- Home

- »

- Automotive & Transportation

- »

-

Used Car Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Used Car Market Size, Share & Trend Report]()

Used Car Market Size, Share & Trend Analysis Report By Vehicle Type (Hybrid, Conventional, Electric), By Vendor Type, By Fuel Type, By Size, By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-119-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Used Car Market Size & Trends

The global used car market size was valued at USD 1.66 trillion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The used car shipment was recorded at 120.3 million units in 2021. The market has witnessed significant growth in the last few years as the price competitiveness among the new players has been one glowing spot in the used car industry. The inability of customers to buy new cars became one of the reasons for the growing used cars sales volume, which is complemented by the investments made by the industry participants to establish their dealership network in the market. These dealership networks helped market participants brand and make used car options viable.

Further, online sales have become a critical growth factor in the market. Online sites in auto marketplaces have played an essential role in bringing access to consumers with a single touch. A combination of such developments created a significant upsurge in the demand for used cars. In addition, factors such as affordability, the availability of used cars, the hike in the need for personal mobility, and the emergence of various online players to organize the market have resulted in the market's growth. For instance, in 2019, Ebay Inc. launched a new eBay Motors application to enhance the online used car sale and purchase process.

Until recently, automobile manufacturers and dealers have mainly focused on their new vehicle business with the exclusion of used cars, often viewed as a byproduct. However, the competition in the market and the threat of new entries have created a great extent of an upsurge in the used car dealership. Moreover, the added quality and reliability of used cars changed the consumer attitude and increased the sales of used passenger cars. Investing in used car management has become one of the market's requirements characterized by a slimming margin, relentless competition, and demanding consumers.

Technological advancements such as the development of the internet and the introduction of hybrid and electric vehicles have changed the buyer position in the market. Moreover, consumers are now knowledgeable about the vehicle, their residual value, quality finance charges, availability, the price applied, and sometimes, the profit margin that the seller makes in a closing deal. This knowledge has changed the dynamics and managed to turn customer intelligence to their advantage. As a result, consumers are more inclined toward buying used cars nowadays.

Some key factors, including transparency and symmetry of the information among consumers and buyers, the growth of the online sales channel, certified used vehicle programs, and the strong position of franchise dealers, play a vital role in driving the market for used cars. Leading companies have set up online and offline stores worldwide to offer seamless used car buying experiences. For instance, in September 2020, AutoNation Inc. expanded its pre-owned vehicle store and opened two new stores in the Denver market in the USA. The organization also announced its goal to open 130 AutoNation Inc. stores across the USA by 2026.

In developed and developing countries, the used-to-new vehicle ratio has increased in the last few years, accounting for the abovementioned reasons. In addition, with support from OEM involvement in certification and marketing programs, online inventory pooling, and access to high-quality contracts, franchised dealers are in a strong position to benefit from the growth in the market.

COVID-19 has greatly disrupted the automotive industry. After the pandemic, consumers preferred private conveyance. However, the financial disparities hampered the purchase of new vehicles, and due to budget constraints, commuters opted for used cars. Further, during this pandemic, virtual reality, online, or digitally generated sales leads buy new vehicles.

Though the pandemic's impact on the automotive market augments the demand for mid-size vehicles, quality compacts are expected to complement the same. The market is also expected to vary with the demand from different segments of customers as every class segment has its preferences regarding opting for a vehicle.

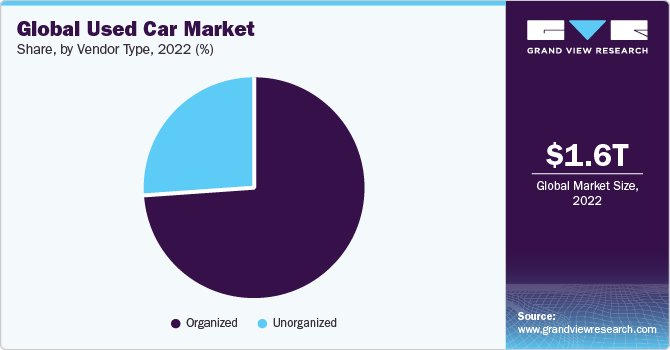

Vendor Type Insights

The organized segment dominated the market with the highest revenue share of 74.3% in 2022 and is projected to register the fastest CAGR of 7.1% over the forecast period. This is attributed to the increasing number of franchised dealers in the market. The entry of new players in the market and new retail models emerged as key factors in fueling the market's growth. According to the National Automobile Dealers Association (NADA), in the U.S., franchised dealers earned higher gross profits on used vehicle sales than independent dealers. In addition, the organized vendors benefited from greater consumer loyalty to the brand across all age groups. With many dealers across the globe, the market could be more cohesive. However, in developed countries such as the U.S., Germany, and the UK, some top dealers such as CarMax Business Services, LLC, and Asbury Automotive Group account for more than half of the volume share in the market.

The unorganized segment is expected to witness significant growth over the forecast period. Unorganized vendors often have lower overhead costs compared to established dealerships. It lets them offer used cars competitively, attracting price-sensitive buyers looking for good deals.

Regional Insights

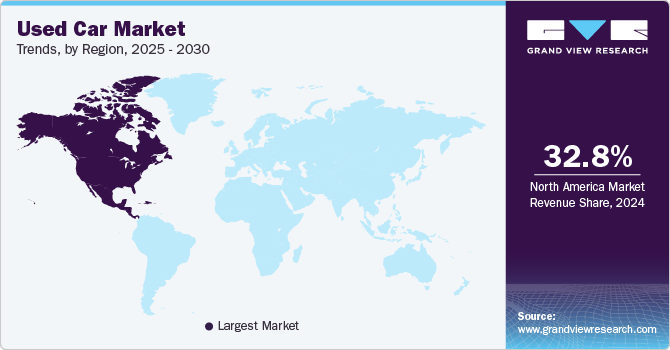

North America dominated the market with the largest revenue share of 35.7% in 2022. The used car market in North America offers a wide variety of vehicles, ranging from recent models with modern features to older classics. This diverse selection caters to different preferences and budgets, attracting more buyers.

The Asia Pacific is expected to grow at the fastest CAGR of 7.7% during the forecast period, in terms of shipment, majorly due to the rapid growth of demand in China for used vehicles. Asia Pacific will expand at the highest CAGR over the forecast period. It is attributed to increased used car sales in China, India, and other Asian countries. The North American region held a notable market share in 2021 and is expected to witness steady growth in the years to come owing to the plummeting growth in the past few years.

With the rising number of organized players with used car trading services in the Asia Pacific region, China has expanded its market footprint in the Asian market. Some Indian car dealers provide a rich array of advanced technology-enabled tools, which include mobile-based applications, a virtual online showroom, cloud services for lead management systems, tracking sales performance, and digital marketing support. Moreover, this advancement in the Indian used car industry creates great opportunities for the consumer base. Within the region, Indonesia, Malaysia, South Korea, and other developing countries have shown significant potential for the market.

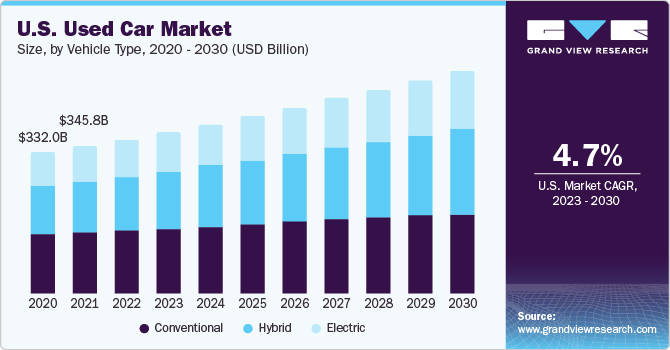

Vehicle Type Insights

The conventional segment accounted for the largest revenue share of over 42.8%. Conventional gasoline vehicles with a large inventory offer multiple choices at an affordable price. This segment of vehicles accounted for the maximum share in all sizes, including compact cars, mid-size cars, and SUV cars. Further, growing concerns over climate change and increasing pollution have created a great demand for a substitute for conventional gasoline vehicles. Hence, the market has registered significant growth driven by electric used cars.

The electric segment is projected to register the fastest CAGR of 7.2% over the forecast period. In the last few years, used electric vehicle prices have remained viable for consumers, which plays a significant driving factor for electric vehicle sales. According to the last few years' price analysis, used electric vehicles' prices have been lower than used hybrid vehicles. Electric vehicle traits, such as technology-driven performance in the luxury vehicle segment, provide a status symbol and support sustainability, thus creating significant demand for used EVs.

Fuel Type Insights

The petrol segment held the largest market share of 42.5% in 2022. This is attributed to the declining usage of diesel vehicles as the government discourages the purchase of used diesel vehicles. The other segment is expected to witness significant growth over the forecast period. In developing countries, CNG-powered vehicles have also shown a sustainable upsurge in used vehicle volume sales. Emission standards for positive ignition (gasoline, NG, LPG, and ethanol) and compression ignition (diesel) vehicles have become one of the reasons for the slump in sales of diesel vehicles. Moreover, excessive emissions of NOx by the diesel engine can be attributed to the decline in diesel engine vehicle sales and an increase in the substitute market. The gasoline-fueled car emission standard is less stringent compared to diesel-fueled passenger cars. Furthermore, gasoline cars with refined engines, decent fuel efficiency, and strong top-end performance have attracted a large consumer base in the last few years. They are expected to continue to do so in the coming years. In addition, increasing inventory for gasoline-based SUVs became one of the driving factors in the gasoline segment.

The others segment comprises CNG, LNG, and battery packs. The others segment is expected to witness the fastest CAGR of 7.6% over the forecast period. The CNG segment, which entails vehicles powered by Compressed Natural Gas, has garnered increasing attention due to its perceived environmental advantages and cost-efficiency. With persistent sustainability considerations influencing consumer decisions, the market for pre-owned CNG-powered vehicles has distinctly established its market presence.

Size Insights

The SUV segment accounted for the largest market share of 37.6% of the market in 2022. With the changing landscape in the automotive market, the SUV segment has caused the downfall of other segments. Offering space and size while remaining compact compared to off-road vehicles, SUVs are considered ideal drives by buyers nowadays in various regions. The market's residual value for SUVs is higher, with great demand and a wider supply network. The European region has witnessed significant demand traction for the used SUV market.

The mid sized segment is expected to register a fastest CAGR of 6.4% over the forecast period. This is attributed to people's preference for economical and compact-size vehicles. The franchised owners have preferred compact vehicles with a high production rate and huge inventory. Easy availability at affordable prices has fueled the demand for used compact vehicles in the last few years. However, with changing consumer preferences and advancements in SUVs, used SUVs have shown significant growth, which is expected to continue in the coming years.

The mid-sized segment is estimated to register the fastest CAGR of 6.4% over the forecast period. Mid-sized cars strike a balance between compact cars and larger sedans or SUVs. They are often considered practical and versatile vehicles that offer enough space for passengers and cargo while being relatively easy to maneuver and park. This appeals to many buyers looking for a well-rounded and functional daily driver.

The compact size segment is expected to register a significant CAGR over the forecast period. This is attributed to people's preference for economical and compact-size vehicles. The franchised owners have preferred compact vehicles with a high production rate and huge inventory. Easy availability with affordable prices fueled the demand for used compact vehicles in the last few years. However, with the changing consumer preferences and advancements in SUVs, the used SUVs have shown significant growth, which is expected to continue in the coming years.

Sales Channel Insights

The offline segment held a considerable market share of 74.8% in 2022.This is attributed to the consumer's preference for the conventional buying mode. However, the online sales channel segment is expected to grow significantly. The development of online tools for sellers and buyers has made the market more competitive. In addition, the online availability of information, including prices, reviews, and specifications, leads to significant growth by dealers.

The online segment is expected to register the fastest CAGR of 9.4% over the forecast period. Online dealers empower digitally savvy customers with complete end-to-end purchasing capabilities, unique delivery options, and extensive vehicle photos and data with search tools. With technically advanced tools integrated with artificial intelligence and machine learning technology, dealers are expanding their network and customer base. AI applications can evaluate the data stored in the dealer management system and aid in refining marketing and sales strategies by modifying the car buying experience. For instance, online sales channels such as Alibaba.com, eBay, CarMax, and mobile.de play a vital role in country-specific growth in the market by targeting the domestic customer base. Various online channels modify their platforms to offer seamless car selling and buying experiences. For instance, in December 2020, Asbury Automotive Group announced the launch of its end-to-end digital retailing solution called Clicklane to create a great used car online shopping experience.

Key Companies & Market Share Insights

The key players in the market focus on expanding the customer base to gain a competitive edge. Thus, vendors are taking several strategic initiatives, such as collaborations, acquisitions & mergers, and partnerships. For instance, in 2020, Volkswagen announced a major investment in the market for used cars through a collaboration of its used-car chain, Das WeltAuto, with various used car platforms. Mainstream automakers have also expanded their presence in this space with their pre-owned car sales networks like Maruti Suzuki's True Value, M&M Mahindra's First Choice Wheels, and Toyota's U Trust.

Key Used Car Companies:

- Alibaba.com.

- CarMax Enterprise Services, LLC

- Asbury Automotive Group

- TrueCar, Inc.

- Scout24 SE

- Lithia Motor Inc.

- Group 1 Automotive, Inc.

- eBay.com

- Hendrick Automotive Group

- AutoNation.com

Recent Developments

-

In June 2023, Jardine Cycle & Carriage Limited, the investment arm of Hong Kong-based Jardine Matheson collaborated with Southeast Asian car marketplace Carro. According to a joint statement by the companies, this collaboration will provide Carro with access to a broader selection of high-quality used cars while enabling Carro to improve Republic Auto's digital services and offerings. The alliance aims to strengthen both companies' positions in the market and enhance their customer experiences.

-

In August 2022, Lexus, a subsidiary of TOYOTA MOTOR CORPORATION, launched the Lexus Certified Programme in the Indian market. This strategic move by Lexus is geared towards providing current Lexus vehicle owners the avenue to secure an elevated resale valuation for their automobiles. Moreover, the initiative aims to augment the accessibility and affordability of Lexus models for prospective customers. By implementing this certified program, Lexus aims to amplify customer contentment while bolstering the brand's prominence within the Indian automotive sector.

Used Car Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.76 trillion

Revenue forecast 2030

USD 2.67 trillion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in Million Units, Revenue in USD Billion/Trillion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, vendor type, fuel type, size, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Alibaba.com.; CarMax Enterprise Services, LLC; Asbury Automotive Group; TrueCar, Inc.; Scout24 SE; Lithia Motor Inc.; Group 1 Automotive, Inc.; eBay.com; Hendrick Automotive Group; AutoNation.com

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Used Car Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global used car market based on vehicle type, vendor type, fuel type, size, sales channel, and region:

-

Vehicle Type Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

Hybrid

-

Conventional

-

Electric

-

-

Vendor Type Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

Organized

-

Unorganized

-

-

Fuel Type Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

Diesel

-

Petrol

-

Others

-

-

Size Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

Compact Car

-

Mid-Sized

-

SUV

-

-

Sales Channel Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global used car market size was estimated at USD 1.66 trillion in 2022 and is expected to reach USD 1.76 trillion in 2023.

b. The global used car market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 2.67 trillion by 2030.

b. Asia Pacific dominated the used car market with a share of 36.3% in 2022, in terms of shipment. This is attributable to emerging economies, including India, which is dominated by unorganized players.

b. Some key players operating in the used car market include Asbury Automotive Group, Alibaba Group Holding Ltd., AutoNation Inc., eBay Inc., Maruti Suzuki India Ltd., Pendragon PLC, Penske Automotive Group Inc., and TrueCar Inc.

b. Key factors that are driving the used car market growth include high disposable income, rising demand for luxury cars, the shorter period of car ownership, and increasing preference of the owner of a two-wheeler to upgrade to a compact car.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."