- Home

- »

- Medical Devices

- »

-

U.S. Ultrasound Devices Market Size, Industry Report, 2030GVR Report cover

![U.S. Ultrasound Devices Market Size, Share & Trends Report]()

U.S. Ultrasound Devices Market Size, Share & Trends Analysis Report By Application (Cardiology, Radiology), By Portability (Handheld, Compact), By End-use (Hospitals, Imaging Centers), By Product (Therapeutic, Diagnostic), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-285-6

- Number of Report Pages: 190

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Ultrasound Devices Market Trends

The U.S. ultrasound devices market size was estimated at USD 2.55 billion in 2023 and is anticipated to grow at a CAGR of 3.26% from 2024 to 2030. Factors such as aging population, advancing technologies, changing patient care strategies, and evolving epidemiological patterns, are dominating the US market. Furthermore, the increasing incidence of chronic diseases such as breast cancer, cardiovascular disorders, and neurological diseases, has created a high demand for imaging devices including ultrasound.

U.S. accounted for 26% of the global ultrasound devices market in 2023. The growing awareness about the safety and diagnostic efficiency of ultrasound devices among healthcare providers has contributed to their rising adoption. The country has well-established medical codes, payment processes, and coverage policies for ultrasound services in hospitals, clinics, & imaging centers. In addition, reimbursements are provided for the use of ultrasound by general practitioners and family physicians at their offices. This has contributed highly to the rising number of ultrasound procedures in the U.S. Furthermore, the growing acceptance of mobile ultrasound devices is expected to boost the market growth.

Rapid technological advancements in ultrasound systems are enhancing the diagnosis and treatment of several diseases. Growing demand for advancements in imaging devices, and minimally invasive treatments, including 3D & 4D image detailing, accelerated processing speed, automated workflow, and Point-of-Care (PoC) solutions, are expected to boost the adoption of such technologies during the forecast period. The demand for early diagnosis is increasing, thus, leading to a large number of patients opting for PoC ultrasound devices to obtain instant results.

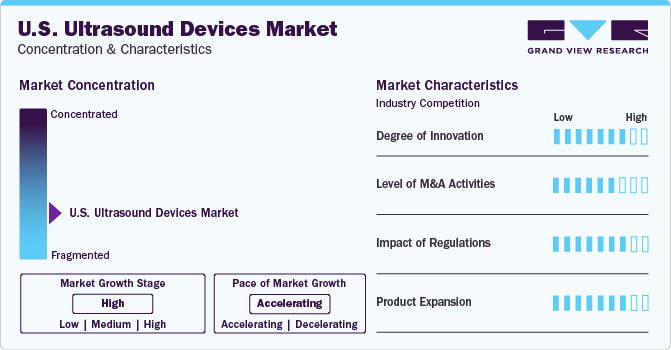

Market Concentration & Characteristics

The industry is fragmented with several key players actively participating in it. Recent product launches and ongoing partnerships between market players and governments are highly benefitting the industry. In the U.S., the installed base of ultrasound units has significantly increased over the years. In addition, the rising demand for minimally invasive surgery and technological advancements in ultrasound imaging technology are key factors driving the market.

Frequent product launches that offer improved imaging, workflow, & ergonomic capabilities are anticipated to drive the industry growth. Major players are investing in several R&D activities to develop technologically advanced products. For instance, in July 2023, FUJIFILM SonoSite, Inc., launched Sonosite ST which has a 21-inch touchscreen with an all-touch interface, a 10" by 7.5" image area, automated setting optimization for each exam type, and Auto Steep Needle Profiling (SNP).

Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in July 2022, CANON MEDICAL SYSTEMS CORPORATION announced the acquisition of NXC Imaging, a medical devices and service provider headquartered in Minneapolis, Minnesota.

The regulatory authorities regulate and evaluate the safety & biocompatibility of medical devices as a part of premarket submissions. An increasing number of government initiatives to strengthen the installed base of ultrasound devices from standalone units to low-cost portable devices is expected to boost the market. Furthermore, reimbursement policy in the U.S. is favorable for providers and patients in comparison to other nations.

Portability Insights

The cart/trolley segment dominated the market with a share of 67.93% in 2023 owing to their wide usage in 3D & 4D procedures. These trolleys are easy to transport to the patient's location, such as the ICU or emergency department. In addition, it helps in rapid diagnosis, and decision-making, and also contributes to better patient recovery with satisfaction.

The handheld segment is expected to witness highest growth over the forecast period owing to its portability, ease of use, & compact nature. It is expected to witness a surge in demand, especially in point-of-care, home care, and emergency care settings. This advanced wireless transducer technology is also compatible with smartphones. Factors as such are expected to boost the segment’s growth in the upcoming years.

Product Insights

The diagnostic ultrasound devices segment dominated the market with a share of 84.82% in 2023 owing to the wide range of applications in obstetrics, cardiology, and oncology. Moreover, the technological advancements and growing prevalence of several lifestyle-related disorders are projected to surge the diagnostic ultrasound devices demand. In addition, the government is focusing on the early diagnosis of diseases, which has further led to an increased adoption of these devices.

The therapeutic ultrasound devices segment is expected to witness highest growth over the forecast period. In therapeutic ultrasound, energy is deposited in tissue to induce a wide range of biological effects. The segment is divided into two categories- high-intensity focused ultrasound (HIFU), and extracorporeal shockwave lithotripsy (ESWL).HIFU is used for cosmetic treatment for skin tightening, and it is a non-invasive and painless replacement for facelifts. Whereas, the ESWL offers advantages such as minimally invasive technique, shorter hospital stays, and minimum postoperative follow-up time.

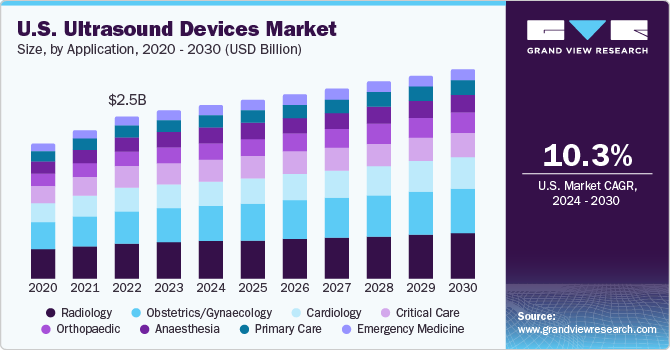

Application Insights

The radiology segment dominated the market with a share of 22.23% in 2023. A rising number of product launches and increasing adoption of ultrasound devices for general imaging are projected to surge segment growth during the forecast period. Various organizations are being established based on radiology to increase its awareness & adoption. The Radiological Society of North America (RSNA) is a nonprofit organization that provides educational resources, such as physician’s certifications, and radiology conferences is expected to increase the general population’s knowledge of radiology. These factors are projected to further enhance the segment’s growth.

The obstetrics/gynecology segment is expected to witness highest growth over the forecast period owing to its feature of providing valuable information about fetal health, such as its age, position, and placental location. Furthermore, a healthy woman receives at least two ultrasound scans during pregnancy to assess fetal growth. Increasing birth rates, rising awareness about monitoring fetal health regularly, along with reimbursement policies are expected to boost the segment in the upcoming years.

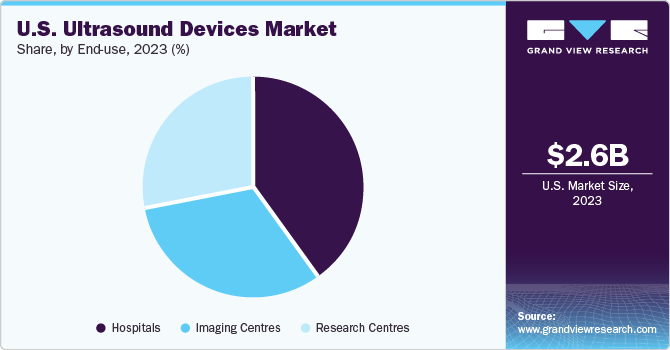

End-use Insights

The hospitals segment dominated the market with a share of 39.97% in 2023. The number and type of ultrasound studies performed at the hospital facility are higher than any other end users. Therefore, the higher utilization rate of ultrasound, coupled with a large patient base, has contributed to this segment’s largest market share. On the other hand, ultrasound has become a key diagnostic tool during emergency visits & bedside monitoring. This is expected to further boost the market growth.

The imaging centers segment is expected to witness highest growth over the forecast period. The longer wait time & high cost of ultrasound services associated with other end-users have contributed to the growing ultrasound procedural volume at imaging centers. In addition, the segment is anticipated to witness lucrative growth with the introduction of teleradiology services in diagnostic centers, where ultrasound images can be transferred within hours to physician computer screens from diagnostic clinics.

Key U.S. Ultrasound Devices Company Insights

Some prominent U.S. ultrasound devices companies include GE Healthcare, Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, Mindray Medical International Limited, Samsung Medison Co., Ltd., and FUJIFILM SonoSite, Inc. Moreover, new entrants such as Butterfly Network, Insightec, and Exo Imaging, Inc are creating their footprints in the point-of-care ultrasound devices with strong technological advancements & strategies. These companies are adopting several strategies to withstand their market position.

Currently, the manufacturers are focusing on expanding ultrasound devices in radiology. They have driven the interest in ultrasound due to improvements in imaging quality and workflow as well as growing awareness of radiation dose issues with other imaging modalities. These players are investing in improving their product offerings through upgradation and taking advantage of important cooperation activities, along with exploring acquisitions & government clearances to expand their customer base and gain a larger share of the overall market.

Key U.S. Ultrasound Devices Companies:

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- FUJIFILM SonoSite, Inc.,

- Konica Minolta Inc.

- Esaote

Recent Developments

-

In February 2023, Boston Imaging announced the launch of Hera W10 Elite which is an exclusive model of the Hera platform for obstetrics and gynecology. It offers clinicians powerful AI tools and clinical applications to further enhance their diagnostic experience

-

In April 2023, Becton, Dickinson, and Company launched the BD Prevue II System, an advanced ultrasound equipment with a specific probe designed to support clinicians with proper IV placement

-

In October 2022, Koninklijke Philips N.V. announced the launch of a new, compact ultrasound system 5000 Series at RSNA 2022, which would enable first-time-right diagnosis for patients

U.S. Ultrasound Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.19 billion

Growth rate

CAGR of 3.26% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, portability, applications, end-use

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ultrasound Devices Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ultrasound devices market report based on product, portability, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Ultrasound Devices

-

2D

-

3D/4D

-

Doppler

-

-

Therapeutic Ultrasound Devices

-

High-intensity Focused Ultrasound

-

Extracorporeal Shockwave Lithotripsy

-

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Compact

-

Cart/Trolley

-

Point-of-Care Cart/Trolley Based Ultrasound

-

Higher-end Cart/Trolley Based Ultrasound

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Obstetrics/Gynaecology

-

Radiology

-

Orthopaedic

-

Anaesthesia

-

Emergency Medicine

-

Primary Care

-

Critical Care

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centres

-

Research Centres

-

Frequently Asked Questions About This Report

b. The U.S. ultrasound devices market size was estimated at USD 2.55 billion in 2023 and is expected to reach USD 2,636.3 million in 2024.

b. The U.S. ultrasound devices market is expected to grow at a compound annual growth rate of 3.26% from 2024 to 2030 to reach USD 3.19 billion by 2030.

b. The diagnostic ultrasound devices segment accounted for the largest revenue share of more than 84% in 2023 owing to the wide range of applications in obstetrics, cardiology, and oncology. The demand for diagnostic ultrasound devices is also anticipated to increase due to technological improvements and rising prevalence of various lifestyle-related diseases.

b. Some key players operating in the U.S. ultrasound devices market include Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote

b. Key factors that are driving the market growth include rising usage of ultrasound equipment for diagnostic imaging and treatment, along with the increasing prevalence of chronic and lifestyle disorders. Other factors influencing market growth include increased demand for minimally invasive surgeries and frequent developments in ultrasound imaging technology.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."