- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Transparent Plastics Market Size, Industry Report, 2033GVR Report cover

![U.S. Transparent Plastics Market Size, Share & Trends Report]()

U.S. Transparent Plastics Market (2025 - 2033) Size, Share & Trends Analysis Report By Polymer Type (PET, PVC, PP, PS, PC, PMMA), By Form (Rigid, Flexible), By Application (Medical & Healthcare, Automotive, Consumer Goods, Packaging), And Segment Forecasts

- Report ID: GVR-4-68040-687-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Transparent Plastics Market Summary

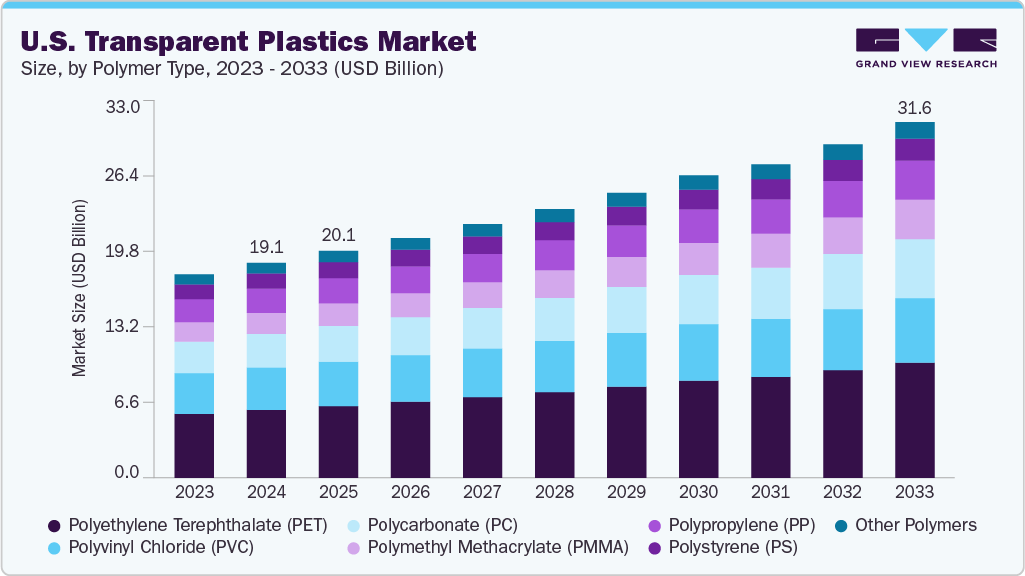

The U.S. transparent plastics market size was estimated at USD 19.10 billion in 2024 and is projected to reach USD 31.59 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The growing use of transparent plastics in smart packaging and consumer electronics is boosting market demand due to their clarity and design flexibility.

Key Market Trends & Insights

- By polymer type, the polymethyl methacrylate (PMMA) segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

- By form, the rigid segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By applications, the medical & healthcare segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 19.10 Billion

- 2033 Projected Market Size: USD 31.59 Billion

- CAGR (2025-2033): 5.8%

Additionally, the rise in e-commerce is increasing the need for durable and visually appealing protective packaging. The industry is experiencing a significant shift toward high-performance engineered polymers, particularly in medical devices and consumer electronics. The demand for advanced plastics like polycarbonate and polymethyl methacrylate is rising as industries seek greater clarity, impact resistance, and design flexibility.

Increasing customization in end-use applications, driven by design innovation and regulatory compliance, is steering manufacturers toward specialty transparent plastics over conventional resins. This shift is also creating opportunities for the integration of additives that enhance UV resistance and antimicrobial properties.

Drivers, Opportunities & Restraints

One of the core drivers in the industry is the accelerated adoption of lightweight plastic alternatives in automotive and aerospace manufacturing. With federal policies and industry mandates targeting fuel efficiency and emission reduction, manufacturers are increasingly replacing traditional glass and metal components with transparent polymers.

These materials not only reduce overall weight but also support intricate moldability and safety features, meeting stringent design and safety criteria. The growing integration of heads-up displays and advanced lighting systems further reinforces plastic usage across next-gen mobility platforms.

A strong opportunity lies in the U.S. healthcare and medical packaging sector, where transparent plastics are vital for sterile and tamper-evident solutions. With the rise in outpatient surgical procedures and home-based healthcare, demand for visually clear, durable, and disposable medical-grade plastics is expanding.

Growth in diagnostics, wearable biosensors, and pharmaceutical blister packaging is expected to further strengthen this segment. Manufacturers investing in FDA-compliant, biocompatible polymers and sustainable production practices are well-positioned to capture this evolving demand.

The primary restraint confronting the market is the increasing scrutiny and regulatory pressure related to environmental sustainability and chemical safety. As awareness around microplastic pollution and BPA-related health risks intensifies, both federal and state-level agencies are pushing for stricter compliance standards. These pressures are compelling manufacturers to reformulate products, invest in alternative resins, and adjust supply chains to meet evolving legal thresholds. The resulting cost implications and development delays pose a notable challenge for market scalability and innovation speed.

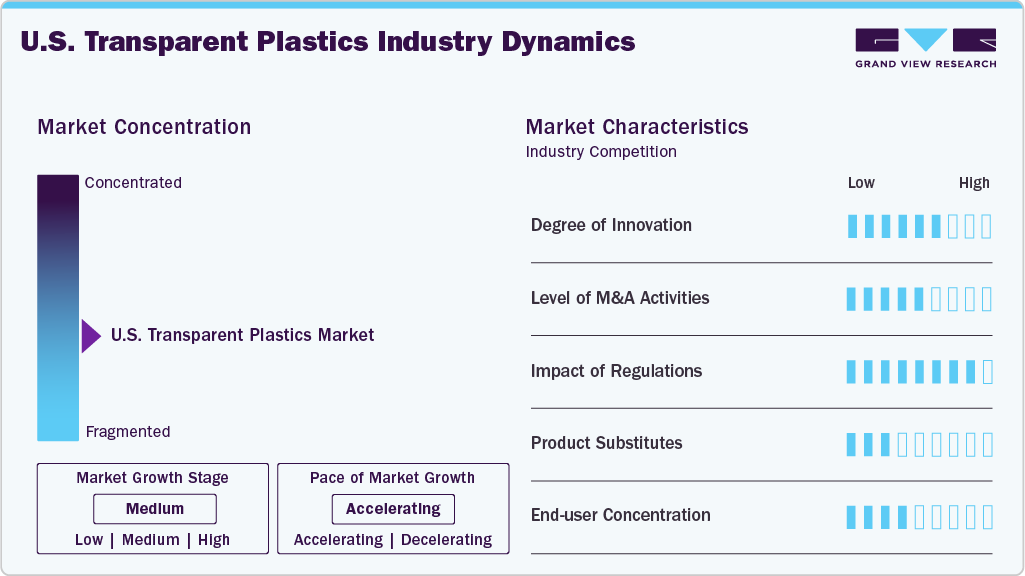

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies like Eastman Chemical Company, Dow Inc., SABIC Innovative Plastics, Trinseo, Plaskolite, LLC, Spartech LLC, Ensinger Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the industry is characterized by the rapid deployment of advanced materials and processing techniques. Companies are investing in bio‑based polymers to reduce reliance on fossil feedstocks while maintaining optical clarity and mechanical performance.

Nanocomposite additives are being introduced to impart UV stability and antimicrobial properties without compromising transparency. In parallel, digital printing and surface functionalization technologies are enabling bespoke value‑added features such as anti‑fog and scratch resistance. This continuous R&D focus is driving differentiation among suppliers and accelerating time to market for next‑generation products.

Regulatory frameworks are reshaping the transparent plastics landscape by enforcing stricter sustainability and health standards. Extended producer responsibility laws at both the federal and state levels incentivize manufacturers to integrate recycled content and design for recyclability.

Simultaneously, tighter restrictions under the Toxic Substances Control Act are prompting reformulations to eliminate substances of concern such as certain phthalates and PFAS. Food and Drug Administration guidance continues to set stringent criteria for medical and food contact applications, adding compliance complexity. These converging mandates are compelling market participants to balance innovation with cost‑effective regulatory adherence.

Polymer Type Insights

Polyethylene terephthalate (PET) dominated the market, accounting for a share of 31.57% in 2024 and is forecasted to grow at a CAGR of 6.1% from 2025 to 2033. A significant driver for the PET segment is the strong push toward circular economy practices across the beverage and food industries.

Major bottlers and brand owners are committing to higher recycled content targets, which is boosting investments in bottle-to-bottle recycling infrastructure. This shift is supported by federal and state regulations mandating recycled content levels, creating stable demand for transparent PET resin.

The polymethyl methacrylate (PMMA) segment is anticipated to grow at the fastest CAGR of 7.3% through the forecast period, driven by rapid expansion in LED lighting and display technologies. Manufacturers are turning to PMMA for its superior light transmission and weather resistance, particularly in outdoor luminaires and architectural glazing.

Demand is further accelerated by the trend toward smart building systems, which require durable and optically clear panels for sensors and screens. In automotive, LED headlamp assemblies increasingly incorporate PMMA lenses to meet styling and performance criteria. These application trends are propelling PMMA to outpace other transparent polymers in growth rate.

Form Insights

The rigid segment dominated the industry, accounting for a share of 69.02% in 2024 and is anticipated to grow at a CAGR of 6.1% over the forecast period. This can be attributed to the booming consumer electronics market. Device makers select rigid transparent plastics for screens, protective covers, and camera modules to achieve scratch resistance and design flexibility.

Strong sales of smartphones, tablets, and wearables are directly translating into higher volumes of rigid polymer demand. Additionally, the material’s dimensional stability under varying temperatures makes it essential for industrial instrument housings. This combination of factors ensures that rigid transparent plastics lead both in scale and in speed of adoption.

The flexible segment is anticipated to grow at a significant CAGR of 4.9% through the forecast period. Growth in the flexible form segment is underpinned by the rising need for transparent films in packaging labels and pouches.

Brand owners value flexible plastic solutions for their lightweight nature, high print quality, and ability to conform to complex shapes. The surge in personalized and small-batch product runs has also made roll-to-roll film formats more attractive than rigid alternatives.

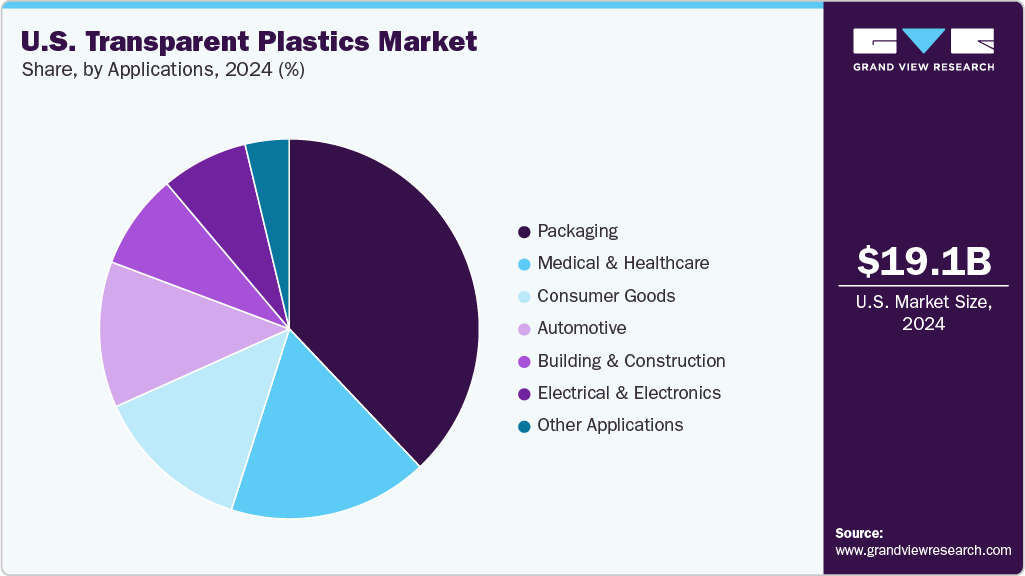

Applications Insights

Packaging led the market, accounting for a share of 37.93% in 2024, and is expected to grow at a CAGR of 5.5% through the forecast period, due to its critical role in product visibility and brand differentiation.

Retailers and manufacturers leverage transparent plastics to showcase product quality, which drives consumer engagement at the shelf. Growth in online commerce and omnichannel retail strategies is further escalating demand for protective yet clear packaging that withstands shipping stress. In parallel, lightweight transparent packages help companies reduce logistics costs and carbon footprint. These combined drivers cement packaging as the dominant application for transparent plastics.

The medical & healthcare segment is expected to expand at a substantial CAGR of 7.3% through the forecast period, driven by stringent hygiene protocols and the rise of point-of-care diagnostics. Transparent plastics are essential for single use syringes, vials, test cartridges and biosensor housing because they provide clarity for visual inspection and meet biocompatibility standards.

The recent acceleration of rapid testing technologies and home healthcare devices has amplified demand for clear polymer components. Regulatory approvals for medical grade resins have also streamlined product development timelines. Consequently, this application area is experiencing the most rapid expansion among all end‑use segments.

Key U.S. Transparent Plastics Manufacturers Insights

Key players operating in the U.S. transparent plastics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Transparent Plastics Manufacturers Companies:

- Eastman Chemical Company

- Dow Inc.

- SABIC Innovative Plastics

- Trinseo

- Plaskolite, LLC

- Spartech LLC

- Ensinger Inc.

- Berry Global

Recent Developments

-

In May 2025, Borealis introduced HC609TF, a new high-stiffness polypropylene (PP) homopolymer designed for packaging uses such as trays, cups, and containers. The company reported that this material combined enhanced stiffness, high transparency, and good processability, leading to up to a 10% reduction in manufacturing cycle times and improved efficiency.

U.S. Transparent Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.15 billion

Revenue forecast in 2033

USD 31.59 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Polymer type, form, and applications

Country Scope

U.S.

Key companies profiled

Eastman Chemical Company, Dow Inc.; SABIC Innovative Plastics; Trinseo; Plaskolite; LLC; Spartech LLC; Ensinger Inc.; Berry Global

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Transparent Plastics Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. transparent plastics market report on the basis of polymer type, form, and applications:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene Terephthalate (PET)

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Polycarbonate (PC)

-

Polymethyl Methacrylate (PMMA)

-

Other Polymers

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Rigid

-

Flexible

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical & Healthcare

-

Automotive

-

Consumer Goods

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. transparent plastics market size was estimated at USD 19.10 billion in 2024 and is expected to reach USD 20.15 billion in 2025.

b. The U.S. transparent plastics market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2033, reaching USD 31.59 billion in 2033.

b. Polyethylene terephthalate (PET) dominated the U.S. transparent plastics market with a revenue share of 31.57% in 2024, owing to surging demand for sustainable beverage packaging as brand owners shift toward lightweight, fully recyclable containers to meet circular economy targets.

b. Some of the key players in the U.S. transparent plastics market include Eastman Chemical Company, Dow Inc., SABIC Innovative Plastics, Trinseo, Plaskolite, LLC, Spartech LLC, Ensinger Inc., and Berry Global

b. Key factors driving the U.S. transparent plastics market are the growing use of transparent plastics in smart packaging and consumer electronics due to their clarity and design flexibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.