- Home

- »

- Pharmaceuticals

- »

-

U.S. Tremfya Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Tremfya Market Size, Share & Trends Report]()

U.S. Tremfya Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Moderate-to-Severe Plaque Psoriasis, Psoriatic Arthritis (PsA)), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies), And Segment Forecasts

- Report ID: GVR-4-68040-651-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Tremfya Market Size & Trends

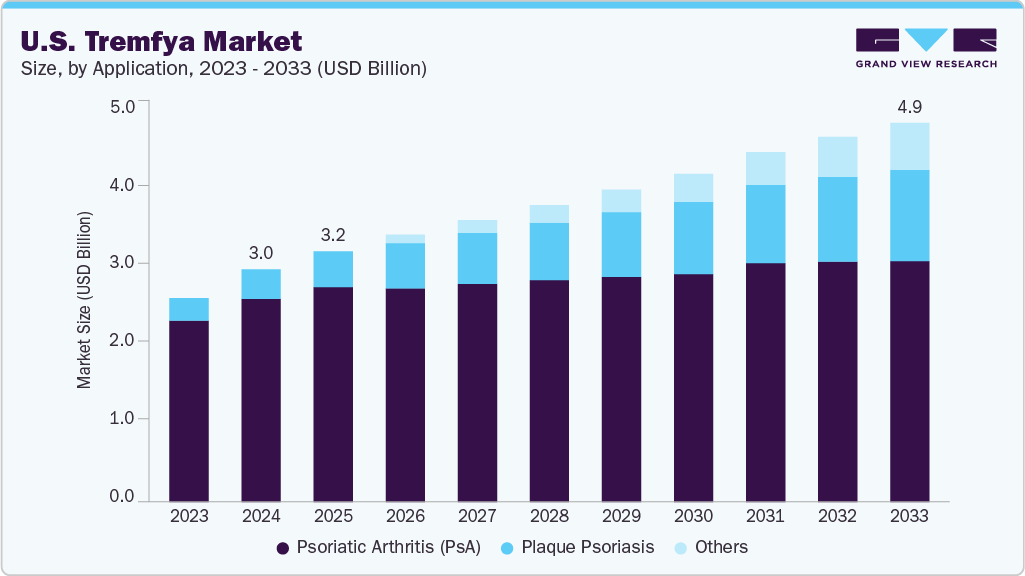

The U.S. Tremfya market size was estimated at USD 3.00 billion in 2024 and is projected to reach USD 4.89 billion by 2033, growing at a CAGR of 5.32% from 2025 to 2033. The rising incidence of chronic plaque psoriasis and psoriatic arthritis in the U.S. is contributing to increased demand for advanced biologic treatments. As these autoimmune disorders become more widespread, there is a growing emphasis on therapies that offer lasting disease control and improved patient outcomes. Tremfya (guselkumab), an IL-23 inhibitor, has demonstrated reliable effectiveness in managing moderate-to-severe forms of these conditions.

Its ability to provide sustained symptom relief, combined with a well-tolerated safety profile, has supported its broader adoption. U.S. healthcare professionals, including dermatologists and rheumatologists, are increasingly incorporating Tremfya into treatment regimens. This trend reflects a shift toward precision-targeted biologics that align with long-term management goals.

Tremfya’s commercial growth in the U.S. is strongly supported by Janssen Pharmaceuticals’ effective marketing efforts and robust competitive strategy. The therapy has carved out a distinct position in the biologics market by demonstrating higher efficacy than several established treatments, such as TNF and IL-17 inhibitors. Clinical comparisons have highlighted its ability to deliver faster skin clearance and maintain results over time. For instance, in October 2024, Johnson & Johnson’s SPECTREM study showed Tremfya effectively cleared difficult psoriasis areas like the scalp, face, hands, feet, and genitals, with clearance rates up to 80%. Most patients maintained clear or almost clear skin through week 48. The treatment also significantly improved patients’ quality of life by reducing symptoms like itch and pain.

The future growth of the Tremfya market in the U.S. is supported by ongoing clinical development and lifecycle management strategies. Current trials are assessing its use in additional indications such as Crohn’s disease and hidradenitis suppurativa, potentially expanding its treatment range. The manufacturer is also conducting real-world evidence research to confirm its effectiveness across varied patient groups. Rising interest in personalized medicine and biomarker-focused treatments is boosting demand for IL-23 inhibitors. Collaborations with specialty pharmacies and efficient distribution systems improve access in key regions. Continued investment in physician training and patient support initiatives strengthens brand engagement.

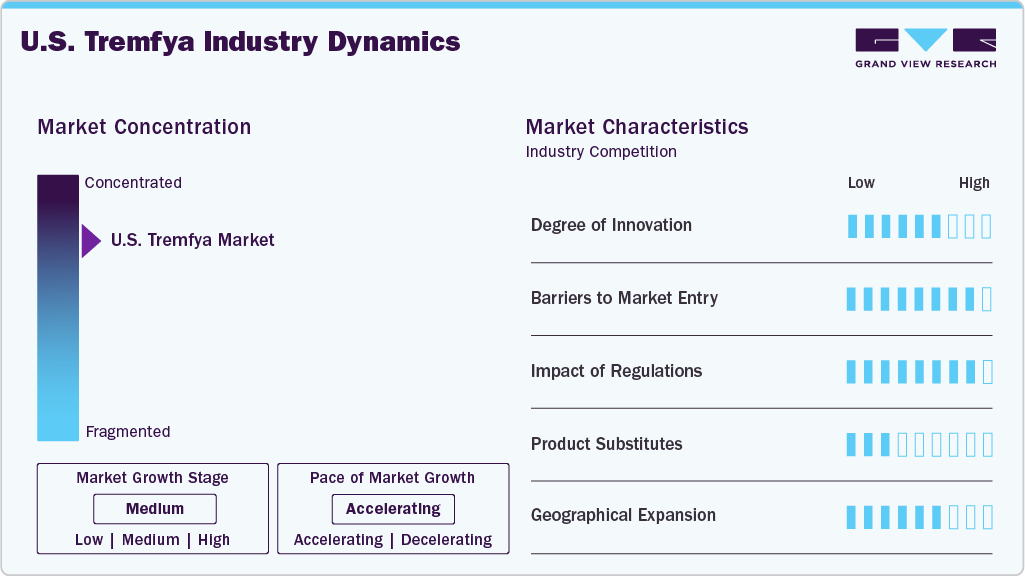

Market Concentration & Characteristics

The Tremfya market in the U.S. is characterized by a high degree of innovation due to its biologic nature, targeting the IL-23 pathway for chronic plaque psoriasis and psoriatic arthritis. Continuous research focuses on improving efficacy, safety, and patient adherence. Advances in biotechnology and formulation techniques further drive novel developments. Innovation is essential to maintain a competitive advantage and address unmet clinical needs. The market benefits from a dynamic pipeline of next-generation biologics.

Entry barriers in the market are significant, primarily due to the complexity of biologic drug development and the high associated costs. Regulatory approval processes are rigorous, requiring extensive clinical trial data to prove safety and efficacy. Intellectual property protections and patent exclusivity shield established players. In addition, manufacturing biologics demands specialized technology and expertise. New entrants face challenges in establishing market credibility and physician trust.

Regulatory frameworks heavily influence the U.S. market, ensuring strict compliance with safety, quality, and efficacy standards. Approval by the FDA and EMA agencies involves detailed clinical evaluation and post-marketing surveillance. Regulations affect pricing, labeling, and promotional activities, impacting market access and reimbursement. Changes in healthcare policies and guidelines can alter treatment paradigms. Companies must proactively adapt to evolving regulatory landscapes to maintain their market position.

Tremfya faces competition from other biologics and small-molecule therapies targeting psoriasis and psoriatic arthritis. Established substitutes include TNF inhibitors, IL-17 inhibitors, and conventional systemic treatments. Biosimilars emerging post-patent expiry also represent alternatives. Differentiation in efficacy, safety profile, and dosing schedule influences physician and patient preference. The presence of multiple substitutes intensifies competition, impacting pricing and market share.

Geographical expansion in the U.S. market is focused on broadening access across developed and emerging regions. Established markets like North America and Europe dominate revenue due to higher healthcare spending and infrastructure. Growth opportunities exist in Asia Pacific and Latin America, driven by increasing disease awareness and improving healthcare systems. Market entry requires navigating local regulatory requirements and reimbursement policies. Strategic partnerships and localized marketing are key to successful expansion.

Application Insights

The plaque psoriasis segment dominated the market with the largest revenue share of 87.3% in 2024, driven by the increasing prevalence of moderate-to-severe cases and growing demand for targeted biologic therapies. Tremfya (guselkumab), which selectively inhibits IL-23, has demonstrated superior skin clearance and long-term disease control in multiple clinical trials. For instance, in September 2024, Johnson & Johnson announced TREMFYA approval for treating plaque psoriasis, active psoriatic arthritis, and ulcerative colitis. This expanded indication strengthened its role in inflammatory disease management. The approval supported wider clinical use and ongoing research. Rising awareness among dermatologists regarding its efficacy and safety has supported its widespread adoption for plaque psoriasis management. Continuous promotional efforts and educational initiatives by Johnson & Johnson have strengthened the drug’s presence in this segment.

The Psoriatic Arthritis (PsA) segment is projected to grow at a significant CAGR of 5.32% over the forecast period, fueled by increasing diagnosis rates and the need for durable joint symptom control. For instance, in April 2025, Johnson & Johnson announced TREMFYA approval in Europe for treating active psoriatic arthritis in adults with prior inadequate response to DMARDs. The approval was based on Phase 3 DISCOVER-1 and DISCOVER-2 trials showing significant ACR20 improvements versus placebo. TREMFYA became the first IL-23 inhibitor to reduce symptoms and structural damage progression in PsA patients. Tremfya has shown significant improvement in joint-related outcomes and physical functioning, which is encouraging rheumatologists to consider it a long-term treatment. Rising disease burden and reduced quality of life among PsA patients are accelerating the demand for IL-23 inhibitors. Expanding clinical evidence supporting Tremfya’s benefits in PsA influences prescribing trends in specialty clinics.

Distribution Channel Insights

The hospital pharmacies segment dominated the market with the largest revenue share of 55.32% in 2024, driven by structured biologics procurement processes and specialist-led prescribing practices. Hospitals offer the infrastructure for accurate patient eligibility assessment and continuous monitoring, essential for administering advanced treatments such as Tremfya. Their formularies tend to prioritize biologics with strong clinical outcomes, which has supported Tremfya’s favorable placement. Integrated care teams within hospital systems provide coordinated autoimmune disease management, contributing to higher patient retention. Centralized inventory control and bulk purchasing agreements also help ensure consistent availability of Tremfya. These combined operational strengths and clinical governance have positioned hospital pharmacies as the primary distribution channel.

The online pharmacies segment is projected to grow at the fastest CAGR of 6.86% over the forecast period due to the growth of digital infrastructure and changing consumer preferences, as more patients are opting for home delivery of prescription drugs. Greater awareness of the convenience and affordability of online refills encourages those using chronic treatments like Tremfya to turn to digital channels. Trusted e-commerce systems are boosting patient confidence in managing ongoing therapies remotely. Streamlined prescription processing and partnerships with specialty couriers are improving delivery efficiency and supporting better adherence. The expansion of telehealth services has also narrowed the gap between specialist consultations and prescription fulfillment. With digital, patient-focused care models gaining traction, online pharmacies are set to play a larger role in Tremfya’s future growth.

Key U.S. Tremfya Company Insights

Johnson & Johnson Services, Inc. continues to lead the U.S. market, supported by its extensive footprint, solid regulatory track record, and well-established distribution systems. The market’s competitive landscape is shaped by its strategic pricing models, ongoing innovation, and efficient supply chain practices. Emerging companies such as Arven Pharmaceuticals (Turkey), Biocon (India), and MorphoSys (Germany) are gradually gaining traction through focused clinical pipelines and affordable manufacturing approaches. These firms are working to compete with leading players by developing alternative formulations and addressing treatment gaps in overlooked segments. With the growing demand for cost-effective and reliable therapies, competition in the U.S. market is expected to become more intense.

Key U.S. Tremfya Companies:

- Johnson & Johnson Services, Inc.

Recent Developments

-

In March 2025, Johnson & Johnson reported that Icotrokinra significantly improved plaque psoriasis severity with rapid and sustained PASI score reductions. The treatment showed a strong safety profile and was well tolerated by patients. These results suggest Icotrokinra could become a new standard therapy for moderate-to-severe plaque psoriasis.

-

In March 2025, Johnson & Johnson announced the FDA approval of Tremfya (guselkumab) as the first IL-23 inhibitor with subcutaneous and intravenous options for adults with moderate to severely active Crohn’s disease. This approval offers flexible treatment methods to improve patient outcomes. It also expands Tremfya’s use beyond psoriasis and arthritis to include Crohn’s disease.

-

In May 2024, Johnson & Johnson announced that Tremfya’s phase 3 study showed superior results versus ustekinumab in treating Crohn’s disease. The data highlighted Tremfya’s strong efficacy for moderate to severe cases. This advancement reinforced Tremfya’s potential as a key therapy in inflammatory bowel disease.

U.S. Tremfya Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.23 billion

Revenue forecast in 2033

USD 4.89 billion

Growth rate

CAGR of 5.32% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application and distribution channel

Key company profiled

Johnson & JohnsonServices, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tremfya Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Tremfya market report based on application and distribution channel:

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Plaque Psoriasis

-

Psoriatic Arthritis (PsA)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Frequently Asked Questions About This Report

b. The U.S. Tremfya market size was estimated at USD 3.00 billion in 2024 and is expected to reach USD 3.23 billion in 2025.

b. The U.S. Tremfya market is projected to grow at a CAGR of 5.32% from 2025 to 2033 to reach USD 4.89 billion by 2033.

b. Based on application, plaque psoriasis segment dominated the market with the largest revenue share of 87.3% in 2024, driven by the increasing prevalence of moderate-to-severe cases and growing demand for targeted biologic therapies.

b. Johnson & Johnson Services, Inc. leads the U.S. Tremfya market, supported by its regulatory approvals, distribution systems, and pricing models. The competitive landscape includes companies such as Arven Pharmaceuticals, Biocon, and MorphoSys, which are entering the market through clinical pipelines and manufacturing capabilities. These companies aim to introduce alternative formulations and address treatment gaps. Market dynamics are influenced by pricing strategies, supply chain operations, and product availability. Competition is expected to increase due to rising demand for cost-effective and accessible therapies.

b. The U.S. Tremfya market is driven by expanded regulatory approvals, increasing diagnosis of immune-mediated conditions, and broader biologic adoption. Additional factors include insurance coverage, structured patient access programs, and specialty pharmacy networks. Rising healthcare spending and focus on long-term treatment adherence also support market growth. These factors collectively contribute to sustained demand for Tremfya across approved therapeutic indications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.