- Home

- »

- Digital Media

- »

-

U.S. Webtoons Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Webtoons Market Size, Share & Trends Report]()

U.S. Webtoons Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Platform (Mobile & Tablets, Laptop & Computers, Television), By Monetization Model, By Demographic, And Segment Forecasts

- Report ID: GVR-4-68040-655-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Webtoons Market Size & Trends

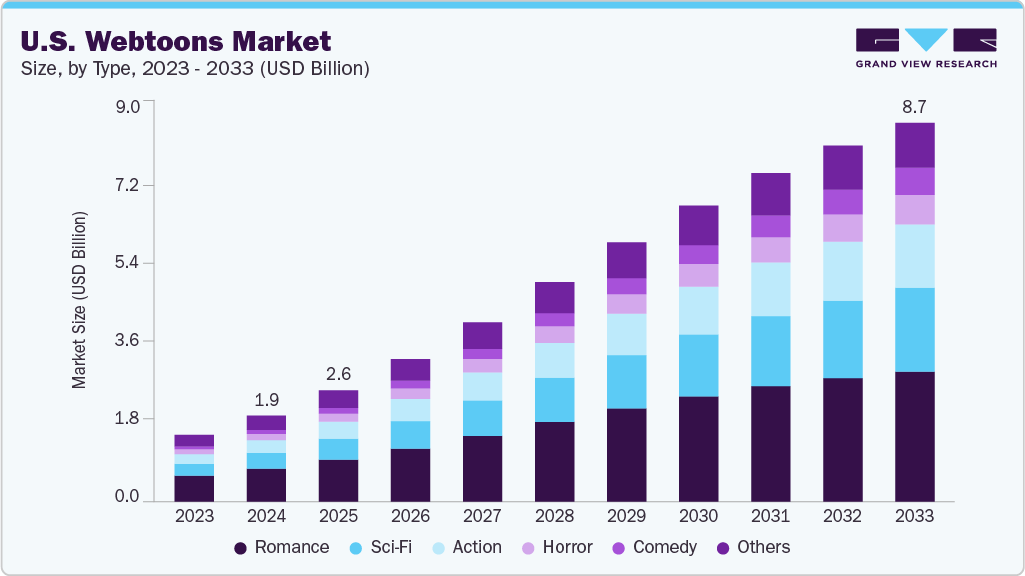

The U.S. webtoons market size was estimated at USD 1,980.6 million in 2024 and is projected to reach USD 8,721.7 million by 2033, growing at a CAGR of 16.5% from 2025 to 2033. The growth is primarily driven by the increasing penetration of smartphones and high-speed internet, which makes digital comics more accessible to a younger, tech-savvy audience. The rise of social media platforms and content-sharing apps has also played a key role in driving traffic to webtoon platforms. The growing trend of transmedia storytelling, where webtoons are adapted into K-dramas, animated series, and movies, has significantly increased their popularity and monetization potential. The integration of AI and personalization algorithms allows platforms to offer curated content, increasing user engagement and time spent on apps. These drivers are transforming the market into a major segment of the digital entertainment industry.

The rapid evolution and deployment of digital storytelling platforms and mobile technologies are fundamentally transforming the U.S. webtoons industry. Advanced systems such as AI-based content recommendation engines, mobile-first comic distribution models, and interactive reader engagement tools enable creators and publishers to reach audiences more efficiently and monetize content effectively. The demand for personalized and on-demand entertainment continues to grow, thereby accelerating the expansion of the U.S. webtoons industry.

Additionally, the increasing popularity of Korean pop culture, anime, and digital-native storytelling formats among Gen Z and Millennial audiences is driving demand for webtoons. Streaming platforms and publishers are partnering with webtoon creators to develop original intellectual property (IP) for cross-media adaptation, including TV shows, films, and games. This multi-platform storytelling trend positions webtoons as a critical investment, fueling market growth through diversified revenue streams and content franchising opportunities.

The rising adoption of webtoons in educational, promotional, and social campaigns is significantly contributing to market expansion. Government agencies, brands, and advocacy groups are leveraging the visual and narrative appeal of webtoons to engage audiences on topics ranging from health awareness to civic engagement. Supportive initiatives such as content creator grants, local language adaptation programs, and public-private digital literacy collaborations are encouraging the production and distribution of inclusive and culturally relevant webtoon content. This collaborative ecosystem is fostering long-term growth and innovation in the U.S. webtoons industry.

Type Insights

The romance segment dominated the market and accounted for the largest share of over 38% in 2024. The genre’s widespread appeal among female and young adult readers, combined with mobile-friendly storytelling formats and bingeable episodic structures, has significantly influenced the growth of this segment. Platforms are investing in AI-driven personalization and fast-track translation services, ensuring that global romance titles are localized rapidly for audiences. The segment’s commercial success is further supported by merchandise, adaptations into live-action and animated series, and strong community engagement on social media, all of which continue to drive demand for the romance segment in the U.S. webtoons industry.

The comedy segment is expected to witness the fastest CAGR of over 21% from 2025 to 2033. This growth is driven by increasing consumer demand for light-hearted, relatable content that offers emotional relief and escapism, particularly among Gen Z and Millennial readers. The rise of social media-driven humor, meme culture, and short-form storytelling has made comedy webtoons highly shareable and viral, boosting their visibility. Platforms are investing in diverse, creator-driven comedy titles and integrating personalized content recommendation engines, which enhance user engagement and retention, further propelling segment expansion.

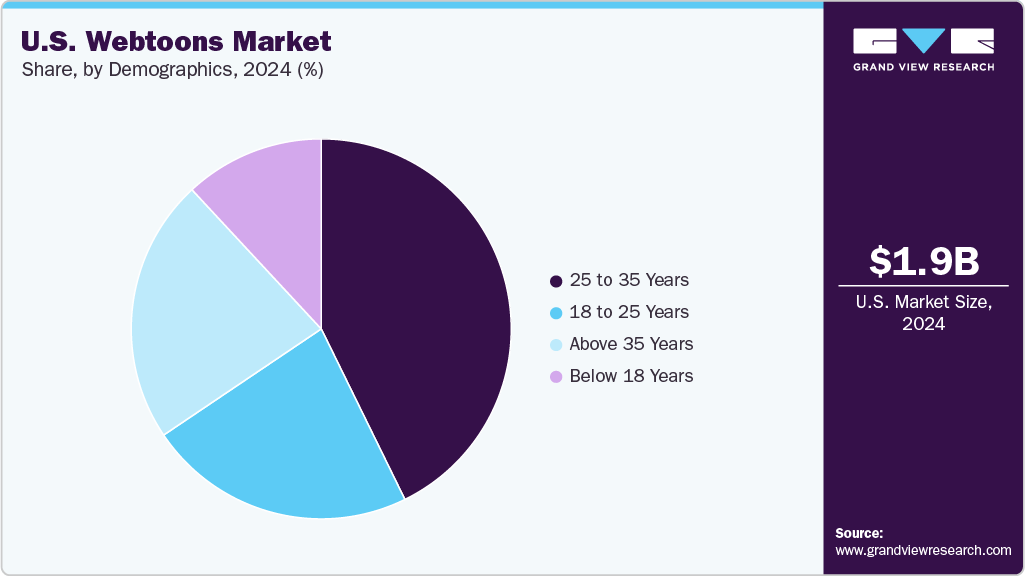

Demographics Insights

The 25 to 35 years segment accounted for the largest share of the U.S. webtoons market in 2024, driven by the age group, characterized by its tech-savvy and digitally immersed nature. The convenience of accessing engaging and visually appealing content on mobile devices has contributed to the surge in popularity. The platform’s interactive and dynamic storytelling format resonates well with the preferences of this demographic, fostering a sense of connection and community. Creators are increasingly tailoring content to cater to the diverse innovation of the 25 to 35-year age bracket, driving innovation and expansion within the market. The growth is a testament to the platform’s ability to capture the attention of a digitally native audience.

The below 18 years segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the increasing digital media consumption among Gen Alpha and younger Gen Z users, who are highly engaged with mobile-first content formats. The accessibility of free-to-read platforms, visually engaging storytelling, and age-appropriate genres such as fantasy, school life, and coming-of-age dramas are fueling demand. Additionally, the integration of webtoons into educational content and gamified learning tools is further boosting engagement among younger audiences.

Platform Insights

The mobile and tablet segment accounted for the largest share of the U.S. webtoons industry in 2024. The growing preference for on-the-go entertainment and the widespread adoption of smartphones among younger audiences drive the growth. The vertical-scroll format of webtoons is optimized for mobile devices, offering an intuitive and immersive reading experience. Platforms are increasingly releasing mobile-exclusive features, including personalized recommendations, offline reading, and in-app purchases. This mobile-first consumption pattern has made smartphones and tablets the primary access points for digital comics in the market.

The laptop and computers segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the growing consumption of long-form and visually detailed webtoons that benefit from larger screens and higher resolution. Increased usage among professional and hobbyist creators using digital art tools and webtoon editing software on desktops also supports this trend. The rise of webtoon reading communities and fan engagement platforms optimized for web access further propels adoption. Enhanced multitasking capabilities and the preference for immersive reading experiences contribute to the segment’s strong growth outlook.

Monetization Model Insights

The subscription-based segment accounted for the largest share of the U.S. webtoons market in 2024. This surge is driven by increasing consumer preference for ad-free, bingeable content and the rising willingness to pay for premium storytelling experiences. Platforms like MANTA and WEBTOON are leveraging this model to offer exclusive series and early access to episodes, enhancing user retention. The surge in mobile readership and personalized content recommendations is further fueling demand for subscription services as a convenient and immersive monetization model.

The advertising-based segment is expected to witness the fastest CAGR from 2025 to 2033. The growth in mobile-first content consumption, especially among Gen Z and Millennials, has made ad-supported webtoons an attractive monetization model. Platforms leverage targeted advertising, branded content, and in-story product placements to generate revenue while keeping content free for users. The growth of programmatic ad technologies and increased collaboration between webtoon platforms and global brands are further driving this segment. Rising user engagement and time spent on webtoon apps continue to boost ad impressions and advertiser interest, reinforcing the segment's dominance.

Key U.S. Webtoons Company Insights

Some of the key players operating in the market include NAVER WEBTOON Ltd. and Kakao Entertainment.

-

NAVER WEBTOON Ltd. operates the leading webtoon platform "WEBTOON" in the U.S., offering a vast library of original and creator-submitted digital comics across genres such as romance, fantasy, action, and horror. The platform is widely credited with popularizing the webtoon format in North America and boasts a massive U.S. user base. NAVER WEBTOON collaborates with both independent artists and studios. It has entered partnerships with major entertainment companies for IP adaptation, contributing to the mainstream growth of the U.S. webtoons industry.

-

Kakao Entertainment is a key player in the U.S. webtoons industry. Kakao’s platforms focus on serialized storytelling and have successfully localized Korean webtoons for American audiences. The company particularly supports indie creators and U.S.-originated content, offering monetization tools and production support. Kakao Entertainment’s strategic expansion into the U.S. aims to establish a global IP value chain encompassing webtoons, TV, film, and publishing.

MANTA and INKR are some of the emerging participants in the U.S. webtoons market.

-

MANTA is rapidly gaining traction in the U.S. webtoons industry through its unique subscription-based model. MANTA focuses on delivering binge-worthy, high-quality romance and fantasy webtoons with no ads or locked episodes. Its intuitive user experience and steady stream of original content are attracting a growing U.S. subscriber base, particularly among Gen Z and Millennial readers. MANTA is positioning itself as a premium alternative to freemium platforms in the U.S. webtoons market.

-

INKR is an emerging digital comics platform that aggregates a broad range of webtoons, manga, and manhua for U.S. readers. Built by the team behind the popular Manga Rock app, INKR emphasizes ease of discovery and personalized reading experiences. Forming partnerships with multiple publishers and offering multi-format content, INKR is steadily carving out a niche among digital-first comic readers in the market.

Key U.S. Webtoons Companies:

- NAVER WEBTOON Ltd.

- Kakao Entertainment.

- Tappytoon

- Lezhin Entertainment, LLC

- MANTA.

- INKR

- Toomics Global Co. Ltd.

- Pixiv

- Comikey Media Inc.

- Webcomics Holdings HK Limited.

Recent Developments

-

In May 2025, MANTA launched new and returning webtoon series, including For My Own Good and The Flower of Allure, specifically curated for U.S. audiences through its subscription-based platform. The company also debuted the BL webtoon Love in Ruins by indie creator Flannce Stories across Manta and Patreon, enhancing engagement with Western creator communities and expanding its footprint in the U.S. webtoons industry.

-

In March 2025, Kakao Entertainment launched Berriz, a global fan engagement platform designed to integrate K-pop, K-drama, and webtoon content for international audiences. This new initiative enhances interactive experiences for U.S. users by bridging webtoon fandoms with other Korean entertainment sectors, fostering stronger community engagement and expanding cross-media storytelling opportunities in the U.S. webtoons market.

-

In March 2025, NAVER WEBTOON Ltd. became the first webcomic platform to join the Alliance for Creativity and Entertainment (ACE), reinforcing its efforts to combat piracy and protect intellectual property across the U.S. webtoons industry. This strategic move enhances the platform’s credibility among content creators and rights holders, supporting the broader growth and legitimacy of digital comics in the U.S. webtoons industry.

U.S. Webtoons Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,565.3 million

Revenue forecast in 2033

USD 8,721.7 million

Growth rate

CAGR of 16.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, monetization model, demographics

Country scope

U.S.

Key companies profiled

NAVER WEBTOON Ltd.; Kakao Entertainment; Tappytoon; Lezhin Entertainment, LLC; MANTA; INKR; Toomics Global Co. Ltd.; Pixiv; Comikey Media Inc.; Webcomics Holdings HK Limited.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Webtoons Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. webtoons market report based on type, platform, monetization model, and demographics:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Comedy

-

Action

-

Romance

-

Horror

-

Sci-Fi

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile & Tablets

-

Laptop & Computer

-

Television

-

Others

-

-

Monetization Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Subscription Model

-

Advertising Model

-

Others

-

-

Demographics Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 18 Years

-

18 to 25 Years

-

25 to 35 Years

-

Above 35 Years

-

Frequently Asked Questions About This Report

b. The U.S. webtoons market size was valued at USD 1,980.6 million in 2024 and is expected to reach USD 2,565.3 million in 2025.

b. The U.S. webtoons market is expected to grow at a compound annual growth rate of 16.5% from 2025 to 2030 to reach USD 8,721.7 million by 2030.

b. The romance segment dominated the market with a share of over 38% in 2024, owing to the genre’s widespread appeal among female and young adult readers, combined with mobile-friendly storytelling formats and bingeable episodic structures.

b. Some key players operating in the U.S. webtoons market include NAVER WEBTOON Ltd., Kakao Entertainment.,Tappytoon, Lezhin Entertainment, LLC, MANTA., INKR, Toomics Global Co. Ltd., Pixiv, Comikey, Media Inc., Webcomics Holdings HK Limited.

b. The increasing penetration of smartphones and high-speed internet, the rise of social media platforms and content-sharing apps, and the growing trend of transmedia storytelling, where webtoons are adapted into K-dramas, animated series, and movies, are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.