- Home

- »

- Semiconductors

- »

-

U.S. Vibration Control System Market, Industry Report, 2030GVR Report cover

![U.S. Vibration Control System Market Size, Share & Trends Report]()

U.S. Vibration Control System Market (2024 - 2030) Size, Share & Trends Analysis Report By System Type (Motion Control, Vibration Control), By Application (Automotive, Manufacturers), And Segment Forecasts

- Report ID: GVR-4-68040-214-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vibration Control System Market Trends

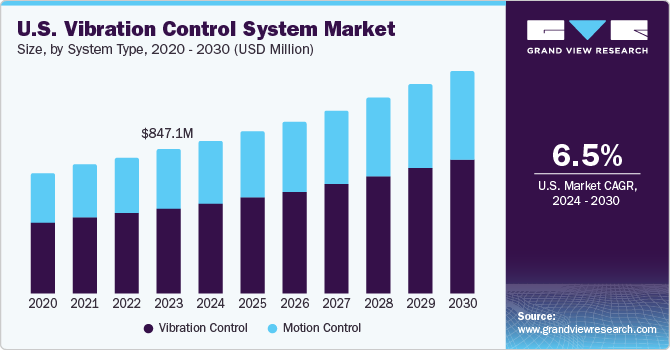

The U.S. vibration control system market size was estimated at USD 847.12 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030. Vibration control systems (VCS) effectively detect and analyze vibrations by utilizing advanced algorithms and precision sensors, providing real-time feedback and control mechanisms to reduce vibration intensity to safe and manageable levels, which if not controlled or managed, can lead to equipment damage, safety hazards, and decreased productivity. VCS offers practical benefits in various manufacturing and industrial applications, such as aerospace & defense, automotive, robots, consumer electronics, and rotors. Hence, the application of VCS across various industries has led to its market growth. The growing emphasis on mechanical stability and balancing of industrial machinery and automobiles is anticipated to support market growth.

The U.S. market for vibration control systems accounted for approximately 16.3% of the global vibration control system market.

The growth of the U.S. vibration control systems market is propelled by recent advancements such as the development of affordable and dependable sensors, user-friendly data analytics software that is powerful, and cloud-based solutions that facilitate the collection and analysis of data from various locations. Manufacturing companies worldwide are increasingly adopting wireless monitoring technology for improved safety, decision-making support, intuitive operation, cost of implementation, and return on investment.

VCS were initially designed for use in automotive and electrical equipment. These systems are now used in aerospace & defense, oil & gas, and mining & quarrying, among others. Electric motors used in EVs operate at higher RPMs (revolutions per minute) than internal combustion engines, which can lead to higher levels of vibration. This is especially true for direct-drive electric motors, which do not require a gearbox and can generate high torque at low RPMs. To minimize the vibrations generated by these motors, vibration control components such as dampers and isolators absorb and isolate the vibrations.

In recent years, the aerospace & defense industry has been using anti-vibration control systems to maintain the reliability of various components, such as sensors, actuators, and controllers that require upgrade/improvement, thus inhibiting the market's growth. Trained personnel and dedicated vibration monitoring equipment are vital in the implementation of a predictive maintenance program. Knowledge platforms for vibration analysis are constantly evolving, as a result of which the vibration maintenance team needs continuous training. However, there is a shortage of experienced vibration analysis engineers, which can create bottlenecks in the implementation of significant vibration analysis programs. The lack of trained technical resources for data analysis can make it difficult for companies to implement and use vibration control systems effectively.

Market Concentration & Characteristics

The market growth stage is medium, and the rate of growth is accelerating. The vibration control systems have multiple applications throughout a diverse range of industries spanning from manufacturing, automotive, and aerospace, to healthcare. Due to the diverse industry applications in various industries, the market for VCS is fragmented as well as it sees a large activity of partnerships and collaborations as well as mergers and acquisitions.

Various latest technologies are emerging in the VCS market. For instance, advanced wireless vibration systems can enhance the speed and convenience of monitoring additional equipment. They are standalone devices that combine sensors and transmitters, making installation and configuration easy. These devices can be configured on-site or preconfigured using a handheld device or wireless gateway, allowing installation at any facility location without needing to connect separate sensors to the transmitter.

In the U.S., the rising awareness about the benefits of vibration control systems, such as improved safety, increased productivity, and reduced maintenance costs, are driving the adoption of vibration control systems, especially in the manufacturing, oil & gas, and aerospace industries. The incumbents of the manufacturing industry are among the significant end users of vibration control systems. Higher levels of vibration stemming from the increasing use of automated machinery and equipment in the manufacturing industry can culminate in severe damage to the equipment and machinery, thereby leading to increased downtime and maintenance costs. However, this damage and the subsequent downtime and maintenance costs can be reduced by employing vibration control systems.

Stringent regulations in the U.S. regarding safety, workplace conditions, and environmental impact contribute to the increased adoption of vibration control systems. These systems help businesses comply with regulations, ensure the well-being of workers, and mitigate the negative effects of vibrations on equipment and the surrounding environment.

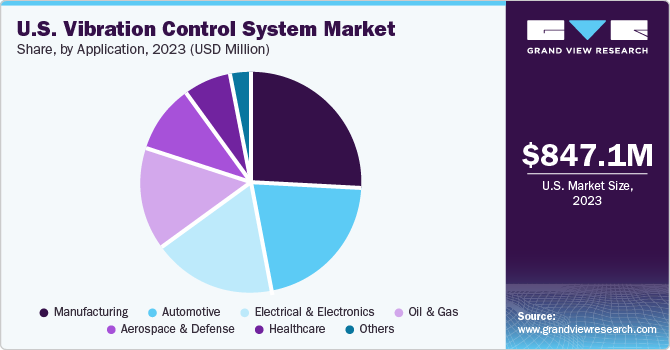

Application Insights

In 2023, the manufacturing segment dominated the market with approximately 25.68% of revenue share. The manufacturing sector is the largest consumer of vibration control systems because it uses a wide variety of machinery and equipment that are susceptible to vibration. Vibration can cause several problems in manufacturing, including reduced accuracy and precision, increased wear and tear, noise pollution, and safety hazards. Therefore, VCS is extensively used in the manufacturing industries as vibration control solutions to help reduce machinery-induced vibrations, prevent structural damage, minimize noise levels, and optimize manufacturing operations. The benefits of efficient production processes, improved product quality, and enhanced equipment lifespan have propelled the market growth.

The automotive segment is anticipated to register the fastest CAGR of 8.3% over the forecast period. As the production and demand for electric vehicles increase, the demand for vibration control components such as dampers, isolators, and mounts are also expected to increase. This increase in demand is also anticipated to fuel market growth. VCS enables to make vehicles more efficient by minimizing vibrations and reducing friction and hence contributes to the optimal functioning of vehicle parts. This improves fuel efficiency and reduces wear and tear.

The electrical & electronics segment is expected to incur significant growth opportunities for all companies involved in the value chain on the back of increasing industrial machinery manufacturing globally. The vibration control mechanisms in the electronics industry consist of control electronics, vibration sensors, and actuators, which create a feedback loop in the mechanism and protect structures and equipment from impact forces.

System Type Insights

The vibration control segment is anticipated to emerge as the fastest-growing segment with a CAGR of 6.5% over the forecast period. The growth is attributed to the rising demand for trembling and quiver controls in various oil & gas and power plant industries. These mechanisms use multiple anti-vibration devices such as washers, absorbers, bushes, mounts, springs, hangers, and dampers to isolate the effects of trembling and shock in power plants. The vibration control segment is bifurcated into various sub-segments, including isolating pads and isolators.

Followed by the vibration control segment, the VCS with motion control type segment is anticipated to register considerable growth by 2030. This growth is due to the growing automotive and aerospace sector. The motion control systems regulate or manipulate the motion of a mechanical system to effectively manage or counteract unwanted vibrations. These systems are used in fixed-wing aircraft that help the reduction of quiver and tremble in the helicopter fuselage generated by the main rotor. In addition, the increasing need for passenger comfort and convenience in aircraft is also expected to spur segment growth over the years.

Key U.S. Vibration Control Systems Company Insights

Some of the key companies in the U.S. market for VCS include Isolation Technology Inc., Hutchinson, and Parker Hannifin Corp.

-

Isolation Technology Inc. is engaged in offering vibration isolators, soundproofing systems, and noise & vibration control systems, including marine engine mounts and sound-damping materials. The company operates through two categories, namely vibration control and noise control. Through the vibration control category, the company provides a full line of vibration isolators, shock mounts, and other anti-vibration products for entertainment & sports facilities, indoor pools, factories, and retail stores, among others.

-

In September 2022, Motion and control technologies company Parker-Hannifin Corp. announced that it had completed its acquisition of aerospace and defense components manufacturer Meggitt PLC (Coventry, U.K.) for approximately £6.3 billion.

Sumitomo Riko America, Inc. and Trelleborg are some of the emerging companies in the U.S. market for VCS.

-

Sumitomo Riko America - holds a significant share of automotive anti-vibration products. It operates through two business segments, namely automotive products and general industrial products. The automotive product segment supplies anti-vibration rubber, interior equipment, hoses, sound-reducing materials, and products for fuel seal products cell vehicles to domestic and foreign customers.

-

Trelleborg - The company offers antivibration products to remove unwanted vibration and noise for key industries such as industrial machines & equipment, agriculture & forestry, construction & mining, renewable energy & power generation, marine, and material handling.

Key U.S. Vibration Control System Companies:

- Fabreeka

- Isolation Technology

- Kinetics Noise Control, Inc

- PARKER HANNIFIN CORP

- Sentek Dynamics Inc.

- VMC Group

- LMCURBSMason Industries Inc.

- MicroMetl Corporation

- Hutchinson

Recent Developments

-

In September 2023, Kinetics Noise Control, Inc., a manufacturer of noise control products and solutions, announced the launch of V.LOCK, a highly effective seismic cable restraint connector. V.LOCK CAN restrain nonstructural components, including ducts, electrical cable trays, piping, and other equipment. It makes restraint of services faster, easier, and more cost-effective than alternatives in the market through extensive savings in field labor.

-

Trelleborg has entered into an agreement to acquire Baron Group, an Australian-Chinese company, which manufactures advanced precision silicone components. This acquisition helps strengthen Trelleborg’s application expertise, and manufacturing capacity and positions the Group as a global partner for medical technology products, in areas such as sleep apnea, respiratory care, and chronic obstructive pulmonary disease (COPD).

U.S. Vibration Control System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 897.58 million

Revenue forecast in 2030

USD 1308.67 million

Growth Rate

CAGR of 6.5% from 2024 to 2030

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

System type, application

Country scope

U.S.

Key companies profiled

Fabreeka; Isolation Technology; Kinetics Noise Control, Inc; PARKER HANNIFIN CORP; Sentek Dynamics Inc.; VMC Group; LMCURBS; Mason Industries Inc; MicroMetl Corporation; Hutchinson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vibration Control System Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. vibration control system market report based on system type and application:

-

System Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Motion Control

-

Springs

-

Hangers

-

Washers & Bushes

-

Mounts

-

-

Vibration Control

-

Isolating Pads

-

Isolators

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace & Defense

-

Manufacturing

-

Electrical & Electronics

-

Healthcare

-

Oil & Gas

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. vibration control system market size was estimated at USD 847.12 million in 2023 and is expected to reach USD 897.58 million in 2024.

b. The U.S. vibration control system market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1,308.67 million by 2030.

b. In 2023, the manufacturing segment dominated the market with approximately 25.68% of revenue share. The manufacturing sector is the largest consumer of vibration control systems because it uses a wide variety of machinery and equipment that are susceptible to vibration.

b. Some of the prominent companies in the U.S. vibration control system market include Fabreeka, Isolation Technology, Kinetics Noise Control, Inc., PARKER HANNIFIN CORP, Sentek Dynamics Inc., VMC Group, LMCURBS, Mason Industries Inc., MicroMetl Corporation, and Hutchinson.

b. The growth of the U.S. vibration control systems market is propelled by recent advancements such as the development of affordable and dependable sensors, user-friendly data analytics software that is powerful, and cloud-based solutions that facilitate the collection and analysis of data from various locations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.