- Home

- »

- Automotive & Transportation

- »

-

Automotive Electronics Market Size, Industry Report, 2030GVR Report cover

![Automotive Electronics Market Size, Share & Trend Report]()

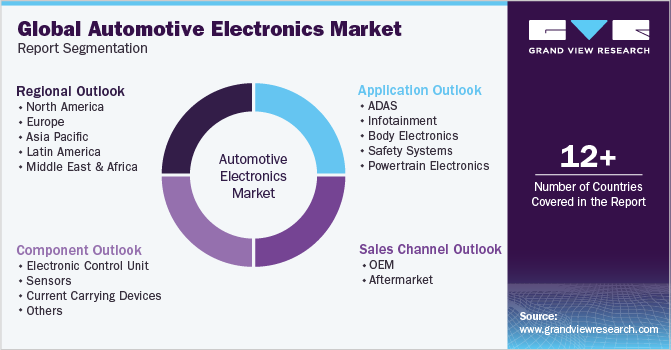

Automotive Electronics Market (2024 - 2030) Size, Share & Trend Analysis Report By Component (Electronic Control Unit, Sensors), By Vehicle Type, By Propulsion, By Application (ADAS, Infotainment), By Sales Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-357-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Electronics Market Summary

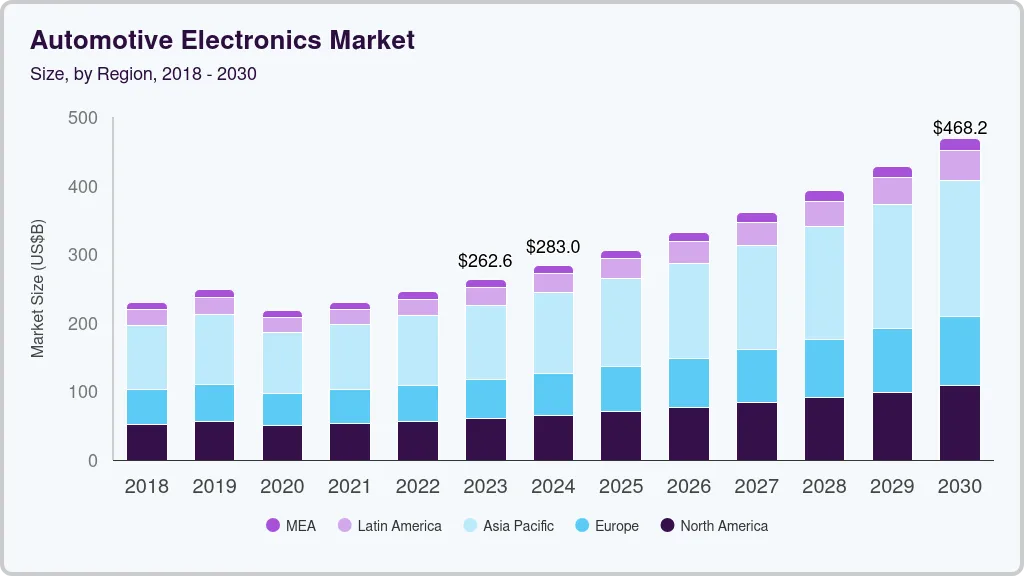

The global automotive electronics market size was estimated at USD 262.60 billion in 2023 and is projected to reach USD 468.17 billion by 2030, growing at a CAGR of 8.8% from 2024 to 2030. The increasing integration and implementation of advanced safety systems such as automatic emergency braking, airbags, parking assistance systems, and lane departure warning to decrease road accidents is expected to favor demand over the forecast period.

Key Market Trends & Insights

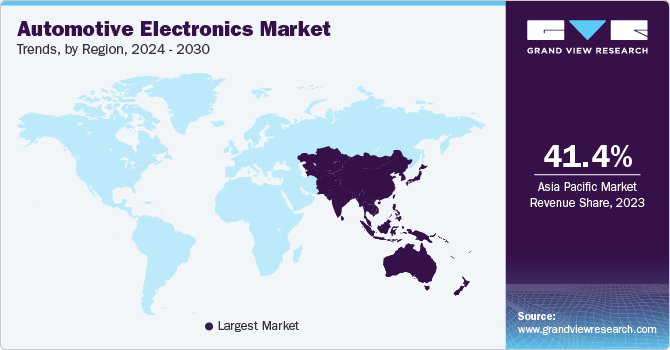

- Asia Pacific dominated the automotive electronics market and accounted for 41.4% share in 2023.

- The automotive electronics market in the U.S. is expected to grow at a CAGR of 9.9% from 2024 to 2030.

- By component, the current-carrying devices segment led the market and accounted for 40.2% in 2023.

- By application, the safety systems segment accounted for the largest market revenue share in 2023.

- By sales channel, the OEM segment led the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 262.60 Billion

- 2030 Projected Market Size: USD 468.17 Billion

- CAGR (2024-2030): 8.8%

- Asia Pacific: Largest market in 2023

Moreover, features such as emergency call systems, alcohol ignition interlocks, and accident data recorder systems are rapidly adopted to safeguard in-vehicle passengers and are expected to drive market growth over the forecast period.

The increasing demand for electric vehicles is driving the demand for automotive electronics. Many people are switching from fuel ignited vehicles to electrics vehicles, and this is increasing the demand for systems. It has increased the demand for battery management systems and electric powertrains of electric vehicles. However, apart from the growing demand for electric vehicles, government regulations and funding have also impacted positively the automotive electronics market growth.

Government imposed safety regulations which made automakers around the world improve the safety of vehicles and reduce the number of accidents on the roads, which boosts the demand for automotive electronics. Government safety regulations can also be used to support the development of new technologies, such as electric vehicles, which can improve efficiency and reduce emission from vehicles. For instance, China has laid down regulations focusing on reducing energy consumption of passenger cars and maximizing the sales of new energy vehicles, including plug-in hybrid and fully electric cars. Governments across various countries are providing annual tonnage tax and automobile tax to promote the use of electric vehicles.

Technological advancements have positively impacted the growth of automotive electronics. Advancements in areas such as automotive powertrain electronics, autonomous driving, and connected vehicles. The automotive electronics market forms an essential part of the automotive industry, which provides automakers and goods with efficient and sustainable automotive electronics solutions. The market for automotive electronics is likely to remain focused for industry players and policymakers as urbanization and the demand for automotive vehicles continue to grow.

Parking assistance, electrical suspensions, braking, and steering systems are some of the critical systems incorporated in luxury cars and mid-size cars. Furthermore, the government promotes the adoption of zero-emission vehicles and imposes obligatory safety standards for automotive manufacturers. Governments are also regulating the use of ADAS safety system installations in vehicles. For instance, the New Car Assessment Program mandates advanced active and passive safety systems in China and Europe. Also, the Indian government allows specific low-frequency band usage to help automotive manufacturers use radar-based systems to install ADAS features in vehicles. All these factors are driving the growth of the automotive electronics market.

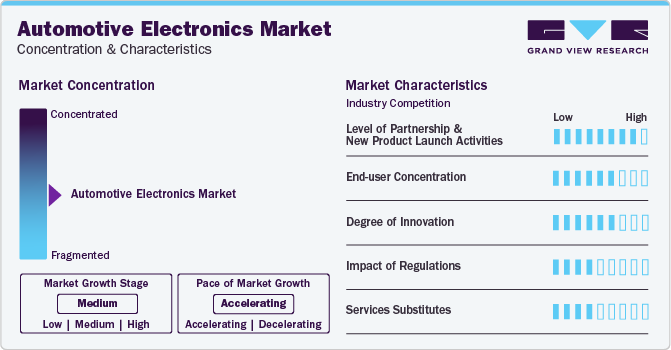

Market Concentration & Characteristics

Industry growth stage is medium, and industry growth pace is accelerating. The demand for automotive electronics is anticipated to rise as the government mandates CO2 emissions and increases usage of modern technologies such as IoT, AI, and cloud networking. Growing demand for electric vehicles, self-driving cars, and cutting-edge automotive technology is expected to boost the demand for automotive electronic components.

The automotive electronics industry is characterized by a high level of partnerships and new product launch activity by the companies. This is due to several factors, including access to technology, or infrastructure to launch innovative and advanced products in the market. Also, to expand their regional reach by leveraging the partner’s existing customer base, distribution channels, allowing companies in the automotive electronics industry to tap into new demographics.

Both governments and industry regulators are focusing on ensuring the safety of automotive electronics component on various parameters, including crashworthiness, fire safety, and compliance with signaling and control systems. There are growing concerns over the environmental impact, particularly the greenhouse gas emissions associated with all type of vehicles. Hence, regulations are being drafted to encourage the use of more energy-efficient and low-emission automotive electronics component.

Automotive electronics form one of the significant components of automobiles. Thus, the replacement of electronics in the automotive industry may pose challenges in the form of design modifications. Furthermore, a recent innovation in technology is expected to increase the automotive electronic substitution rate for the manufacturers since automotive electronics consolidates would solve the purpose of multiple electronics, thereby reducing the average number of electronics used per car. Hence, the differentiated, customized solutions and unavailability of alternatives contribute to the low threat of substitutes.

Buyers are increasingly looking for automotive electronics component tailored to their specific needs. They are demanding customized designs, interiors, and features to meet the evolving needs of passengers and operators.

Component Insights

Current carrying devices segment led the market and accounted for 40.2% in 2023. Current carrying devices are essential components in the automotive industry, as they transmit electrical power and signals throughout the vehicle's electrical system. The demand for current-carrying devices in the component segment is due to the high cost and numerous electronic components used in vehicles, including switches, fuses, connectors, and wiring harnesses.

The sensors segment is anticipated to register the highest growth rate over the forecast period. This growth can be attributed to significantly emerging in the automotive electronics market as most passengers prefer vehicles due to their safety, efficiency, and more connected vehicles. Sensors are used in various automotive applications, including engine management, safety systems, and entertainment systems. Furthermore, several countries' government initiatives and investments for people's safety and security fuel demand for sensors. For instance, in April 2022, the Ministry of Electronics and Information Technology (MeitY) launched the Onboard Driver Assistance and Warning System (ODAWS) product. ODAWS aims to incorporate vehicle-borne sensors to monitor vehicle surroundings and driver propensity to signal visual and acoustic alerts for driver assistance.

Application Insights

The safety systems segment accounted for the largest market revenue share in 2023. The demand for efficient, safe, convenient driving experiences and stringent safety regulations is rising. Manufacturers such as Continental AG, DENSO Corporation, Infineon Technologies AG, and Robert Bosch GmbH are developing safety systems vehicles to cater to the increasing demand for light and heavy commercial vehicles. Factors such as increasing focus on vehicle safety and the rising number of road accidents contribute to the segment's growth. For instance, in March 2023, Hyundai Motor India Limited launched its new Hyundai Verna with a level 2 ADAS system and 65 advanced safety features, and many others. The new Verna would also feature Hyundai’s Smart Sense safety features that would get automated sensing technology with radars, cameras to detect obstacles, and sensors on the road and assist in corrective warnings and actions.

The Advanced Driver Assistance System (ADAS) segment is expected grow at the highest CAGR over the forecast period. Factors such as government regulations requiring safety and growing public knowledge of passenger comfort and safety contribute to the segment's expansion. In addition, customers have an increased preference for the newest technologies as the automobile industry experiences a rise in technological advancements, which improve driver and passenger safety and driving enjoyment. Consumer behavior is significantly impacted by ADAS features like blind spot detection, lane assistance, collision warning, etc. These features are also anticipated to improve the performance of vehicles by decreasing vehicle downtime and warning the owner of any problems with the vehicle.

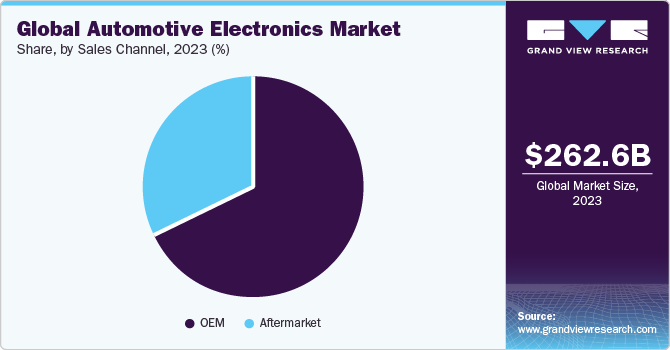

Sales Channel Insights

The OEM segment led the market in 2023. This dominance can be attributed to the increased durability and shelf-life of electronic components. Since electronic components form an integral part of the vehicles, consumers prefer buying them through OEMs in order to obtain genuine parts. Furthermore, with the increase in the design complexity of these electronic components, aftermarket electronic components are expected to account for a lower revenue share over the forecast period.

The aftermarket segment is expected to register a considerable growth over the forecast period. Factors include increasing vehicle age, cost-effective repair options, consumer demand for advanced features, product innovation, and increased online sales. Hence, with the increase in the design complexity of these electronic components, aftermarket electronic components demand will grow over the forecast period.

Regional Insights

The automotive electronics market in North America is expected to register a considerable growth rate from 2024 to 2030. The region is home to several Automotive Electronics companies that are implementing partnership and collaboration initiatives to grow their demographic presence. For instance, in January 2023, U.S. based automotive electronics supplier, announced technology collaboration with semiconductor and software manufacturer Qualcomm for developing advanced automotive cockpit domain controller which is designed to enable automotive companies’ modern cockpits. Through this partnership, the companies are helping the automotive industry to transform to a more intelligent, customized vehicle experience.

U.S. Automotive Electronics Market Trends

The automotive electronics market in the U.S. is expected to grow at a CAGR of 9.9% from 2024 to 2030. The U.S. automotive industry is experiencing a shift towards connected cars, which are vehicles that are equipped with Internet access and the ability to communicate with other devices, including smartphones, other cars, and even infrastructure. This trend is driving the growth of automotive electronics, as connected cars require sophisticated electronic systems to enable connectivity.

Asia Pacific Automotive Electronics Market Trends

Asia Pacific dominated the automotive electronics market and accounted for 41.4% share in 2023. The growing demand for advanced electronics in vehicles, increasing purchasing power of the consumers, and growing consumer awareness of safety features in the developing countries are the key factors driving the growth in the Asia Pacific region. Automotive manufacturers intend to enhance their production volume by implementing modern manufacturing technology. For instance, Mercedes Benz, General Motors, and Volkswagen shifted their production plants to developing countries. Furthermore, Asia Pacific is home to leading semiconductor suppliers. And easy availability of power electronics components and devices makes Asia Pacific the leading regional market.

The automotive electronics market in China accounted for a 51.3% revenue share of the Asia Pacific in 2023. Government incentives, subsidies, and regulation promoting NEVs have led to a surge in the demand for electric cars is anticipated to drive growth in automotive electronics. Furthermore, China has been investing heavily in autonomous driving technology is witnessing a growth in sensors, LiDAR, radar systems, and AI algorithms.

India automotive electronics market is expected to grow at a CAGR of 8.7% from 2024 to 2030. Rapid advancements in technology have led to the development of new and innovative automotive electronics products, such as infotainment systems, navigation systems, and advanced driver assistance systems (ADAS). This has fueled the growth of the automotive electronics market in India.

The automotive electronics market in Japan is driving demand owing to several initiatives and policies introduced by the government to promote the adoption of EVs, including tax incentives, subsidies, and regulatory measures. The government has set a target of having EVs account for 50% of new car sales by 2030.

Europe Automotive Electronics Market Trends

The automotive electronics market in Europe was values at USD 65.02 billion in 2023. Consumers are increasingly looking for vehicles with advanced connectivity features, such as smartphone integration, navigation, and entertainment systems. As a result, automakers are investing heavily in the development of infotainment systems that can provide these features.

UK automotive electronics market is accounted for a 13.1% revenue share of the Europe in 2023. Growing focus on enhancing vehicle safety through the integration of advanced safety systems such as collision avoidance systems, lane departure warnings, and emergency braking. Such advancements in the safety systems are anticipated to drive the demand for automotive electronics in the U.K.

The automotive electronics market in Germany is expected to grow at a CAGR of 6.7% from 2024 to 2030. The country’s integration into the global automotive supply chain is influencing the adoption of electronic components and technologies to meet international standards and market demands is anticipated to drive the growth of the automotive electronics market in Germany.

France automotive electronics market is projected to grow owing to the growing demand for customized and personalized features in their vehicles. Advanced electronics allowed for tailored in-car experience, including audio unit, navigation unit, and heads-up display are anticipated to drive the growth of the automotive electronics in France.

MEA Automotive Electronics Market Trends

The automotive electronics market in the Middle East and Africa (MEA) region is anticipated to reach USD 17.44 billion by 2030. The demand for connected cars in MEA is on the rise, as consumers increasingly seek vehicles that are equipped with features such as infotainment systems, advanced driver assistance systems (ADAS), and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication capabilities.

The automotive electronics in Saudi Arabia is driven by growing demand for IoT technologies and integration of sensors in vehicles for monitoring and data collection. This includes sensors for monitoring vehicle health, tire pressure, and other parameters to enhance safety and performance.

Key Companies & Market Share Insights

Some of the key players operating in the market includeDenso Corporation, Robert Bosch GmbH, Xilinx, Inc., Continental AG, Hella GmbH & Co., ZF Friedrichshafen AG, and Infineon Technologies AG.

-

Denso Corporation is an automotive supplier offering electrification, powertrain, mobility, thermal, and electronic systems to carmakers across the globe. The company focuses on developing core technologies in four fields, namely automated driving, electrification, connected driving, and factory automation.

-

ZF Friedrichshafen AG is engaged in delivering active and passive safety technology for commercial vehicles and passenger cars. It operates through seven divisions, namely Car Chassis Technology, Car Powertrain Technology, Industrial Technology, Commercial Vehicle Technology, Active & Passive Safety Technology, e-Mobility, and ZF Aftermarket. The company has a presence in 230 locations across 40 countries globally.

-

Visteon Corporation, Hitachi Automotive Systems Ltd., MotoLink, and iElektron are some of the emerging market participants in the automotive electronics market.

-

Hitachi Automotive Systems Ltd. is engaged in development, manufacturing, sale, as well as service of industrial machines and systems, transportation related components, and automotive components in Japan and globally. It delivers engine management systems such as fuel systems, control units, intake and exhaust systems, ignition systems, engines, and sensors.

- Visteon Corporation is a manufacturer of automotive cockpit electronics such as android based infotainment, instrument clusters telematics, advance driver assistance system, battery management system displays, domain controller. The company also develops mobility technologies based on artificial intelligence, interior sensing, cybersecurity, connected car technology and user experience.

Key Automotive Electronics Companies:

- Continental AG

- DENSO Corporation

- Hella GmbH & Co. Kgaa

- Hitachi Automotive Systems, Ltd.

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

Recent Developments

-

In March 2023, Infineon Technologies AG expanded its partnership with Delta Electronics, Inc., an energy, and power management company that would deepen its innovative activities to provide higher density and more efficient solutions for the growing market of electric vehicles. With partnership would provide EV drivetrain applications such as on-board chargers, DC-DC converters, and traction inverters, along with a wide range of components such as low-voltage and high-voltage microcontrollers and discrete as well as modulus.

-

In January 2023, ZF Friedrichshafen AG announced the introduction of Smart Camera 6, a next-generation camera for automated driving and safety systems. The main focus of Smart Camera 6 is to fulfill the demand for 3D surround view and Interior Monitoring Systems with the support of Image Processing Module systems.

-

In January 2023, Xilinx, Inc. collaborated with an embedded AI autonomous driving provider, Motovis to provide a solution that combines Motovis’ convolutional neural network (CNN) IP and Zynq system-on-chip (SoC), Xilinx Automotive (XA) platform for forward camera systems' vehicle control and perception in the automotive industry. The aim of the solution is to enhance customers with robust platforms and rapid development.

-

In October 2022, Hitachi Automotive Systems, Ltd. developed a 360-degree stereo vision system with a multi-camera 3D sensing prototype for automated vehicles traveling on road. The prototype is integrated into a single in-vehicle camera system with high accuracy, cost advantage, and high resolution.

Automotive Electronics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 283.02 Billion

Revenue forecast in 2030

USD 468.17 Billion

Growth Rate

CAGR of 8.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD Million and CAGR from 2024 to 2030

Segments Covered

Component, application, vehicle type, propulsion, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Continental AG; DENSO Corporation; Hella GmbH & Co. Kgaa; Hitachi Automotive Systems, Ltd.; Infineon Technologies AG; Robert Bosch GmbH; Valeo Inc.; Visteon Corporation; Xilinx, Inc.; ZF Friedrichshafen AG

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Global Automotive Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive electronics market report by component, application, vehicle type, propulsion, sales channel, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Control Unit

-

Sensors

-

Current Carrying Devices

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ADAS

-

Infotainment

-

Body Electronics

-

Safety Systems

-

Powertrain Electronics

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Two Wheeler

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the automotive electronics market include Continental AG, Denso Corporation, Aptiv PLC, Robert Bosch GmbH, Altera (Intel Corporation), Broadcom Ltd., HELLA GmbH & Co. KGaA.

b. Key factors that are driving the automotive electronics market growth include rising safety and security concerns, increasing adoption of connected car systems, and growing demand for luxury, hybrid, and electric vehicles.

b. The global automotive electronics market size was estimated at USD 244.95 billion in 2022 and is expected to reach USD 262.60 billion in 2023.

b. The global automotive electronics market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 468.17 billion by 2030.

b. Asia Pacific dominated the automotive electronics market with a share of over 40% in 2022. This is attributable to the rising demand for luxury and hybrid vehicles in the region.

b. The current carrying devices segment accounted for the largest revenue share of around 40% in 2022, in the automotive electronics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.