- Home

- »

- Pharmaceuticals

- »

-

U.S. Women’s Health Market Size, Industry Report, 2030GVR Report cover

![U.S. Women’s Health Market Size, Share & Trends Report]()

U.S. Women’s Health Market Size, Share & Trends Analysis Report By Application (Postmenopausal Osteoporosis, Infertility, Contraceptives, Menopause, PCOS), By Age, By Drug Class, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-106-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Women’s Health Market Size & Trends

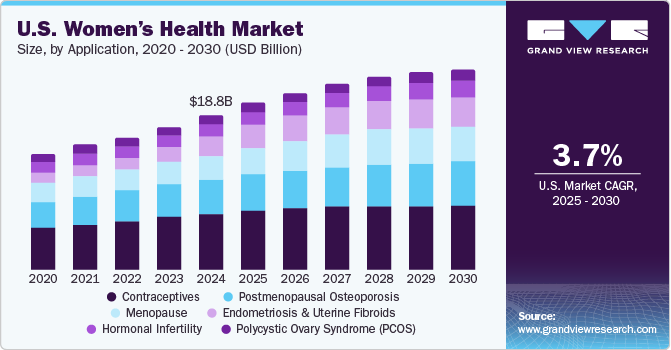

The U.S. women’s health market size was estimated at USD 18.82 billion in 2024 and is expected to grow at a CAGR of 3.7% from 2025 to 2030. Market growth can be attributed to the rising prevalence of target diseases such as menopause, hormonal infertility, endometriosis, child or early marriages, and rising publicly funded family planning services. In the U.S., approximately 45% of pregnancies are estimated to be unwanted every year. Despite advancements in contraceptive technology and increased R&D spending on contraceptives, the rate of unplanned pregnancies in the U.S. has remained unchanged for decades.

Early marriages often lead to early and unplanned pregnancies. Young girls who are married off at an early age may lack the knowledge, resources, and decision-making power to protect their sexual & reproductive health. They face higher risks of complications during pregnancy and childbirth, including maternal mortality, as their bodies are not fully developed to handle the physical demands of pregnancy. Child brides are more vulnerable to sexual violence and abuse within their marriages. They may experience forced sexual relations and lack the ability to negotiate safe & consensual sexual practices. This can result in physical injuries, Sexually Transmitted Infections (STIs), and long-term psychological trauma.

Contraceptives play an important role in preventing unwanted pregnancies. Currently, there are no OTC pills available in the U.S. for controlling pregnancy. Thus, introducing OTC contraceptive pills in the U.S. is expected to contribute to market growth positively. For instance, in July 2022, HRA Pharma submitted its application to the U.S. FDA for Rx-to-OTC change for the Opill contraceptives for women. The successful approval of Opill can make it the first birth control contraceptive to be available OTC without prescription in the U.S. Thus, the wide availability of OTC contraceptives and vitamin supplements, such as One A Day Women’s Prenatal 1, Nature Made Prenatal Multi, Rainbow Light Prenatal One, & Vitamin Code Raw, is anticipated to drive the women’s health market over the forecast period.

Governments and private organizations across the globe are increasing their focus on women’s health, which is likely to drive the market over the forecast period. In developed economies, coverage provided to women is one of the key factors expected to drive the market. For instance, various coverage plans in the U.S. provide preventive services for women without copayment charges, which include folic acid supplements for women trying to get pregnant, contraceptives, and screening for breast cancer, anemia, & hepatitis B. In the U.S., the Department of Health and Human Services established Healthy People 2020, aimed at improving U.S. individuals' health over the decade.

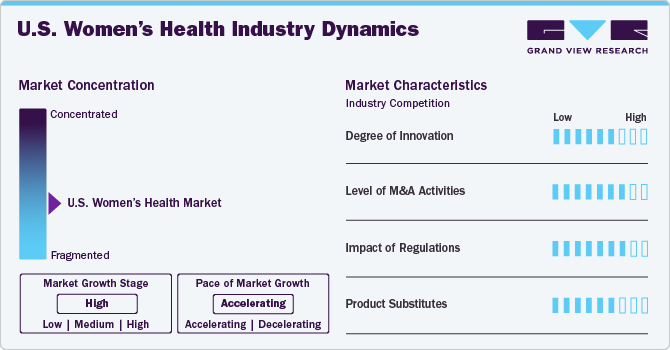

Market Concentration & Characteristics

Level of M&A Activities: The market growth stage is high, and the market growth is accelerating. The women's healthcare market is marked by significant innovation, spurred by swift technological progress. This advancement is fueled by next-generation contraceptives, AI-enhanced ultrasounds, and cutting-edge diagnostic tools.

Level of M&A Activities: The U.S. Women’s Health Market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This trend is driven by several factors, such as the pursuit of new technologies and talent acquisition, the imperative to consolidate in a swiftly expanding market, and the rising strategic significance of AI, among others.

Impact of Regulation: Regulatory agencies such as the FDA and EMA play an important role in regulating approval and commercialization of new women’s health products across the country. This trend reflects the growing recognition of the new product in the U.S. women’s health industry.

Product Substitute: This market has many products substitute including lifestyle modifications, physical therapies, or complementary medicine approaches can sometimes be used in place of pharmaceuticals for conditions like osteoporosis or menopausal symptoms.

Application Insights

The contraceptives segment held the highest market share of more than 35.46% of the U.S. Women’s Health Market revenue in 2024. The growth is supported by favorable government policies, such as in the U.S., where federal regulations ensure that all female-controlled contraceptive methods, including counseling and related services, are covered without out-of-pocket expenses for patients. These measures are expected to contribute to the increased adoption of contraceptives, fostering further market expansion. The approval of a nonprescription oral contraceptive contributes to market growth by expanding access and meeting consumer demand for over-the-counter options. For instance, in July 2023, Perrigo Company plc received FDA approval for the first daily nonprescription oral contraceptive in the U.S.

The menopause segment is expected to grow at the fastest CAGR over the forecast period. The development of non-hormonal and innovative treatments has played a crucial role in shaping the market, offering women more diverse choices beyond traditional hormone replacement therapies (HRT).In August 2024, Bayer submitted a New Drug Application (NDA) to the U.S. FDA for elinzanetant, another non-hormonal therapy aimed at treating moderate to severe VMS. Elinzanetant is unique in that it acts as a dual NK-1 and NK-3 receptor antagonist, providing a new, innovative approach to managing menopause symptoms. The NDA submission was based on positive results from Phase III trials, which demonstrated significant reductions in VMS frequency and severity.

Drug Class Insights

The hormonal therapies segment led the U.S. women’s health industry in 2024, with share of 40.19% and is expected to grow at fastest growth rate over the forecast period with hormonal contraceptives maintaining strong demand across developed regions. The expansion into emerging markets will likely be driven by government initiatives to improve access to family planning and contraceptive services, increasing the adoption of these therapies. Additionally, growing awareness of menopause management is expected to drive demand for vaginal estrogens and HRT products, further bolstering market growth. Overall, the hormonal therapy market is anticipated to perform robustly with continued growth fueled by innovation, expanding access, and rising global awareness of reproductive health.

The bone health agents segment was second largest growing drug class in 2024 driven by several factors, including the increasing prevalence of osteoporosis, aging populations, and greater awareness of bone health issues. Bisphosphonates continue to be the most widely prescribed class of drugs for osteoporosis and other bone-related conditions due to their proven efficacy in reducing fracture risk. The market for bisphosphonates is expected to remain strong, with moderate growth as generics continue to dominate after the expiration of patents for several key drugs..

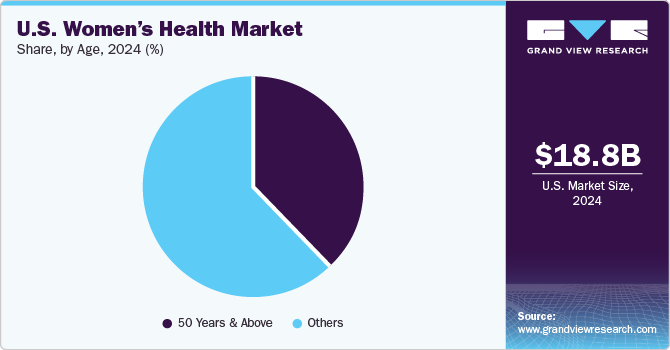

Age segment Insights

The others (below 50 years) segment held a considerable market share in 2024. This can be attributed to rising population of women with below age of 50 years. Women aged below 50 years are mainly in the reproductive age, and women’s health issues associated with this age group are more likely related to fertility, such as hormonal infertility, endometriosis, and PCOS. In the U.S., about 30% of menstruating women, along with 42% of young & pregnant women, were reported to be iron deficient, which can be attributed to monthly blood loss. This is expected to boost the demand for therapeutic drugs, thereby driving the market growth during the forecast period.

The 50-year-old & above-age segment is expected to register the fastest CAGR over the forecast period. Women aged 50 & above form the core demographic for the likelihood of menopause, and hence, the adoption of postmenopausal products is higher within this segment. According to the National Academy of Medical Science (NAMS) stated that every day in the U.S., an estimated 6,000 women reach menopause, which mean over 2 million women reach menopause every year. All these factors are expected to drive the growth of this segment in the years to come.

Key U.S. Women’s Health Company Insights

Some of the key players operating in the U.S. women’s health industry include Amgen, Inc.; AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; and Pfizer, Inc. These key players boast an extensive product portfolio encompassing a wide array of women’s health solutions, catering to a diverse consumer base. This broad coverage intensifies competition among leading companies, ultimately impacting profitability due to heightened competitive pressures.

TherapeuticsMD, Inc. and Mithra Pharmaceuticals are some of the emerging market participants in the U.S. Women’s Health Market. These players usually focus on strategic collaborations and partnerships with leading players to diversify and attain a position in the market.

Key U.S. Women’s Health Companies:

- AbbVie, Inc.

- Bayer AG

- Merck & Co., Inc.

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Agile Therapeutics

- Amgen, Inc.

- Apothecus Pharmaceutical Corp.

- Eli Lilly and Company

- Ferring B.V.

View a comprehensive list of companies in the U.S. Women’s Health Market

Recent Developments

-

In April 2024, Cleveland Clinic launched its new Women’s Comprehensive Health and Research Center dedicated to help women with women during midlife in getting specialized care. The launch health center for women treatment is expected to boost market growth in U.S.

-

In March 2024, the U.S. FDA approved Jubbonti/ Wyost (denosumab) developed by Sandoz, the first biosimilar to reference Amgen’s Prolia/ Xgeva (denosumab) in the U.S. This drug is indicated for the treatment of adults with hypercalcemia and osteoporosis as well as prevent skeletal-associated events with condition of bone metastases from solid tumors.

- In June 2023, Pfizer Inc. announced the restock of DUAVEE, an estrogen-based menopause hormone therapy in the U.S.

U.S. Women’s Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.32 billion

Revenue forecast in 2030

USD 24.36 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, age, drug class, region

Country scope

U.S.

Key companies profiled

AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer, Inc; Teva Pharmaceutical Industries Ltd.; Agile Therapeutics; Amgen, Inc; Apothecus Pharmaceutical Corp.; Eli Lilly and Company; Ferring B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Women’s Health Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. women’s health market report based on age, application, and drug:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Infertility

-

Contraceptives

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Polycystic Ovary Syndrome (PCOS)

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Therapies

-

Bone Health Agents

-

Fertility Agents

-

GnRH Modulators

-

Pain and Symptom Management

-

Metabolic Agents

-

Others

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

50 years and above

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. women’s health market size was estimated at USD 18.82 billion in 2024 and is expected to reach USD 20.32 billion in 2025.

b. The U.S. women’s health market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030 to reach USD 24.36 billion by 2030.

b. The contraceptives segment held the highest market share of more than 35.46% in 2024 in the U.S. women’s health market. The growth is supported by favorable government policies, such as in the U.S., where federal regulations ensure that all female-controlled contraceptive methods, including counseling and related services, are covered without out-of- pocket expenses for patients.

b. Some key players operating in the U.S. women’s health market include AbbVie Inc., Merck & Co., Inc. (ORGANON), Amgen, Inc., Agile Therapeutics, Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Apothecus Pharmaceutical Corp., Pfizer, Inc., Lilly (Eli Lilly), and Ferring B.V.

b. Key factors that are driving the market growth include the rising prevalence of women’s health-related conditions, increasing government and various organizations initiatives, and rising funding from public organizations in family planning services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."