- Home

- »

- Biotechnology

- »

-

U.S. Vitrification Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Vitrification Market Size, Share & Trends Report]()

U.S. Vitrification Market (2024 - 2030) Size, Share & Trends Analysis Report, By Specimen (Oocytes, Embryo, Sperm), By End-use (IVF Clinics, Biobanks), And Segment Forecasts

- Report ID: GVR-4-68040-249-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vitrification Market Size & Trends

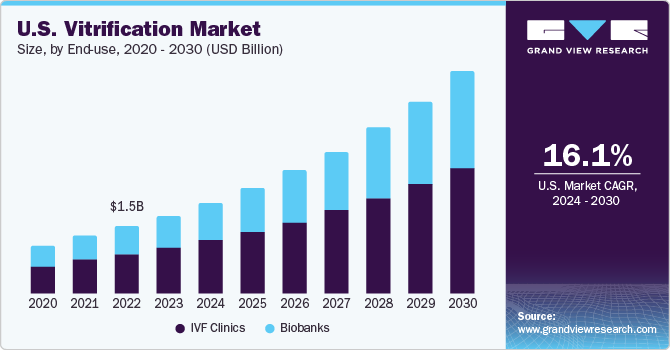

The U.S. vitrification market size was estimated at USD 1.74 billion in 2023 and is expected to grow CAGR of 16.08% from 2024 to 2030, driven by factors such as changing sociodemographic aspects, increased infertility cases, and advanced fertility preservation techniques like IVF. Oocyte vitrification’s success, societal acceptance, and rising demand for cryopreservation services contribute to market expansion. Moreover, cancer patients and those at higher risk of cancer are encouraged to seek fertility preservation treatments, further fueling market growth.

The U.S. vitrification market accounted for over 20% of the global vitrification market in 2023. This can be attributed to several factors, including changing sociodemographic aspects and advancements in fertility preservation techniques. Approximately 10% women in the U.S., aged between 15 and 44 years, face challenges in conceiving as reported by the CDC. This increasing number of infertile individuals fuels the demand for fertility preservation services. With the help of advanced technologies, such as IVF, the chances of conceiving a child can be increased. In line with these trends, the CDC’s January 2023 report highlights that the average age of U.S. women having their first child has increased over time, further emphasizing the need for fertility preservation techniques.

Modern egg preservation methods, such as oocyte vitrification, have demonstrated significant success rates, increasing social acceptance and driving market growth. Fertility preservation techniques have gained more acceptance in numerous countries, including legal endorsements of same-sex marriage and an increase in single parenthood. This has led to a higher demand for cryopreservation of eggs and sperm, resulting in increased demand for vitrification services. The American Cancer Society recommends egg freezing or embryo freezing for women with cancer to preserve fertility, further increasing the demand for fertility preservation services.

The growing acceptance of fertility preservation in society is also evident in the suggestion provided to individuals with a higher probability of acquiring cancer. These individuals are encouraged to seek egg preservation treatment for future use, as cancer treatments may affect fertility. With over 11,000 cervical cancer cases reported annually in the U.S., the need for fertility preservation techniques is on the rise. These factors collectively contribute to market expansion.

Market Concentration & Characteristics

The U.S. vitrification market is relative concentrated, with the presence of several large company accounting for most of the market share. These companies are constantly involved in product innovation, M&A activities, new product development, and geographic expansion as their key market expansion activities.

The industry demonstrates a high level of innovation as companies continuously work on improving their technologies and services. Various advancements in vitrification techniques, storage methods, and quality control processes are prevalent in the industry, fostering progress and enhancing outcomes for patients needing fertility preservation or treatment. Integrating AI and ML in fertility treatments may enhance fertility tests as well. Key players are specifically focusing on ovarian tissue vitrification. Numerous efforts have been made to assess the feasibility of vitrifying large ovarian tissues, supporting the effectiveness of vitrification over programmed freezing for larger ovarian tissues.

The industry is characterized by notable mergers and acquisitions in recent years, indicating a level of consolidation and strategic growth. For instance,in November 2023, CooperCompanies acquired select Cook Medical assets focused on obstetrics, doppler monitoring, and gynecology surgery, strengthening CooperSurgical’s position as a leading global fertility and women’s health company. This acquisition expanded their medical device portfolio.

The U.S.FDA and the Centers for Medicare and Medicaid Services, two federal agencies under the Department of Health and Human Services (HHS), oversee important facets of vitrification-based systems and storage systems in the country. Moreover, the authority is also responsible for regulating various aspects of assisted reproductive technologies and cryopreservation.

Companies are investing in innovating products and acquisitions at a significant pace to capitalize on opportunities. Many players strive to expand their industry share, undertaking significant efforts. For example, in December 2021, CooperCompanies acquired Generate Life Sciences, a company offering fertility cryopreservation services, for USD 1.6 billion.

Companies in the industry are expanding across various states to tap into regional demand, access new customer bases, and establish a broader industry presence. For instance, in May 2022, Cook Medical introduced the MINC+ Benchtop Incubator for IVF clinics in Canada and the U.S., expanding their Assisted Reproductive Technology (ART) product suite.

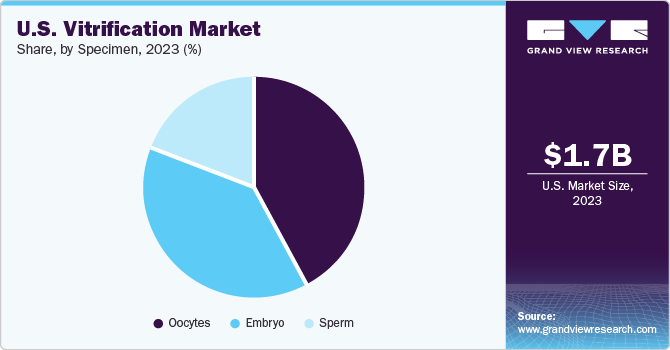

Specimen Insights

Oocytes led the segment in 2023 with over 40% of the total revenue share, driven by their effectiveness, as demonstrated by higher oocyte survival rates, pregnancy success, and live births. Advancements in oocyte vitrification techniques are expected to fuel market growth. The Society of Assisted Reproductive Technology (SART) observed a significant increase in egg-freezing processes in 2021 compared to 2019. The COVID-19 pandemic also led to a rise in egg-freezing adoption. Seattle Reproductive Medicine reported a 20% increase in 2020. Academic and research institutions are actively studying oocyte vitrification outcomes, while international organizations like WHO are supporting them through funding and grants.

The sperm segment is anticipated to register the fastest CAGR over the forecast period. This growth can be attributed to the increasing adoption of sperm vitrification, a technique with high potential for preserving sperm quality. Technological advancements have led to improved sperm survival rates after thawing. In addition, innovations in 3D printing may contribute to new methods of manufacturing freezing devices. For example, a recent report by the SART revealed a 25% increase in sperm-freezing procedures in 2022 compared to the previous year.

End-use Insights

In 2023, IVF Clinics led the market by occupying nearly 60% of the total revenue generated. This advanced technique has significantly improved IVF success rates and the number of freezing cycles for oocytes and embryos. As more individuals opt for vitrification to preserve their biospecimens, the number of clinics offering this service is increasing.

A study published in Science Direct in February 2020 revealed that vitrified embryos exhibit better survival rates than those from the slow freezing process. The enhanced pregnancy and survival rates offered by vitrification have increased their use in IVF clinics. Market players are expanding their presence through strategies like acquisitions, partnerships, and facility expansions.

Biobanks are anticipated to grow at the fastest rate from 2024 to 2030 owing to the rising utility for biospecimen preservation and banking & processing. Cryobanking, complementing the vitrification market, has also seen significant growth due to a shift from slow freezing to the vitrification technique for preserving eggs, embryos, and sperm.

The rising number of ART procedures has fueled the demand for cryobanking services. Vitrification has revolutionized egg preservation by offering a rapid, cost-effective, and efficient mode of specimen preservation, leading to increased egg storage in biobanks. Furthermore, the emergence of online egg donor platforms is expected to stimulate the segment growth. For example, Tulip, an online egg donor matching platform launched in November 2020, managed to attract approximately 20,000 egg donors from 90% of U.S. agencies.

Key U.S. Vitrification Company Insights

The U.S. vitrification market exhibits a consolidated landscape, with a few prominent companies holding a substantial market share. This concentration may result in heightened competition among major players, while potentially restricting new entrants from accessing the market. Some key companies in the U.S. vitrification market are Cook Medical LLC; Vitrolife; Genea Biomedx; NidaCon International AB; Minitube; and IMV Technologies Group (Cryo Bio System), among others.

Notable companies in the industry are implementing diverse strategic approaches, including product launches, collaborations, and partnerships, to maintain and strengthen their market presence. Furthermore, they are focusing on innovation to drive advancements and introduce novel solutions for the market’s benefit.

For instance, in February 2024, Kitazato Corporation and IVF2.0 formed a strategic collaboration to revolutionize the IVF market with AI solutions. The partnership aimed to enhance real-time sperm selection based on ploidy prediction for ICSI and embryo ranking. Kitazato leveraged its global distribution network to introduce IVF2.0’s software, which assists embryologists in making critical decisions for improved fertility outcomes.

Key U.S. Vitrification Companies:

- Cook Medical LLC

- Vitrolife

- Genea Biomedx

- NidaCon International AB

- Minitube

- IMV Technologies Group (Cryo Bio System)

- The Cooper Companies, Inc. (A CooperSurgical Fertility Company)

- FUJIFILM Corporation (FUJIFILM Irvine Scientific)

- Biotech, Inc.

- Kitazato Corporation

- Shenzhen VitaVitro Biotech

Recent Developments

-

In October 2023, Cellipont Bioservices and Evia Bio collaborated to launch the Cryo Excellence Center (CryoX) in Houston, Texas.

-

In June 2023, Fairtility launched CHLOE OQ. This launch encouraged patients and embryologists with oocyte quality insights for egg donation, egg freezing, and IVF applications.

-

In July 2021, Vitrolife entered an agreement to acquire 100% shares of lgenomix from EQT. This acquisition made Vitrolife a leader in the reproductive health business.

U.S. Vitrification Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.74 billion

Revenue forecast in 2030

USD 4.96 billion

Growth rate

CAGR of 16.08% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Specimen, end-use

Country scope

U.S.

Key companies profiled

Cook Medical LLC; Vitrolife; Genea Biomedx; NidaCon International AB; Minitube; IMV Technologies Group (Cryo Bio System); The Cooper Companies, Inc. (A CooperSurgical Fertility Company); FUJIFILM Corporation (FUJIFILM Irvine Scientific); Biotech, Inc.; Kitazato Corporation; Shenzhen VitaVitro Biotech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vitrification Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. vitrification market report based on specimen and end-use:

-

Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Oocytes

-

Devices

-

Kits & Consumables

-

-

Embryo

-

Devices

-

Kits & Consumables

-

-

Sperm

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IVF Clinics

-

Biobanks

-

Frequently Asked Questions About This Report

b. The U.S. vitrification market size was estimated at USD 1.74 billion in 2023.

b. The U.S. vitrification market is expected to register a compound annual growth rate (CAGR) of 16.08% from 2024 to 2030 to reach USD 4.96 billion by 2030.

b. Oocytes led the segment in 2023 with over 40% of the total revenue share, driven by their effectiveness, as demonstrated by higher oocyte survival rates, pregnancy success, and live births.

b. Some key companies in the U.S. vitrification market are Cook Medical LLC; Vitrolife; Genea Biomedx; NidaCon International AB; Minitube; and IMV Technologies Group (Cryo Bio System), among others.

b. The growth is driven by factors such as changing sociodemographic aspects, increased infertility cases, and advanced fertility preservation techniques like IVF.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.