- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Watches Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Watches Market Size, Share & Trends Report]()

U.S. Watches Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Analog, Digital), By Price (Economy, Premium), By Type, By Price Range, By End User (Men, Women), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-826-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Watches Market Summary

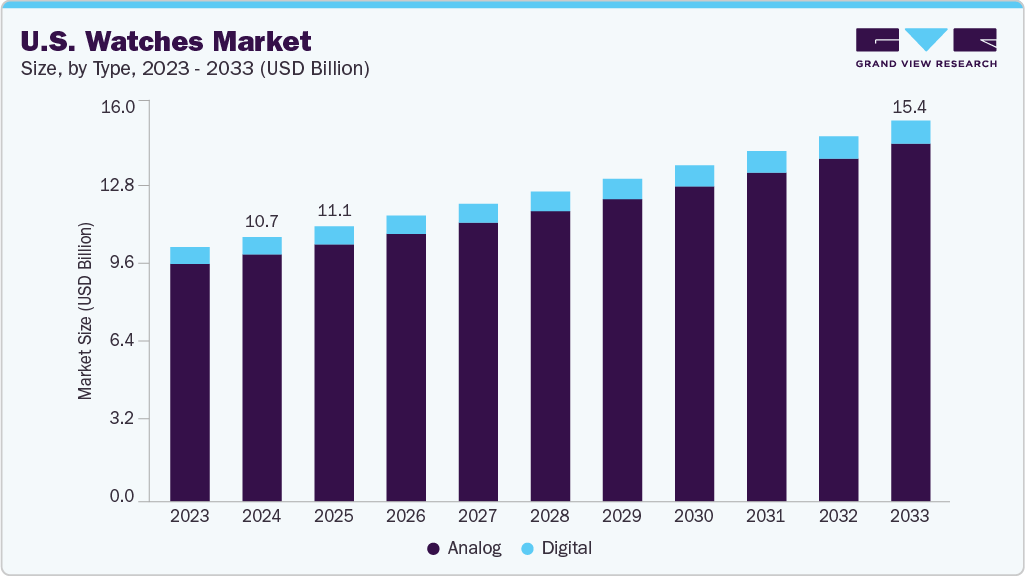

The U.S. watches market size was estimated at USD 10.67 billion in 2024 and is projected to reach USD15.37 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. A strong demand across all price tiers, driven by brand-conscious consumers seeking luxury, mid-range, and affordable mechanical and quartz watches for style, gifting, and investment purposes, drives the market growth.

Key Market Trends & Insights

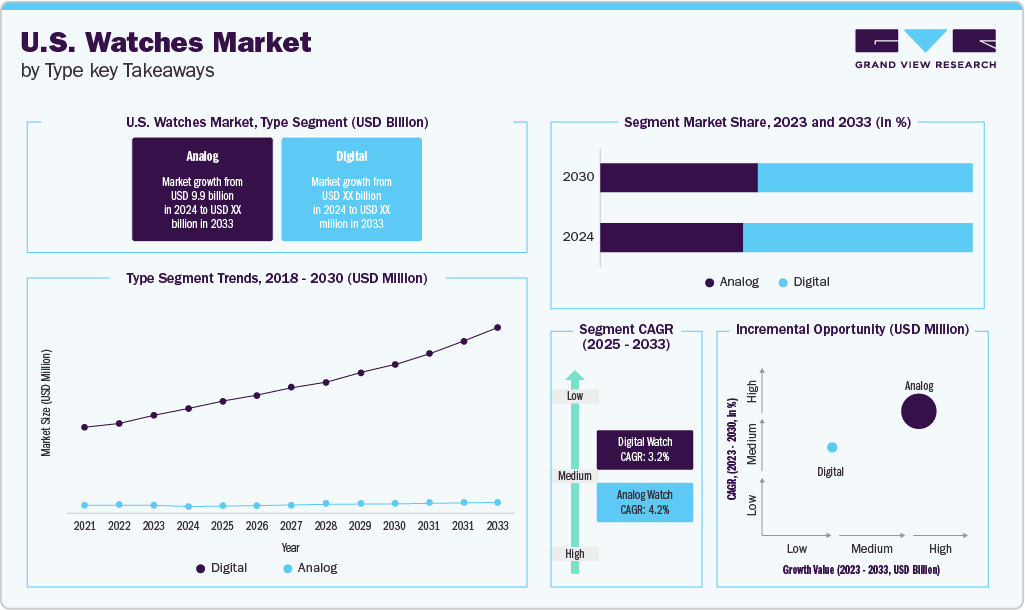

- By type, the analog watches segment led the market with a revenue share of 93.46% in 2024.

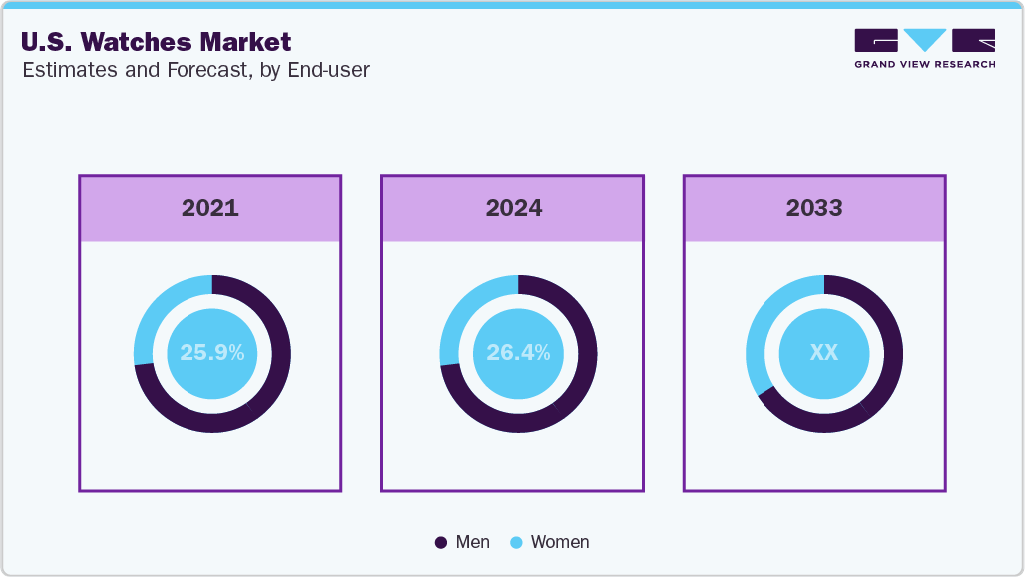

- By end user, the men segment led the market, with a revenue share of 73.60% in 2024.

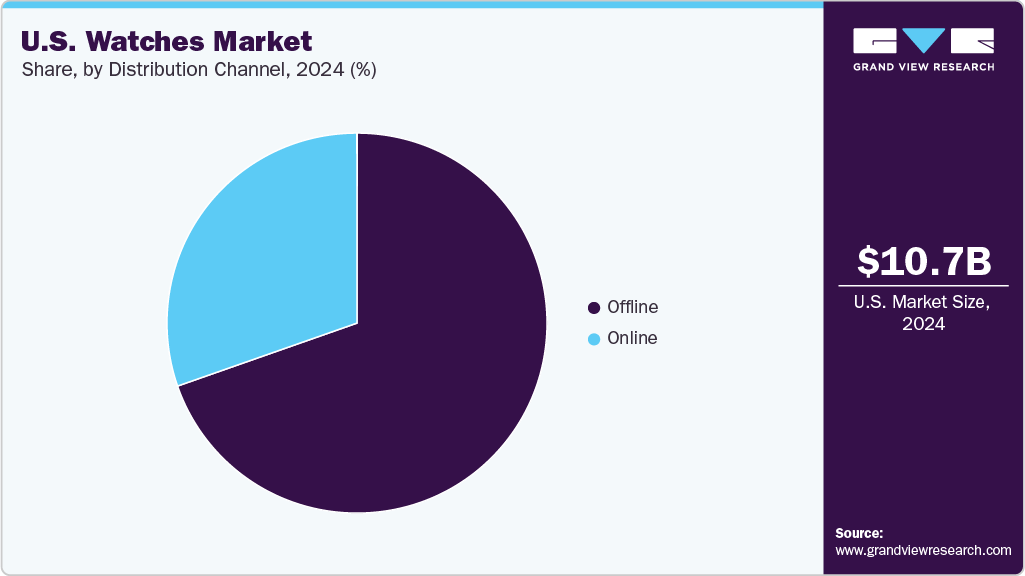

- By distribution channel, the offline sales segment held the largest market share of 69.63% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.67 Billion

- 2033 Projected Market Size: USD 15.37 Billion

- CAGR (2025-2033): 4.2%

A key ongoing trend in the U.S. traditional watches market is the growth of direct-to-consumer online sales by both heritage and mid-tier brands, with companies like Christopher Ward, Seiko, and TAG Heuer expanding e-commerce channels, offering full collections, limited-edition releases, and easy home delivery. This trend caters to younger, digitally engaged buyers while reducing reliance on physical store expansion.Strong demand from high-net-worth consumers continues to drive growth in the U.S. traditional watch market. Collectors and style-conscious buyers are attracted to heritage Swiss brands and complicated mechanical watches that serve as status symbols and investment pieces. Brands like Rolex, Patek Philippe, and Audemars Piguet dominate the ultra-luxury segment, with limited-edition releases and boutique experiences encouraging repeat purchases and sustaining high revenue contributions.

Mid-tier and accessible luxury watches also contribute significantly to market growth, as aspirational buyers seek well-crafted, recognizable watches without the ultra-luxury price tag. Brands such as Omega, TAG Heuer, Tissot, and Seiko provide a range of quartz and mechanical options across price tiers, appealing to buyers in urban centers like New York, Los Angeles, and Miami. Marketing campaigns, mall retail presence, and reliable after-sales service support consistent sales in this segment.

The rise of e-commerce is reshaping the U.S. watches industry, with brands increasingly selling directly to consumers online. Heritage and mid-tier brands, including Christopher Ward, Seiko, and TAG Heuer, leverage online channels to offer full collections, limited editions, and convenient home delivery, catering to younger, digitally engaged buyers. This trend enhances accessibility across all price tiers and complements traditional brick-and-mortar sales, sustaining overall market growth.

Consumer Insights

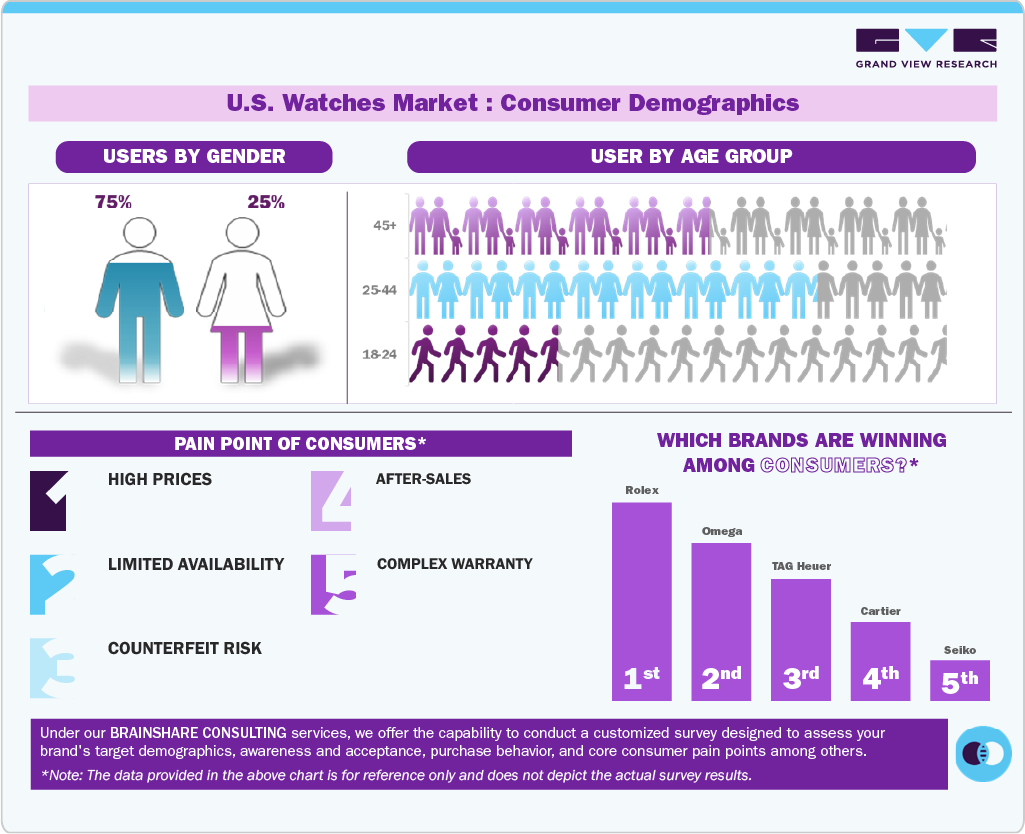

The traditional watches market in the U.S. remains noticeably male-led, regardless of price tier.

-

Men form the dominant majority of traditional watch buyers, driven by strong cultural and lifestyle associations with watches, status signaling, personal style, and gifting-across everything from affordable fashion watches to high-end Swiss mechanical models.

-

Women represent a smaller yet steadily growing segment, increasingly purchasing traditional watches as style accessories, professional wear, and premium gifts, particularly in cosmopolitan markets like New York, Los Angeles, and Miami, where fashion adoption is fast evolving.

Age groups continue to play a decisive role in purchasing patterns across the traditional watch spectrum.

-

The 25-44 age group remains the largest buyer base, combining strong spending power with high brand awareness and lifestyle-driven shopping habits. They purchase across categories-from entry-level fashion and quartz watches to mid-range Swiss quartz and mechanical models.

-

The 45+ segment ranks second, representing mature buyers who favor well-known Swiss heritage brands and often purchase for gifting within families and social circles.

-

The 18-24 cohort sits third, but is influential in creating early demand for affordable quartz and fashion watches, driven by social media trends, e-commerce exposure, and celebrity endorsements.

Consumers in the U.S. traditional watch market encounter specific, recurring pain points across price categories.

-

Stock shortages and long waitlists for popular mid-range and luxury models continue to frustrate buyers.

-

Limited warranties and inconsistent after-sales service on fashion and mid-tier watches reduce purchase confidence.

-

Counterfeit exposure, particularly for affordable and mid-range watches, pushes consumers toward trusted retailers, authorized brand boutiques, and verified e-commerce channels.

Across the U.S., top-performing traditional watch brands include Rolex, Omega, TAG Heuer, Cartier, and Seiko, each catering to a different income band and buyer profile.

Insight: Consumers in the U.S. are brand-conscious, experience-driven, and quality-oriented, valuing authenticity, design, and reliable retail or online experiences-making traditional watches a blend of personal identity, style signaling, and gifting tradition across all price ranges.

Type Insights

The analog watches segment led the U.S. watches market, with a revenue share of 93.46% in 2024. The dominant share of analog watches in the U.S. is driven by consumer preference for craftsmanship, heritage, and luxury appeal. Collectors and style-conscious buyers favor mechanical or quartz analog watches from brands like Rolex, Omega, and TAG Heuer because of their intricate movements, classic designs, and status symbolism. Retailers and brand boutiques also emphasize analog watches in marketing and in-store experiences, reinforcing their prestige and desirability across all price tiers.

The digital watch segment is anticipated to witness a CAGR of 3.2% from 2025 to 2033, driven by demand for practical, multifunctional timepieces that combine traditional design with modern convenience. Brands like Casio and Timex are introducing mid-range digital models with features such as alarms, world time, and enhanced durability, appealing to younger consumers and everyday users.

Price Range Insights

The ultra luxury watches segment led the U.S. watches industry, accounting for a 40.68% revenue share in 2024. They dominate revenue because high-net-worth consumers in the U.S. prioritize prestige, craftsmanship, and investment value. Brands like Rolex, Patek Philippe, Audemars Piguet, and Richard Mille cater to collectors and affluent buyers willing to pay premium prices for limited editions, complicated movements, and iconic designs. The substantial resale value, exclusivity, and status associated with owning these watches contribute disproportionately to their revenue, despite their relatively low volume.

The luxury watches segment is anticipated to grow at a CAGR of 4.7% from 2025 to 2033. Luxury watch growth is driven by expanding demand among aspirational buyers in urban U.S. markets, including New York, Los Angeles, and Miami. Brands like Omega, Cartier, and TAG Heuer are introducing new collections, limited editions, and entry-level luxury models that appeal to younger, digitally engaged consumers. Enhanced in-store experiences, targeted marketing campaigns, and the availability of direct-to-consumer online channels are also encouraging more frequent purchases, fueling steady growth in the luxury segment.

End User Insights

Watches for men accounted for a 73.60% share of the U.S. watches market in 2024. Men’s traditional watches dominate the market because most collectors and status-driven buyers are male, especially for luxury and sporty lines such as the Rolex Submariner, Omega Seamaster, and TAG Heuer Carrera. These watches are marketed as tools, investment pieces, or symbols of achievement. Larger case sizes, chronographs, and complex mechanical movements are traditionally designed for men, reinforcing the higher male share across all price tiers.

Watches for women are anticipated to witness a CAGR of 4.7% from 2025 to 2033. Women’s traditional watch sales are growing due to rising financial independence and changing preferences toward owning their own luxury and mid-tier watches. Brands are expanding offerings with smaller mechanical and quartz models, elegant unisex designs, and more refined aesthetics.

Examples include the Tissot Carson Premium 30 mm Automatic and the Seiko Presage 33.8 mm, which cater specifically to female buyers seeking style, craftsmanship, and wearable daily pieces. Marketing campaigns are also targeting women directly, rather than positioning watches solely as gifts, which further supports growth.

Distribution Channel Insights

The sale of watches through offline channels accounted for 69.63% of the U.S. watches market in 2024. Offline sales remain strong in the U.S. because buyers can verify authenticity in person, crucial for luxury Swiss watches like Rolex and Patek Philippe. Collectors and gifting customers prefer trying watches on to ensure a good fit and style, while boutiques such as Bulgari in New York offer repairs, warranty support, and exclusive in-store editions, thereby enhancing the luxury experience and encouraging higher-value purchases.

The sale of watches through online channels is expected to grow at a CAGR of 4.7% from 2025 to 2033, as buyers increasingly trust official brand websites and verified e-commerce platforms for mid-tier and luxury watches. Millennials and Gen Z value convenient comparisons and home delivery, particularly for mid-range quartz and mechanical watches. Brands like Christopher Ward and Seiko are expanding direct-to-consumer online channels, while digital marketing and social media campaigns drive awareness and purchases.

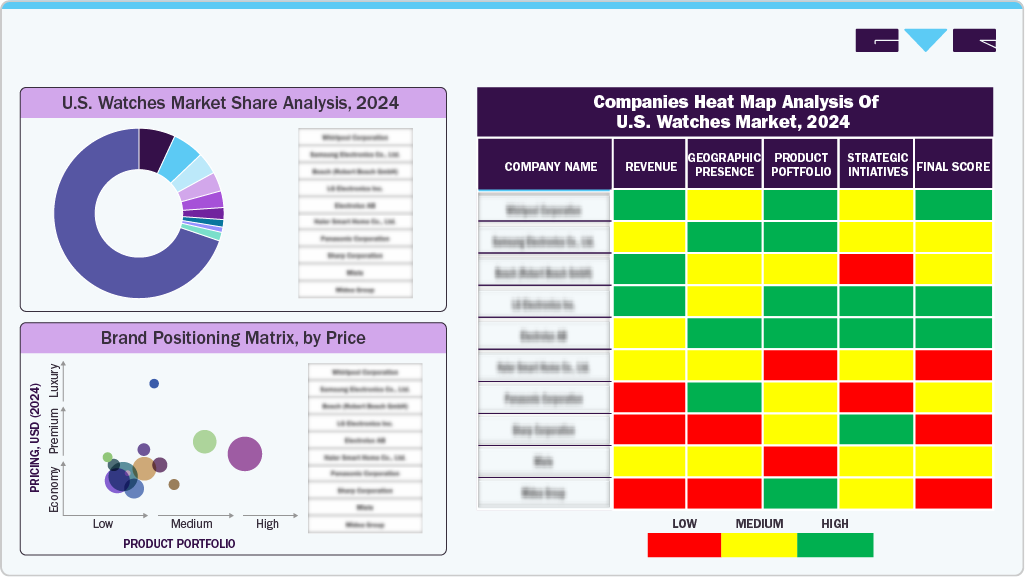

Key U.S. Watches Company Insights

The U.S. traditional watch market covers the full spectrum of price ranges, from mass-market to ultra-luxury, and includes both global heritage brands and domestic players. Swiss, Japanese, and European brands are particularly strong in the premium and mid-tier segments, attracting collectors, gifting buyers, and fashion-conscious consumers through craftsmanship, design, and brand prestige.

Luxury-focused labels concentrate on affluent urban centers such as New York, Los Angeles, and Miami, with growth supported by high-end retail stores, brand boutiques, and limited-edition collections. These brands leverage marketing, exclusivity, and celebrity endorsements to reinforce their premium positioning and appeal to high-net-worth buyers.

At the same time, domestic and value-oriented brands cater to everyday consumers, offering accessible mechanical and quartz models that appeal to a broad audience. This combination of luxury, mid-range, and mass-market offerings ensures a diverse, balanced, and resilient market ecosystem across the U.S.

Key U.S. Watches Companies:

- Omega

- Cartier

- Patek Philippe

- Breitling

- TAG Heuer

- Longines

- Tissot

- Fossil Group

- Bulova

Recent Developments

-

In November 2024, Tissot added a new 25 mm quartz model to its PRX collection. This watch combines the brand’s 1970s integrated-bracelet design with a modern touch. The watch features a Swiss quartz movement with an End-of-Life indicator and is water-resistant to 100 meters. Available in several finishes, including carnation-gold PVD, this timepiece appeals to those seeking an elegant, vintage-inspired piece that is also compact and durable.

-

In May 2024, Audemars Piguet introduced a set of three compact Royal Oak models powered by quartz, each featuring a petite 23mm diameter.

U.S. Watches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.09 billion

Revenue forecast in 2033

USD 15.37 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, price range, end user, distribution channel

Key companies profiled

Rolex; Omega; Cartier; Patek Philippe; Breitling; TAG Heuer; Longines; Tissot; Fossil Group; Bulova

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Watches Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. watches market report based on type, price range, end user, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Analog

-

Mechanical

-

Quartz

-

-

Digital

-

-

Price Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-range

-

Premium

-

Luxury

-

Ultra Luxury

-

-

End User Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. watches market size was estimated at USD 10.67 billion in 2024 and is expected to reach USD 11.10 billion in 2025.

b. The U.S. watches market is expected to grow at a compound annual growth rate (CAGR) of 4.2 % from 2025 to 2033 to reach USD 15.37 billion by 2033.

b. Analog watches held a market share of 93.46% in 2024. The dominant share of analog watches in the U.S. is driven by consumer preference for craftsmanship, heritage, and luxury appeal.

b. Rolex, Omega, Patek Philippe, Audemars Piguet, Longines, Tissot, Seiko, Casio, Citizen, Tag Heuer

b. Growth in traditional watches in the U.S. is due strong demand across all price tiers, driven by brand-conscious consumers seeking luxury, mid-range, and affordable mechanical and quartz watches for style, gifting, and investment purposes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.