- Home

- »

- Next Generation Technologies

- »

-

U.S. Transcription Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Transcription Market Size, Share & Trends Report]()

U.S. Transcription Market (2025 - 2030) Size, Share & Trends Analysis Report By Vertical (Legal, Medical, Media And Entertainment, BFSI, Government, Education), By Type (Software, Services), And Segment Forecasts

- Report ID: GVR-4-68038-404-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Transcription Market Size & Trends

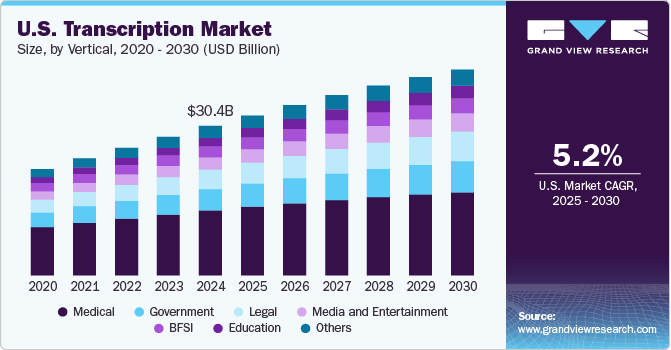

The U.S. transcription market size was valued at USD 30.42 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The market is primarily driven by the increasing need for accurate and efficient documentation across various industries, including legal, medical, media and entertainment, BFSI, government, and education. In addition, businesses are leveraging transcription services to ensure accurate records of virtual events and communications, which are crucial for transparency, compliance, and collaboration. This trend, combined with the increasing popularity of remote and hybrid working models, is expected to further fuel the market growth in the coming years.

The widespread adoption of transcription services in the healthcare industry is boosting market growth. With the rise of electronic health records (EHRs) and stringent regulations such as the Health Insurance Portability and Accountability Act (HIPAA), the demand for precise medical transcriptions has escalated. The need to accurately document patient records while maintaining confidentiality has made transcription services a crucial component in healthcare, thereby driving the market expansion.

In addition, the legal sector's reliance on transcription services for creating accurate legal documents, court proceedings, and depositions is boosting the market growth. The need for quick and error-free transcription services is increasing as legal firms continue to handle a volume of case data. The U.S. legal system’s demand for clear, well-documented transcriptions is further fueling the market’s growth, particularly in areas such as speech-to-text software integration, where accuracy and turnaround time are essential. This trend is expected to drive the market expansion.

Furthermore, people with hearing impairments are increasingly opting for transcription services to participate effectively in public meetings, office events, academic lectures, and religious gatherings. These services help transcribe telephone calls, sermons, and academic content, making communication more accessible. Transcription services are also widely used for podcasts, conference calls, and content such as presentations and speeches. This growing reliance on transcription services underscores their vital role in fostering inclusivity and enhancing communication for individuals with hearing impairments across various settings, further contributing to the market growth.

Moreover, U.S.-based companies are employing various strategies, including leveraging artificial intelligence and machine learning to enhance transcription accuracy and efficiency, as well as forming strategic partnerships to broaden service offerings and improve turnaround times. For instance, in September 2024, Otter.ai revealed research indicating that its AI Meeting Assistant significantly boosts productivity, with 62% of professionals saving over four hours per week-equating to more than a month of work annually. The company's focus on automating transcription and enhancing productivity through AI aligns with the broader trends in the transcription industry, which is increasingly integrating advanced technologies to improve accuracy and efficiency. This trend is expected to drive market expansion in the coming years.

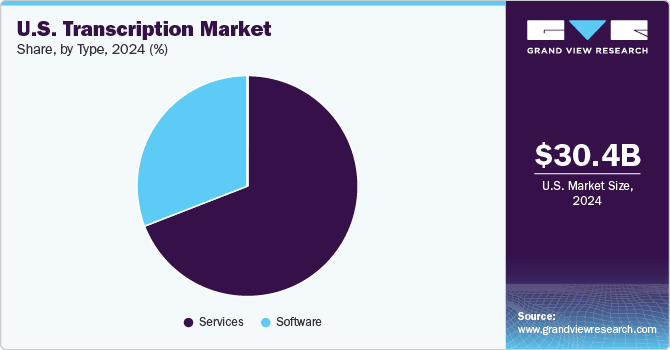

Type Insights

The software segment accounted for a significant market share in 2024, owing to the increasing adoption of AI-powered transcription tools and speech recognition software across industries. These technologies provide faster, more accurate transcription with minimal human intervention, appealing to sectors such as healthcare, legal, media, and education that require real-time or high-volume transcription. The cost-efficiency, scalability, and continuous improvement of transcription software have contributed to its widespread adoption, further solidifying the segmental growth.

The services segment is expected to register a significant CAGR from 2025 to 2030, driven by the growing demand for personalized, industry-specific transcription services. Sectors such as healthcare and legal require transcription services that ensure confidentiality, compliance with regulations, and high accuracy in specialized terminology. Additionally, the demand for human transcription services remains strong in cases where context, nuance, and linguistic complexity are crucial, complementing AI-powered solutions. This rising need for tailored transcription solutions is expected to propel the growth of the services segment.

Vertical Insights

The medical segment accounted for the largest market share of over 43% in 2024, owing to the increasing demand for accurate and efficient documentation in healthcare settings. This growth is driven by several factors, including the rising adoption of advanced reporting techniques and automation in medical services, which enhance operational efficiency and data accuracy. Additionally, the prevalence of hearing impairments among the population has intensified the need for transcription services to ensure accessibility and compliance with regulatory standards.

The legal segment is expected to witness the fastest CAGR from 2025 to 2030, owing to the critical need for accurate and detailed documentation of court proceedings, depositions, and legal documents. Legal firms heavily rely on transcription services to manage the increasing volume of case-related data, ensuring precise, error-free records. The sector's demand for compliance, confidentiality, and high-quality transcripts is expected to drive segmental growth in the coming years.

Key U.S. Transcription Company Insights

Some of the key players operating in the market are 3Play Media and VITAC, among others.

-

3Play Media is a provider of closed captioning, transcription, and audio description services focused on making video content accessible to all. The company has grown significantly through strategic acquisitions, including Captionmax and National Captioning Canada, which have enhanced its service offerings and market presence. 3Play Media emphasizes high-quality output, boasting a 99% accuracy rate across more than 25 languages, and offers a comprehensive platform that integrates various media accessibility solutions.

-

VITAC is another player in the transcription and captioning industry, known for delivering high-quality closed captioning services across multiple platforms. The company provides solutions tailored for broadcast, digital media, and live events, ensuring that content is accessible to diverse audiences. The company focuses on innovation, recently introducing AI-driven tools to enhance its offerings further.

TranscribeMe Inc. and Robin Healthcare are some of the emerging participants in the U.S. Transcription market.

-

TranscribeMe Inc. is a player in the U.S. transcription market, specializing in speech-to-text services across various industries, including medical, legal, and AI training. The company utilizes a hybrid model that combines advanced Automatic Speech Recognition (ASR) technology with a network of highly trained human transcriptionists. With a commitment to quality and efficiency, the company has established itself as a leader in providing scalable transcription solutions tailored to meet the diverse needs of its clients.

-

Robin Healthcare is an innovative company focused on transforming the medical documentation process through advanced technology. By leveraging artificial intelligence and a team of trained medical scribes, the company provides real-time transcription services that allow healthcare providers to focus more on patient care rather than administrative tasks. The company aims to improve healthcare delivery by streamlining workflows and reducing the burden of paperwork on clinicians, ultimately leading to better patient outcomes.

Key U.S. Transcription Companies:

- 3Play Media

- VITAC

- TranscribeMe, Inc.

- Moretti Group

- Robin Healthcare

- Peterson Reporting

- TSG Reporting, Inc.

- Captionmax LLC

- Nuance Communication, Inc.

- MModal IP LLC.

Recent Developments

-

In August 2024, 3Play Media collaborated with NBC Sports aimed at enhancing accessibility for the upcoming Paris Paralympics, following a successful partnership during the Olympic Games. This initiative focuses on providing high-quality captioning for over 4,000 video highlights, utilizing a combination of Automatic Speech Recognition (ASR) and human-produced captions to ensure accurate representation of diverse athletes' names and sports terminology.

-

In April 2024, VITAC unveiled its new AI-powered transcription and captioning solution, Captivate, at the National Association of Broadcasters (NAB) show in Nevada, U.S This innovative tool, developed in-house, combines advanced technology with extensive industry experience to deliver high-accuracy transcripts and captions tailored to specific user needs.

-

In April 2024, 3Play Media launched an innovative AI Dubbing solution that combines human-edited transcripts and translations with advanced AI voice-matching technology. This development aims to enhance localization efforts, making dubbing a viable option for content distribution.

U.S. Transcription Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.58 billion

Revenue forecast in 2030

USD 41.93 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Vertical

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vertical, type

Country Scope

U.S.

Key companies profiled

3Play Media, VITAC, TranscribeMe, Inc., Moretti Group, Robin Healthcare, Peterson Reporting, TSG Reporting, Inc., Captionmax LLC, Nuance Communication, Inc., MModal IP LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Transcription Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. transcription market report based on vertical and type:

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Legal

-

Medical

-

Media and Entertainment

-

BFSI

-

Government

-

Education

-

Corporate

-

Academics

-

K-12

-

Undergraduates

-

Universities

-

Individual

-

-

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Electronic Reporting

-

Digital Recording

-

-

Services

-

Frequently Asked Questions About This Report

b. The U.S. transcription market size was estimated at USD 30.42 billion in 2024 and is expected to reach USD 32.58 billion in 2025.

b. The U.S. transcription market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 41.93 billion by 2030.

b. Medical segment dominated the U.S. transcription market with a share of over 43% in 2024. This is attributable to the rising adoption of advanced reporting techniques and continued automation of medical and healthcare services.

b. Some key players operating in the U.S. transcription market include 3Play Media; VITAC; TranscribeMe Inc.; Moretti Group; Robin Healthcare; Peterson Reporting; TSG Reporting, Inc.; Captionmax LLC; Nuance Communication Inc.; and MModal IP LLC.

b. Key factors that are driving the market growth include the growing adoption of transcription services across medical and legal sectors and growing need for accurate data.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.