- Home

- »

- Medical Devices

- »

-

X-ray Irradiation Market Size & Share, Industry Report, 2033GVR Report cover

![X-ray Irradiation Market Size, Share & Trends Report]()

X-ray Irradiation Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Medical Devices, Pharmaceuticals, Biotech & Laboratory Supplies), By Size (Small, Mid, Large), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-672-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

X-ray Irradiation Market Summary

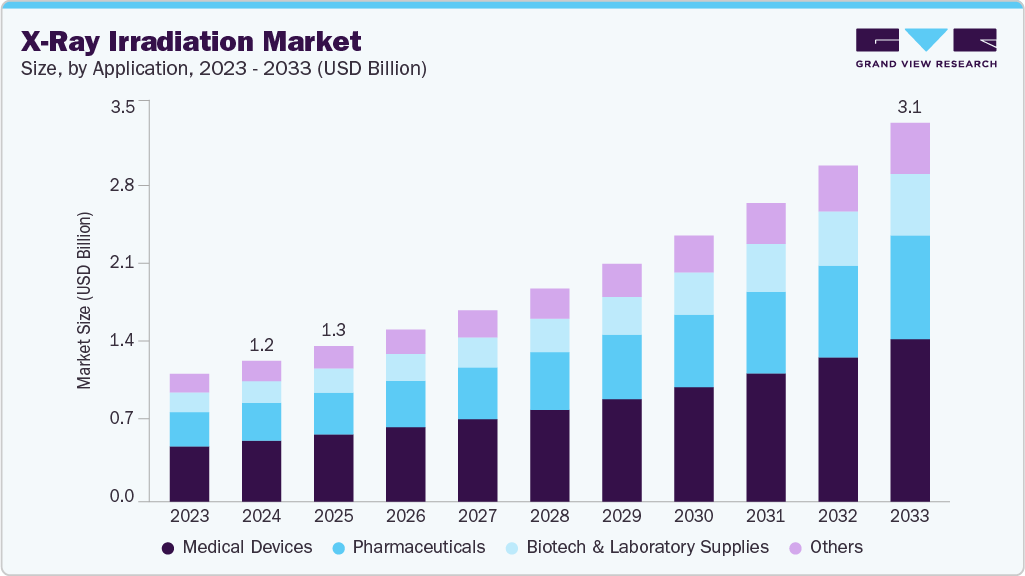

The global X-ray irradiation market size was estimated at USD 1.17 billion in 2024 and is projected to reach USD 3.14 billion by 2033, growing at a CAGR of 11.78% from 2025 to 2033. The market growth is attributed due to the global shift from radioactive isotope-based systems, such as cesium-137 and cobalt-60, to safer, non-radioactive X-ray alternatives.

Key Market Trends & Insights

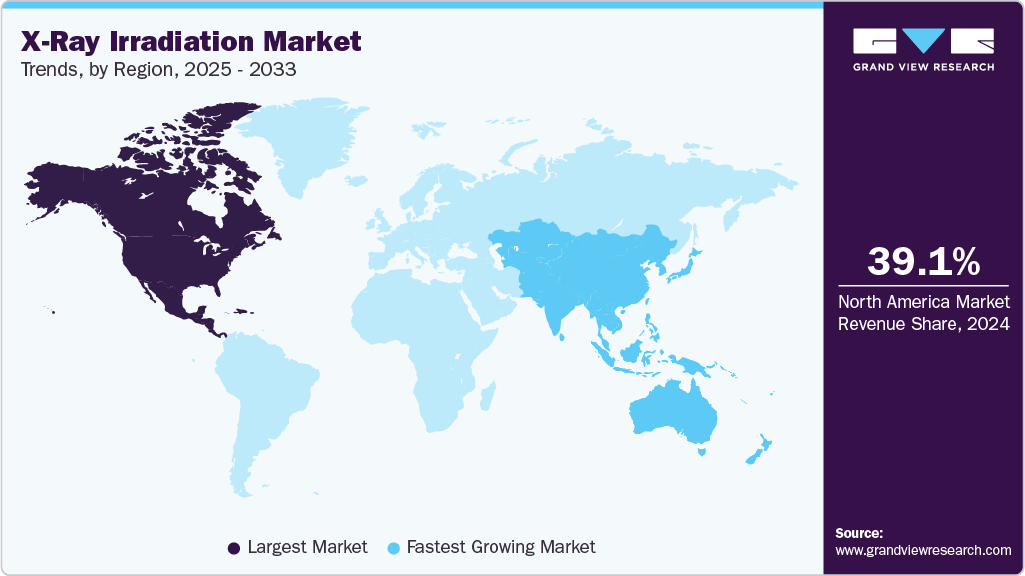

- North America dominated the global X-ray irradiation market with a revenue share of 39.06% in 2024.

- The X-ray irradiation market in the U.S. accounted for the largest market revenue share of 80.19% in North America in 2024.

- Based on application, the medical devices segment led the market with the largest revenue share of 43.33% in 2024.

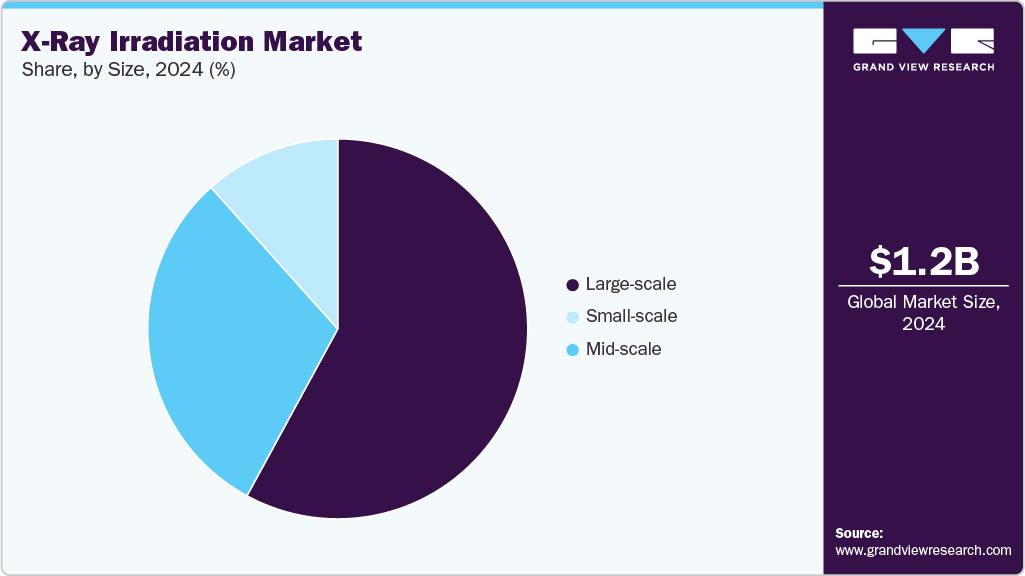

- Based on size, the large-scale segment led the market with the largest revenue share of 57.93% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.17 billion

- 2033 Projected Market Size: USD 3.14 Billion

- CAGR (2025-2033): 11.78%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This transition is fueled by growing concerns over radiological security, increasing regulatory restrictions, and rising costs associated with handling, licensing, and disposing of radioactive materials. In addition, the expanding need for safe blood transfusions, cancer research, and sterilization in healthcare and life sciences is pushing demand for precise, automated, and eco-friendly X-ray irradiators. Technological advancements, along with growing adoption in emerging markets, further accelerate the market’s growth trajectory.The transition from radioisotopes to X-ray irradiation systems is a key driver of market growth, propelled by heightened safety concerns, regulatory mandates, and improved operational efficiency. Unlike radioisotopes such as Cesium-137, which are susceptible to misuse in radiological threats like "dirty bombs", X-ray systems generate radiation only when actively powered, significantly reducing security risks during storage, transport, and use. In addition, radioisotope-based devices involve high ongoing costs due to stringent licensing requirements, continuous security measures, and the need for safe disposal of radioactive waste. In contrast, X-ray systems offer a safer, cost-effective, and regulatory-compliant alternative.

Rising healthcare and medical applications are significantly driving the X-ray irradiation industry by increasing the demand for precise, reliable, and safe radiation tools in diagnostics, treatment, and research. As the prevalence of chronic diseases like cancer, cardiovascular disorders, and autoimmune conditions grows, so does the need for advanced imaging and therapeutic solutions. X-ray irradiators are widely used for blood irradiation in transfusion medicine, sterilization of medical tools, and preclinical research involving animal models and cell lines. Expanding healthcare infrastructure, clinical trials, and biomedical research, especially in developing regions, further strengthens the adoption of X-ray systems, positioning them as essential components across hospitals, laboratories, and research institutions.

Cancer Incidence Prediction from 2022 - 2025

Cancer Type

2022

2025

Leukaemia

487,294

515,145

Multiple myeloma

187,952

201,903

Breast Cancer

2,296,840

2,454,864

Brain, central nervous system

321,731

340,751

Trachea, bronchus and lung

2,480,675

2,661,254

All cancers

19,976,499

21,325,245

Source: IARC, Grand View Research

Emerging economies across Asia-Pacific, Latin America, the Middle East, and Africa are actively investing in expanding their healthcare infrastructure, including establishing modern hospitals, cancer treatment centers, blood banks, and diagnostic labs. To align with current safety and clinical standards, these facilities are increasingly adopting advanced, non-radioactive X-ray irradiation systems for essential applications such as safe blood transfusion, cancer therapy support, and infection control. For instance, in India, introducing X-ray blood irradiators in states like Uttar Pradesh and Madhya Pradesh has significantly improved transfusion safety for immunocompromised cancer patients, highlighting a growing regional shift toward safer, more effective medical technologies.

Technological advancements and innovation are playing a pivotal role in driving the X-ray irradiation industry by delivering systems that are safer, more efficient, and easier to operate across healthcare, research, and industrial settings. Today’s X-ray irradiators incorporate automated dose control, built-in dosimetry, and image-guided precision, significantly enhancing accuracy and operational efficiency. Developing high-dose benchtop units, remote access capabilities, and software-enabled safety functions has improved usability and reliability, especially in facilities shifting away from radioactive sources. These innovations optimize performance and safety, minimize regulatory burden, and maintenance costs. As research continues to introduce advancements like AI-assisted dose planning and cloud-based system integration, technological innovation firmly establishes X-ray irradiation as the preferred solution for applications in blood transfusion, cancer therapy research, and sterilization.

Technological Advancements

Company Name

Product Launch

KOLs

Precision X-Ray

In May 2023, Precision X-Ray, Inc., a leading provider of cabinet X-ray irradiators, introduced the CellRadHD, a next-generation benchtop irradiator. Engineered with advanced features such as integrated dosimetry and precise dose control, the CellRadHD offers the highest dose output in its class, representing a major leap forward in compact X-ray irradiation technology for research and clinical applications.

"“Precision prides itself on anticipating our customer’s needs. Combining advanced features with a benchtop design allows researchers to place the CellRadHD right next to the incubator, helping labs maintain safety and security, while maximizing workflow. CellRadHD also comes with improved power, increasing throughput, a critical feature in feeder cell and stem cell development.” said Viktoriya Baytser, CEO."

Rad Source Technologies

In September 2024, Rad Source Technologies has revealed the RS 2000·Q2, establishing a new standard in biological irradiation. Specifically engineered for applications such as small animal studies, stem cell research, cancer investigations, and immunology, the RS 2000·Q2 offers advanced capabilities tailored to the evolving needs of modern biomedical research.

“George Terry, Rad Source Technologies’ Executive Vice President, emphasized the transformative capabilities of the RS 2000·Q2. He states, “The RS 2000·Q2 leads the industry in terms of symmetry, flatness, penetration, and dose uniformity and is further enhanced by optional features such as imaging, configurable filters, and our exclusive RADPlus™ accessories."

Source: Precision X-Ray, Rad Source Technologies, Grand View Research

Market Concentration & Characteristics

The X-ray irradiation industry demonstrates high innovation, driven by advancements in non-radioactive technology, dose precision, and automated safety controls. Modern systems now feature integrated dosimetry, real-time dose monitoring, and automated sample handling, making them more efficient, safe, and user-friendly. Notable innovations include the development of benchtop irradiators with the highest dose size, image-guided irradiation platforms for preclinical research, and AI-enhanced control systems that improve workflow automation and dose uniformity. In addition, the transition from cesium-137 has led to rapid R&D in eco-friendly, maintenance-light devices, fueling the replacement cycle in developed and emerging markets.

Regulations are pivotal in shaping the X-ray irradiation industry, particularly by accelerating the shift away from radioactive isotope-based systems such as cesium-137 and cobalt-60. Regulatory bodies like the U.S. Nuclear Regulatory Commission (NRC), Food and Drug Administration (FDA), and international organizations like the IAEA have implemented stringent guidelines for using, storing, and disposing of radioactive materials, increasing the operational and compliance burden on institutions using isotope irradiators. In contrast, X-ray systems, which do not involve radioactive sources, are subject to less restrictive safety protocols and licensing requirements, making them more attractive to hospitals, blood banks, and research labs. In addition, government-backed initiatives such as the U.S. DOE’s Cesium Irradiator Replacement Project (CIRP) are actively funding the transition to X-ray alternatives, further driving adoption. These evolving regulations encourage modernization and open new market opportunities for safer, cost-effective, and eco-friendly irradiation technologies.

The level of mergers and acquisitions (M&A) in the X-ray irradiation industry has been moderate but strategic, primarily driven by the need for technological consolidation, geographic expansion, and the shift toward non-radioactive platforms. Key players are acquiring or partnering with companies offering complementary technologies, such as high-dose X-ray systems, automated platforms, or regional distribution channels, to strengthen their market positions. For instance, in June 2025, IBA, a global leader in particle accelerator technology and advanced electron beam and X-ray irradiation solutions, has announced a new contract with Steri-Tek, a rapidly expanding provider of irradiation services. Under this agreement, IBA will install its fully integrated Be Wide X-ray Solution, enhancing Steri-Tek’s capacity to deliver high-efficiency, non-radioactive sterilization services for medical devices, pharmaceuticals, and advanced materials.

“Thomas Servais, President of IBA Industrial, added: "This collaboration with Steri-Tek underscores the increasing demand for scalable, high-capacity sterilization solutions. We are proud to support their expansion with cutting-edge technology and extensive service support, ensuring they stay ahead of industry demands."

The system provided by IBA will enhance Steri-Tek’s service offering to medical device manufacturers across North America. It will also help the company to ensure a seamless transition to IBA's Rhodotron-based X-ray technology in line with their growth strategy. It is expected to be fully operational by the end of 2027. The typical price for a Be Wide X-ray Solution with customization ranges from EUR 16 million to EUR 19 million, depending on the configuration and options. A first payment has been received by IBA.

The primary substitutes for X-ray irradiation systems are radioisotope-based irradiators, particularly those using cesium-137 and cobalt-60. These devices have traditionally been used for blood irradiation, sterilization, and research applications. However, their use is declining globally due to increasing regulatory scrutiny, high security risks, radioactive waste concerns, and complex licensing requirements. Other alternatives include electron beam (e-beam) irradiation systems, which offer high-speed sterilization and are suitable for industrial-scale applications, such as medical device and food sterilization. While e-beam systems deliver high throughput, they often require more complex shielding and infrastructure, making them less ideal for clinical or research settings.

The X-ray irradiation industry exhibits a moderately high level of end-user concentration, with demand primarily concentrated among a few key sectors-hospitals and blood banks, research institutions, and biopharmaceutical companies. Hospitals and transfusion centers are major end users due to the widespread need for blood component irradiation to prevent TA-GvHD in immunocompromised patients. Similarly, academic and government research labs use X-ray irradiators for radiobiology, oncology, and immunology studies, often funded through grants and public initiatives. A smaller but growing share is driven by contract research organizations (CROs) and industrial sterilization providers, especially in North America and Europe.

Application Insights

The medical devices segment accounted for the largest market revenue share in 2024. This growth can be attributed to the increasing demand for safe, effective, and non-radioactive sterilization methods within the healthcare industry. As single-use and implantable devices continue to rise, manufacturers are turning to X-ray irradiation for terminal sterilization that ensures product integrity while meeting stringent safety standards. Unlike traditional gamma irradiation, X-ray systems offer greater operational flexibility, quicker processing, and reduced regulatory complexities, making them ideal for sterilizing a wide range of medical products, including syringes, surgical instruments, and catheters. With regulatory bodies promoting cleaner, non-isotope-based technologies, the medical device industry’s shift toward X-ray sterilization has strengthened its dominance in the market.

The biotech & laboratory supplies segment is expected to witness at the fastest CAGR over the forecast period. Owing to the rising demand for precision research tools in genomics, cell biology, cancer studies, and immunology. As biotechnology companies, academic labs, and contract research organizations (CROs) expand their focus on radiation-based experiments, compact, benchtop X-ray irradiators increasingly adopt those that offer precise dose control, integrated dosimetry, and safety without the regulatory challenges of radioactive systems. The growth is further fueled by increased R&D funding, rapid expansion of biopharma pipelines, and global emphasis on non-isotope alternatives for in vitro and in vivo studies. In addition, integrating AI-driven software and automation in modern irradiation systems enhances research efficiency, making this segment highly attractive for future investment and adoption.

Size Insights

The large scale segment led the market with the largest revenue share of 57.93% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to its widespread use in high-volume applications such as blood irradiation in major hospitals, industrial sterilization of medical devices, and large-scale research facilities. These systems are designed to handle higher throughput, accommodate bulk samples, and deliver uniform radiation doses across a wide area, making them ideal for institutions that require consistent, efficient, and regulatory-compliant irradiation processes. Their ability to support automation, advanced dosimetry, and integration with facility-wide workflows has made large-scale systems the preferred choice for centralized healthcare settings and industrial users, contributing to their dominant market position.

The mid-scale segment is expected to witness at a significant CAGR over the forecast period. This growth can be attributed to its growing adoption across medium-sized hospitals, regional blood banks, academic research centers, and biotech labs. These systems offer an optimal balance between capacity, cost-efficiency, and operational flexibility, making them ideal for institutions requiring moderate throughput without large-scale units' infrastructure demands. With features like integrated dosimetry, user-friendly interfaces, and smaller physical footprints, mid-scale X-ray irradiators are increasingly preferred in settings transitioning away from radioactive devices. Their adaptability across both clinical and research applications positions them as a highly scalable solution, fueling rapid growth within this segment.

Regional Insights

North America dominated the X-ray irradiation market with the largest revenue share of 39.06% in 2024. The growth is driven by regulatory initiatives like the U.S. Department of Energy’s Cesium Irradiator Replacement Project (CIRP), which promotes the transition from radioactive cesium-137 devices to safer, non-radioactive X-ray systems. Hospitals and blood banks are leading adopters due to the rising demand for transfusion safety in cancer and transplant care. At the same time, research institutions and pharmaceutical companies increasingly use benchtop and cabinet X-ray irradiators for radiobiology and preclinical studies.

U.S. X-ray Irradiation Market Trends

The X-ray irradiation market in the U.S. is primarily driven by the growing need for non-radioactive, secure, and compliant technologies across healthcare, research, and industrial sectors. A major catalyst is the U.S. Department of Energy’s Cesium Irradiator Replacement Project (CIRP), which offers funding and logistical support to replace cesium-137–based devices with X-ray systems, reducing radiological security risks. In addition, the increasing incidence of cancer, organ transplants, and immunocompromised conditions has boosted demand for safe blood transfusion practices, where X-ray blood irradiators play a crucial role. Rising investments in biomedical research and strict regulatory frameworks by bodies like the NRC and FDA further push institutions toward modern, maintenance-light X-ray platforms. This combination of safety, policy incentives, and clinical need is accelerating the market’s growth in the U.S.

Europe X-ray Irradiation Market Trends

The X-ray irradiation market is experiencing steady growth, driven by the region’s strong focus on radiological safety, healthcare modernization, and research excellence. Regulatory pressure to phase out radioactive cesium-137 and cobalt-60 irradiators, aligned with EU-wide safety directives, has accelerated the adoption of X-ray-based alternatives across blood banks, hospitals, and research centers. Countries like Germany, France, and the UK are at the forefront, while Eastern European nations such as Hungary and Poland are making rapid transitions with support from international partnerships and government programs. In addition, the growing demand for precision cancer research, blood irradiation, and non-radioactive sterilization solutions fuels innovation and cross-border collaborations. These factors, combined with high R&D spending and supportive public health policies, position Europe as a key region in the global shift toward safe and sustainable irradiation technologies.

The UK X-ray irradiation market is driven by several key factors, primarily in the country's focus on public health safety, regulatory compliance, and advanced medical research. One major driver is the national initiative to phase out radioactive sources, including cesium-137, in alignment with the UK Health Security Agency (UKHSA) and international radiological safety standards. This has increased demand for non-radioactive X-ray irradiators across hospitals, blood transfusion centers, and laboratories. In addition, the UK's high cancer burden and transplant activity fuel the need for reliable blood irradiation systems to prevent transfusion-associated complications like TA-GvHD.

Asia Pacific X-ray Irradiation Market Trends

The X-ray irradiation market in Asia Pacific is anticipated to grow at the fastest CAGR of 12.3% from 2025 to 2033. Fueled by rising healthcare infrastructure investment, a surging cancer burden, and the ongoing shift from radioactive irradiators. Countries like India, China, Japan, and South Korea are expanding their hospital networks, cancer centers, and blood banks, increasing demand for safe and efficient blood and research irradiation systems. Government-led modernization programs and growing awareness around radiological security are pushing institutions to adopt X-ray over cesium-based technologies. In addition, the rise of preclinical research, biotechnology hubs, and contract research organizations (CROs) in the region is fueling the adoption of compact, high-throughput X-ray irradiators for cellular and animal studies. Domestic manufacturing capabilities and cost-effective distribution channels are also helping regional players meet the increasing demand, making Asia-Pacific one of the fastest-growing markets globally for X-ray irradiation systems.

The China X-ray irradiation market is driven by healthcare expansion, technological modernization, and regulatory efforts to phase out radioactive devices. With a rising incidence of cancer, organ transplants, and chronic diseases, there is increasing demand for safe and efficient blood transfusion practices, where X-ray blood irradiators are critical. The Chinese government’s significant investment in hospital infrastructure, research institutions, and biotech development zones further supports adopting advanced irradiation systems.

Latin America X-ray Irradiation Market Trends

The X-ray irradiation market in Latin America is showing steady growth, driven by healthcare system modernization, an increasing burden of chronic diseases and cancer, and a regional push toward safer, non-radioactive technologies. Countries like Brazil and Argentina are investing in new hospitals, blood banks, and research labs, which require modern irradiation systems for safe blood transfusions and biomedical studies. As awareness grows around the risks and regulatory burdens of radioactive cesium-137 devices, institutions are gradually transitioning to X-ray-based alternatives that offer enhanced safety, lower operational complexity, and compliance with global best practices. Support from international health organizations and public-private partnerships has also helped boost the adoption of X-ray irradiators across public health facilities.

Middle East & Africa X-ray Irradiation Market Trends

The X-ray irradiation market in the Middle East & Africa is experiencing steady growth, fueled by increasing investments in healthcare infrastructure, rising prevalence of cancer and infectious diseases, and adoption of safer, non-radioactive technologies. Countries like the United Arab Emirates, Saudi Arabia, South Africa, and Kuwait are leading regional demand, driven by the expansion of hospitals, blood banks, and research facilities. The shift from cesium-137–based irradiators is gaining momentum, particularly in high-income Gulf states, where governments prioritize radiological security and modern medical technologies. For instance, the UAE has deployed advanced X-ray blood irradiators (such as the RS 3400) to improve transfusion safety and reduce regulatory burdens. In Sub-Saharan Africa, market growth is supported by international aid programs and partnerships that enable access to essential irradiation systems in public health settings. As awareness of non-radioactive alternatives rises and regulatory frameworks evolve, MEA is positioned as an emerging market with significant long-term potential for X-ray irradiation technologies.

Key X-Ray Irradiation Company Insights

The X-ray irradiation industry is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the X-ray irradiation industry, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the X-ray irradiation industry is predicted to grow during the forecast period.

Key X-Ray Irradiation Companies:

The following are the leading companies in the X-Ray irradiation market. These companies collectively hold the largest market share and dictate industry trends.

- STERIS

- Ionisos

- SteriTek, Inc.

- Symec Engineers (India) Pvt. Ltd

- Sterigenics U.S., LLC – A Sotera Health company

- IBA Industrial Solution

- E-BEAM Services, Inc

- KUB TECHNOLOGIES INC.

- Precision X-Ray

- Hopewell Designs, Inc.

- Dandong Mastery Technology Co., Ltd

- Raycision Medical Technology Co., Ltd.

- PTW Freiburg GmbH

- Zhuhai Livzon Diagnostics Inc. (Livzon Pharmaceutical Group Inc.)

Recent Developments

-

In September 2024, Rad Source Technologies has revealed the RS 2000·Q2, establishing a new standard in biological irradiation. Specifically engineered for applications such as small animal studies, stem cell research, cancer investigations, and immunology, the RS 2000·Q2 offers advanced capabilities tailored to the evolving needs of modern biomedical research.

-

In May 2023, Precision X-Ray, Inc., a leading provider of cabinet X-ray irradiators, introduced the CellRadHD, a next-generation benchtop irradiator. Engineered with advanced features such as integrated dosimetry and precise dose control, the CellRadHD offers the highest dose output in its class, representing a major leap forward in compact X-ray irradiation technology for research and clinical applications.

-

In October 2024, Precision X-Ray, Inc. and Gilardoni SpA have announced an exclusive distribution partnership to bring the RADGIL2 X-ray blood irradiator to the U.S. market. Specifically designed for the safe and efficient irradiation of blood and blood components, RADGIL2 plays a vital role in preventing transfusion-related complications such as Transfusion-associated Graft versus Host Disease (TA-GvHD). As a non-radioactive alternative, it provides a safer, more compliant, and operationally efficient solution than traditional cesium-137-based irradiators, aligning with modern healthcare standards and regulatory expectations.

X-ray Irradiation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.29 billion

Revenue forecast in 2033

USD 3.14 billion

Growth rate

CAGR of 11.78% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, size,region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

STERIS; Ionisos; SteriTek, Inc.; Symec Engineers (India) Pvt. Ltd; Sterigenics U.S., LLC – A Sotera Health company; IBA Industrial Solution; E-BEAM Services, Inc.; KUB TECHNOLOGIES INC.; Precision X-Ray; Hopewell Designs, Inc; Dandong Mastery Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global X-Ray Irradiation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global X-ray irradiation market report based on the application, size, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Devices

-

Pharmaceuticals

-

Biotech & Laboratory Supplies

-

Others

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small-scale

-

Mid-scale

-

Large-scale

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global X-ray irradiation market size was estimated at USD 1.17 billion in 2024 and is expected to reach USD 1.29 billion in 2025.

b. The global X-ray irradiation market is expected to grow at a compound annual growth rate of 11.78% from 2025 to 2033 to reach USD 3.14 billion by 2033.

b. North America dominated the X-ray irradiation market with a share of 39.06% in 2024. This is attributable to its regulatory initiatives like the U.S. Department of Energy’s Cesium Irradiator Replacement Project (CIRP), which promotes the transition from radioactive cesium-137 devices to safer, non-radioactive X-ray systems.

b. Some key players operating in the X-ray irradiation market include STERIS; Ionisos; SteriTek, Inc.; Symec Engineers (India) Pvt. Ltd; Sterigenics U.S., LLC – A Sotera Health company; IBA Industrial Solution; E-BEAM Services, Inc; KUB TECHNOLOGIES INC.; Precision X-Ray; Hopewell Designs, Inc; Dandong Mastery Technology Co., Ltd.

b. Key factors that are driving the market growth include increasing demand for sterilization in healthcare and rising cancer-related transfusion needs boost adoption. Technological advancements in precision, automation, and regulatory compliance further accelerate growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.