- Home

- »

- Pharmaceuticals

- »

-

Tremfya Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Tremfya Market Size, Share & Trends Report]()

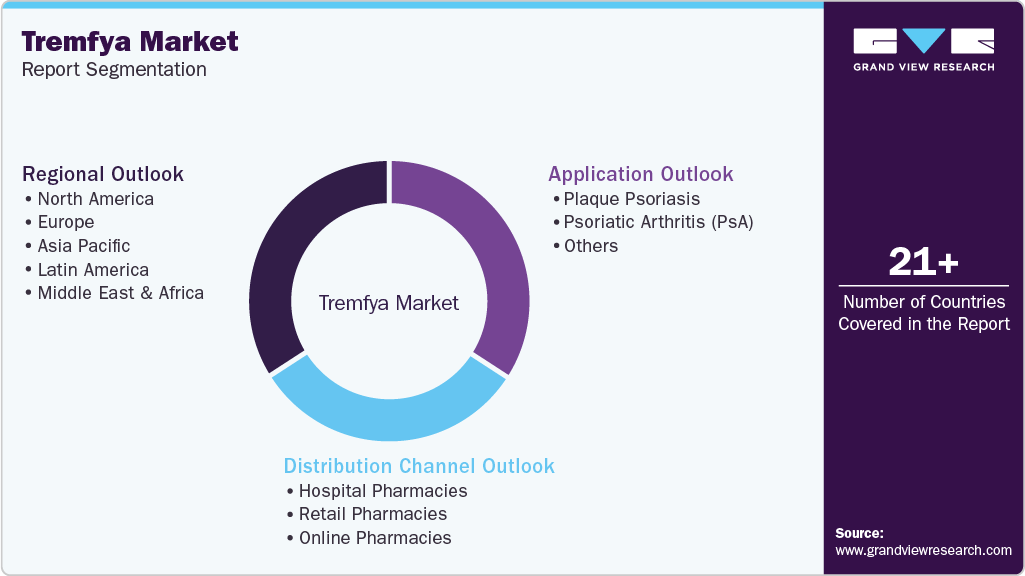

Tremfya Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Plaque Psoriasis, Psoriatic Arthritis (PsA)), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-648-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tremfya Market Summary

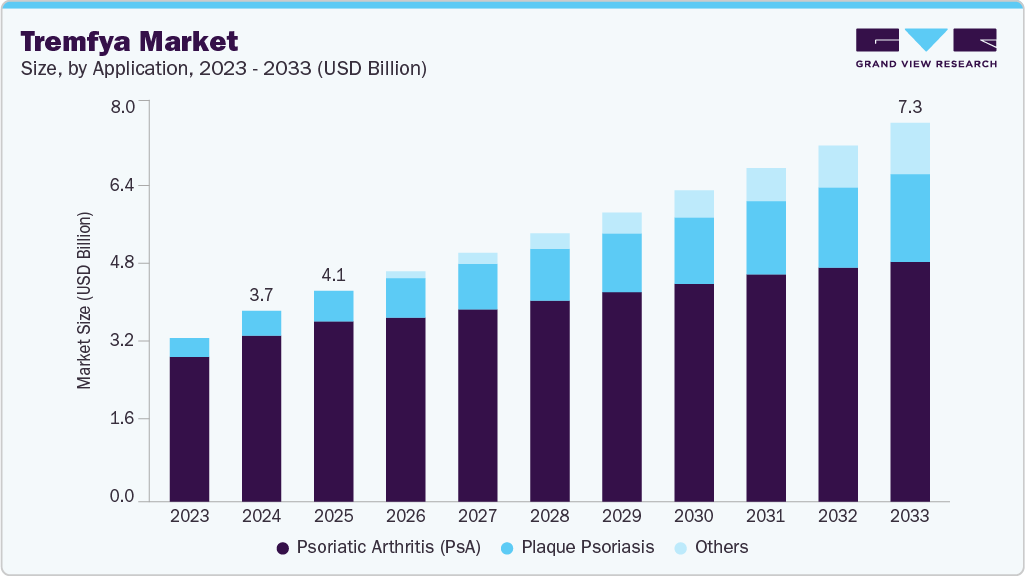

The global tremfya market size was estimated at USD 3.67 billion in 2024 and is projected to reach USD 7.29 billion by 2033, growing at a CAGR of 7.60% from 2025 to 2033. The increasing prevalence of chronic plaque psoriasis and psoriatic arthritis drives greater demand for advanced biologic therapies.

Key Market Trends & Insights

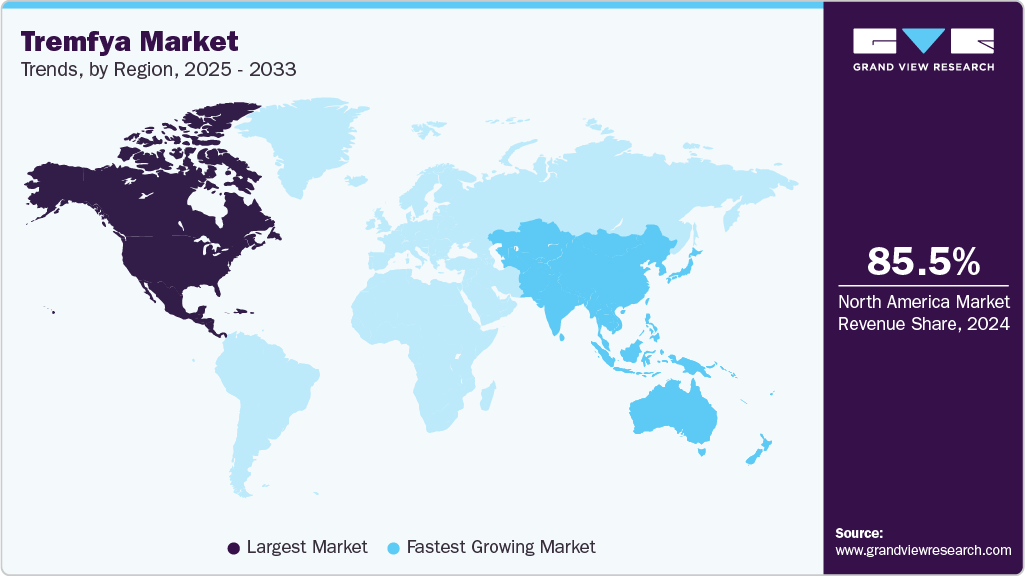

- North America Tremfya market held the largest share of 85.46% of the global market in 2024.

- The Tremfya market in the U.S. is expected to grow significantly over the forecast period.

- By application, the plaque psoriasis segment held the highest market share of 87.0% in 2024.

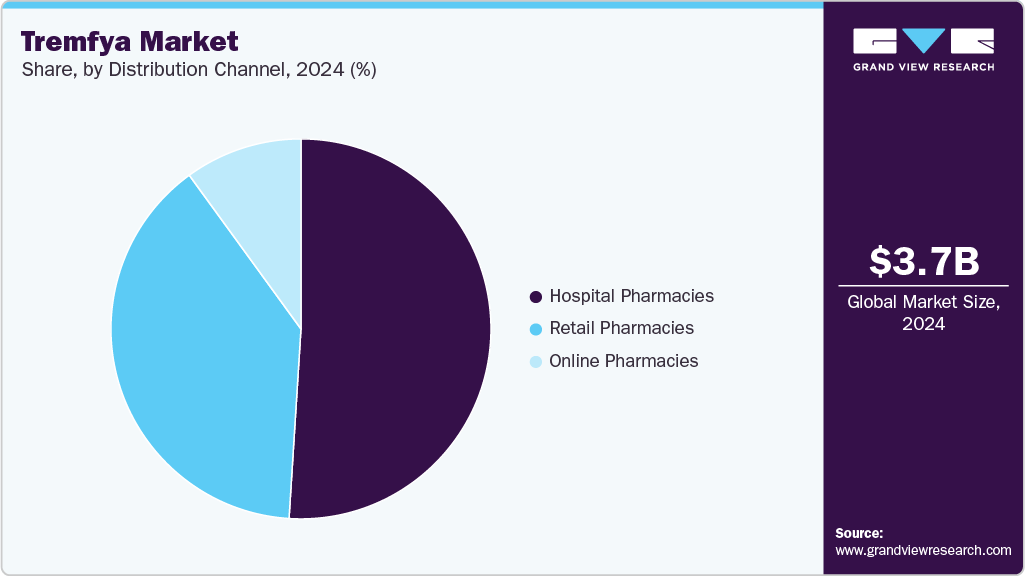

- By distribution channel, the hospital pharmacies segment held the highest market share of 51.15% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.67 Billion

- 2033 Projected Market Size: USD 7.29 Billion

- CAGR (2025-2033): 7.60%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These autoimmune conditions continue to rise globally, resulting in a growing need for effective and long-term treatment options. Tremfya, a monoclonal antibody that targets interleukin-23 (IL-23), has delivered strong efficacy and durable outcomes in moderate-to-severe cases. Its consistent clinical performance and favorable safety profile have strengthened its acceptance among dermatologists and rheumatologists.Janssen Pharmaceuticals ' strong marketing strategies and competitive positioning drive Tremfya’s commercial success. The drug has differentiated itself through superior efficacy data compared to some existing biologics, including TNF and IL-17 inhibitors. Head-to-head studies have shown Tremfya’s ability to achieve rapid skin clearance and sustained response, giving it a strategic advantage in the treatment landscape. For instance, In October 2024, Johnson & Johnson’s SPECTREM study showed Tremfya effectively cleared difficult psoriasis areas like the scalp, face, hands, feet, and genitals, with clearance rates up to 80%. Most patients maintained clear or almost clear skin through week 48. The treatment also significantly improved patients’ quality of life by reducing symptoms like itch and pain.

Ongoing clinical research and lifecycle management initiatives support the Tremfya market's future growth. New clinical trials are exploring expanded applications, such as hidradenitis suppurativa and Crohn’s disease, which could significantly widen its therapeutic scope. The drug’s manufacturer also invests in real-world evidence studies to validate its effectiveness in diverse populations. The growing interest in precision medicine and biomarker-driven therapies is increasing the relevance of IL-23 inhibitors in personalized treatment regimens. Partnerships with specialty pharmacies and streamlined distribution networks enhance availability in high-demand markets. The company’s continued focus on physician education and patient support programs reinforces brand loyalty.

Pipeline Analysis

Tremfya (guselkumab), developed by Johnson & Johnson, has established a strong foothold in the IL-23 inhibitor class, initially approved for moderate-to-severe plaque psoriasis and later expanded to psoriatic arthritis. Recent developments have significantly broadened its market potential, particularly with its FDA approval for ulcerative colitis in 2024 and European approval for Crohn’s disease in 2025. Clinical data from Phase 3 programs, such as the APEX study in psoriatic arthritis, have further reinforced its competitive edge by demonstrating not only symptomatic improvement but also inhibition of structural joint damage-a key differentiator in a crowded biologics market.

In parallel, J&J is actively building a pipeline of next-generation therapies targeting similar pathways. A notable candidate is JNJ-2113, an oral IL-23 receptor antagonist, which has shown promising results in Phase 2b trials for psoriasis, positioning it as a convenient oral alternative with potential to complement or succeed Tremfya in select indications. The company is also developing TLL018-205, a dual TYK2/JAK1 inhibitor currently in Phase 2 for plaque psoriasis. These pipeline assets are strategically aimed at capturing patient segments preferring oral options over injectables, a growing trend across immunology markets.

Clinical Trials for Tremfya - Pipeline Analysis

Indication

Development Phase

Psoriatic Arthritis Structural Damage

Phase 3

Pediatric Crohn's Disease

Phase 3

Pediatric Ulcerative Colitis

Phase 3

Impact of Tremfya Access Programs on Uninsured and Underinsured Patients

If Tremfya (guselkumab) secures approval for additional indications, its impact on uninsured and underinsured patients will be particularly significant. These populations often face substantial financial barriers to accessing high-cost biologic therapies, which can lead to delayed treatment or reliance on less effective alternatives. By offering structured patient assistance programs, Janssen can improve access to Tremfya for individuals without adequate insurance coverage. This support could lead to earlier intervention and improved disease management in underserved populations, particularly chronic conditions like pediatric inflammatory bowel disease. Ensuring affordability for uninsured and underinsured patients may also enhance treatment adherence and long-term outcomes, reducing the burden on healthcare systems. Ultimately, increased accessibility through assistance initiatives could drive wider adoption of Tremfya, especially in economically vulnerable groups.

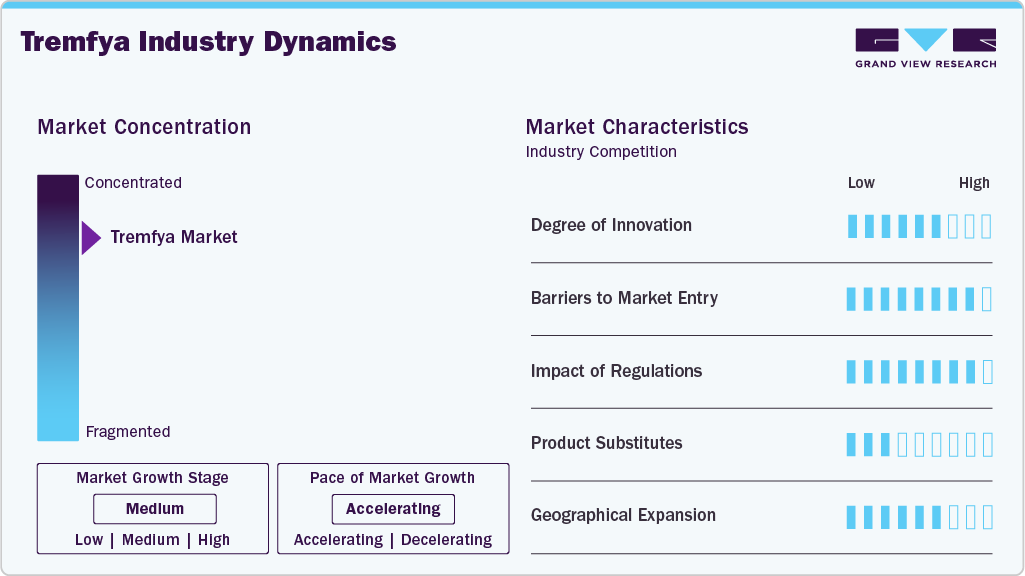

Market Concentration & Characteristics

The Tremfya market is characterized by a high degree of innovation due to its biologic nature targeting the IL-23 pathway for chronic plaque psoriasis and psoriatic arthritis. Continuous research focuses on improving efficacy, safety, and patient adherence. Advances in biotechnology and formulation techniques further drive novel developments. Innovation is essential to maintain competitive advantage and address unmet clinical needs. The market benefits from a dynamic pipeline of next-generation biologics.

Entry barriers in the Tremfya market are significant, primarily due to the complexity of biologic drug development and high associated costs. Regulatory approval processes are rigorous, requiring extensive clinical trial data to prove safety and efficacy. Intellectual property protections and patent exclusivity shield established players. Additionally, manufacturing biologics demands specialized technology and expertise. New entrants face challenges in establishing market credibility and physician trust.

Regulatory frameworks heavily influence the Tremfya market, ensuring strict compliance with safety, quality, and efficacy standards. Approval by the FDA and EMA agencies involves detailed clinical evaluation and post-marketing surveillance. Regulations affect pricing, labeling, and promotional activities, impacting market access and reimbursement. Changes in healthcare policies and guidelines can alter treatment paradigms. Companies must proactively adapt to evolving regulatory landscapes to maintain market position.

Tremfya faces competition from other biologics and small-molecule therapies targeting psoriasis and psoriatic arthritis. Established substitutes include TNF inhibitors, IL-17 inhibitors, and conventional systemic treatments. Biosimilars emerging post-patent expiry also represent alternatives. Differentiation in efficacy, safety profile, and dosing schedule influences physician and patient preference. The presence of multiple substitutes intensifies competition, impacting pricing and market share.

Geographical expansion in the Tremfya market is focused on broadening access across developed and emerging regions. Established markets like North America and Europe dominate revenue due to higher healthcare spending and infrastructure. Growth opportunities exist in Asia Pacific and Latin America, driven by increasing disease awareness and improving healthcare systems. Market entry requires navigating local regulatory requirements and reimbursement policies. Strategic partnerships and localized marketing are key to successful expansion.

Application Insights

The plaque psoriasis segment dominated the market with the largest revenue share of 87.0% in 2024, driven by the increasing prevalence of moderate-to-severe cases and growing demand for targeted biologic therapies. Tremfya (guselkumab), which selectively inhibits IL-23, has demonstrated superior skin clearance and long-term disease control in multiple clinical trials. For instance, In September 2024, Johnson & Johnson announced Tremfya approval for treating plaque psoriasis, active psoriatic arthritis, and ulcerative colitis. This expanded indication strengthened its role in inflammatory disease management. The approval supported wider clinical use and ongoing research. Rising awareness among dermatologists regarding its efficacy and safety has supported its widespread adoption for plaque psoriasis management. Continuous promotional efforts and educational initiatives by Johnson & Johnson have strengthened the drug’s presence in this segment.

The Psoriatic Arthritis (PsA) segment is projected to grow at the fast CAGR over the forecast period, fueled by increasing diagnosis rates and the need for durable joint symptom control. For instance, In April 2025, Johnson & Johnson announced Tremfya approval in Europe for treating active psoriatic arthritis in adults with prior inadequate response to DMARDs. The approval was based on Phase 3 DISCOVER-1 and DISCOVER-2 trials showing significant ACR20 improvements versus placebo. Tremfya became the first IL-23 inhibitor to reduce symptoms and structural damage progression in PsA patients. Tremfya has shown significant improvement in joint-related outcomes and physical functioning, which is encouraging rheumatologists to consider it a long-term treatment. Rising disease burden and reduced quality of life among PsA patients are accelerating the demand for IL-23 inhibitors. Expanding clinical evidence supporting Tremfya’s benefits in PsA influences prescribing trends in specialty clinics.

Distribution Channel Insights

The hospital pharmacies segment dominated the market with the largest revenue share of 51.2% in 2024, attributed to structured biologics procurement systems and specialist-driven prescribing patterns. Hospital settings enable precise eligibility screening and monitoring for patients requiring advanced therapies like Tremfya. Institutional formularies often prioritize biologics based on clinical performance, which has favored Tremfya's inclusion due to its proven results. Multidisciplinary care teams within hospitals ensure comprehensive management of autoimmune diseases, increasing patient retention within this channel. Bulk purchasing agreements and centralized inventory systems further streamline Tremfya's availability in these settings. These operational efficiencies and clinical oversight factors have made hospital pharmacies the leading distribution channel.

The online pharmacies segment is projected to grow at the fastest CAGR over the forecast period due to expanding digital infrastructure and shifting consumer preferences toward home delivery of prescription medications. Increasing awareness about convenience and cost-effectiveness prompts patients to refill chronic medications like Tremfya online. Secure e-commerce platforms are improving confidence among patients managing long-term therapies. Automation in prescription verification and logistical integration with specialty couriers are enhancing delivery timelines and adherence rates. The rise of telehealth consultations has also bridged gaps between specialist care and prescription access. As patient-centric digital models evolve, online pharmacies are expected to play an increasingly pivotal role in Tremfya’s market expansion.

Regional Insights

North America held the largest share of the Tremfya market in 2024, accounting for 85.46% of global revenue, fueled by high psoriasis and psoriatic arthritis prevalence, advanced healthcare systems, and biologics expertise. The region’s growth is supported by favorable reimbursement coverage, clinical trial activity, and physician familiarity with IL-23 inhibitors. The U.S. leads due to strong pharmaceutical innovation, extensive patient access programs, and accelerated approvals through FDA mechanisms. Continued investments in dermatology and rheumatology research further support Tremfya’s widespread adoption. Strong biologics supply chains and specialty pharmacy infrastructure reinforce the region’s leadership. Overall, North America remains the core revenue-generating hub for Tremfya-based therapies.

U.S. Tremfya Market Trends

The U.S. drives North American growth with rising diagnoses of moderate-to-severe plaque psoriasis and psoriatic arthritis. The country benefits from early biologic access, direct-to-consumer marketing, and robust insurance coverage. Pharmaceutical partnerships and ongoing post-marketing studies enhance treatment penetration. Tremfya is widely prescribed in dermatology and rheumatology clinics and is supported by many infusion centers and specialty pharmacies. Retail and mail-order pharmacy channels streamline access for chronic care patients. The U.S. remains a critical testing ground for label expansions and lifecycle management strategies.

Europe Tremfya Market Trends

Europe maintains steady Tremfya (guselkumab) market growth, led by Germany, France, and the UK, driven by national biologic formularies, specialist networks, and public health screening initiatives. Pan-European harmonization of treatment guidelines and access through centralized procurement channels support product adoption. Rising physician preference for IL-23 inhibitors over older TNF inhibitors enhances Tremfya’s positioning. The market benefits from centralized healthcare funding and biosimilar cost controls. Dermatology and rheumatology societies in Europe have increasingly included Tremfya in clinical practice guidelines. Hospital pharmacies dominate distribution, ensuring standardized biologic availability across public systems.

The UK Tremfya market grows steadily due to NHS cancer care reforms, improved diagnostic timelines, and adoption of IL-23 biologics for difficult-to-treat psoriasis cases. NICE approvals and cost-effectiveness analyses guide widespread use across NHS trusts. Expanded access programs and hospital-recommended protocols support uniform Tremfya utilization. Integration of teledermatology enhances patient reach in remote areas. Retail and online pharmacy channels supplement hospital supply, particularly for maintenance therapies. The UK plays an active role in clinical trials and real-world evidence generation.

Germany leads European demand for Tremfya (guselkumab) due to its early adoption of advanced biologics, rigorous reimbursement processes, and strong medical specialist base. Hospitals and outpatient dermatology clinics follow well-defined prescribing pathways supported by statutory health insurers. Tremfya’s use is increasing in rheumatology due to its evidence-based inclusion in treatment pathways. E-pharmacies and specialty logistics providers support timely therapy delivery. Germany’s health data systems enable precise population targeting and treatment monitoring. Pharmaceutical companies benefit from the country’s predictable regulatory and pricing environment.

France shows a strong uptake of Tremfya, which is supported by national psoriasis programs, universal reimbursement, and physician training in biologics use. Hospital-based formularies ensure routine access, while retail pharmacies are expanding their role in biologic fulfillment. Increased patient education and telehealth services promote adherence and follow-up care. Clinical registry data supports Tremfya’s inclusion in national treatment protocols. Biosimilar discussions are ongoing but have not significantly impacted branded Tremfya prescriptions. The French market remains stable, with consistent growth across both dermatology and rheumatology indications.

Asia-Pacific Tremfya Market Trends

Asia Pacific Tremfya market is expected to register the fastest CAGR of 15.73% over the forecast period, driven by increasing disease awareness, healthcare modernization, and greater affordability of biologics. China, Japan, and India dominate regional demand, supported by rising diagnosis rates and expanded public health insurance coverage. Regulatory agencies are accelerating approvals for IL-23 inhibitors in chronic inflammatory conditions. Both hospital and retail pharmacy channels play key roles in improving accessibility. Growing local production capacity and favorable policy reforms further support regional expansion. Asia Pacific is emerging as a key strategic region for clinical development and post-marketing studies.

Japan’s Tremfya market is growing steadily due to its aging population, universal health insurance system, and strong dermatology networks. Clinical acceptance of IL-23 inhibitors is increasing, especially for patients with systemic therapy resistance. The government supports the coexistence of biosimilar and branded therapy through regulated pricing mechanisms. Tremfya is distributed mainly through hospital-affiliated pharmacies and specialty outpatient centers. Digital health initiatives and mobile prescription services enhance patient compliance. Japan serves as a regional center for real-world data collection and pharmacovigilance efforts.

China’s Tremfya market is expanding rapidly due to healthcare reforms, broader reimbursement access, and the rising prevalence of moderate-to-severe psoriasis. Centralized drug procurement and national essential drug listings are facilitating cost-effective adoption. Local biosimilar manufacturing and contract research partnerships strengthen the supply ecosystem. Urban hospitals dominate initial biologic prescribing, while Tier 2 and Tier 3 cities are seeing growth via telemedicine and online pharmacies. Public-private partnerships in dermatology and rheumatology are supporting training and education. China is a country that is focused on label expansion and strategic commercialization.

Latin America Tremfya Market Trends

Latin America sees moderate growth in the Tremfya market, led by Brazil and Argentina, driven by rising biologics awareness and public healthcare investment. Delays in regulatory approval and variable reimbursement remain challenges, but government-led treatment programs are increasing therapy uptake. Clinical use of Tremfya is concentrated in urban hospitals and specialized private clinics. Regional health ministries are adopting biosimilar-friendly policies while maintaining access to originator biologics. Increased funding for autoimmune disease treatment and medical infrastructure development support future growth. Specialty pharmacy models are gaining prominence across major metro areas.

Brazil’s Tremfya market is expanding due to the growing psoriasis burden, increased biologics funding, and evolving public-private healthcare models. The Ministry of Health supports access to high-cost biologics through institutional procurement frameworks. Tremfya is primarily distributed through hospital networks and government-approved pharmacy programs. Local manufacturing partnerships are being developed to ensure supply chain stability. Rheumatology and dermatology associations are advocating for updated biologic treatment guidelines. Patient advocacy campaigns are improving early diagnosis and treatment adherence.

Middle East & Africa Tremfya Market Trends

The Middle East and Africa region is experiencing rising demand for Tremfya, especially in Saudi Arabia, UAE, and South Africa, driven by non-communicable disease growth, expanding insurance coverage, and improved hospital infrastructure. Biologics adoption is increasing across private healthcare networks, with governments supporting access through national drug plans. Distribution is centered around specialty and hospital pharmacies, with emerging digital platforms enabling therapy access in underserved areas. Training healthcare providers in biologic use improves treatment outcomes. Regulatory agencies are streamlining biologic approvals and post-marketing surveillance. The region offers long-term growth potential due to unmet needs in psoriasis and psoriatic arthritis care.

Saudi Arabia’s Tremfya market is advancing due to Vision 2030 reforms, improved chronic disease management, and expanded health sector investment. Government-run hospitals lead therapy provision, supported by structured biologics procurement channels. Public awareness campaigns and continuing medical education improve early diagnosis and prescription rates. Local pharma manufacturing initiatives aim to reduce dependency on imports. Hospital and retail pharmacy channels operate in tandem, with digital services supporting follow-ups. The Kingdom is a regional hub for advanced dermatology and rheumatology care delivery.

Key Tremfya Company Insights

Johnson & Johnson Services, Inc. remains the key player in the Tremfya market, leveraging its strong global presence, robust regulatory approvals, and comprehensive distribution networks. Strategic pricing, innovative research, and effective supply chain operations influence competitive dynamics in this market. Emerging players such as Arven Pharmaceuticals from Turkey, Biocon from India, and MorphoSys from Germany are gradually expanding their presence by focusing on clinical development and cost-effective production. These companies aim to challenge established players by introducing new formulations and targeting underserved markets. As healthcare providers increasingly seek affordable and effective treatment options, competition in the Tremfya market is expected to intensify. Overall, the market is projected to grow significantly throughout the forecast period.

Key Tremfya Companies:

The following are the leading companies in the tremfya market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

Recent Developments

-

In March 2025, Johnson & Johnson reported that Icotrokinra significantly improved plaque psoriasis severity with rapid and sustained PASI score reductions. The treatment showed a strong safety profile and was well tolerated by patients. These results suggest Icotrokinra could become a new standard therapy for moderate-to-severe plaque psoriasis.

-

In March 2025, Johnson & Johnson announced the FDA approval of Tremfya as the first IL-23 inhibitor with subcutaneous and intravenous options for adults with moderate to severely active Crohn’s disease. This approval offers flexible treatment methods to improve patient outcomes. It also expands Tremfya’s use beyond psoriasis and arthritis to include Crohn’s disease.

-

In May 2024, Johnson & Johnson announced that Tremfya’s phase 3 study showed superior results versus ustekinumab in treating Crohn’s disease. The data highlighted Tremfya’s strong efficacy for moderate to severe cases. This advancement reinforced Tremfya’s potential as a key therapy in inflammatory bowel disease.

Tremfya Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.06 billion

Revenue forecast in 2033

USD 7.29 billion

Growth rate

CAGR of 7.60% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key company profiled

Johnson & Johnson Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tremfya Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Tremfya market report based on application, distribution channel and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Plaque Psoriasis

-

Psoriatic Arthritis (PsA)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Tremfya market size was estimated at USD 3.67 billion in 2024 and is expected to reach USD 4.06 billion in 2025.

b. The global Tremfya market is projected to grow at a CAGR of 7.60% from 2025 to 2033 to reach USD 7.29 billion by 2033.

b. Based on application, plaque psoriasis segment dominated the market with the largest revenue share of 87.0% in 2024, driven by the increasing prevalence of moderate-to-severe cases and growing demand for targeted biologic therapies.

b. Johnson & Johnson Services, Inc. remains the key player in the Tremfya market, leveraging its strong global presence, robust regulatory approvals, and comprehensive distribution networks. Strategic pricing, innovative research, and effective supply chain operations influence competitive dynamics in this market.

b. Tremfya’s market growth is driven by rising autoimmune disease prevalence, strong clinical efficacy in psoriasis and psoriatic arthritis, and expanding indications like ulcerative colitis. Its targeted IL-23 inhibition, favorable safety profile, and convenient subcutaneous dosing support high patient adherence and growing acceptance among dermatologists and rheumatologists.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.