- Home

- »

- Homecare & Decor

- »

-

U.S. Wedding Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Wedding Services Market Size, Share & Trend Report]()

U.S. Wedding Services Market (2025 - 2030) Size, Share & Trend Analysis Report By Type (Destination, Local), By Booking Mode (Online, Offline), By Service (Catering Services, Decoration Services, Entertainment & Music), And Segment Forecasts

- Report ID: GVR-4-68040-510-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wedding Services Market Size & Trends

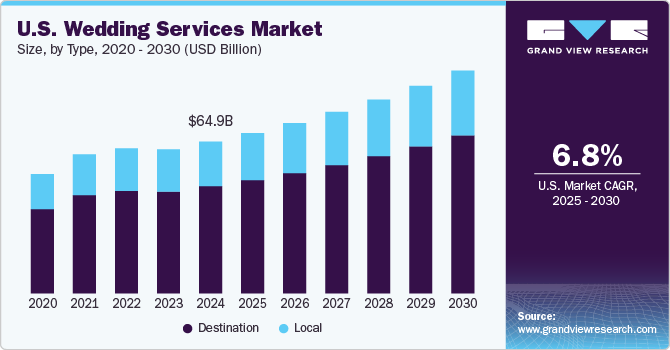

The U.S. wedding services market was valued at USD 64.93 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. The country’s growing diversity has led to an increase in multicultural and interfaith weddings, increasing the demand for vendors who understand and can accommodate specific traditions and customs. Many couples incorporate elements from their heritage, such as traditional South Asian multi-day weddings, Hispanic celebrations with live music and vibrant decor, or Jewish ceremonies with specific rituals. This has created a demand for specialized wedding planners, officiants, and caterers who can tailor their services to meet diverse cultural needs.

Furthermore, destination weddings have gained popularity, with couples opting for unique locations across the U.S., such as vineyards in California, beaches in Florida, and historic estates in New England, increasing demand for travel coordination and luxury event planning.

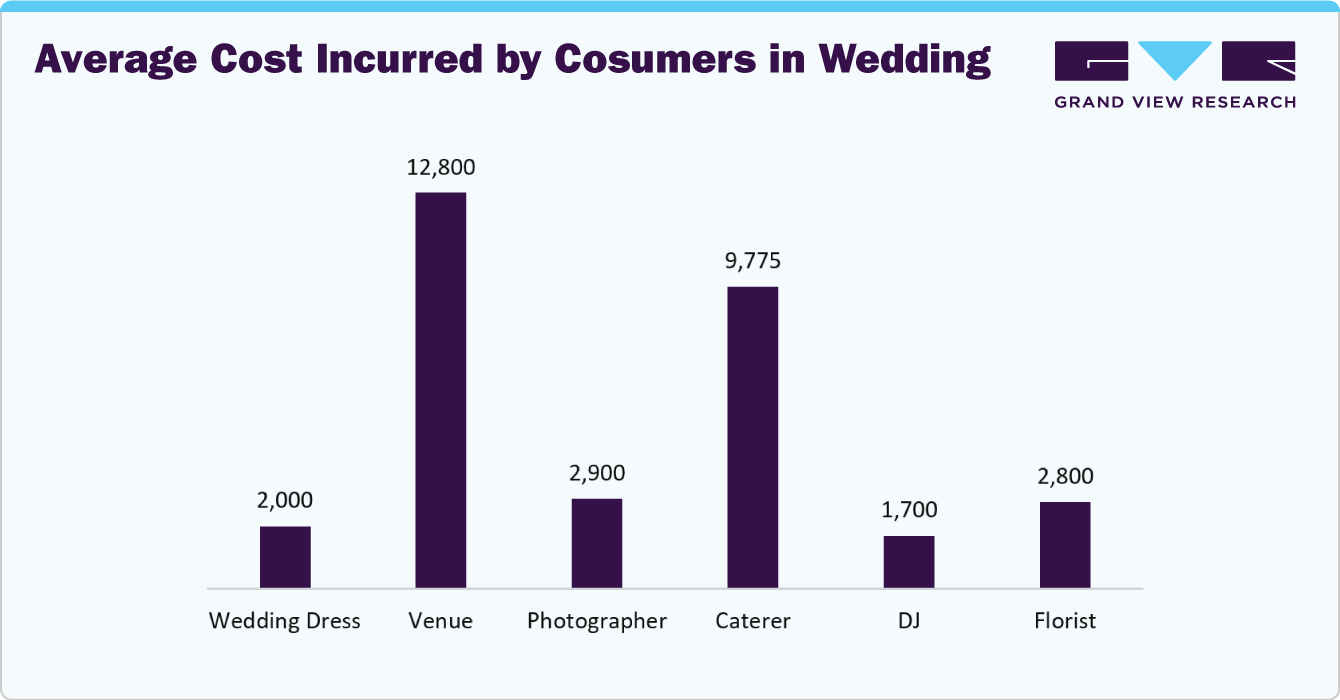

Unlike previous generations, where parents traditionally covered most wedding expenses, many couples in the U.S. today are paying for their weddings. This shift gives them more control over their budgets and allows them to spend on customized and premium services that reflect their personal preferences. The rise of dual-income households has also played a role, as couples with higher disposable incomes are willing to invest in lavish weddings, including high-end venues, designer wedding attire, personalized entertainment, and elaborate floral arrangements. With a stronger economy and a thriving job market, many couples feel financially secure enough to host larger and more extravagant celebrations, further fueling the demand for wedding services.

Platforms such as Instagram, Pinterest, TikTok, and YouTube expose couples to extravagant wedding trends, encouraging them to create visually stunning and highly personalized celebrations. Many couples prioritize aesthetics and uniqueness, seeking out professional photographers, videographers, and wedding planners to ensure that every detail is meticulously captured and shareable online. The pressure to create a "Pinterest-worthy" or "viral" wedding has led to increased spending on decor, luxury venues, and customized experiences.

Consumer Insights

There is an increasing desire for customized weddings that reflect individual tastes, values, and cultural backgrounds. Unlike past generations, today’s couples are less likely to follow traditional wedding templates and instead seek unique themes, personalized decor, and non-traditional venues. This shift has led to a growing demand for specialized wedding planners, boutique florists, and custom-tailored services that allow couples to create one-of-a-kind experiences.

The growing influence of digital tools in wedding planning has transformed how modern couples organize their big day. Many rely on wedding planning apps, online vendor marketplaces, and social media for inspiration and coordination. Platforms like The Knot and Zola have become go-to resources for comparing venues, booking services, and managing guest lists. In addition, social media sites such as Instagram, Pinterest, and TikTok play a crucial role in shaping wedding aesthetics, as couples aim to create visually stunning celebrations that reflect the latest trends.

According to a 2023 real wedding study by the knot, this shift toward digital planning is evident in engagement trends, with the average engagement length in 2023 being 15 months and a notable portion (12%) lasting over two years. During this period, couples dedicate significant time, averaging seven hours per week, to planning, with 91% of that time spent online. The use of digital tools has expanded, with QR codes for wedding details rising in popularity and TikTok emerging as a major planning resource, especially among Gen Z (48% usage). As a result, wedding vendors are increasingly offering digital consultations, virtual venue tours, and AI-powered planning tools to cater to tech-savvy couples and streamline the wedding planning experience.

The financial aspect of weddings has also evolved, with many couples funding their celebrations rather than relying on family contributions. This has resulted in more budget-conscious decision-making, where couples are willing to invest in high-impact elements such as professional photography, gourmet catering, and entertainment while cutting costs in other areas. At the same time, there is a rising demand for luxury experiences, with affluent couples opting for high-end venues, custom couture, and extravagant destination weddings. This dual trend of budget-conscious spending alongside luxury splurges has led wedding vendors to offer flexible pricing models and curated package deals to cater to different financial needs.

Type Insights

Destination weddings held a revenue share of 70.7% of the overall wedding services industry in 2024. Many couples view destination weddings as an opportunity to combine their wedding and honeymoon into a single, immersive event, often in picturesque locations such as tropical beaches, vineyards, or historic estates. In addition, destination weddings often allow for more intimate celebrations, as guest lists tend to be smaller, leading couples to invest more in luxury accommodations, high-end catering, and personalized experiences for their guests. The growing preference for experiential travel, fueled by social media and influencer culture, has also played a key role in this trend, as couples aspire to create visually stunning weddings in breathtaking locations.

Local weddings in the U.S. wedding services industry are expected to grow at a CAGR of 6.7% from 2025 to 2030. Local weddings often allow couples to tap into familiar venues, vendors, and support networks, making the planning process more manageable and less stressful. With the rise of micro-weddings and intimate ceremonies, local weddings offer flexibility and personalization while remaining cost-effective. Moreover, as more couples focus on inclusivity and accessibility, hosting a wedding in their local community ensures that all family and friends can attend without the burden of extensive travel.

Service Insights

Catering services accounted for a revenue share of 32.23% of the overall wedding services industry in 2024. Weddings are increasingly seen as an opportunity to showcase unique culinary experiences, with couples opting for custom menus that reflect their tastes, cultural traditions, or dietary preferences. This shift toward personalized dining experiences has led to a rise in demand for specialty catering services, such as gourmet meals, vegan and vegetarian options, and international cuisines. In addition, with the growing trend of smaller, more intimate weddings, couples are willing to invest more in high-quality catering to create a memorable dining experience for their guests. The rise of food-centric wedding trends, such as food stations, interactive catering, and artisanal cocktails, has also contributed to the demand for innovative and diverse catering services.

Wedding planning services in the industry are expected to expand at a CAGR of 8.5% from 2025 to 2030. Wedding planners provide invaluable expertise in budgeting, coordinating vendors, and ensuring that the event runs smoothly. In addition, as couples prioritize creating unique, high-quality experiences, they rely on planners to source specialized vendors, recommend trending themes, and execute complex logistics. The growing popularity of destination weddings, micro-weddings, and large-scale celebrations further drives the need for expert planning services to handle the coordination of travel, accommodation, and event scheduling.

Booking Mode Insights

The online booking mode represented a significant revenue share of the industry, accounting for 64.93% in 2024. Online platforms provide a centralized location where couples can compare prices, read reviews, view portfolios, and secure services all in one place, making the planning experience more efficient and stress-free. The ability to book services instantly without the need for in-person meetings is particularly appealing to couples with busy schedules or those planning long-distance weddings. Furthermore, online booking systems often include features such as payment processing, contract management, and real-time availability, adding convenience.

Offline booking for wedding services in the U.S. is expected to grow at a CAGR of 6.5% from 2025 to 2030. While online booking offers convenience, many couples still value the opportunity to meet vendors in person, build relationships, and ensure their vision is understood and executed. This face-to-face interaction is especially important for services such as catering, photography, and event planning, where personal preferences and details are critical to achieving the desired outcome. In addition, many couples appreciate the reassurance of having direct communication with a vendor to discuss specific needs, ask questions, and negotiate terms.

With the increasing popularity of bespoke and luxury weddings, couples are more likely to invest time in carefully selecting vendors, which can be more efficiently done through offline consultations. Furthermore, for couples planning more traditional or larger weddings, the complexity of booking multiple services may make offline communication and coordination more comfortable and effective.

Key U.S. Wedding Services Company Insights

Some of the key companies include XO Group Inc., Zola, Inc., The Knot Worldwide Inc., and Bodas.net.

-

Zola, Inc. is an online wedding planning platform that provides a comprehensive suite of services designed to simplify the wedding planning process for couples. Zola offers a wide range of offerings in the U.S. wedding services industry, including wedding websites, registry services, invitation designs, and a vendor marketplace. Couples can create personalized wedding websites that share event details, manage RSVPs, and collect gifts through Zola’s integrated registry system. Additionally, Zola’s marketplace connects couples with vendors for venues, photographers, and planners, offering easy booking and seamless coordination. The platform also provides tools for managing guest lists, creating to-do lists, and keeping track of wedding tasks.

-

The Knot Worldwide Inc. is a wedding planning company that offers a diverse range of services to help couples plan and organize their weddings. With a strong presence in the U.S. wedding services industry, the company operates popular platforms such as The Knot and WeddingWire, which serve as comprehensive resources for engaged couples. Its offerings include wedding planning tools, vendor directories, personalized wedding websites, budgeting assistance, and guest list management. The company also provides access to a vast network of venues, photographers, florists, and caterers, making it easier for couples to find and book services that match their vision. Additionally, The Knot Worldwide offers digital invitations, registry services, and expert wedding advice catering to a wide range of planning needs.

Key U.S. Wedding Services Companies:

- XO Group Inc.

- Zola, Inc.

- The Knot Worldwide Inc.

- Bodas.net

- Luxe Atlanta Events

- Bustle Events

- HauteFetes

- Mae&Co Creative

- Amaretto Sour

- Marcy Blum Associates

Recent Developments

-

In July 2024,The Knot Worldwide announced significant updates to its platforms, The Knot, and WeddingWire, aiming to enhance the experience for wedding professionals. These enhancements are designed to improve lead quality, optimize vendor storefronts, and provide deeper insights to assist vendors in securing more bookings. The company plans to introduce free and affordable advertising options to make its services more accessible to a broader range of vendors. The new features include AI-powered tools such as smart photo selectors and automated review summaries, which help vendors showcase their work more effectively.

-

In September 2023, Zola introduced the Zola Baby app for iPhone users. This launch responds to over 500 customer requests for a baby registry platform and addresses the trend of users adding baby items to their wedding registries. The app offers a curated selection of baby products and allows users to register for services and experiences, featuring exclusive partnerships with providers like Tiny Hood, Boram, and Stocked. Zola aims to differentiate itself from traditional retailers by leveraging technology to create a user-friendly registry experience.

U.S. Wedding Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 68.63 billion

Revenue forecast in 2030

USD 95.35 billion

Growth rate (Revenue)

CAGR of 6.8% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, booking mode, service

Country scope

U.S.

Key companies profiled

XO Group Inc., Zola, Inc., The Knot Worldwide Inc., Bodas.net, Luxe Atlanta Events, Bustle Events, HauteFetes, Mae&Co Creative, Amaretto Sour, Marcy Blum Associates

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wedding Services Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. wedding services market report based on type, booking mode, and service:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Destination

-

Local

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Catering Services

-

Decoration Services

-

Entertainment & Music

-

Videography & Photography Services

-

Wedding Planning Services

-

Other Services

-

Frequently Asked Questions About This Report

b. The U.S. wedding services market was estimated at USD 64.93 billion in 2024 and is expected to reach USD 68.63 billion in 2025.

b. The U.S. wedding services market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030, reaching USD 95.35 billion by 2030.

b. Destination weddings accounted for 70.7% of the market share in 2024, due to increasing demand for unique, experiential weddings and higher spending on travel, venues, and related services.

b. Some key players operating in the U.S. wedding services market include XO Group Inc., Zola, Inc., The Knot Worldwide Inc., Bodas.net, Luxe Atlanta Events, Bustle Events, HauteFetes, Mae&Co Creative, Amaretto Sour, Marcy Blum Associates

b. Key factors driving the U.S. wedding services market include, rising disposable incomes, social media influence, and the trend toward personalized and extravagant weddings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.