- Home

- »

- Next Generation Technologies

- »

-

Utility Locator Market Size, Share & Trends Report, 2030GVR Report cover

![Utility Locator Market Size, Share & Trends Report]()

Utility Locator Market (2024 - 2030) Size, Share & Trends Analysis Report By Technique, By Offering, By Target, By Vertical (Oil & Gas, Electricity), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-405-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Utility Locator Market Summary

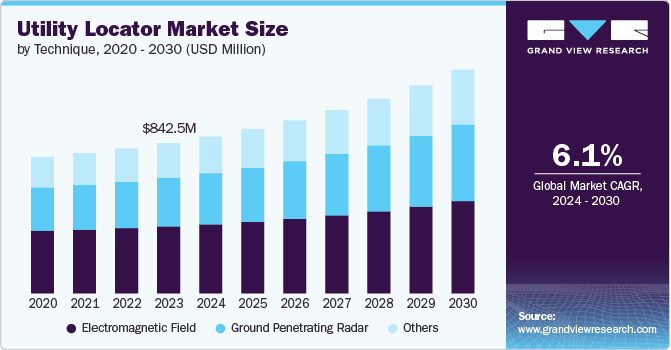

The global utility locator market size was estimated at USD 842.5 million in 2023 and is projected to reach USD 1,252.3 million by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The surge in infrastructure projects, including roads, railways, buildings, and utilities, necessitates precise underground utility mapping to prevent accidents and delays.

Key Market Trends & Insights

- North America dominated the utility locator market with a largest revenue share of 36.8% in 2023.

- The utility locator market in U.S. is anticipated to exhibit at a significant CAGR over the forecast period.

- Based on technique, the electromagnetic field segment led the market with the largest revenue share of 44.5% in 2023.

- Based on offering, the equipment segment led the market with the largest revenue share of 65.69% in 2023.

- Based on target, the metallic segment led the market with the largest revenue share of 68.50% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 842.5 Million

- 2030 Projected Market Size: USD 1,252.3 Million

- CAGR (2024-2030): 6.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, the risk of accidental damage to underground utilities during excavation can lead to injuries, fatalities, and substantial financial losses. Utility locators mitigate these risks.

The booming construction industry, both residential and commercial, is a major consumer of utility location services. Furthermore, stringent regulations mandating utility location before excavation are driving the adoption of utility locators to ensure compliance and avoid penalties. Also, the integration of advanced technologies like ground penetrating radar (GPR), electromagnetic induction (EMI), and global positioning systems (GPS) into utility locators is enhancing accuracy and efficiency. Thus, driving the market growth.

The growing demand for underground utilities’ real-time analysis, such as concrete structures, roads, and railway lines, represents a key development and emerging trend within the utility locator sector. Various advanced technologies, including ground-penetrating radar, electromagnetic fields, and others, are applied for detection purposes. Modern technologies permit owners of these utilities to conduct immediate evaluations of their underground systems. Providers of utility locating services and equipment are now incorporating these technologies, such as fleet telemetry systems, GPS devices, GIS data devices, and ground-penetrating radar (GPR) devices. Thus, there is high market growth.

Utility locators are increasingly implemented in various sectors such as construction, telecommunications, and various other utilities, including water, gas, and electricity, as well as in the transportation industry. They serve a vital function in pre-digging assessments to detect and accurately chart the course of underground utilities, ensuring their exact positions are marked on the surface. Moreover, these tools are indispensable for regular upkeep and, in urgent situations, facilitating the swift pinpointing and evaluation of below-ground services for immediate repair or enhancement. Technology advancements and the adoption of digital approaches to managing infrastructure bode well for utility locator technology. Enhancements in sensor systems and the ability to merge data more effectively are driving improvements in both precision and operational efficiency. Thus, driving the market growth.

Technique Insights

Based on technique, the electromagnetic field segment led the market with the largest revenue share of 44.5% in 2023. The electromagnetic field (EMF) technology is generally more affordable than other methods like ground penetrating radar (GPR), making it a preferred choice for many businesses. Ongoing innovations in EMF technology, such as improved sensitivity and depth penetration, are expanding its capabilities. The surge in construction activities worldwide drives the demand for efficient and reliable utility location solutions. Governments are imposing stricter regulations to prevent accidents caused by damage to underground utilities, boosting the adoption of utility locators.

The ground penetrating radar segment is predicted to foresee at the fastest CAGR during the forecast period. Ground Penetrating Radar (GPR) is a crucial segment driving market growth. Its ability to detect both metallic and non-metallic underground objects makes it an essential tool for various applications. The rapid expansion of urban areas necessitates extensive underground utility installations, leading to a surge in demand for accurate utility location services. Moreover, the construction of roads, railways, and airports requires precise identification of underground utilities to prevent damage and delays.

Offering Insights

Based on offering, the equipment segment led the market with the largest revenue share of 65.69% in 2023. The expansion of urban areas and the growing need for transportation, energy, and communication networks are driving the demand for efficient utility location solutions. Moreover, stricter safety standards for construction and excavation projects are mandating the use of utility locators to prevent accidents and damage. Furthermore, the integration of advanced technologies like GPS, GIS, and ground penetrating radar (GPR) into utility locators is improving accuracy and efficiency, boosting market demand.

The services segment is anticipated to exhibit at the fastest CAGR over the forecast period. The growing population is driving the need for new residential and commercial buildings, leading to increased excavation activities. Moreover, various companies are outsourcing utility location services to specialized providers to reduce operational costs and focus on core competencies. Furthermore, utility locator service providers offer specialized knowledge and equipment, ensuring efficient and accurate service delivery.

Target Insights

Based on target, the metallic segment led the market with the largest revenue share of 68.50% in 2023.The metallic segment is a significant component of the market growth. This is primarily due to the widespread use of metal in underground infrastructure, such as pipes, cables, and conduits. The metallic segment of the global market is expected to continue growing due to the increasing demand for safe and efficient underground infrastructure development. Advancements in technology and a rising awareness of the risks associated with underground utilities will further drive market expansion.

The non-metallic segment is anticipated to exhibit at the fastest CAGR over the forecast period. There's a growing trend towards using non-metallic materials like plastic, fiberglass, and concrete for underground utilities due to their corrosion resistance, durability, and cost-effectiveness. Moreover, rapid urbanization and infrastructure development are leading to an increased installation of non-metallic pipes for water, sewage, and gas distribution systems. Furthermore, the refinement of GPR technology has significantly improved the detection and mapping of non-metallic utilities. It offers high-resolution images of underground structures, enabling precise location and identification.

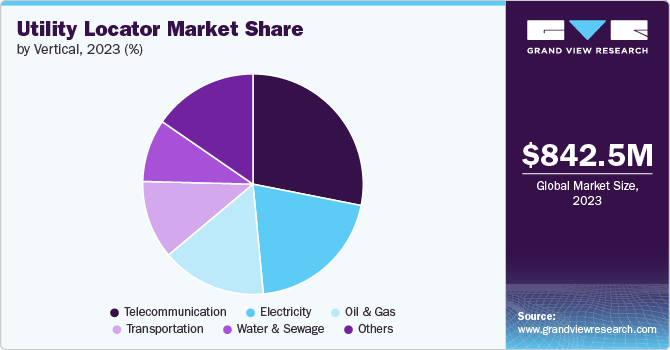

Vertical Insights

Based on vertical, the telecommunication segment led the market with the largest revenue share of 28.1% in 2023. The telecommunication sector is a significant driver of market growth. This is primarily due to the increasing demand for faster and more reliable communication networks, which necessitates extensive underground infrastructure development. The advancement of 5G networks requires a significant increase in cell towers and fiber optic cables, leading to extensive underground infrastructure development.

The water and sewage segment are anticipated to exhibit at the fastest CAGR over the forecast period. Rapid urbanization leads to increased demand for water and sewage systems, necessitating extensive infrastructure development. Aging water and sewage pipelines require frequent repairs and replacements, driving the need for accurate utility location. Early detection and repair of leaks can significantly reduce water and energy consumption costs. Furthermore, governments worldwide are imposing stricter environmental regulations to protect water resources and prevent pollution.

Regional Insights

North America dominated the utility locator market with a largest revenue share of 36.8% in 2023. The expansion of transportation networks, energy grids, and communication systems is driving the demand for accurate utility location services to prevent damage and disruptions.Governments and regulatory bodies are imposing stricter regulations to protect workers and public safety during excavation and construction activities. Utility locators play a crucial role in complying with these regulations.

U.S. Utility Locator Market Trends

The utility locator market in U.S. is anticipated to exhibit at a significant CAGR over the forecast period. Stringent regulations across its states mandate utility locators for any excavation project, ensuring the safety of workers and preventing damage to underground infrastructure. In addition, growing awareness of the risks associated with accidental damage to underground utilities has driven demand for utility location services across the country.

Europe Utility Locator Market Trends

The utility locator market in the Europe is expected to witness at a significant CAGR over the forecast period. The surge in construction projects across European countries is a primary driver. Accurate utility location is crucial to prevent damage, reduce downtime, and ensure project efficiency. In addition, governments in Europe are imposing stricter regulations for underground utility detection before excavation. This mandates the use of utility locators to prevent accidents and liabilities.

Asia Pacific Utility Locator Market Trends

The utility locator market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. The region is witnessing a surge in urbanization and industrialization, leading to extensive construction projects. Accurate utility location is crucial to prevent damage and ensure project efficiency. Furthermore, stringent safety regulations and standards for underground utility management are being implemented, driving the demand for reliable utility locators.

Key Utility Locator Company Insights

Key utility locator companies include Radiodetection Ltd., The Charles Machine Works, Inc., and Leica Geosystems AG. Companies active in the global market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in July 2023, Ditch Witch, utility locator provider, Heavy Equipment Colleges of America (HEC), heavy equipment training programs provider, to provide training for the Horizontal Directional Drilling (HDD) Certification Program to both new and experienced operators, HEC has entered into an agreement to become an Authorized Ditch Witch training provider. This collaboration introduces instructor-led training sessions that focus on fundamental machine operation and safety practices at the job site.

Key Utility Locator Companies:

The following are the leading companies in the utility locator market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Emerson Electric Co.

- Geophysical Survey Systems, Inc.

- Geotech

- Guideline Geo

- Leica Geosystems AG

- MultiVIEW

- Radiodetection Ltd.

- The Charles Machine Works, Inc.

- USIC, LLC

Recent Developments

-

In July 2024, Leica Geosystems AG launched the Leica DD300 CONNECT utility locator and the Leica DA300 signal transmitter offers a comprehensive solution for dependable and adaptable utility locating. The advanced utility locator is designed to seamlessly sync with the Leica DX Shield software, offering advanced tracking features and a unified platform for overseeing activities on the site and numerous devices.

-

In March 2024, Radiodetection Ltd. collaborated with Trimble Inc., software and services company, to enhance the precision of utility workflows. The integration of Radiodetection's RD Map application and high-precision locator products alongside the Trimble Catalyst DA2 GNSS system introduces a software and hardware solution that optimizes utility-locating processes. This combination offers advanced measurement accuracy, facilitating the production of detailed underground utility maps in a solitary field activity

-

In October 2023, USIC, LLC collaborated with broadband authorities and internet service providers (ISP) to secure the necessary utility locating support for the nationwide rollout of broadband, backed by USD 42.45 million from the Broadband Equity, Access, and Deployment (BEAD) Program over the next five years. USIC, LLC is actively engaging with broadband industry leaders to identify how utility locators can contribute to these efforts, aiming to develop a workforce that matches the broadband expansion goals within their states

Utility Locator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 878.8 million

Revenue forecast in 2030

USD 1,252.3 million

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, offering, target, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

3M; Emerson Electric Co.; Geophysical Survey Systems, Inc.; Geotech; Guideline Geo; Leica Geosystems AG; MultiVIEW; Radiodetection Ltd.; The Charles Machine Works, Inc.; and USIC, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Utility Locator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global utility locator market report based on technique, offering, target, vertical, and region.

-

Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Electromagnetic Field

-

Ground Penetrating Radar

-

Others

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Services

-

-

Target Outlook (Revenue, USD Million, 2017 - 2030)

-

Metallic

-

Non-metallic

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Electricity

-

Transportation

-

Water and Sewage

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global utility locator market size was estimated at USD 842.5 million in 2023 and is expected to reach USD 878.8 million in 2024.

b. The global utility locator market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 1,252.3 million by 2030.

b. North America dominated the utility locator market with a share of 36.8% in 2023. The expansion of transportation networks, energy grids, and communication systems is driving the demand for accurate utility location services to prevent damage and disruptions. Governments and regulatory bodies are imposing stricter regulations to protect workers and public safety during excavation and construction activities. Utility locators play a crucial role in complying with these regulations.

b. Some key players operating in the utility locator market include 3M; Emerson Electric Co.; Geophysical Survey Systems, Inc.; Geotech; Guideline Geo; Leica Geosystems AG; MultiVIEW; Radiodetection Ltd.; The Charles Machine Works, Inc.; and USIC, LLC.

b. The surge in infrastructure projects, including roads, railways, buildings, and utilities, necessitates precise underground utility mapping to prevent accidents and delays. In addition, the risk of accidental damage to underground utilities during excavation can lead to injuries, fatalities, and substantial financial losses. Utility locators mitigate these risks. Moreover, the booming construction industry, both residential and commercial, is a major consumer of utility location services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.