- Home

- »

- Consumer F&B

- »

-

U.S. Vodka Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Vodka Market Size, Share & Trends Report]()

U.S. Vodka Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Flavored, Non-flavored), By Distribution Channel (Off-trade, On-trade), Consumer Behavior, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-545-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vodka Market Size & Trends

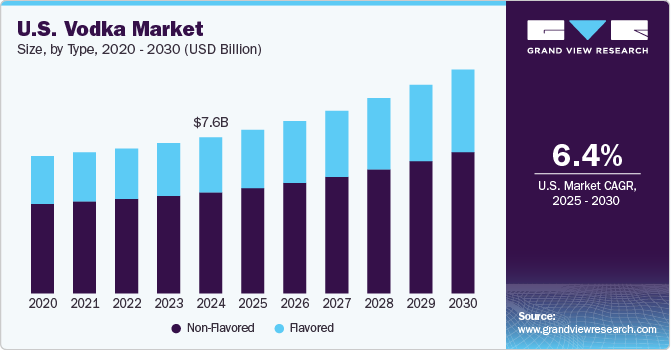

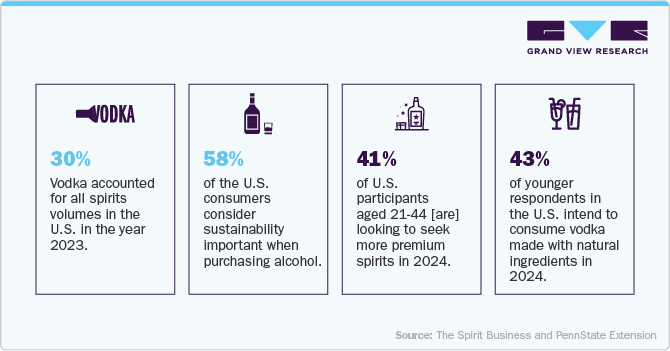

The U.S. vodka market size was estimated at USD 7.62 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030. This growth is attributable to the increasing demand for premium and flavored vodkas, which appeal to consumers seeking unique and high-quality drinking experiences. The robust cocktail culture in the U.S. further fuels this demand, as vodka is a versatile base for various cocktails. One key driver of the U.S. vodka industry is the rise of craft and artisanal vodka brands. These brands offer unique flavors and production methods that appeal to consumers seeking distinctive products. For instance, brands such as Tito's Handmade Vodka have gained popularity by offering high-quality, craft vodka products that resonate with consumers looking for authentic and locally produced spirits.

The growth of e-commerce platforms and online sales channels has also contributed significantly to the U.S. vodka market expansion. This shift allows consumers to explore a wide range of vodka products from the comfort of their homes, enhancing accessibility and convenience. In addition, the increasing preference for at-home consumption has led to a rise in off-trade sales, further driving market growth.

The U.S. market benefits from a strong distribution network, including both on-trade and off-trade channels. Supermarkets and hypermarkets play a crucial role in making vodka products accessible to a wide consumer base. For instance, retailers such as Walmart collaborate with vodka manufacturers to offer exclusive deals and promotions, which helps drive sales and maintain market momentum. This strategic collaboration enhances consumer engagement and supports the overall growth of the vodka market in the U.S.

Consumer Insights for Vodka Products in the U.S.

The U.S. reveals a strong trend towards premiumization, where consumers are increasingly willing to pay more for high-quality spirits that offer unique flavors and craftsmanship. This trend is evident in the growing demand for craft and artisanal vodkas, which appeal to consumers seeking authentic and distinctive drinking experiences. For instance, brands like Tito's Handmade Vodka have capitalized on this trend by offering high-quality, craft vodka products that resonate with consumers looking for locally produced spirits.

The U.S. vodka market is also influenced by the rise of cocktail culture and mixology, which has fueled demand for versatile spirits like vodka. Consumers are experimenting with crafting their cocktails at home, discovering vodka's adaptability as a base for a wide range of drinks. This trend encourages consumers to explore premium vodka brands that offer unique flavors and production methods, driving innovation and differentiation in the market.

Another key consumer insight is the growing focus on health and wellness, with many consumers moderating their alcohol intake and seeking lower-alcohol options. According to recent surveys, nearly half of Americans plan to drink less in 2025, reflecting a broader shift towards more mindful consumption habits. This trend presents opportunities for vodka brands to develop lower-ABV or responsibly sourced products that appeal to health-conscious consumers.

The U.S. vodka industry benefits from effective marketing strategies that emphasize brand personality, cultural relevance, and shared experiences. For example, Absolut's collaborations with popular events and influencers help engage younger demographics and create memorable brand experiences. By leveraging these strategies, vodka brands can maintain relevance and appeal to a diverse range of consumers, from those seeking premium products to those prioritizing health and sustainability.

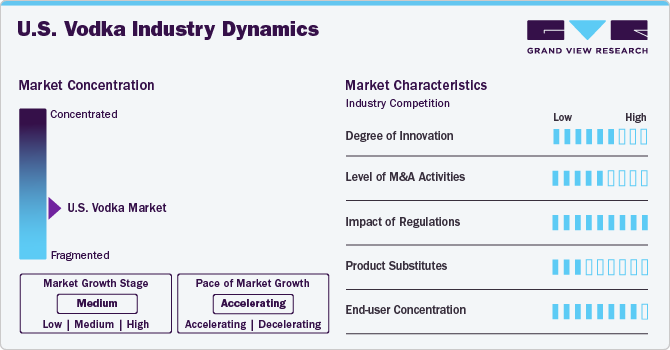

Market Concentration & Characteristics

Product innovation in the U.S. vodka market is driven by advancements in premium and flavored vodka offerings, catering to evolving consumer preferences for unique and high-quality spirits. Companies are investing in innovative production methods and flavor profiles to enhance the appeal of their products. For instance, brands are focusing on craft and artisanal vodka, offering distinctive flavors and production techniques that resonate with consumers seeking authentic and locally produced spirits.

The U.S. market for vodka has seen a moderate level of merger and acquisition activities as companies seek to expand their product portfolios and strengthen their market presence. Large spirits manufacturers are acquiring craft vodka brands to capitalize on shifting consumer preferences towards premium and craft products.

The regulatory landscape for the U.S. vodka market is governed by agencies such as the Federal Trade Commission (FTC) and the Alcohol and Tobacco Tax and Trade Bureau (TTB), ensuring compliance with labeling and advertising standards. Vodka products must adhere to specific regulations regarding alcohol content and labeling claims.

The U.S. vodka industry faces competition from various substitutes, including other spirits, such as whiskey and tequila, and alternative beverages, such as wine and beer. However, vodka's versatility in cocktails and premium offerings continue to attract consumers seeking unique drinking experiences.

Type Insights

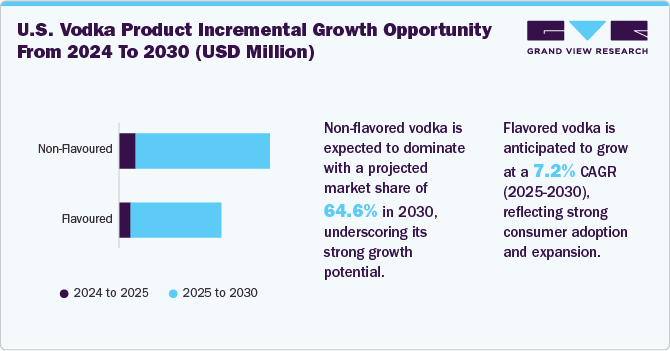

The non-flavored vodka segment accounted for a market share of 64.6% of the U.S. revenue in 2024. Key growth drivers for non-flavored vodka include its versatility and neutral taste, which make it ideal for mixing with other beverages. The growth of cocktail culture and the preference for using non-flavored vodka as a base for personalized drinks further supports its market presence.

The flavored vodka segment in the U.S. is projected to grow at a CAGR of 7.2% from 2025 to 2030. The increasing demand for diverse and unique flavors among consumers, particularly millennials, who are eager to explore new taste experiences, has driven the market. This trend is supported by the rise of cocktail culture and mixology, where flavored vodka offers bartenders and enthusiasts a wide range of creative possibilities. For instance, brands such as Bacardi have launched products like TAILS COCKTAILS, which cater to the growing demand for premium flavored vodka drinks by providing easy-to-make, high-quality cocktails at home.

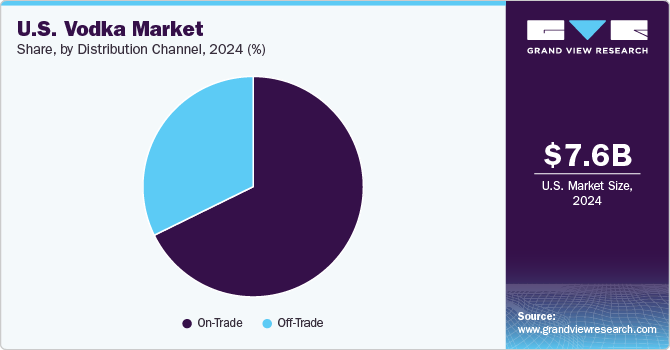

Distribution Channel Insights

The on-trade segment accounted for a share of 67.7% of the U.S. revenue in 2024. One major driver is the increasing demand for diverse and unique flavors among consumers, particularly millennials, who are eager to explore new taste experiences. This trend is supported by the rise of cocktail culture and mixology, where flavored vodka offers bartenders and enthusiasts a wide range of creative possibilities. In addition, the growth of online and offline retail channels has made flavored vodka more accessible, further fueling its market expansion.

The off-trade segment is projected to grow at a CAGR of 7.4% from 2025 to 2030. Consumers are leveraging the convenience offered by retail outlets such as supermarkets and online platforms, where they can access a wide variety of vodka products at competitive prices. For instance, companies such as Walmart and Tesco collaborate with vodka manufacturers to offer exclusive deals and promotions, enhancing consumer engagement and driving sales. Additionally, the rise of e-commerce platforms has further accelerated off-trade growth by providing easy access to premium and super-premium vodka products, allowing consumers to explore new brands and flavors from the comfort of their homes.

Key U.S. Vodka Company Insights

In the U.S. vodka market, established companies and emerging players create a competitive environment by focusing on product innovation, quality, and pricing strategies. Key players employ strategies to maintain a competitive edge by launching innovative products, such as premium and craft vodkas, and adopting sustainable practices. They leverage marketing and advertising to enhance brand visibility and engage with consumers, often highlighting unique flavors and production methods. Additionally, companies invest in eco-friendly packaging and production methods to appeal to environmentally conscious consumers. Strategic acquisitions and partnerships also play a role in expanding product portfolios and strengthening market presence, as seen with major brands acquiring craft vodka distilleries to diversify their offerings.

Key U.S. Vodka Companies:

- Belvedere Ltd.

- Brown-Forman Corp.

- Fifth Generation, Inc.

- Pernod Ricard S.A

- Sazerac Company, Inc.

- Bacardi Ltd.

- New Amsterdam Spirits Company

- Diageo Plc.

- Distell Group Holdings Ltd

- American Liquor Co.

Recent Developments

-

In March 2025, Kraft Heinz launched Crystal Light Vodka Refreshers, a 77-calorie beverage, aligning with consumer demand for lower-calorie alcoholic options. This move underscored Kraft Heinz's focus on tapping into the expanding market for hard seltzers, potentially increasing investor interest. The company's full-year earnings report revealed a significant increase in net income despite a sales drop, reassuring investors about profitability. Simultaneously, the company introduced HEINZ Flavor Tour Condiments, reflecting a diversification strategy that positively influenced investor perception.

-

In February 2025, Cardrona Distillery, a New Zealand-based distillery, partnered with Hotaling & Co. as its exclusive U.S. importer, aiming to expand its presence in the United States. This collaboration marked a key move to introduce Cardrona's award-winning The Cardrona Single Malt Whisky and The Reid Vodka to a wider audience of spirits enthusiasts. The Reid, a single malt vodka crafted from rich malted barley, pristine alpine water, and distiller’s yeast, is now available in select US markets.

-

In August 2024, GREY GOOSE vodka announced a partnership with tennis star Frances Tiafoe to celebrate the U.S. Open, solidifying its 18-year role as the tournament's official vodka. The collaboration included a new campaign to inspire fans through content, social media, and a contest to upgrade a lucky fan's US Open experience with premium seats. GREY GOOSE also continued its tradition of serving the Honey Deuce™ cocktail, a US Open icon, at branded cocktail bars throughout the venue, and offered canned versions for home viewers in select cities.

U.S. Vodka Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.97 billion

Revenue forecast in 2030

USD 10.90 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel

Country scope

U.S.

Key companies profiled

Belvedere Ltd.; Brown-Forman Corp.; Fifth Generation, Inc.; Pernod Ricard S.A; Sazerac Company, Inc.; Bacardi Ltd.; New Amsterdam Spirits Company; Diageo Plc.; Distell Group Holdings Ltd; American Liquor Co.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vodka Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. vodka market report based on type, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Non-Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-Trade

-

On-Trade

-

Frequently Asked Questions About This Report

b. The U.S. vodka market was estimated at USD 7.62 billion in 2024 and is expected to reach USD 7.97 billion in 2025.

b. The U.S. vodka market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 10.90 billion by 2030.

b. Non-flavored vodka segment dominated the U.S. vodka market with a share of 64.64% in 2024, owing to its versatility and neutral taste, which make it ideal for mixing with other beverages. The growth of cocktail culture and the preference for using non-flavored vodka as a base for personalized drinks further supports its market presence.

b. Some of the key market players in the U.S. vodka market are Belvedere Ltd.; Brown-Forman Corp.; Fifth Generation, Inc.; Pernod Ricard S.A; Sazerac Company, Inc.; Bacardi Ltd.; New Amsterdam Spirits Company; Diageo Plc.; Distell Group Holdings Ltd; and American Liquor Co.

b. A significant driver is the increasing consumer preference for flavored and infused vodkas, offering a wider range of taste profiles beyond the traditional neutral spirit. This trend fuels experimentation with cocktails and caters to consumers seeking convenient and flavorful options. Another prominent trend involves the rise of premium and super-premium vodkas, fueled by a desire for higher quality ingredients, unique distillation processes, and a more sophisticated drinking experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.