- Home

- »

- Pharmaceuticals

- »

-

Uveitis Treatment Market Size, Share, Industry Report, 2030GVR Report cover

![Uveitis Treatment Market Size, Share & Trends Report]()

Uveitis Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment (Corticosteroids, Immunosuppressant, Monoclonal Antibodies), By Disease, By Cause, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-992-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Uveitis Treatment Market Size & Trends

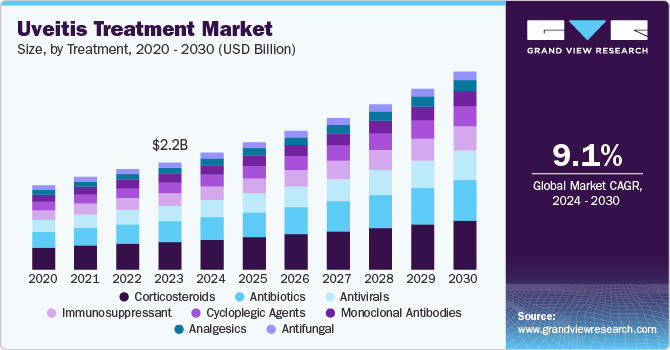

The global uveitis treatment market size was valued at USD 2.23 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. The growth is due to rising prevalence of uveitis, increased awareness and early diagnosis. The growing R&D activities in the field of ophthalmology, technological advancements and aging population have also propelled the market growth.

Increased incidence of autoimmune conditions such as rheumatoid arthritis, lupus, and Crohn's disease is leading to a higher prevalence of uveitis. The increasing prevalence of uveitis, particularly non-infectious forms, is a primary driver for market growth. A study of medical records in California found that uveitis causes blindness in a significant number of people, accounting for approximately 10% of all blindness cases. As the global population ages, there is an expected increase in age-related eye disorders, including uveitis. According to WHO, the global population aged 60 and over will surge from 900 million in 2015 to 2 billion by 2050, representing a rapid shift from 12% to 22% of the total population.

There has been a notable shift towards biologics and immunomodulatory therapies for managing uveitis. Advancements in ophthalmology diagnostic tools and techniques are enabling earlier detection of uveitis fueling the growth of market. Raising awareness about uveitis and its potential complications is encouraging patients to seek medical attention sooner. The development of targeted therapies, biologics, and innovative drug delivery systems is providing more effective and convenient treatment options. Advancements in laser surgery and other surgical procedures are improving outcomes for uveitis patients further driving the market growth.

Treatment Insights

The corticosteroids segment dominated the market with 25.6% of revenue share in 2023. Corticosteroids are anti-inflammatory medications that help reduce inflammation in the eye, which is crucial for managing uveitis symptoms and preventing complications. Moreover, there's growing interest in developing corticosteroids with reduced systemic absorption or enhanced specificity to target inflammatory cells involved in uveitis, aiming to improve safety and efficacy.

The antibiotics segment is anticipated to witness the fastest CAGR of 9.6% over the forecast period. The increasing incidence of infectious uveitis due to pathogens such as bacteria, viruses, and fungi has significantly contributed to the rising demand for antibiotics in the treatment landscape. As awareness about infectious causes of uveitis grows among healthcare professionals, there is a corresponding increase in the prescription of antibiotics tailored to specific infections.

Disease Insights

Anterior uveitis dominated the market with 47.6% of revenue share in 2023. This is due to the rise in autoimmune diseases, infections, and systemic inflammatory conditions that predispose individuals to this type of uveitis. Moreover, the growing awareness and advancements in diagnostic techniques have led to earlier detection and treatment of anterior uveitis cases. This heightened awareness among healthcare professionals and patients alike contributes to an increase in treatment demand. Furthermore, the aging population is more susceptible to various ocular diseases, including anterior uveitis, thereby driving market growth.

Posterior uveitis is anticipated to witness the fastest CAGR of 9.4% over the forecast period. The rising incidence of systemic inflammatory diseases, such as sarcoidosis and tuberculosis, is driving the increase in posterior uveitis cases. The global spread of these diseases due to factors such as urbanization and international travel has resulted in a higher incidence of posterior uveitis. Advances in imaging technologies have also improved the diagnosis of posterior uveitis, leading to more patients being identified and treated effectively.

Cause Insights

The infectious segment dominated the market with 82.4% of revenue share in 2023. This is due to the rising incidence of infectious diseases that can lead to uveitis, such as toxoplasmosis and viral infections. The growing awareness among healthcare professionals regarding the importance of early diagnosis and intervention in managing infectious uveitis is also contributing to market growth.

The non-infectious segment is anticipated to witness the fastest CAGR of 9.8% over the forecast period. This growth is attributed to the rising prevalence of autoimmune diseases such as rheumatoid arthritis and sarcoidosis, which are known to cause non-infectious uveitis.

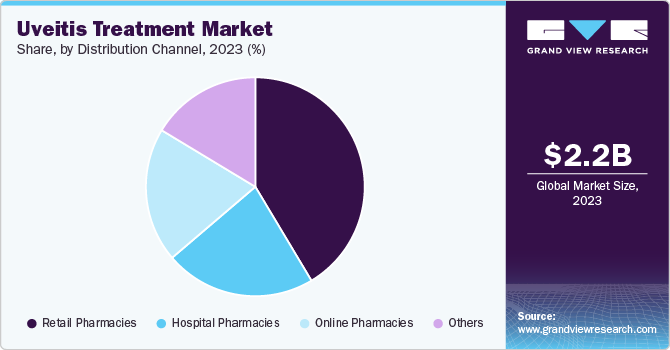

Distribution Channel Insights

Retail pharmacies dominated the market with 41.4% share in 2023 due to their widespread accessibility and convenience. Patients often rely on local pharmacies to obtain prescription medications for their conditions. The increasing number of retail pharmacy chains and their expansion into underserved areas further contribute to their market dominance. Moreover, retail pharmacies frequently offer patient counseling and support services, which can be valuable for patients with chronic conditions such as uveitis.

Online pharmacies are projected to grow at the fastest CAGR of 9.5% over the forecast period due to the growing acceptance of e-commerce in healthcare. These platforms provide patients with the ability to order medications from the comfort of their homes, often at lower prices than traditional retail pharmacies. Patients appreciate the convenience of ordering medications from home, which is especially beneficial for those with mobility issues or those living in remote areas.

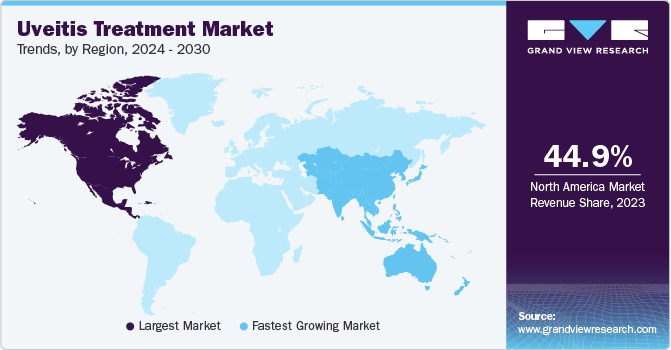

Regional Insights

North America uveitis treatment market dominated with 44.9% market share in 2023. This growth can be attributed the region’s large, aging population, which increases the risk of developing uveitis, the advanced healthcare infrastructure and a well-developed pharmaceutical industry.

U.S. Uveitis Treatment Market Trends

The U.S. uveitis treatment market dominated the North America market in 2023. The country's robust healthcare system, coupled with a strong focus on research and development, has led to significant advancements in the diagnosis and treatment of uveitis.

Europe Uveitis Treatment Market Trends

The Europe uveitis treatment market was identified as a lucrative region in 2023 due to rising geriatric population, rising prevalence of uveitis, and growing awareness among healthcare professionals regarding the importance of early diagnosis and treatment. According to European Commission, more than one fifth of European population is aged 65 years and over.

The Germany uveitis treatment market is expected to grow rapidly in the coming years. The country's well-developed healthcare system, coupled with a strong focus on research and innovation, has led to significant advancements in ophthalmology. The presence of key pharmaceutical companies and clinical research organizations within Germany fosters innovation and enhances access to cutting-edge therapies for patients suffering from uveitis.

Asia Pacific Uveitis Treatment Market Trends

Asia Pacific market is anticipated to witness the fastest CAGR in the coming years. This growth is attributed to the large and growing population, increasing prevalence of autoimmune diseases & infectious diseases.

The uveitis treatment market in India held a substantial share in 2023 due to its large population, rising incidence of infectious diseases, and increasing affordability of healthcare services. Moreover, there is an increasing investment in healthcare infrastructure by both public and private sectors that enhances access to ophthalmic care.

Key Uveitis Treatment Company Insights

Some of the key companies in the uveitis treatment market are AbbVie Inc., Bausch Health Companies Inc., EyePoint Pharmaceuticals, Inc., Novartis AG, Ophthotech Corporation, Pfizer Inc. and others. Companies in the market are focusing on launching new products to gain a competitive edge in the industry.

-

Ocular Therapeutix, Inc. is a biopharmaceutical company focused on improving vision through the development and commercialization of innovative therapies for retinal diseases and other eye conditions.

Key Uveitis Treatment Companies:

The following are the leading companies in the uveitis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Santen Pharmaceutical Co., Ltd.

- Bausch Health Companies Inc.

- Regeneron Pharmaceuticals Inc.

- EyePoint Pharmaceuticals, Inc.

- Novartis AG

- Ocular Therapeutix, Inc.

- Ophthotech Corporation

- Pfizer Inc.

Recent Developments

- In March 2022, Bausch + Lomb and Clearside Biomedical launched XIPERE. It is the first U.S. FDA approved therapy for suprachoroidal use for treating macular edema associated with eye inflammation/uveitis.

Uveitis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.42 billion

Revenue forecast in 2030

USD 4.10 billion

Growth rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, disease, cause, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

AbbVie Inc., Santen Pharmaceutical Co., Ltd. , Bausch Health Companies Inc. , Regeneron Pharmaceuticals Inc., EyePoint Pharmaceuticals, Inc. , Novartis AG , Ocular Therapeutix, Inc. , Ophthotech Corporation, Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Uveitis Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global uveitis treatment market report based on treatment, disease, cause, distribution channel, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Corticosteroids

-

Immunosuppressant

-

Monoclonal Antibodies

-

Cycloplegic Agents

-

Antibiotics

-

Antivirals

-

Antifungal

-

Analgesics

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Anterior Uveitis

-

Posterior Uveitis

-

Intermediate Uveitis

-

Panuveitis

-

-

Cause Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious

-

Non-infectious

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.