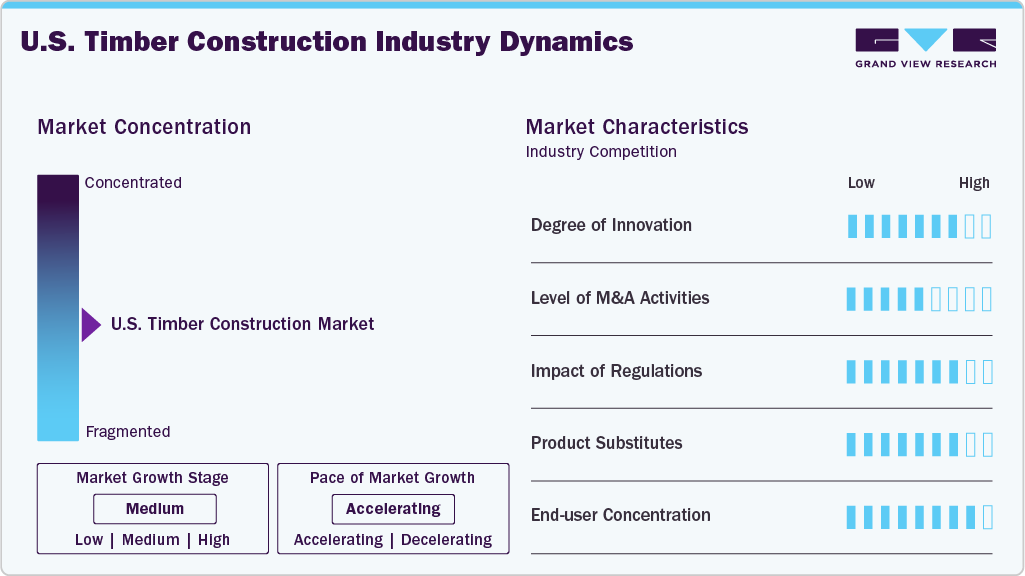

Market Concentration & Characteristics

The industry exhibits a moderately concentrated structure, characterized by the presence of both established players and a growing number of innovative entrants specializing in engineered wood products. The degree of innovation is relatively high, driven by technological advancements in cross-laminated timber (CLT), glue-laminated timber (glulam), and modular timber systems. These innovations are improving load-bearing capacity, fire resistance, and design flexibility, thereby expanding timber's application in commercial and multi-story residential buildings. Product development is often supported by collaborations between construction firms, architects, and research institutions, leading to a dynamic and evolving product landscape.

In terms of industry dynamics, the market has seen moderate levels of mergers and acquisitions, particularly among manufacturers and construction firms aiming to consolidate their supply chains or expand their geographic reach. Regulatory frameworks play a pivotal role, with evolving building codes gradually accommodating mass timber usage in taller structures-an essential factor enabling market growth. Substitution threats exist, particularly from steel and concrete; however, timber’s environmental appeal, ease of use, and thermal efficiency position it as a strong alternative in the green construction space. The end-use market is becoming increasingly concentrated, with demand primarily stemming from the residential, institutional, and commercial construction segments that are actively pursuing sustainable building solutions.

End Use Insights

The residential segment held the highest revenue market share of 61.91% in 2024, driven by the growing demand for sustainable and energy-efficient housing solutions. With rising awareness of environmental concerns and increasing support for green building initiatives, homeowners and developers are increasingly opting for timber as a primary construction material due to its renewable nature and lower carbon footprint. Additionally, advancements in engineered wood products and prefabrication technologies have made timber-based construction more viable and cost-effective for single-family homes and multi-residential units. Government incentives for energy-efficient residential buildings and the integration of modern architectural designs using timber further reinforce the segment’s expansion across urban and suburban regions.

The non-residential segment is expected to grow at the fastest CAGR of 9.6% over the forecast period,driven by the rising adoption of mass timber in commercial, institutional, and public infrastructure projects. Developers are increasingly recognizing timber’s structural strength, aesthetic appeal, and sustainability benefits, making it a favorable choice for office buildings, schools, and community centers. Supportive building code reforms across various U.S. states have also enabled taller and larger timber structures, expanding their application in mid-rise and high-rise developments. Additionally, faster construction timelines, reduced site waste, and improved thermal performance make timber an attractive option for non-residential construction. This trend aligns with broader environmental goals and corporate sustainability mandates across sectors.

Timber Type Insights

The softwood segment held the highest revenue of 54.7% in 2024, driven by its widespread availability, cost-effectiveness, and favorable structural properties. Softwood varieties such as pine, fir, and spruce are commonly used in framing, paneling, and structural components due to their lightweight and ease of processing. Their renewable nature and compatibility with prefabrication technologies have further increased their demand in sustainable building practices. Moreover, softwood is increasingly being incorporated into engineered wood products, enhancing its versatility in both residential and commercial projects. The segment’s growth is also supported by growing investments in timber processing facilities and supply chain efficiency across North America.

The engineered wood segment is expected to grow at the fastest CAGR of 9.8% over the forecast period, driven by its superior strength-to-weight ratio, dimensional stability, and design flexibility. Products such as cross-laminated timber (CLT), laminated veneer lumber (LVL), and glued laminated timber (glulam) are gaining traction across residential and non-residential projects due to their ability to support long spans and resist warping. Engineered wood also enables greater material efficiency and reduces construction time through precision prefabrication. Growing interest in green building certifications, such as LEED and WELL, is further boosting the segment, as these materials often carry lower embodied carbon compared to traditional concrete or steel. The rising adoption of hybrid construction methods is also enhancing the integration of engineered wood in modern architectural design across the U.S.

Key U.S. Timber Construction Company Insights

Key players operating in the U.S. timber construction market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Timber Construction Companies:

- Weyerhaeuser Company

- West Fraser Timber Co. Ltd.

- Canfor Corporation

- Georgia-Pacific LLC

- Boise Cascade Company

- Interfor Corporation

- Simpson Strong-Tie Company Inc.

- Stora Enso Oyj

- Structurlam Mass Timber Corporation

Recent Development

-

In May 2025, InventWood, a Maryland-based firm, introduced “Superwood,” a timber type 10 times tougher than steel and resistant to water and fire. This innovation strengthens the position of engineered wood in the U.S. construction market. Superwood addresses durability and safety concerns, making it ideal for large-scale infrastructure. Its launch highlights the rising role of advanced wood technologies in sustainable building.

U.S. Timber Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.46 billion

Revenue forecast in 2033

USD 9.08 billion

Growth rate

CAGR of 9.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, timber type

Country scope

U.S.

Key companies profiled

Weyerhaeuser Company; West Fraser Timber Co. Ltd.; Canfor Corporation; Georgia-Pacific LLC; Boise Cascade Company; Interfor Corporation; Simpson Strong-Tie Company Inc.; Stora Enso Oyj; Structurlam Mass Timber Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Timber Construction Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. timber construction market report based on timber type and end use:

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Timber Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Softwood

-

Hardwood

-

Engineered Wood

-

Frequently Asked Questions About This Report

b. The U.S. timber construction market size was estimated at USD 4.12 billion in 2024 and is expected to reach USD 4.46 billion in 2025.

b. The U.S. timber construction market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2033 to reach USD 9.08 billion billion by 2033.

b. Residential segment held the highest revenue market share of 61.91% in 2024, driven by the growing demand for sustainable and energy-efficient housing solutions.

b. Some of the prominent companies in the timber construction market include Weyerhaeuser Company, West Fraser Timber Co. Ltd., Canfor Corporation, Georgia-Pacific LLC, Boise Cascade Company, Interfor Corporation, Simpson Strong-Tie Company Inc., Stora Enso Oyj, and Structurlam Mass Timber Corporation

b. Key factors driving the U.S. timber construction market include growing demand for sustainable building materials, increasing adoption of green construction practices, and advancements in engineered wood technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.