- Home

- »

- Advanced Interior Materials

- »

-

U.S. Washing Machine Parts Market Size & Share Report, 2030GVR Report cover

![U.S. Washing Machine Parts Market Size, Share & Trends Report]()

U.S. Washing Machine Parts Market Size, Share & Trends Analysis Report By Distribution Channel (Online, Offline), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-996-8

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

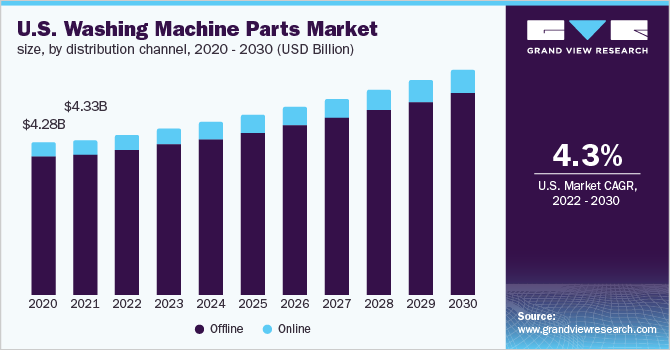

The U.S. washing machine parts market size was estimated at USD 4.34 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2022 to 2030. The growth of the industry in the U.S. is attributed to the use of technology to create parts that consume less water and energy. The market for washing machine parts is expanding as a result of changing lifestyles, rising disposable income, and the availability of cutting-edge technologies. Manufacturers in the U.S. are also focusing on developing parts that reduce the consumption of water and energy.

The U.S. is experiencing high economic growth and with the growing purchasing power of the population in the U.S., the market is expected to witness further growth. The consumer goods sector, including washing machines, is expected to grow at a significant pace over the forecast period. This would further result in the demand for washing machine components in the U.S. There is a growing preference for repair and maintenance of washing machines instead of buying a new unit because of its increasing cost by unit.

The value chain of the U.S. washing machine parts market is characterized by the presence of raw material suppliers, product manufacturers, distributors, and end users. These parts are manufactured using aluminum, copper, stainless steel, and propylene as raw materials. Out of the entire weight of the washing machine, steel has the maximum proportion by weight, followed by plastic (propylene).

The lid switch assembly, motor coupling, drive belt, and water inlet valve are the most replaced parts in the overall U.S. washing machine market. Numerous players are engaged in the manufacture of these parts using different raw materials such as stainless steel (porcelain-coated steel), copper, and plastic (polypropylene), thus, creating significant competition in the industry.

The online segment is expected to grow at a CAGR of 5.3%, attributed to increased digitalization. The offline segment is expected to grow at a CAGR of 4.2% over the forecasted period. Various innovations have been made such as Whirlpool Top Load Washer with 2 in 1 Removable Agitator introduced by Whirlpool, U.S. It enables customization to meet consumer demands. The agitator can be installed and removed depending on the variety of clothes being washed. On its removal, the agitator facilitates the availability of sufficient space for heavier loads of clothes to be washed.

The market players in the U.S. are heavily engaged in merger & acquisition strategies, increased R&D investments, and expansion of production facilities for improving the product portfolio. For instance, in February 2022, EVI Industries, Inc. completed its mergers with Central Equipment Company in Columbia, SC, and Raleigh, NC, both of which distribute commercial washing products in and out of the U.S. and offer related technical installation and maintenance services.

Industry participants in the U.S. are additionally focusing on collaborations with third-party suppliers and distributors to deliver the entire washing machine parts product portfolio to end users. Apart from that, the washing machine parts market is gaining popularity throughout the U.S. on account of the affordability, excellent functions, and durability of the components.

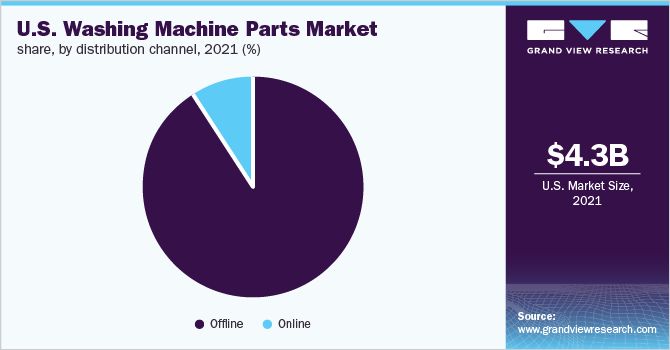

The offline segment dominated the distribution channel segment in the U.S. washing machine parts industry. The offline medium of the sales of these parts enforces manufacturers and suppliers to introduce efficient marketing strategies. Also, it reduces the time taken to possess the part physically henceforth, offering an instant replacement, repair, and maintenance. Therefore, the segment is expected to lead in the U.S. economy.

The price of washing machines is increasing. Hence, repair and maintenance of washing machines is an alternate solution. Hence, repair and maintenance are preferred choices over purchasing a new unit. The growth of the industry can be attributed to the rising demand for washing machine parts for residential use in the country.

Distribution Channel Insights

During the forecast period, it is predicted that the offline segment dominated the market in 2021 and captured a considerable share. Manufacturers of washing machine parts opt for offline and online modes to deliver their products to consumers. They deliver their products through mediums like retail shops, company/manufacturer outlets, third-party sellers, e-commerce, and brand website portals.

The offline market for washing machine parts in the U.S. has a bigger share due to its many advantages. Customers who want to ensure the authenticity of products buy offline parts. Various manufacturers deliver their products through online channels. The product reaches its specific customer through a third-party online supplier or the online delivery portals established by the company itself. A major challenge faced by consumers of washing machine parts is the authenticity of parts. Hence, ensuring the authenticity of the product along with optimum delivery time is important for the manufacturers and third-party delivery service providers.

Offline distribution channel includes selling at the plant, door-to-door sales, service centers, wholesalers, and opening own selling outlets. These factors are expected to contribute to the growth of the U.S. market. The apparel industry is exposed to constant upgradations and innovation concerning fabrics among other factors. To cater to the new and upgraded fabrics, the washing machine industry has to develop products that can handle the way these fabrics are being washed and dried without affecting their quality.

This depends upon the way the fabric reacts to the agitator and drum of the washing machine while being washed. Hence, the development of smart washing machines with optimum parts is becoming prevalent to meet the demands of various existing and new textiles during the cleaning process. This is propelling the need to develop smart washing machine components.

The online distribution channel is gaining importance in the U.S. due to the growing inclination of the population toward online shopping post-pandemic. The consumers of the U.S. get to choose from a variety of brands’ products & services and price ranges depending upon the specific part that needs to be repaired or replaced.

Key Companies & Market Share Insights

There are a large number of players offering washing machine parts in the U.S. that provide a range of product varieties leading to a high competitive rivalry in the industry. The key players offering washing machine parts in the U.S. are Beko U.S., Inc.; Asko Appliance AB; LG Electronics; GE Appliances; and Sundberg America, Inc. with their strong distribution network.

Players in the U.S. washing machine sector mainly compete based on product quality and product advancements in terms of new technology. Major companies in the U.S. are focusing on developing new strategies to cater to the increasing demand from customers. Different innovations with the help of modern technologies, such as AddWash by Samsung, Top Load Washer with Quick Wash, and sanitization for washing machines by Whirlpool, are expected to increase the scope of parts manufacturing.

These market players are engaged in the manufacture and distribution of washing machine parts such as pumps, drain pipes, inlet valves for water, tubs/drums, agitators, motors, and circuit control boards among others. The manufacturers cater to the rising demand from the commercial and residential sectors. Some prominent players in the U.S. washing machine parts market include:

-

Beko U.S., Inc.

-

LG Electronics

-

RepairClinic.com.

-

Sundberg America, Inc.

-

Jenfab Cleaning Solutions

-

Alliance Laundry Systems LLC

-

SamsungParts.com

-

GE Appliances

-

Whirlpool Corporation

-

Kellett Enterprises, Inc.

U.S. Washing Machine Parts Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.50 billion

Revenue forecast in 2030

USD 6.33 billion

Growth rate

CAGR of 4.3% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel

Country scope

U.S.

Key companies profiled

Beko U.S., Inc.; LG Electronics; RepairClinic.com.; Sundberg America, Inc.; Jenfab Cleaning Solutions; Alliance Laundry Systems LLC; SamsungParts.com; GE Appliances; Whirlpool Corporation; Kellett Enterprises, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Washing Machine Parts Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. washing machine parts market report based on distribution channel:

-

Online

-

Offline

Frequently Asked Questions About This Report

b. The U.S. washing machine parts market size was estimated at USD 4.34 billion in 2021 and is expected to reach USD 4.50 billion in 2022.

b. The U.S. washing machine parts market is expected to grow at a compound annual growth rate of 4.3% from 2022 to 2030 to reach USD 6.33 billion by 2030.

b. The offline distribution channel segment dominated the U.S. washing machine parts market with a share of 90.82% in 2021 which is attributed to the upgrading lifestyle and growth in coupled with rapid industrialization.

b. Some of the key players operating in the U.S. washing machine parts market include Beko U.S., Inc., LG Electronics, RepairClinic.com., Sundberg America, Inc., Jenfab Cleaning Solutions, Alliance Laundry Systems LLC, SamsungParts.com, GE Appliances, Whirlpool Corporation, and Kellett Enterprises, Inc.

b. The key factors that are driving the U.S. washing machine parts market include a continuous change in various textiles leads to upgradation in the washing machine parts, increasing urbanization and domestic production, and growing demand for washing machine parts, and increasing consumer preference towards repair & replacements over new washing machines.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."