- Home

- »

- Advanced Interior Materials

- »

-

U.S. Wet Process Equipment Market, Industry Report, 2033GVR Report cover

![U.S. Wet Process Equipment Market Size, Share & Trends Report]()

U.S. Wet Process Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cleaning Systems, Etching Systems, Stripping Systems), By Type (Automatic, Semi-automatic, Manual), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-679-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wet Process Equipment Market Summary

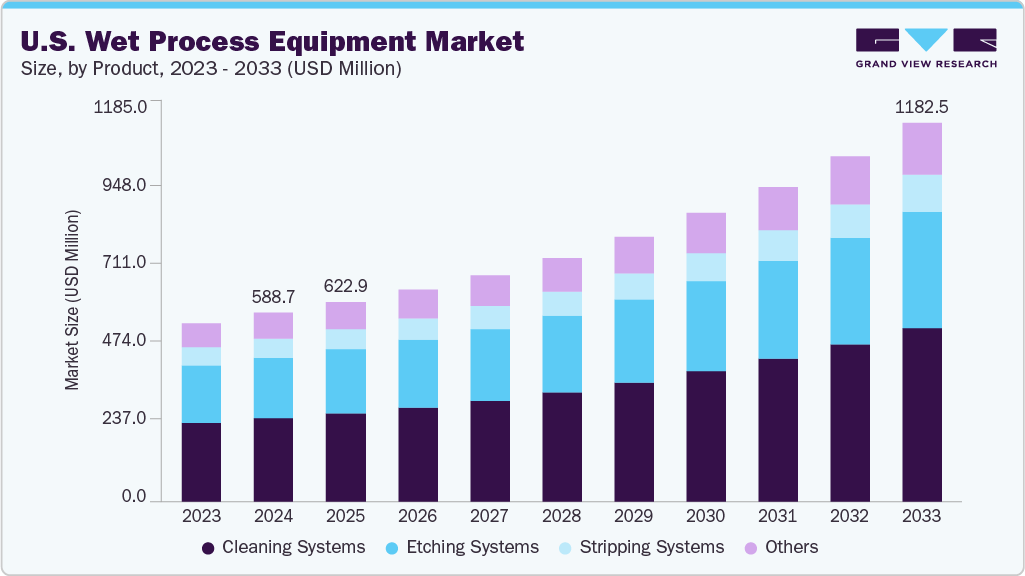

The U.S. wet process equipment market size was estimated at USD 588.7 million in 2024 and is projected to reach USD 1,182.5 million by 2033, growing at a CAGR of 8.3% from 2025 to 2033. Growth is primarily driven by increased domestic semiconductor manufacturing, supported by government initiatives like the CHIPS Act.

Key Market Trends & Insights

- By product, the cleaning systems segment dominated the U.S. market in 2024, accounting for a 44.1% share.

- By type, the automatic wet process equipment segment dominated the U.S. market in 2024, accounting for a 60.5% share.

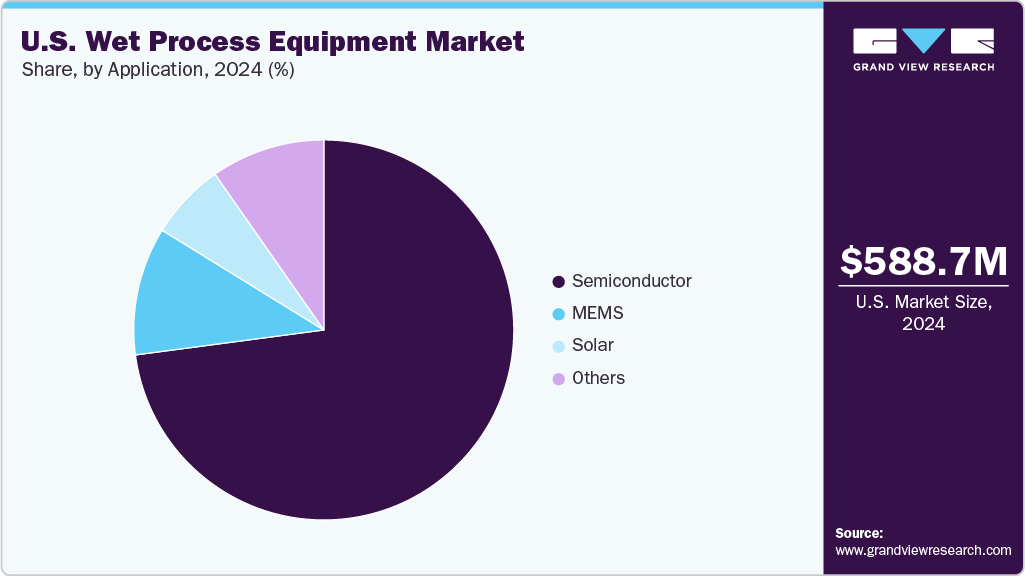

- By application, the semiconductor sector dominated the U.S. market and accounted for 72.9% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 588.7 Million

- 2033 Projected Market Size: USD 1,182.5 Million

- CAGR (2025-2033): 8.3%

Rising demand from advanced technologies such as 5G, AI, and IoT, along with a strategic push for supply chain resilience and high-performance chip production, is fueling investments in modern fabrication facilities. In the U.S., growing consumer electronics usage, data center expansion, and supportive national semiconductor policies are accelerating investments in fabrication facilities, further driving demand for wet process equipment.

The shift toward smaller process nodes and larger wafer sizes requires more advanced wet processing solutions, positioning the U.S. market for strong and sustained growth.

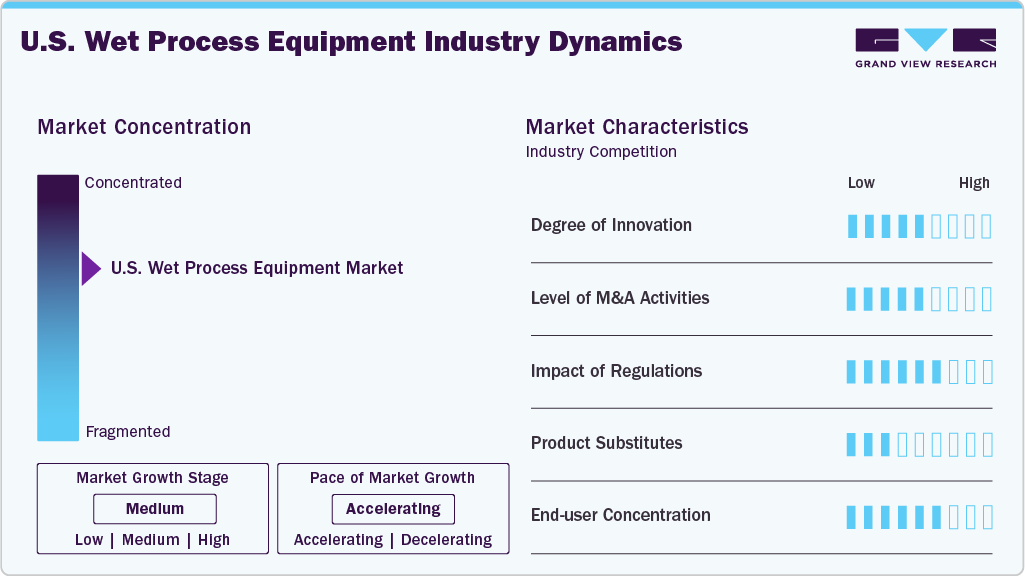

Market Concentration & Characteristics

The U.S. wet process equipment industry is moderately consolidated, dominated by a few major players with strong technological capabilities and established customer bases. Companies such as Lam Research, Applied Materials, and Veeco Instruments hold significant market share due to their innovation, product range, and deep integration with leading semiconductor manufacturers. Smaller firms operate in niche segments or serve as OEM partners. High entry barriers, capital intensity, and specialized expertise contribute to this concentrated competitive landscape.

In the U.S., the wet process equipment industry is characterized by a high level of innovation, driven by rapid advances in semiconductor technology. Continuous R&D efforts focus on improving precision, contamination control, and chemical efficiency. Key developments include single-wafer processing, advanced wafer cleaning, and environmentally friendly solutions to meet evolving chip design demands.

Mergers and acquisitions activity in the U.S. is strategic, aimed at enhancing technological capabilities and expanding market reach. For instance, Lam Research’s acquisition of SEMSYSCO GmbH in 2022 strengthened its position in advanced wet processing for next-generation semiconductor manufacturing.

U.S. regulations play a significant role in enforcing stringent environmental and workplace safety standards. Compliance requirements for chemical handling, wastewater treatment, and emissions drive demand for high-efficiency, sustainable equipment. Federal policies, including incentives for clean manufacturing and semiconductor self-reliance, further accelerate innovation and investment in the U.S. wet process equipment industry.

Drivers, Opportunities & Restraints

U.S. wet process equipment industry is strongly driven by the growth of domestic semiconductor manufacturing, fueled by initiatives like the CHIPS Act. With increasing demand for advanced technologies such as AI, 5G, and automotive electronics, the U.S. is investing heavily in new fabrication facilities. These fabs require high-precision wet processing tools for cleaning and etching, directly boosting demand for advanced wet process equipment across the country.

Government support presents a major opportunity for the U.S. wet process equipment industry. Federal initiatives, including funding and tax incentives for semiconductor manufacturing, are encouraging infrastructure growth and technological innovation. This policy-driven momentum supports not only large manufacturing facilities but also startups and equipment suppliers, enabling a broader ecosystem to thrive and meet the rising need for efficient, sustainable wet processing solutions in high-tech manufacturing.

A significant challenge in the wet process equipment industry is the high cost of acquiring, installing, and maintaining wet process equipment. These systems are capital-intensive and require specialized infrastructure. In addition, operating and servicing them demands skilled labor, which can be limited, especially outside major tech regions. This creates barriers for smaller manufacturers trying to adopt advanced technologies, potentially slowing broader market adoption despite rising demand.

Product Insights

The cleaning systems segment dominated the U.S. market in 2024, accounting for a 44.1% share. This leadership position is attributed to the segment's critical role in removing contaminants from semiconductor wafers, which is essential for maintaining high product quality and manufacturing yield. The adoption of advanced cleaning technologies further enhances process efficiency and minimizes defects, making these systems indispensable in modern semiconductor fabrication.

The stripping systems segment is witnessing rapid growth, driven by increasing demand for the effective removal of photoresist and residual films during wafer processing. Advanced stripping solutions offer improved precision and defect control, which are vital for producing high-performance and miniaturized semiconductor devices. As chip architectures become more complex, the role of high-accuracy stripping systems becomes increasingly important for ensuring optimal device performance and yield.

Type Insights

The automatic wet process equipment segment dominated the U.S. market in 2024, accounting for a 60.5% share. This dominance is driven by the growing demand for high precision, reduced human error, and enhanced productivity in semiconductor manufacturing. Automation enables consistent, high-throughput processing, critical for producing complex and miniaturized chip designs. Ongoing advancements in AI and robotics are further accelerating the adoption of fully automated systems.

The semi-automatic segment is also witnessing steady growth, offering U.S. manufacturers a flexible and cost-effective alternative. By combining manual control with partial automation, these systems are well-suited for mid-scale production environments and companies transitioning toward fully automated manufacturing processes. This balance between control and efficiency makes semi-automatic equipment an attractive option in various production settings.

Application Insights

The semiconductor sector dominated the U.S. market and accounted for 72.9% share in 2024, driven by growing demand for advanced chips used in AI, 5G, and IoT applications. With chip designs becoming smaller and more complex and precise, contamination-free processing is essential, prompting significant investment in wet process equipment for cleaning, etching, and wafer development across domestic fabrication facilities.

The MEMS (Micro-Electro-Mechanical Systems) segment is the fastest-growing application in the U.S. market, driven by the expanding use of MEMS in sensors, medical devices, and consumer electronics. MEMS fabrication requires highly precise wet processing steps such as etching, cleaning, and surface treatment to ensure device integrity at micro and nano scales. The rising demand for compact, high-performance devices is pushing U.S. manufacturers to invest in specialized wet process equipment that enhances fabrication accuracy, process control, and overall efficiency.

Key U.S. Wet Process Equipment Company Insights

Some of the key players operating in the market include Veeco Instruments Inc., Modutek Corporation, Plastic Design, Inc.

-

Veeco Instruments Inc. is a provider of advanced semiconductor manufacturing equipment, specializing in wet process technologies, thin film deposition, and precision metrology solutions. The company supports semiconductor, data storage, and LED industries with innovative tools designed to enhance production efficiency and improve device performance. Veeco’s wet process equipment, including wafer cleaning and etching systems, is widely used in advanced semiconductor fabrication, enabling high precision and contamination control.

-

Modutek Corporation is a provider of wet process equipment for the semiconductor industry. The company designs and manufactures a comprehensive range of products, including wet benches, chemical delivery systems, and precision parts cleaning systems. Modutek emphasizes customization, offering tailored solutions to meet specific customer requirements. With a focus on precision, reliability, and innovation, Modutek supports semiconductor manufacturers in achieving high-quality results and efficient production processes.

Key U.S. Wet Process Equipment Companies:

- Modutek Corporation

- Plastic Design, Inc.

- Lam Research Corporation

- Applied Materials, Inc.

- Veeco Instruments Inc.

- Akrion Systems LLC

- MicroTech Systems, Inc.

- Wafer Process Systems, Inc.

- Solid State Equipment LLC

- RENA Technologies North America

Recent Developments

-

In April 2025, Veeco Instruments Inc. announced that a leading global semiconductor IDM has qualified its WaferStorm and WaferEtch wet processing platforms for two new applications in advanced packaging, with initial orders placed in the first quarter. This strategic milestone highlights Veeco’s expanding footprint in advanced packaging, supported by the platforms’ industry-leading wet processing performance, unique capabilities, and cost-effective operation.

-

In September 2023, Lam Research expanded its R&D operations in Oregon to enhance semiconductor equipment innovation, focusing on advanced wet and dry process technologies to support next-generation chip manufacturing and strengthen its market position.

U.S. Wet Process Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 622.9 million

Revenue forecast in 2033

USD 1,182.5 million

Growth Rate

CAGR of 8.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, type, application

Country Scope

U.S.

Key companies profiled

Modutek Corporation; Plastic Design, Inc.; Lam Research Corporation; Applied Materials, Inc.; Veeco Instruments Inc.; Akrion Systems LLC; MicroTech Systems, Inc.; Wafer Process Systems, Inc.; Solid State Equipment LLC; RENA Technologies North America

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wet Process Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the U.S. wet process equipment market report based on product, type, and application:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cleaning Systems

-

Etching Systems

-

Stripping Systems

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Semiconductor

-

MEMS

-

Solar

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. wet process equipment market size was estimated at USD 588.7 million in 2024 and is expected to reach USD 622.9 million in 2025.

b. The U.S. wet process equipment market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2033 to reach USD 1,182.5 million by 2033.

b. The cleaning systems segment dominated the wet process equipment market in 2024 and accounted for 42.5% share, holding a significant share due to its crucial role in eliminating contaminants from semiconductor wafers and ensuring high product quality. Advanced cleaning technologies enhance efficiency and yield, making them indispensable in chip manufacturing.

b. Some of the key players operating in the U.S. wet process equipment market include Modutek Corporation, Plastic Design, Inc., Lam Research Corporation, Applied Materials, Inc., Veeco Instruments Inc., Akrion Systems LLC, MicroTech Systems, Inc., Wafer Process Systems, Inc., Solid State Equipment LLC, RENA Technologies North America

b. Key factors driving the U.S. wet process equipment market include increased domestic semiconductor manufacturing, government incentives, demand for advanced chips in AI and 5G, and the need for precise, contamination-free wafer processing to support next-generation device production and innovation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.