- Home

- »

- Automotive & Transportation

- »

-

U.S. Truck Bed Accessories Market, Industry Report, 2030GVR Report cover

![U.S. Truck Bed Accessories Market Size, Share & Trends Report]()

U.S. Truck Bed Accessories Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Tonneau Cover, Bedliner, Storage System, Toolbox), By Sales Channels (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-029-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Truck Bed Accessories Market Trends

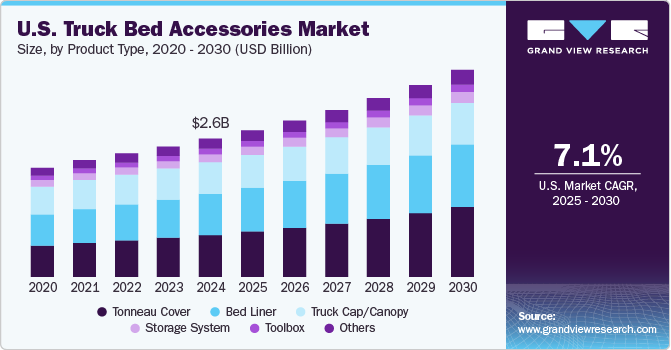

The U.S. truck bed accessories market size was estimated at USD 2.56 billion in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. The U.S. market is expanding rapidly, driven by a surge in pickup truck ownership across the country. This growth is supported by increasing consumer demand for accessories that enhance vehicle functionality, such as bed liners, tonneau covers, and storage solutions. The versatility of pickup trucks for both work and recreational purposes has led to wider acceptance and the need for customization options, encouraging consumers to invest in add-ons that protect and maximize the truck bed space.

Rising disposable income also plays a role, as individuals are more willing to invest in accessories that improve both the aesthetic and utility of their vehicles. Manufacturers are responding with innovative products that offer durability and weather resistance, addressing consumer needs effectively.

Advancements in material technology have enhanced the quality and longevity of truck bed accessories, appealing to both individual owners and businesses. Many companies are now utilizing materials such as high-density polyethylene and aluminum to create lightweight yet robust accessories that are easier to install and maintain. This shift has particularly benefited the commercial sector, where fleet operators seek durable solutions that can withstand heavy use without frequent replacements. Moreover, the demand for customizable options, including modular storage units and cargo organizers, continues to rise as consumers look for ways to personalize their trucks to suit specific needs. Some accessories now also include technological features, like built-in lighting or lockable storage, which add functionality.

Environmental considerations are also impacting the U.S. truck bed accessories market, with an increasing focus on eco-friendly and recyclable materials. As consumers become more environmentally conscious, they prefer products that minimize their carbon footprint without compromising on performance. In response, several manufacturers are introducing sustainable materials and processes, such as recyclable plastics and eco-friendly coatings. Moreover, government regulations encouraging the reduction of waste and promoting recycling are influencing production practices. This trend aligns with a broader shift in consumer behavior, where environmental responsibility is a key factor in purchasing decisions.

Product Type Insights

The tonneau cover segment dominated the market in 2024 with a revenue share of 30.4%, driven by the need for secure and weather-resistant solutions. These covers are popular due to their ability to protect cargo from harsh weather conditions and potential theft, making them essential for truck owners who prioritize security. Innovations in design, including retractable and foldable options, have further boosted their appeal, catering to consumers seeking convenience and enhanced aesthetics. The availability of lightweight, durable materials has also contributed to the growth of this segment, offering consumers a range of choices that balance protection with ease of use. The trend toward multi-functional truck usage has reinforced the demand for tonneau covers, establishing them as a preferred accessory among truck owners.

The bed liner segment is anticipated to witness significant growth from 2025 to 2030 as consumers increasingly recognize its benefits in protecting truck beds from wear, tear, and corrosion. Bed liners, including drop-in and spray-on types, provide a safeguard against heavy loads, scratches, and weather-induced damage, making them valuable for both personal and commercial truck usage. With new, resilient materials such as polyurethane and rubber composites, bed liners have become more durable and easier to maintain, appealing to truck owners who require long-lasting solutions. This growth is also supported by a rise in aftermarket modifications, where consumers seek to enhance their vehicles’ longevity and resale value through protective accessories. As a result, the bed liner market is expected to expand further, driven by consumer interest in maintaining truck quality over time.

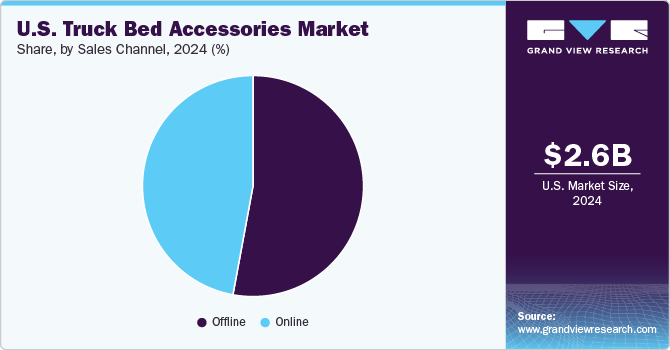

Sales Channel Insights

The offline sales channel dominated the market in 2024, as many consumers prefer to physically inspect products before purchase, particularly for items such as tonneau covers and bed liners. In-store shopping allows customers to assess quality, durability, and fit, which are essential considerations for truck accessories. Many retailers also provide personalized service, such as installation assistance, which adds value and builds customer trust. Offline sales benefit from the strong presence of automotive specialty stores and larger retail chains, making products accessible to a broad audience. The hands-on experience and immediate availability offered by offline channels continue to drive their leading position in the market.

The online sales channel is expected to grow at fastest CAGR from 2025 to 2030 as consumers increasingly turn to e-commerce platforms for convenience and variety in truck bed accessory options. Online shopping provides access to a wider selection of products, allowing customers to compare brands, read reviews, and find competitive pricing. Digital platforms often offer discounts, free shipping, and easy return policies, which attract cost-conscious buyers and increase online sales traction. Moreover, advancements in virtual fitting tools and detailed product descriptions help bridge the gap for customers who prefer seeing items before buying. The ease and accessibility of online shopping are expected to continue fueling its growth in the truck bed accessories market.

Key U.S. Truck Bed Accessories Company Insights

Some key companies in the market include CURT Manufacturing LLC., DECKED, Dee Zee, Inc., and DU-HA, Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

CURT Manufacturing LLC has expanded its product line in recent years, focusing on high-strength hitches, towing systems, and accessories for truck beds. They’ve integrated new technologies for enhanced durability, with an emphasis on weather-resistant materials and ease of installation to cater to diverse truck models and heavy-duty use.

-

Dee Zee continues to develop truck bed liners, mats, and toolboxes that are designed to withstand impact and abrasion. They have introduced new materials that enhance durability and protect truck beds from corrosion and wear. Dee Zee also emphasizes eco-friendly manufacturing, incorporating recycled materials into many of their products.

Key U.S. Truck Bed Accessories Companies:

- CURT Manufacturing LLC.

- DECKED

- Dee Zee, Inc.

- DU-HA, Inc.

- EZ STAK INC.

- GOOSE GEAR, INC

- Highway Products, Inc.

- Reliable Engineered Products, LLC.

- Rockland Custom Products.

- TruckVault Inc.

- Worksport Ltd.

Recent Developments

-

In May 2024, Worksport Ltd. secured a U.S. patent for its SOLIS Solar Tonneau Cover, integrating solar technology with truck bed covers to enhance energy capture. Compatible with major truck brands and offering versatility, it aims to transform the market, especially when paired with Worksport’s COR portable energy storage system, targeting both combustion and EV pickup trucks.

-

In January 2024, Worksport Ltd. launched the AL3 PRO Low Profile Aluminum Tonneau Cover, a durable, stylish, and functional hard-folding cover made in the USA. This new product is compatible with various popular truck models, including those from RAM, GMC, Chevrolet, Ford, Jeep, Nissan, and Toyota, with plans to expand compatibility to the Honda Ridgeline.

U.S. Truck Bed Accessories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.72 billion

Revenue forecast in 2030

USD 3.83 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Product type, sales channel

Country scope

U.S.

Key companies profiled

CURT Manufacturing LLC.; DECKED; Dee Zee, Inc.; DU-HA, Inc.; EZ STAK INC.; GOOSE GEAR, INC; Highway Products, Inc.; Reliable Engineered Products, LLC.; Rockland Custom Products.; TruckVault Inc.; Worksport Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Truck Bed Accessories Market Report Segmentation

This report offers revenue growth forecasts at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. truck bed accessories market report based on product type, and sales channel:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bedliner

-

Storage system

-

Toolbox

-

Truck Cap/Canopy

-

Tonneau Cover

-

Others

-

-

Sales Channel (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. truck bed accessories market size was estimated at USD 2.56 billion in 2024 and is expected to reach USD 2.72 billion in 2025.

b. The U.S. truck bed accessories market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030 to reach USD 3.83 billion by 2030.

b. Tonneau cover segment dominated the U.S. truck bed accessories market with a share of 30.3% in 2024. This is attributable to the rising discretionary income levels in the U.S. and a growing preference for high-end vehicles brought on by changing lifestyles, soft tonneau coverings are in high demand.

b. Some key players operating in the U.S. truck bed accessories market include CURT Manufacturing LLC, DECKED, Dee Zee, Inc., DU-HA, Inc., EZ STAK INC., GOOSE GEAR, INC., Highway Products, Inc., Reliable Engineered Products, LLC., Rockland Custom Products, TruckVault Inc.

b. Key factors that are driving the U.S. truck bed accessories market growth include rapid technological advancements, rising demand for tonneau covers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.