- Home

- »

- Medical Devices

- »

-

U.S. X-ray Irradiation Market Size, Industry Report, 2033GVR Report cover

![U.S. X-ray Irradiation Market Size, Share & Trends Report]()

U.S. X-ray Irradiation Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Medical Devices, Pharmaceuticals, Biotech & Laboratory Supplies), By Size (Small-scale, Mid-scale, Large-scale), And Segment Forecasts

- Report ID: GVR-4-68040-678-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. X-ray Irradiation Market Trends

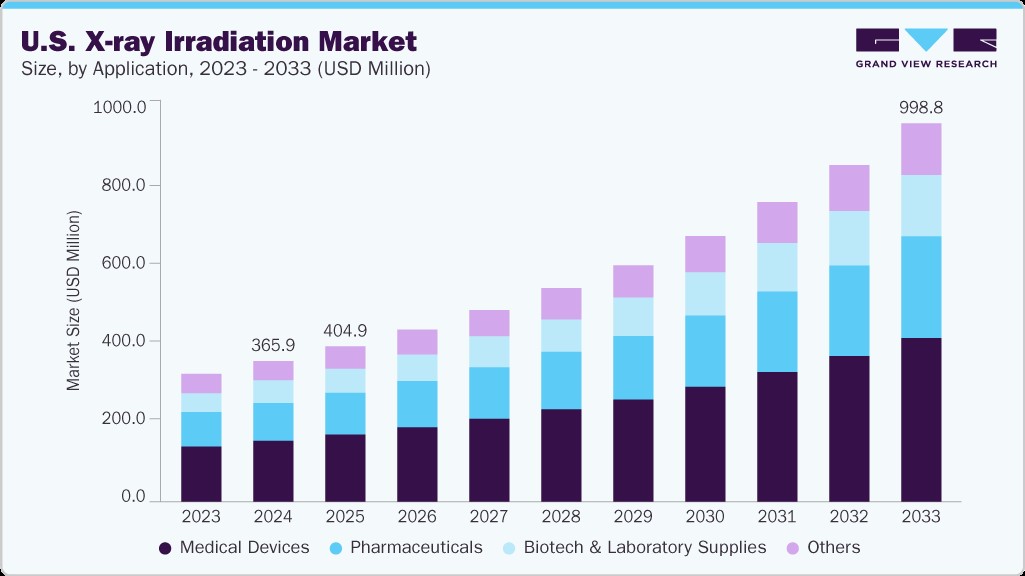

The U.S. X-ray irradiation market size was valued at USD 365.98 million in 2024 and is expected to grow at a CAGR of 11.95% from 2025 to 2033. The growth is attributed to a combination of regulatory initiatives, healthcare advancements, and national security priorities. A key driver is the Cesium Irradiator Replacement Project (CIRP) led by the U.S. Department of Energy, which provides funding and support for replacing cesium-137-based devices with non-radioactive X-ray systems in hospitals, research labs, and blood centers. The growing prevalence of cancer, transplant procedures, and immunocompromised patient populations has heightened the need for safe, efficient blood irradiation technologies. Moreover, the U.S. hosts one of the world’s largest biomedical research networks, where X-ray irradiators are increasingly used for radiobiology, oncology, and preclinical applications, strengthened by federal research grants and institutional investments. With strict regulatory oversight from agencies like the FDA and NRC, the U.S. remains at the forefront of adopting innovative, secure, and compliant X-ray irradiation solutions.

The industry is further propelled by expansions, such as in May 2025, Sterigenics’ announcement of new X-ray sterilization capabilities in the Southeast United States, reflecting rising demand for non-radioactive, scalable sterilization solutions. This move underscores the growing need for regional access to safe and efficient medical device sterilization, particularly as healthcare providers and manufacturers seek alternatives to gamma and ethylene oxide methods amid increasing regulatory scrutiny. Such investments support faster turnaround times and reduced logistics costs and align with national efforts to modernize sterilization infrastructure and phase out radioactive materials, supporting the U.S. market’s leadership in advanced X-ray irradiation technologies.

The growing shift toward outsourcing sterilization services significantly drives the industry, as medical device manufacturers, pharmaceutical firms, and healthcare providers seek more cost-effective and compliant solutions. By partnering with specialized third-party sterilization providers, these organizations can reduce capital investments in in-house infrastructure and benefit from established service providers' expertise, scalability, and regulatory readiness. For instance, IBA's agreement with Steri-Tek in June 2024 to install a fully integrated Be Wide X-ray solution underscores how service providers are expanding capacity to meet growing client needs. These developments illustrate how outsourcing trends fuel investment and innovation in the market.

The rising prevalence of cancer in the U.S. is a major driver of the X-ray irradiation market, as it increases the demand for safe and reliable blood transfusion practices and advanced research tools. Cancer patients undergoing chemotherapy, radiation therapy, or bone marrow transplants are highly immunocompromised and require irradiated blood components to prevent life-threatening conditions such as Transfusion-associated Graft versus Host Disease (TA-GvHD). This has led to the adoption of X-ray blood irradiators in hospitals and transfusion centers as a safer alternative to cesium-based devices. Additionally, the surge in oncology research across U.S. academic institutions and biopharma companies fuels demand for precise, benchtop X-ray systems used in radiobiology and cancer modeling. According to the American Cancer Society, with over 2 million new cancer cases projected in 2024, the need for safe transfusion protocols and cancer-focused research infrastructure continues to support strong growth in the market.

U.S. Estimated New Cancer Cases 2025

Rank

Common Types of Cancer

Estimated New Cases 2025

Estimated Deaths 2025

1

Breast Cancer (Female)

316,950

42,170

2

Prostate Cancer

313,780

35,770

3

Lung and Bronchus Cancer

226,650

124,730

4

Colorectal Cancer

154,270

52,900

5

Melanoma of the Skin

104,960

8,430

6

Bladder Cancer

84,870

17,420

7

Kidney and Renal Pelvis Cancer

80,980

14,510

8

Non-Hodgkin Lymphoma

80,350

19,390

9

Uterine Cancer

69,120

13,860

10

Pancreatic Cancer

67,440

51,980

-

Cancer of Any Site

2,041,910

618,120

Source IARC, Grand View Research

KOLs

Company Name

Verticals

KOLs

Sterigenics, a Sotera Health company

In May 2025, Sterigenics, a Sotera Health company and provider of outsourced terminal sterilization services, has announced the expansion of its Haw River, North Carolina campus by adding a new X-ray sterilization facility, located next to its existing gamma irradiation site. The new facility will open in late 2025, enhancing Sterigenics’ ability to offer diverse, scalable, and non-radioactive sterilization solutions to meet growing customer demand.

“Our state-of-the-art X-Ray facility features innovative technology designed to maximize product safety and provide high-throughput processing while accommodating a wide range of product configurations-giving customers the flexibility and the geographic capacity they are looking for in a sterilization provider” said Mike Rutz, President, Sterigenics”.

SteriTek, Inc.

In June 2025, IBA, a global leader in particle accelerator technology and advanced electron beam and X-ray irradiation solutions, has announced a contract with Steri-Tek, a rapidly expanding provider of irradiation services, to install its fully integrated Be Wide X-ray Solution. This collaboration aims to enhance Steri-Tek’s capabilities in delivering high-performance, non-radioactive sterilization for medical, pharmaceutical, and high-tech industries.

“Larry Nichols, Chief Executive Officer of Steri-Tek, commented: "The integration of IBA's Be Wide X-ray Solution into our newest facility is a transformative step, enhancing our ability to serve customers with a high-volume sterilization capacity while strengthening our presence in North America."

Source: SteriTek, Inc., Sterigenics, a Sotera Health company, Grand View Research

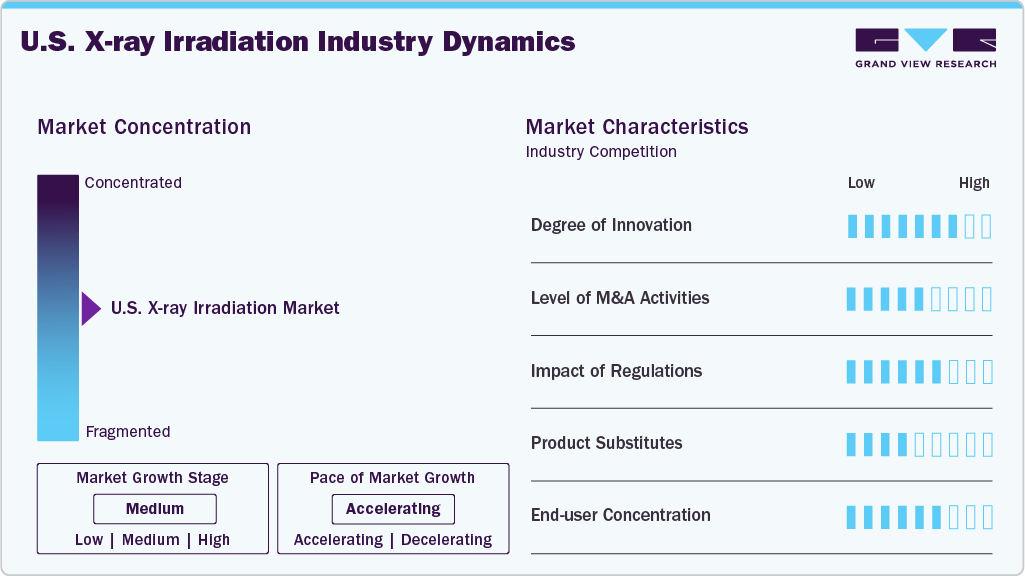

Market Concentration & Characteristics

The degree of innovation in the market is notably high, driven by the country’s strong emphasis on radiation safety, technological advancement, and regulatory modernization. U.S.-based companies are consistently developing next-generation systems with integrated dosimetry, AI-enabled dose control, remote monitoring, and compact designs to serve clinical and research environments. For instance, in May 2023, Precision X-Ray launched the CellRadHD, a high-dose benchtop irradiator with built-in dosimetry and enhanced control capabilities, marking a significant step forward in small-scale, precision irradiation for research labs.

Regulations are pivotal in shaping the market, primarily by encouraging the transition from radioactive cesium-137 irradiators to safer, non-radioactive X-ray systems. Federal agencies like the U.S. Nuclear Regulatory Commission (NRC) and Food and Drug Administration (FDA) have imposed strict controls on using, transporting, and disposing of radioactive materials, significantly increasing the compliance burden and operational costs for facilities using legacy isotope-based irradiators. In response, initiatives such as the Cesium Irradiator Replacement Project (CIRP), led by the U.S. Department of Energy’s National Nuclear Security Administration, offer funding and logistical support to help hospitals, blood banks, and research centers switch to X-ray technology. These regulatory efforts mitigate national security risks and create a favorable environment for the widespread adoption of modern, non-isotope X-ray systems, directly influencing market growth and innovation.

The level of mergers and acquisitions (M&A) activity in the market is moderate but steadily increasing, as companies aim to expand their technological capabilities, geographic reach, and service portfolios. The need for non-radioactive sterilization alternatives and the growing demand from the healthcare and biotech sectors drive this trend. For instance, Sterigenics, a Sotera Health company, has been expanding its service footprint through strategic investments and partnerships, such as the 2024 announcement of a new X-ray sterilization facility in North Carolina, complementing its existing gamma operations.

The primary product substitutes in the market include gamma irradiation (typically using cobalt-60) and electron beam (E-beam) technology. Gamma irradiation has traditionally been used for sterilization and blood irradiation; however, it involves radioactive isotopes, which require strict regulatory controls, high security, and complex waste management, leading many facilities to seek safer alternatives. On the other hand, E-beam systems offer rapid processing. They are effective for surface sterilization but have limited penetration depth, making them less suitable for specific medical and biological applications. While both technologies continue to serve niche markets, X-ray irradiation is increasingly preferred in the U.S. due to its non-radioactive nature, deeper penetration, operational flexibility, and growing regulatory support.

The market exhibits a high level of end-user concentration, with demand predominantly driven by hospitals, blood banks, research institutions, pharmaceutical manufacturers, and contract sterilization service providers. Much of the market is concentrated among large healthcare systems and centralized blood centers, which require consistent, high-throughput, and regulatory-compliant irradiation solutions for transfusion safety and infection control. Additionally, major biomedical research universities and federal research facilities (such as NIH-supported labs) utilize X-ray irradiators for radiobiology, oncology, and preclinical studies.

Application Insights

On the basis of application, the medical devices segment held the largest share in 2024. This growth can be attributed to the growing need for safe, effective, and non-radioactive sterilization methods within the healthcare sector. With the increasing use of single-use, implantable, and high-precision surgical devices, manufacturers are increasingly adopting X-ray irradiation as a preferred method for terminal sterilization. These systems ensure product integrity while complying with stringent regulatory and safety standards. Compared to gamma irradiation, X-ray systems offer faster processing, better flexibility, and lower compliance burdens, making them suitable for sterilizing various devices such as catheters, syringes, surgical kits, and orthopedic implants.

The biotech & laboratory supplies segment is expected to witness significant growth over the forecast period. Owing to the rising demand for precision irradiation tools in genomics, cell biology, cancer research, and immunology fields. As biotechnology companies, academic institutions, and CROs expand their research into radiation-based applications, compact benchtop X-ray systems with integrated dosimetry and dose control are increasingly preferred due to their non-radioactive design and operational simplicity. The segment’s momentum is further supported by increased NIH funding, the expansion of biopharma R&D pipelines, and the growing shift toward in vitro and in vivo testing using non-isotope technologies. Innovations such as AI-enabled software platforms and automation features continue to enhance lab efficiency, making this segment a strategic focus for future investment and adoption across the U.S. market.

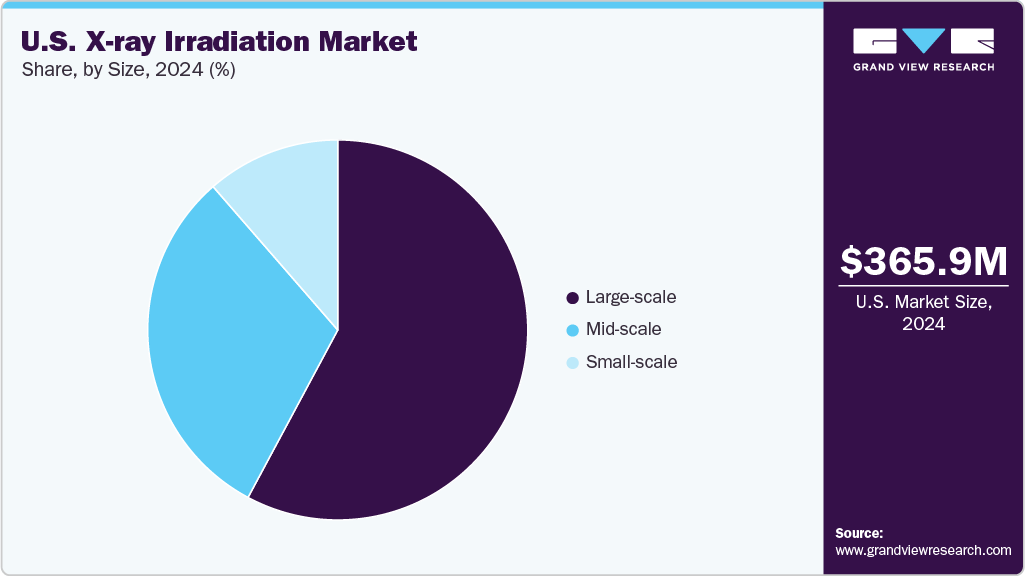

Size Insights

On the basis of size, the large-scale segment held the largest share in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to its essential role in high-capacity operations across healthcare and industrial settings. These systems are uniquely suited for applications that demand consistent performance, broad coverage, and efficient processing, such as large hospital transfusion centers, medical supply sterilization units, and advanced scientific research institutions. Large-scale irradiators are designed to manage heavy workloads and large sample volumes, offer enhanced throughput, precise dose uniformity, and compatibility with automated, facility-wide systems. Their scalability and integration capabilities are particularly valuable for institutions seeking reliable, high-output, and compliant irradiation solutions. They support their dominance in environments where volume, safety, and performance are critical.

The mid-scale segment is expected to witness significant CAGR over the forecast period. This can be attributed to its increasing adoption in medium-sized healthcare facilities, regional blood centers, academic institutions, and biotech laboratories. These systems provide a practical balance between throughput capacity, cost-effectiveness, and space efficiency, making them well-suited for organizations that need reliable performance without the infrastructure or investment required for large-scale setups. Equipped with features like integrated dosimetry, compact design, and intuitive user controls, mid-scale X-ray irradiators are becoming the preferred choice for facilities moving away from cesium-based systems. Their ability to serve both clinical and research needs with flexibility and precision supports their expanding role in the market.

Key U.S. X-ray Irradiation Company Insights

Key players operating in the U.S. X-ray irradiation market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. X-ray Irradiation Companies:

- STERIS

- SteriTek, Inc.

- Sterigenics U.S., LLC

- IBA Industrial Solutions

- E-BEAM Services, Inc

- KUB Technologies Inc.

- Precision X-Ray

- Hopewell Designs, Inc

- Raycision Medical Technology Co.

- PTW Freiburg GmbH

Recent Developments

-

In May 2023, Precision X-Ray, Inc., a leading provider of cabinet X-ray irradiators, introduced the CellRadHD, a next-generation benchtop irradiator. Engineered with advanced features such as integrated dosimetry and precise dose control, the CellRadHD offers the highest dose output in its class, representing a major leap forward in compact X-ray irradiation technology for research and clinical applications.

-

In October 2024, Precision X-Ray, Inc. and Gilardoni SpA announced an exclusive distribution partnership to bring the RADGIL2 X-ray blood irradiator to the U.S. market. Specifically designed for the safe and efficient irradiation of blood and blood components, RADGIL2 plays a vital role in preventing transfusion-related complications such as Transfusion-associated Graft versus Host Disease (TA-GvHD). As a non-radioactive alternative, it provides a safer, more compliant, and operationally efficient solution than traditional cesium-137-based irradiators, aligning with modern healthcare standards and regulatory expectations.

U.S. X-ray Irradiation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 404.93 million

Revenue forecast in 2033

USD 998.81 million

Growth rate

CAGR of 11.95% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and size

Country scope

U.S.

Key companies profiled

STERIS; SteriTek, Inc.; Sterigenics U.S., LLC; IBA Industrial Solutions; E-BEAM Services, Inc; KUB Technologies Inc.; Precision X-Ray; Hopewell Designs, Inc; Raycision Medical Technology Co.; PTW Freiburg GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. X-ray Irradiation Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. X-ray irradiation market report on the basis of application and size:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Devices

-

Pharmaceuticals

-

Biotech & Laboratory Supplies

-

Others

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small-scale

-

Mid-scale

-

Large-scale

-

Frequently Asked Questions About This Report

b. The U.S. X-ray irradiation market size was estimated at USD 365.98 million in 2024 and is expected to reach USD 404.93 million in 2025.

b. The U.S. X-ray irradiation market is expected to grow at a compound annual growth rate of 11.95% from 2025 to 2033 to reach USD 998.81 million by 2033.

b. Medical devices dominated the U.S. X-ray irradiation market with a share of 43.40% in 2024. This is attributable to the growing need for safe, effective, and non-radioactive sterilization methods within the healthcare sector. With the increasing use of single-use, implantable, and high-precision surgical devices, manufacturers are increasingly adopting X-ray irradiation as a preferred method for terminal sterilization.

b. Some key players operating in the U.S. X-ray irradiation market include STERIS; SteriTek, Inc.; Sterigenics U.S., LLC; IBA Industrial Solutions; E-BEAM Services, Inc; KUB Technologies Inc.; Precision X-Ray; Hopewell Designs, Inc; Raycision Medical Technology Co.; PTW Freiburg GmbH.

b. Key factors that are driving the market growth include increasing demand for sterilization in healthcare and rising cancer-related transfusion needs boost adoption. Technological advancements in precision, automation, and regulatory compliance further accelerate growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.