- Home

- »

- Medical Devices

- »

-

Vaccine Storage And Packaging Market Size Report, 2030GVR Report cover

![Vaccine Storage And Packaging Market Size, Share, & Trends Report]()

Vaccine Storage And Packaging Market (2025 - 2030) Size, Share, & Trends Analysis Report By Function (Storage, Packaging), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68039-008-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

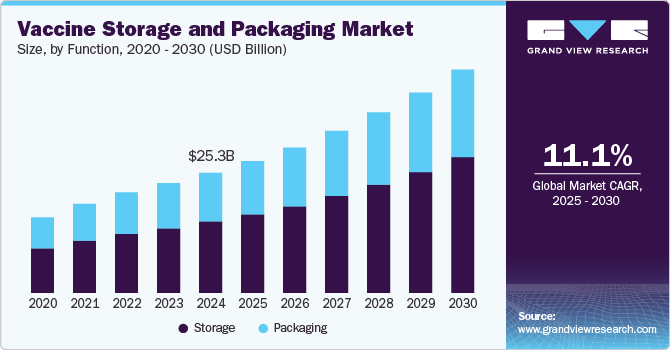

The global vaccine storage and packaging market sizewas estimated at USD 25.30 billion in 2024 and is expected to grow at a CAGR of 11.1% from 2025 to 2030. Growing investments by healthcare institutions and biopharmaceutical companies in the research and development of novel vaccines are primarily driving the growth of this market. An increase in government expenditure on immunization programs is also expected to generate lucrative opportunities.

The emphasis of various governments on enhancing the accessibility to effective vaccines has increased the demand for efficient storage and packaging services. For example, the U.S. government supports several public agencies and programs focused on vaccine-related initiatives. In 2024, the U.S. contributed nearly USD 300 million to Gavi, the Vaccine Alliance, which aims to improve access to immunization in low-income countries. Such investments are expected to generate new storage and packaging provider opportunities. Lack of in-house storage and packaging capabilities and expertise, as well as budget constraints, are anticipated to propel the market demand. Moreover, rising global immunization coverage drives the growth of the vaccine storage equipment market. According to WHO, the global coverage of the first dose of the HPV vaccine in girls increased significantly from 20.0% in 2022 to 27.0% in 2023.

The market is expected to grow due to technological advancements, such as Solar Direct Drive (SDD) refrigerators and RFIDs. In addition, a rise in the prevalence of infectious diseases is expected to fuel the demand for protective vaccines. Repeated outbreaks associated with vaccine-preventable infectious diseases in low-immunization coverage areas are expected to generate more opportunities for this market. For instance, in April 2025, The Texas Department of State Health Services reported 541 confirmed measles cases.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. Ongoing efforts by major market participants to enhance their market shares have resulted in fragmented market scenarios. The growing demand for effective storage and packaging services and the focus of multiple governments and welfare organizations on improving immunization across low-income countries fuel innovation.

The global market is characterized by a high degree of innovation owing to the significantly growing adoption of modern technologies in the healthcare industry. For example, the increasing adoption of Internet of Things (IoT) technology in operations and supply chain management is changing the industry's dynamics. The growing adoption of smartphones and internet connections has enabled additional features such as remote monitoring.

Mergers and acquisitions are not too common in storage and packaging businesses. However, large companies and global manufacturers acquire vaccine developers operating at a smaller scale. For instance, in February 2024, AstraZeneca completed the acquisition of Icosavax, Inc., a biopharmaceutical company engaged in developing innovation-based vaccines. The vaccine storage and packaging industry has a high impact on regulations. In the U.S., vaccine storage is regulated by the Centers for Disease Control and Prevention (CDC) and the Department of Health and Human Services (HHS). End-use concentration in the vaccine storage and packaging market is high due to vaccine availability to selected authorities and organizations running immunization programs.

Function Insights

The storage segment dominated the vaccine storage and packaging market, with a revenue share of 59.5% in 2024. The growth of this segment is primarily driven by the increasing inclination among governments and global health organizations to improve coverage of immunization programs. Efforts by numerous government authorities and welfare organizations, such as Gavi, the Vaccine Alliance, the WHO, and the Coalition for Epidemic Preparedness Innovations (CEPI), drive the demand for effective storage services for vaccines. For instance, in March 2025, Cuba strengthened its storage capacity for vaccines through equipment renewal and the acquisition of a cold storage chamber at José Martí International Airport. The upgrade was accomplished with the support of the Pan American Health Organization (PAHO) and Canada. Such developments are likely to assist this segment in attaining greater growth over the forecast period.

The packaging segment is expected to experience significant growth from 2025 to 2030. Growing demand for novel packaging solutions and recent innovations related to enhanced potency, safety, and quality of vaccines are expected to drive segment growth. For instance, in March 2025, Bavarian Nordic, one of the key players in vaccine development, announced it had received U.S. FDA approval for a freeze-dried formulation of smallpox and mpox vaccines.

Regional Insights

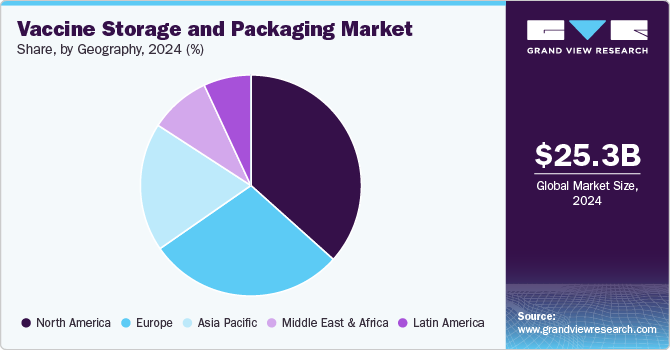

North America vaccine storage and packaging market dominated the global industry with a revenue share of 37.1% in 2024. This market is primarily driven by the presence of multiple regional biopharmaceutical companies and increasing demand from international health and welfare organizations working toward enhanced immunization coverage. In addition, the involvement of various regional organizations in global immunization programs also contributes to the growth.

U.S. Vaccine Storage and Packaging Market Trends

The U.S. vaccine storage and packaging market held the largest revenue share of the North America vaccine storage and packaging industry in 2024. The growth of this market is mainly influenced by factors such as a robust biopharmaceutical industry and access to advanced technologies associated with vaccine development, storage, and packaging. In addition, the U.S. government's focus on increasing the reach of immunization programs run by local authorities is expected to aid lucrative growth.

Europe Vaccine Storage and Packaging Market Trends

Europe vaccine storage and packaging market was identified as one of the key regions of the global vaccine storage and packaging industry in 2024. The region is home to multiple vaccine manufacturers such as Pfizer, Merck, and GSK; numerous pharmaceutical companies and increasing demand for efficient storage and packaging services are expected to influence the market growth. Programs such as the European Immunization Agenda 2030 (EIA2030) adopted by all 53 regional states are anticipated to influence development.

Asia Pacific Vaccine Storage and Packaging Market Trends

Asia Pacific vaccine storage and packaging market is expected to experience the fastest CAGR during the forecast period. The increasing focus of numerous governments on improved healthcare ecosystems and the availability of vaccines for infectious diseases are primary market drivers. The presence of highly populated countries such as China and India, strong immunization programs that are active in the region, and growing demand for vaccines for pertussis (whooping cough), diphtheria, polio, tetanus, measles, rubella, hepatitis B, rotavirus, and other diseases drive the market growth.

China vaccine storage and packaging market dominated the Asia Pacific vaccine storage and packaging industry in 2024. Key growth drivers of this market are the country's robust vaccine industry, government agencies focused on enhancing immunization coverage, and increasing demand for storage solutions such as cold chain storage. In addition, significant development of new vaccines and stringent regulations regarding the storage and packaging of vaccines are expected to generate opportunities for this market.

Key Vaccine Storage And Packaging Company Insights

Some key companies operating in the global vaccine storage and packaging industry are Lineage, Inc.; AmerisourceBergen Corporation; DHL; DB SCHENKER; and NIPRO. The major market participants have been embracing strategies such as the acquisition of new assets and sites and capacity enhancements.

-

Lineage, Inc. specializes in cold storage and logistics services and operates across multiple regions. Its key service offerings include cold storage warehousing, port-centric warehousing, automated warehousing, sustainable warehousing, supply chain engineering, temperature-controlled rail, and others.

-

DB SCHENKER, a global logistics solutions provider, offers various services, including contract logistics, advanced logistics services, industry-specific solutions, and more. It operates across nearly 1,850 locations worldwide and has a network of 725 warehouses.

Key Vaccine Storage And Packaging Companies:

The following are the leading companies in the vaccine storage and packaging market These companies collectively hold the largest market share and dictate industry trends.

- Lineage, Inc.

- AmerisourceBergen Corporation

- DHL

- DB SCHENKER

- CARDINAL LOGISTICS

- MCKESSON CORPORATION

- Thermo Fisher Scientific Inc.

- PHCbi (PANASONIC HEALTHCARE CO., LTD)

- American Biotech Supply

- Arctiko

- NIPRO

Recent Developments

-

In April 2025, Lineage, Inc. announced that it acquired Bellingham Cold Storage along with its three warehouses in Washington state, totaling 24 million cubic feet and 85,000 pallet positions. This acquisition expands Lineage's Pacific Northwest network to 40 facilities and adds a strategic presence at the Port of Bellingham, a key hub for seafood and agricultural products.

-

In April 2025, Gavi, the Vaccine Alliance, a private-public global health partnership, announced the establishment of a new vaccine storage facility in the Suba West sub-county store of Mfangano Island. This is anticipated to help local immunization programs and enable health officials to stock larger quantities of required vaccines.

-

In January 2025, Lineage Inc. acquired Australian company Fremantle City Coldstores (FCC). The acquisition added significant capacity and is expected to support Lineage Inc.'s commitment to enhancing the long-term strategic growth plan for Australia and other countries in the Asia Pacific region.

Vaccine Storage and Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.83 billion

Revenue forecast in 2030

USD 47.02 billion

Growth rate

CAGR of 11.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Function and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Colombia, Chile, South Africa, Saudi Arabia, UAE, Israel, and Kuwait

Key companies profiled

Lineage, Inc.; AmerisourceBergen Corporation; DHL; DB SCHENKER; CARDINAL LOGISTICS; MCKESSON CORPORATION; Thermo Fisher Scientific Inc.; PHCbi (PANASONIC HEALTHCARE CO., LTD); American Biotech Supply; Arctiko; NIPRO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vaccine Storage and Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the vaccine storage and packaging market report on the basis of function and region:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Storage

-

Storage equipment

-

Refrigerator

-

Freezer

-

Others (accessories)

-

-

Service

-

Warehouse storage

-

Transportation (Cold retainers)

-

-

-

Packaging

-

Material

-

Vaccine bags, vials, ampoules

-

Corrugated boxes

-

Others

-

-

Type

-

Primary

-

Secondary

-

Tertiary

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vaccine storage and packaging market size was estimated at USD 25.30 billion in 2024 and is expected to reach USD 27.83 billion in 2025.

b. The global vaccine storage and packaging market is expected to grow at a compound annual growth rate of 11.1% from 2025 to 2030 to reach USD 47.02 billion by 2030.

b. North America dominated the vaccine storage and packaging market and accounted for a revenue share of 37.14% in 2019, owing to the increasing investments by government and non-government organizations for vaccine development and the high prevalence of infectious diseases within the region.

b. Key factors that are driving the vaccine storage and packaging market growth include increasing demand for the vaccine supply chain.

b. Some key players operating in the vaccine storage and packaging market include Lineage Logistics; Cencora Corporation; DHL; DB Schenker; Cardinal Logistics; McKesson; Thermo Fischer Scientific; PANASONIC HEALTHCARE CO., LTD; American Biotech Supply; Arctiko A/S; and NIPRO.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.