- Home

- »

- Homecare & Decor

- »

-

Vacation Rental Market Size, Share & Growth Report, 2030GVR Report cover

![Vacation Rental Market Size, Share & Trends Report]()

Vacation Rental Market Size, Share & Trends Analysis Report By Booking Mode (Online, Offline), By Accommodation Type (Home, Apartment, Resort/Condominium), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-532-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Vacation Rental Market Size & Trends

The global vacation rental market size was estimated at USD 89.32 billion in 2023 and is expected to grow at a CAGR of 3.7% from 2024 to 2030. The rising expenditure on travel, vacations, and accommodation among millennials is driving market growth. According to Copyrise, 200,000 million global tourists are millennials, and they spend around USD 180 billion on travel every year. However, the COVID-19 pandemic has negatively impacted the growth of the market. For instance, according to AirDNA, there was a significant drop in weekly bookings between January and March of 2020. Moreover, the number of bookings in Beijing dropped by 96%, Shanghai by 71%, Seoul by 46%, and Rome by 41%.

Travelers are more inclined toward vacation rental properties than hotels as these properties are affordable, offer a greater level of comfort & privacy than hotels, and provide kids & pet-friendly nature of accommodation. Low cost as compared to hotel accommodation with similar amenities drives the consumer’s inclination toward such properties. For instance, according to the TurnKey Vacation Rentals 2019 survey, 64% of travelers prefer vacation rentals over hotels. Moreover, while traveling with family, consumers consider various factors when choosing a vacation rental for amenities and comfort.

According to the report of iProperty Management in 2021, 71% of families traveling with children prefer to prepare their meals, which was a likely factor in their decision to stay in a vacation rental. In addition, rising supply is increasing the demand and availability of vacation rentals owing to low costs compared to hotels. As per Stratos Jet Charters, Inc. statistics, there are 2.9 million hosts on Airbnb worldwide, and over 14,000 hosts were among the new additions each month in 2021. Moreover, Airbnb operates in around 220 countries, with approximately 100,000 actively listed with Airbnb listings in 2021. As the market evolves, service providers are adapting their offerings to cater to the changing needs of travelers.

SabbaticalHomes, an international listing service initially focused on providing temporary housing for visiting scholars, has expanded its services to include short- and medium-term home rentals and exchanges in 57 countries, catering to both academic and non-academic individuals. Similarly, companies like Plum Guide, BoutiqueHomes, and Homestay are innovating within this space by introducing modifications to their service offerings, aiming to provide the utmost convenience and unique experiences to their customers. The influence of social media and the internet is increasing awareness among consumers regarding services and offerings.

Key players are offering various unique services, exotic locations, and amenities to gain higher market shares. For instance, in January 2020, Golightly was launched, which is a vacation rental platform managed by women and only available for female guests. The company owns more than 350 properties globally. Integrating vacation rental listings with various distribution channels, such as online travel agencies (OTAs) and metasearch engines, opens new avenues for reaching a broader audience. Through partnerships with platforms like Expedia Partner Solutions, HomeToGo, and TripAdvisor, operators can expand their reach and visibility, attracting a larger pool of potential guests. This increased exposure leads to higher booking rates, increased occupancy, and revenue growth.

Market Concentration & Characteristics

The degree of innovation in the market is notably high, driven by advancements in technology and evolving consumer demands. Online platforms like Airbnb, Vrbo, and Booking.com have revolutionized how properties are listed, searched, and booked, incorporating features such as real-time availability, instant booking, and virtual tours. Additionally, smart home technologies are increasingly integrated into vacation rentals, offering guests enhanced convenience with keyless entry, smart thermostats, and voice-activated assistants. Innovations in data analytics and machine learning also enable property owners to optimize pricing, personalize marketing, and enhance guest experiences. These technological advancements, coupled with creative approaches to property management and guest services, continually reshape and elevate the vacation rental market.

Regulations significantly impact the market by creating a framework that balances the interests of various stakeholders, including property owners, renters, and local communities. Strict regulations, such as licensing requirements, zoning laws, and occupancy limits, can limit the availability of vacation rentals, potentially driving up prices and reducing options for travelers. Additionally, regulatory measures addressing issues like noise, waste, and neighborhood disruption help mitigate negative impacts on local residents, promoting a more harmonious coexistence between tourists and communities.

The end-user concentration in the market is largely focused on families, groups of friends, and increasingly, business travelers seeking alternatives to traditional hotel stays. Families and larger groups are attracted by the spaciousness and cost-efficiency of vacation rentals, which offer multiple bedrooms, kitchens, and communal living areas. Millennial and Gen Z travelers, who prioritize unique, local experiences and often prefer home-like amenities, also represent a significant segment of the market. Additionally, the rise of remote work and "workcations" has expanded the market to include professionals looking for longer-term stays that combine work and leisure. This diverse end user base is further broadened by international tourists and retirees seeking extended vacations, thereby driving the sustained growth of the vacation rental market.

Accommodation Type Insights

Based on accommodation type, the home segment dominated the global market with the largest revenue share of about 48% in 2023. Opting for a lavish home or villa as accommodation instead of a luxurious 5-star hotel presents a cost-effective alternative for holiday stays, which can be a significant expense during any trip. Homes offer a budget-friendly option, particularly advantageous for group bookings. Recognizing the growing demand for home vacation rentals, hotel companies have been strategically entering this market segment. In September 2023, Hyatt expanded its offerings with the launch of Homes & Hideaways, a short-term vacation rental platform that features thousands of professionally managed homes across the U.S., including beachfront escapes, cottages, townhouses, mountainside chalets, apartments, and penthouses. Hyatt's platform allows World of Hyatt members to earn points and elite night credits, offering a new way to experience travel beyond traditional hotel stays.

The resort/condominium is anticipated to grow at a CAGR of 4.4% from 2024 to 2030. The segment is driven by travelers seeking luxury and amenities typically associated with resorts, combined with the space, privacy, and home-like comforts of a condominium. These properties often offer a range of upscale features such as swimming pools, fitness centers, and concierge services, appealing to those looking for a more upscale and hassle-free vacation experience. Moreover, the ability to accommodate larger groups or families in a single unit, often with kitchen facilities and multiple bedrooms, adds to their attractiveness.

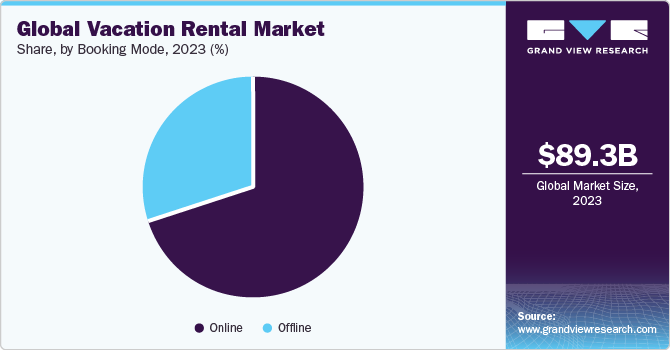

Booking Mode Insights

Based on booking mode, the offline segment dominated the global market with the largest revenue share in 2023. The widespread availability of offline channels and their well-established and extensive networks across the globe are key factors boosting segment growth. Generation X and baby boomers comprise the major share of tourists in the global market. Individuals in these generations are most likely to book their tours through travel agencies and other offline channels that provide convenient and easy services.

The bookings through online mode are anticipated to grow at a CAGR of 4.4% from 2024 to 2030. The vacation rental market has seen substantial growth, significantly propelled by the popularity of online platforms like Vrbo, HomeAway, Airbnb, and Booking.com. Booking vacation rentals has become more convenient post-pandemic, with the proliferation of online booking sites that offer a wide range of options worldwide. Booking.com was ranked as the top online travel company globally as of December 2022, according to a blog by Today's Homeowner Media. Moreover, 40% of leisure travelers who book online are millennials, drawn by their digital savviness, preference for convenience, and desire for unique travel experiences.

Regional Insights

North America vacation rental market held a revenue share of about 24% of the global revenue in 2023. The vacation rental market in North America is driven by a combination of factors including the increasing demand for unique and personalized travel experiences, the growth of digital platforms like Airbnb and Vrbo, and the shift in traveler preferences towards home-like amenities and flexible accommodation options. Economic factors such as rising disposable incomes and the proliferation of remote work have also contributed to this trend, enabling more frequent and extended travel.

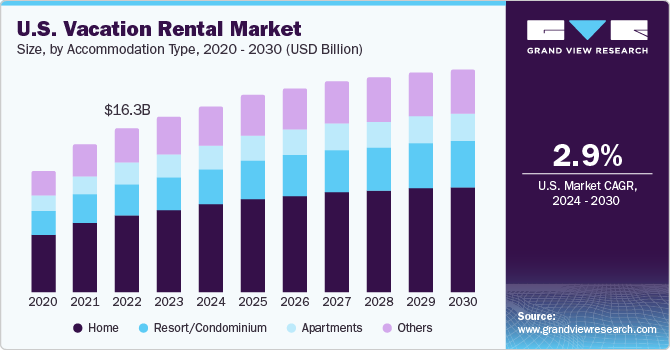

U.S. Vacation Rental Market Trends

The vacation rental market in the U.S. is expected to grow at a CAGR of 2.9% from 2024 to 2030. The U.S. vacation rental industry is primarily driven by increasing consumer preference for unique, personalized travel experiences and the growing demand for accommodations that can cater to larger groups or families, often at a lower cost than traditional hotels.

Europe Vacation Rental Market Trends

The vacation rental market in Europe accounted for a share of around 35% of the global revenue in 2023. Rising travel connectivity and rapid penetration of high-speed internet have made even the most remote places in Europe more accessible to travelers. This is driving the urge to explore new, exotic, and exciting locations across the region, fueling the vacation rental market. Germany, France, the U.K., Italy, and Spain are the largest markets in the region, with cities like London, Paris, Rome, Moscow, Madrid, Saint Petersburg, Barcelona, Lisbon, Milano, and Batumi having the highest number of vacation rentals. Travelers across the region are looking for more convenient options to book and manage trips and accommodations, and this has driven the preference for online and mobile reservations. Booking.com, Kayak, and HotelsCombined are among the common online booking sites.

Asia Pacific Vacation Rental Market Trends

The vacation rental market in Asia Pacific is expected to grow at a CAGR of about 4.9% from 2024 to 2030. The growth is majorly attributed to the rising expenditure of consumers on travel and accommodation. China vacation rental market held the largest revenue share in 2023 in the region and is estimated to maintain its lead in the years to come. Key service players in the country are taking up initiatives and widening the accommodation destinations by partnering with or educating the landlords in the country. For instance, in June 2019, Peng Tao, president of Airbnb China, stated that the company undertook efforts to introduce educational initiatives in educating landlords in second and third-tier cities in China. This initiative enhanced the quality of the company’s listings, consolidated online reviews, and boosted brand-building.

Australia vacation rental market is expected to grow at a substantial CAGR of 5.6% from 2024 to 2030. Australia's beautiful coastline and scenic regions make it an attractive destination for vacation rentals. Coastal areas, beachside towns, and regions with natural attractions like the Great Barrier Reef, Whitsundays, Blue Mountains, and the Yarra Valley are popular spots for vacation rental properties. According to Australian Financial Review, MadeComfy, an Airbnb management company in Australia, reported an average occupancy rate of 73% in Sydney and Melbourne, showing a strong comeback in the STR industry.

Key Vacation Rental Company Insights

The global vacation rental market is characterized by the presence of a few well-established players such as Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; MakeMyTrip Pvt. Ltd.; NOVASOL AS; Oravel Stays Pvt. Ltd. The market players face intense competition from each other as some of them are among the top manufacturers with diverse product portfolios for the products. These companies have a large customer base due to the presence of established and vast service providers to reach out to both, regional and international consumers.

Key Vacation Rental Companies:

The following are the leading companies in the vacation rental market. These companies collectively hold the largest market share and dictate industry trends.

- 9flats.com Pte Ltd.

- Airbnb Inc.

- Booking Holdings Inc.

- Expedia Group Inc.

- Hotelplan Holding AG

- MakeMyTrip Pvt. Ltd.

- NOVASOL AS

- Oravel Stays Pvt. Ltd.

- TripAdvisor Inc.

- Wyndham Destinations Inc.

Recent Developments

-

In August 2022, Oravel Stays Private Limited bought Bornholmske Feriehuse, an operator of vacation rentals to expand its presence in Europe. The acquisition aimed to increase Oyo's presence in Croatia, where it had over 7,000 houses on its Traum Ferienwohnungen platform and close to 1,800 vacation homes on its Belvilla platform

-

In May 2023, in honor of Global Accessibility Awareness Day, Airbnb, Inc. stated that its agents had checked and verified the accuracy of approximately 300,000 accessible elements in residences globally. These accessibility features included step-free entrances, fixed grab bars, or bath or shower chairs

Vacation Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 95.66 billion

Revenue forecast in 2030

USD 119.0 billion

Growth Rate (Revenue)

CAGR of 3.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; UK; Germany; France; China; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; MakeMyTrip Pvt. Ltd.; NOVASOL AS; Oravel Stays Pvt. Ltd.; TripAdvisor Inc.; Wyndham Destinations Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacation Rental Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vacation rental market report based on accommodation type, booking mode, and region:

-

Accommodation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Home

-

Apartments

-

Resort/Condominium

-

Others

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global vacation rental market size was estimated at USD 89.32 billion in 2023 and is expected to reach USD 95.66 billion in 2023.

b. The global vacation rental market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 119.0 billion by 2030.

b. Europe dominated the vacation rental market with a share of 34% in 2023. This is attributable to the presence of big tour operators and online tour operators already catching up with the growing trend of glamping and rising expenditure for booking accommodation in resorts and condominiums.

b. Some key players operating in the vacation rental market include 9flats.com Pte Ltd., Airbnb Inc., Booking Holdings Inc., Expedia Group Inc., Hotelplan Holding AG, MakeMyTrip Pvt. Ltd., NOVASOL AS, Oravel Stays Pvt. Ltd., TripAdvisor Inc. and Wyndham Destinations Inc.

b. Key factors that are driving the vacation rental market growth include comfort, low cost, more privacy, kids, and the pet-friendly nature of the accommodation coupled with rising expenditure on travel, vacations, and accommodation among millennials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."