- Home

- »

- Medical Devices

- »

-

U.S. Vaginal Moisturizers And Lubricants Market Report, 2030GVR Report cover

![U.S. Vaginal Moisturizers And Lubricants Market Size, Share & Trends Report]()

U.S. Vaginal Moisturizers And Lubricants Market Size, Share & Trends Analysis Report By Distribution Channel (Retail, Specialty Store, E-Commerce) And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-922-7

- Number of Report Pages: 66

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

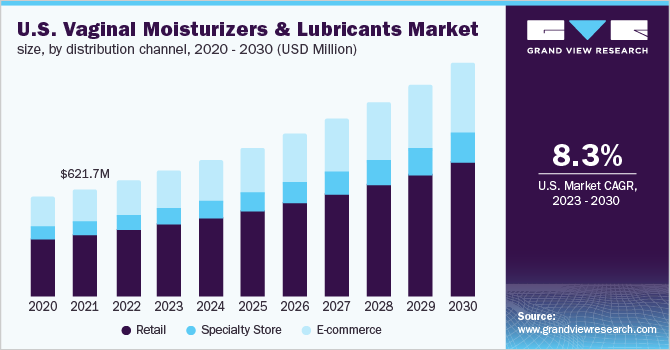

The U.S. vaginal moisturizers and lubricants market size was valued at USD 657.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.34% over the forecast period from 2023 to 2030. Market growth can be attributed to growing awareness regarding sexual wellness and increasing prevalence of vaginal dryness. Open conversations around sexual health, coupled with reduced social stigma, is likely to fuel the market for vaginal moisturizers and lubricants over the forecast period.

The ongoing movement involving the LGBTQ+ community and the increasing acceptance is likely to increase the demand for various sexual wellness products. June is celebrated as Pride Month in the U.S., which is aimed at promoting equality and dignity coupled with increasing awareness. Women reaching menopause often face difficulty in having sexual intercourse due to thinning vaginal tissues and dryness owing to the lack of estrogen. Gel or liquid lubricants are often recommended for women with mild vaginal dryness.

A considerable number of young people are not aware of sexual health, which can increase the prevalence of STDs. According to the CDC, around 20.0 million new cases of STDs occur every year, and young people aged between 15 and 24 contribute to around half of them. Various social media movements, such as the third wave of feminism, are aimed at breaking taboos around sexual health and assisting in changing the general attitude towards sex. OTT platforms are launching several web series regarding sex education to increase awareness among teenagers and young adults. Over the past few years, the sexual wellness industry has shifted its focus toward women’s products.

COVID-19 U.S. vaginal moisturizers & lubricants market impact: 7.97% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

Manufacturing units worked at less capacity, which affected cost of production and logistics. The restrictions led to reduced visits to retail stores, in turn opting for E-commerce platforms for product purchase

Relaxation in the COVID-19 related restrictions is expected to increase the manufacturing capacity and restore sales across all distribution channels

Social restrictions and self-isolation due to the novel coronavirus outbreak increased sales of sexual health and wellness products. For instance, Maude entered the market two years ago and offers lubricants, condoms, candles, and vibrators. The company witnessed an increase in returning customers during February 2020.

Women are increasingly using vaginal lubricants and moisturizers owing to increasing awareness around sexual wellness. Numerous personal care products cater to both menstruation and masturbation. Open conversations around sexual health, coupled with reduced social stigma, is likely to fuel the market over the forecast period.

The growth of the sexual wellness industry in the U.S. has encouraged a lot of indigenous brands to launch their products. There has been an increase in demand for wellness products that are vegan and/or cruelty-free, which is likely to drive the market. For instance, The Yes Yes Company Ltd. offers plant-based products. Its products do not contain any chemicals, parabens, or phthalate plasticizers, which is in line with ongoing trends in the beauty and wellness industry.

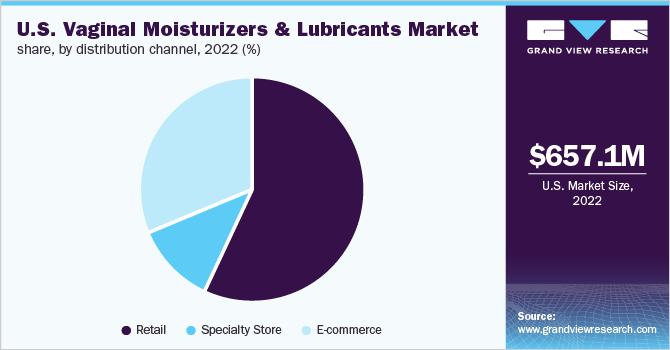

Distribution Channel Insights

The retail store's segment dominated the market in 2022 and accounted for a revenue share of 56.70%. The segment is expected to emerge as the fastest-growing segment with a CAGR of 8.63% during the forecast period. Various retail stores such as Walgreens and Target, sell vaginal lubricants, which offer easy access to customers. Brands often use occasions such as Women’s Day and Valentine’s Day to promote women’s sexual wellbeing. Generation Z is more open and transparent about sex. Millennials often prefer to shop for wellness products online, as it offers greater privacy.

Emerging sexual wellness brands offer products on e-commerce platforms owing to lower cost and easy access to a larger customer base. E-commerce sites, such as Amazon also offer higher privacy to customers who are uncomfortable to shop for sexual wellness products from both retail and standalone stores. Moreover, the ongoing lockdown has also forced people to order which has also led to a massive increase in the sales of sexual wellness products. This is expected to push the sales of sexual wellness products from e-commerce sites.

Standalone specialty stores offering various sexual wellness products, such as lubricants, condoms, sex toys, costumes, and moisturizers, are increasing. Moreover, the FDA has recommended the use of lubricants along with condoms to help increase comfort. Las Vegas offers a lubricant manufacturing facility that develops & tests new flavors and formulas.

Key Companies & Market Share Insights

The manufacturers are adopting various strategies to increase awareness regarding sexual health and provide products focused on reducing side effects. For instance, in January 2020, Dare Bioscience and Bayer AG entered into an agreement pertaining to commercial rights to develop a hormone-free monthly contraceptive Ovaprene for the U.S. market. Moreover, in October 2017, Searchlight Pharma made a financial partnership with Emerillon Capital and Fonds de solidarité FTQ and is expected to promote the growth of Searchlight Pharma. Some of the prominent companies in the U.S. vaginal moisturizers and lubricants market include:

-

Church & Dwight Co., Inc.

-

Bayer AG

-

Reckitt Benckiser Group plc.

-

The Yes Yes Company Ltd.

-

Searchlight Pharma

-

KESSEL medintim GmbH

U.S. Vaginal Moisturizers And Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 705.5 million

Revenue forecast in 2030

USD 1.2 billion

Growth Rate

CAGR of 8.34% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel

Regional scope

U.S.

Key companies profiled

Church & Dwight Co., Inc.; Bayer AG; Reckitt Benckiser Group plc.; The Yes Yes Company Ltd.; Searchlight Pharma; KESSEL medintim GmbH

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. vaginal moisturizers and lubricants market based on distribution channel:

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Specialty Store

-

E-Commerce

-

Frequently Asked Questions About This Report

b. The U.S. vaginal moisturizers and lubricants market size was estimated at around USD 657.1 million in 2022 and is expected to reach around USD 705.5 million in 2023.

b. The U.S. vaginal moisturizers and lubricants market is expected to grow at a compound annual growth rate of 8.34% from 2023 to 2030 to reach around USD 1.4 billion by 2030.

b. The retail segment dominated the U.S. vaginal moisturizers and lubricants market with a share of 56.7% in 2022. This is attributable to the variety of products offered by huge drugstore retail chains such as Walgreens & Target.

b. Some of the key players in the market are Church & Dwight Co., Inc. Bayer AG, Reckitt Benckiser Group plc., The Yes Yes Company Ltd., Searchlight Pharma, and KESSEL medintim GmbH.

b. The increase in the target population, growing awareness regarding sexual wellness, increasing prevalence of vaginal dryness, and increasing use of vaginal lubricants are some of the factors driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."