- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Wine Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Wine Market Size, Share & Trends Report]()

U.S. Wine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Table Wine, Dessert Wine, Sparkling Wine), By Distribution Channel (On-Trade, Off-Trade), And Segment Forecasts

- Report ID: GVR-2-68038-148-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wine Market Summary

The U.S. wine market size was estimated at USD 75.3 billion in 2024 and is projected to reach USD 157.3 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. Wine sales have surged across the U.S. owing to innovation in flavor, color, and packaging.

Key Market Trends & Insights

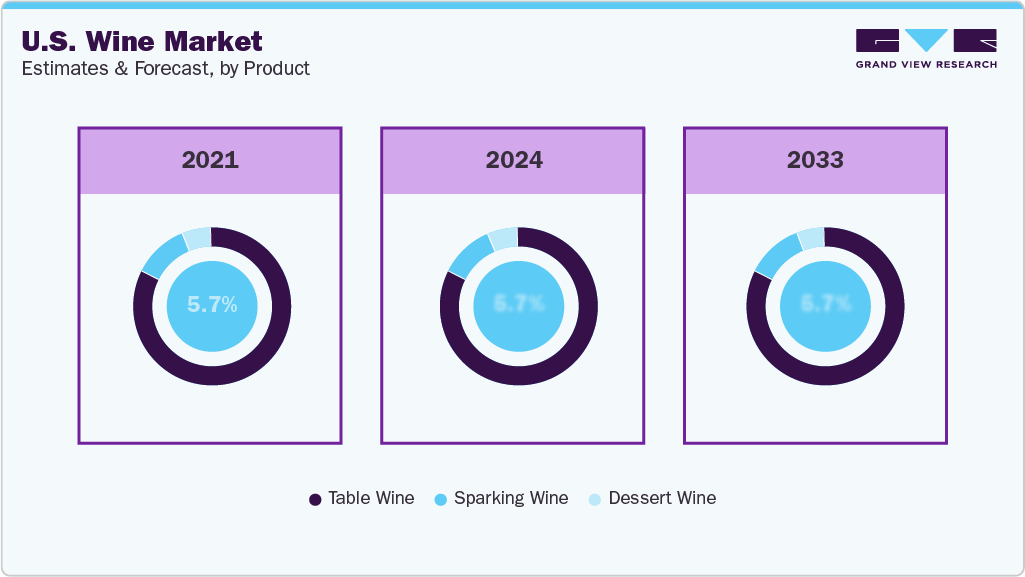

- By product, table wine led the market and accounted for a share of 81.5% in 2024.

- By distribution channel, the off-trade segment led the market and accounted for a share of 76.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 75.3 Billion

- 2033 Projected Market Size: USD 157.3 Billion

- CAGR (2025-2033): 8.8%

Beyond classic wines, niche markets and emerging wine regions are gaining prominence. Regions such as the Willamette Valley in Oregon, the Finger Lakes in New York, Santa Rita Hills in California, and the Columbia Valley are carving out niches with their distinct offerings. Indigenous grape varieties, innovative winemaking techniques, and unique terroirs are captivating adventurous palates.Evolving consumer tastes and preferences play a significant role in shaping the U.S. wine industry. Consumers are increasingly seeking diverse and unique wine experiences, leading to a growing demand for a variety of wine styles, including organic, biodynamic, and sustainable options. The millennial demographic has a considerable impact on the wine industry. This group tends to value authenticity, sustainability, and unique experiences, driving the demand for wines that align with these preferences. Millennial consumers often explore new and niche varietals, contributing to the diversification of the market.

The rise of wine tourism emerges as a noteworthy factor boosting the U.S. market. Consumers express a growing interest in immersive experiences such as vineyard visits, tastings, and insights into the winemaking process. Wine regions, in turn, benefit from the favorable economic impact generated by the influx of tourists.

Many manufacturers prefer to purchase grapes in large quantities from local vineyards for wine production to create a product at a reduced price. Locally-made wine has also been gaining traction owing to the rising consumer demand for organic and natural products. Though U.S. wine is still a niche segment in the overall wine category, its production and consumption have increased in recent years due to rising consumer awareness regarding health and wellness. Furthermore, some manufacturers are of the opinion that organic practices are a necessity for their business growth.

Mergers, acquisitions, and consolidation have been occurring among wineries worldwide. For instance, in October 2024, Butterfly Equity, a Los Angeles-based private equity firm, entered into a definitive agreement to acquire The Duckhorn Portfolio, North America's premier luxury wine company, in a USD 1.95 billion transaction. Following the acquisition, Duckhorn will become a privately held company and continue to operate from St. Helena, California, managing eleven winery brands. Butterfly aims to leverage its expertise in the food and beverage sector to enhance Duckhorn's growth and strategic objectives.

Companies are increasingly focusing on producing new products to gain market share in the U.S. For instance, in February 2025, Rack & Riddle, the leading custom sparkling wine producer in the U.S., introduced CALSECCO, a new California sparkling wine category designed to attract Gen Z and Millennial consumers to premium sparkling wines. Positioned as a fusion of tradition and California winemaking, CALSECCO fills a gap in the market by offering Italian-style sparkling wine with a uniquely Californian identity.

There has been an increase in preference for sparkling U.S. wines. American U.S. wine preferences reflect a strong inclination toward smoother and fruitier U.S. wines, which suggests a widespread appreciation for balanced and approachable flavors. Semi-sweet and sweet U.S. wines also enjoy notable popularity, indicating a preference for U.S. wines with a touch of sweetness that appeals to a broad audience. Meanwhile, dry and savory U.S. wines maintain a steady following, likely catering to those who appreciate more structured and complex profiles. Tannic U.S. wines, which have a bold and intense character, appear to have a more niche appeal. These preferences highlight the diverse palates of American consumers and the evolving trends shaping the U.S. wine industry.

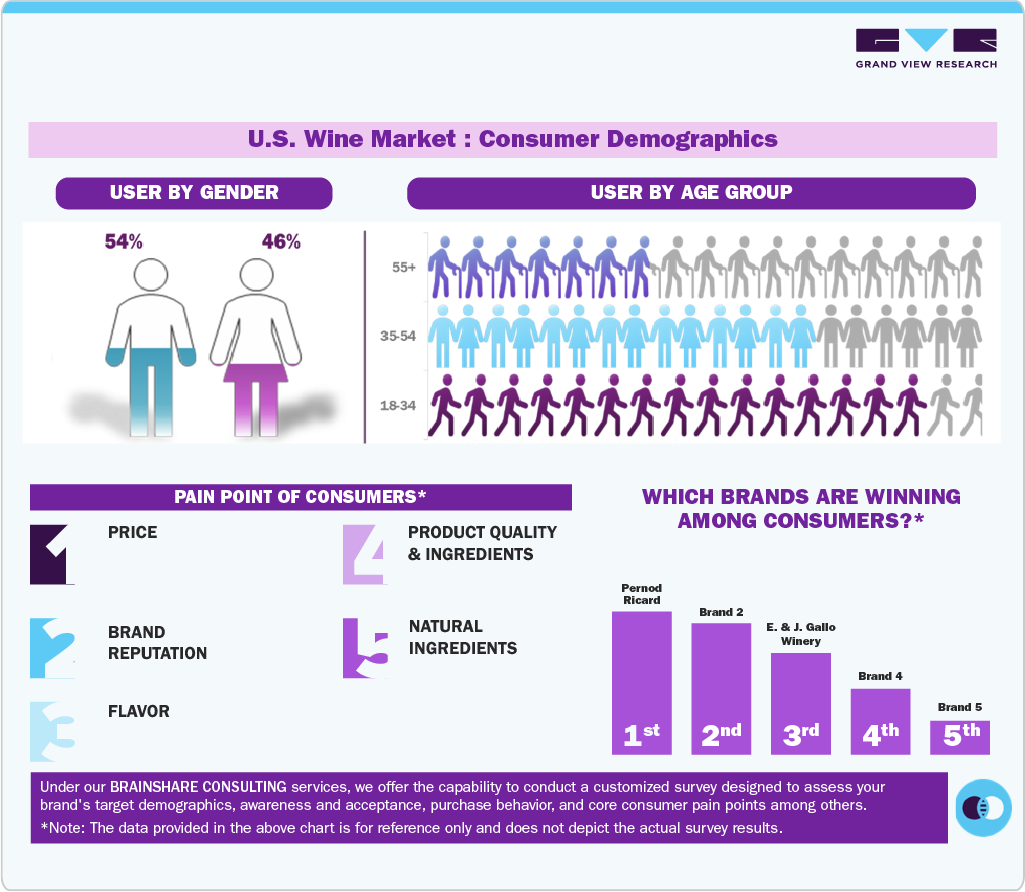

Consumer Insights

The wine industry in the U.S. is facing a decline as consumers are drinking less and spending less on wine. Data shows that younger generations, particularly Millennials and Gen Z, are opting for alternatives like cocktails, spirits, and non-alcoholic beverages. This shift is contributing to slower sales growth and a decrease in wine consumption overall.

This trend aligns with the broader decline in alcohol consumption among Americans, especially younger adults. Compared to two decades ago, a smaller share of young Americans report drinking alcohol, influenced by factors such as health consciousness, changing social norms, and the rise of low- and no-alcohol alternatives. This shift presents challenges for the wine industry as it struggles to attract younger consumers in an evolving beverage market.

Economic factors, including inflation and changing spending habits, have also contributed to the decline as consumers cut back on discretionary purchases. In addition, health-conscious trends and the rise of low- and no-alcohol beverages have further impacted traditional wine consumption. While premium wine sales remain stable, the broader industry is facing challenges in attracting younger drinkers and adapting to evolving preferences.

In 2023, the average American consumed 4.7 liters of wine, with total consumption reaching 18,500 million liters. For 2024, projections further declines to 4.5 liters per capita and 17,800 million liters in total consumption. Economic conditions play a significant role in these trends, as financial strain leads consumers to opt for cheaper alternatives. Cultural changes also impact traditional wine-drinking habits, while effective marketing strategies can temporarily stimulate demand. Despite these challenges, the U.S. wine industry remains an integral part of the nation's food culture and heritage.

Over the years, wine prices in the U.S. have experienced a significant upward trend, reflecting various economic and industry dynamics. Factors such as inflation, production costs, supply chain disruptions, and shifting consumer preferences have contributed to the rise in costs. While periods of steady increases have been observed, certain fluctuations indicate market adjustments influenced by broader economic conditions. Despite some recent declines, wine remains a premium product, with pricing trends shaped by evolving demand and industry challenges. The long-term trajectory highlights the sustained value of wine while also emphasizing the impact of external factors on pricing in the market.

Younger consumers are shifting their drinking preferences towards convenience, opting for premixed, ready-to-drink beverages. These drinks offer ease, variety, and appealing flavors, making them a popular choice over traditional alcohol options. In fact, premixed beverages are among the few segments in the alcohol industry experiencing growth, reflecting changing consumer habits and the demand for on-the-go, hassle-free drinking experiences.

Product Insights

The U.S. table wine segment held the largest market share, more than 81.5% in 2024. The market is growing as consumers seek versatile, everyday wines that offer both affordability and quality. Changing lifestyle trends, including a preference for casual dining and social gatherings, have fueled demand for approachable wines that pair well with a variety of foods. With wineries focusing on innovation in flavors, packaging, and marketing, table wines are becoming a staple choice for both new and seasoned wine drinkers.

The U.S. sparkling wine segment is projected to register the fastest CAGR of 9.9% from 2025 to 2033. The U.S. sparkling wine segment is growing due to rising consumer demand for premium, celebratory, and everyday drinking options. Younger demographics are embracing Prosecco, Champagne, and other sparkling varieties for casual and social occasions. The trend toward low-alcohol and organic wines, along with the expansion of direct-to-consumer (DTC) sales and online retail, is further driving growth. In addition, innovations in packaging, such as single-serve cans, and the increasing popularity of sparkling wine cocktails are attracting new consumers.

Distribution Channel Insights

The off-trade segment accounted for a revenue share of 76.6% in 2024. The market is increasing through off-trade channels in the U.S. due to shifting consumer preferences and evolving purchasing habits. With the rise of e-commerce and direct-to-consumer (DTC) sales, more consumers are opting to buy wine online from retailers, wineries, and subscription services, benefiting from convenience and personalized selections. In addition, the expansion of premium and craft wine options in supermarkets, liquor stores, and specialty retailers has made high-quality wines more accessible.

The on-trade channel is expected to account for the fastest CAGR of 9.6% from 2025 to 2033. The wine market is increasing through on-trade channels in the U.S. due to several key factors. Primarily, the growing preference for experiential dining and premiumization trends has led consumers to seek high-quality wines in restaurants, bars, and hotels. Younger generations, particularly Millennials and Gen Z, are more likely to explore wines in social settings rather than purchasing bottles for home consumption. In addition, wine pairings with gourmet meals and the rise of wine-centric experiences, such as tastings and wine-focused events, are driving on-premise sales.

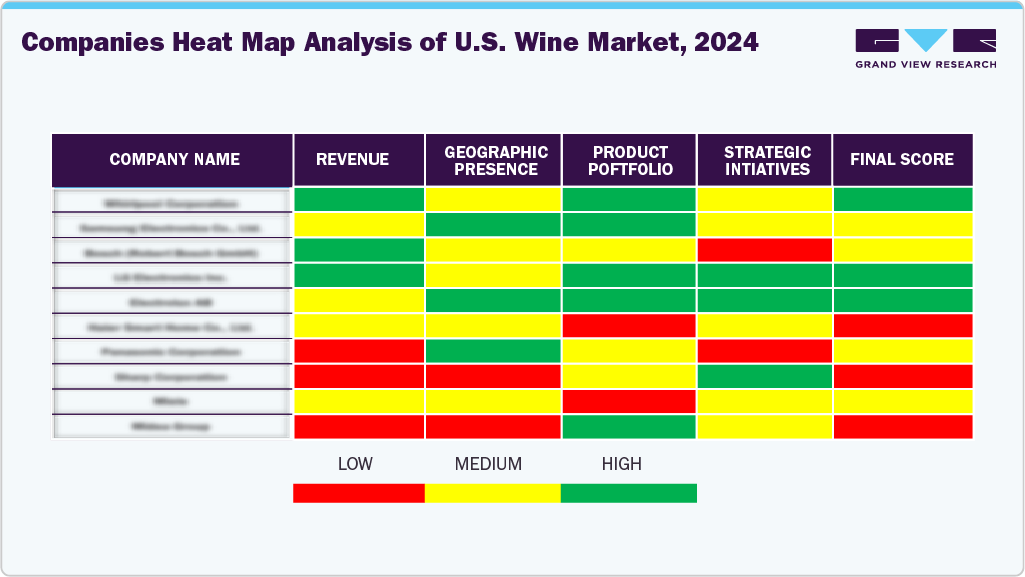

Key U.S. Wine Company Insights

The U.S. wine industry is fragmented, with several regional and country-level competitors present. These companies are investing heavily in acquisitions and promotions to grow their client base and brand loyalty. Furthermore, these firms are leveraging emerging technologies such as blockchain and artificial intelligence to improve consumer experience and streamline supply chain activities.

Key U.S. Wine Companies:

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Trinchero Family Estates

- Pernod Ricard

- Deutsch Family Wine & Spirits

- Accolade Wines

- Castel Frères

- Casella Family Brands

- Bronco Wine Company

Recent Developments

-

In June 2024, Searcys, Great Britain's oldest caterer, launched a new English Sparkling Wine. The new vintage was harvested in 2016, bottled in 2017, and aged on lees for over six and a half years. Produced by Surrey's Greyfriars vineyard, it features vibrant apple and citrus flavors with toasty aromas.

-

In May 2024, Sogrape announced the launch of Solisto, a new sparkling wine, in the U.S. market. This initiative aims to expand Sogrape's presence and introduce its portfolio of Portuguese wines to American consumers.

U.S. Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80.3 billion

Revenue forecast in 2033

USD 157.3 billion

Growth rate

CAGR of 8.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

E. & J. Gallo Winery; Constellation Brands, Inc.; The Wine Group; Trinchero Family Estates; Pernod Ricard; Deutsch Family Wine & Spirits; Accolade Wines; Castel Frères; Casella Family Brands; Bronco Wine Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. wine market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Table Wine

-

Dessert Wine

-

Sparkling Wine

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Trade

-

Off-Trade

-

Frequently Asked Questions About This Report

b. The U.S. wine market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2033 to reach USD 157.3 billion by 2033.

b. The U.S. wine market was estimated at USD 75.3 billion in 2024 and is expected to reach USD 80.3 billion in 2025.

b. Table wine segment dominated the U.S. wine market with a share of 81.5% in 2024. The market is growing as consumers seek versatile, everyday wines that offer both affordability and quality. Changing lifestyle trends, including a preference for casual dining and social gatherings, have fueled demand for approachable wines that pair well with a variety of foods.

b. Some of the key market players in the U.S. wine market are E. & J. Gallo Winery, Constellation Brands, Inc., The Wine Group, Trinchero Family Estates, Pernod Ricard, Deutsch Family Wine & Spirits, Accolade Wines, Castel Frères, Casella Family Brands, and Bronco Wine Company

b. Evolving consumer tastes and preferences play a significant role in shaping the U.S. wine industry. Consumers are increasingly seeking diverse and unique wine experiences, leading to a growing demand for a variety of wine styles, including organic, biodynamic, and sustainable options. The millennial demographic has a considerable impact on the wine market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.