- Home

- »

- Electronic Devices

- »

-

Vacuum Cleaner Market Size & Share, Industry Report, 2033GVR Report cover

![Vacuum Cleaner Market Size, Share & Trends Report]()

Vacuum Cleaner Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Canister, Central, Drum, Robotic, Upright, Wet & Dry), By Distribution Channel (Online, Offline), By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-046-0

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacuum Cleaner Market Summary

The global vacuum cleaner market size was estimated at USD 16.38 billion in 2025 and is expected to reach USD 35.37 billion by 2033, growing at a CAGR of 10.1% from 2026 to 2033. The factors, including changing lifestyles, high disposable incomes, and a growing working population, have driven market growth.

Key Market Trends & Insights

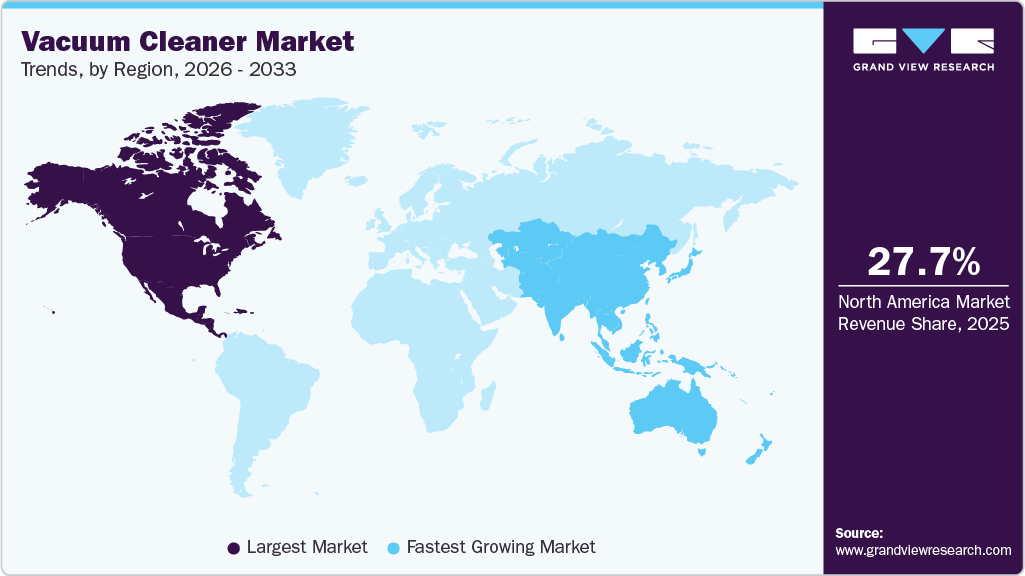

- North America held the largest share of the vacuum cleaner market in 2025, accounting for 27.7%.

- The Asia Pacific vacuum cleaner market is experiencing the fastest CAGR of 10.8% over the forecast period.

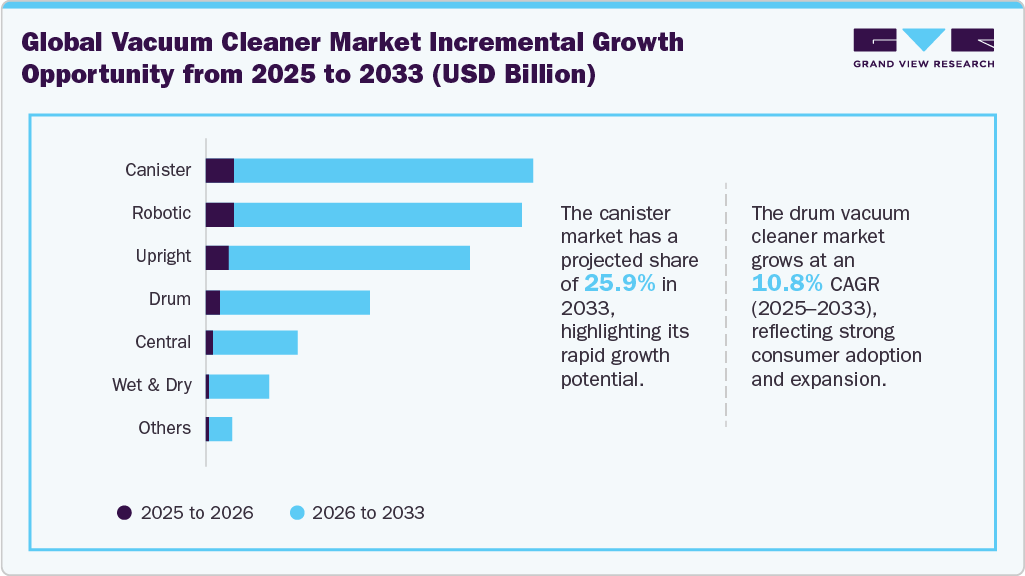

- By product, the canister market held the largest share of 25.7% in 2025.

- By product, the drum vacuum cleaner market is experiencing the fastest growth, projecting a CAGR of 10.8%.

- By application, the residential vacuum cleaner market held the largest share of 47.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 16.38 Billion

- 2033 Projected Market Size: USD 35.37 Billion

- CAGR (2026-2033): 10.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, increased awareness about the benefits of maintaining cleanliness in residential and commercial places has contributed to the market’s growth. The market is expected to benefit from several trends and drivers, including changing lifestyles, high disposable incomes, a growing working population, increased awareness of hygiene and cleanliness, and shifting consumer preferences towards online shopping. Moreover, the increasing incidences of allergy and asthma caused due to the dust and dirt in residential settings, coupled with the need to keep homes disease-free, is expected to drive the demand for residential vacuum cleaners.

Furthermore, the rising availability of advanced products, which can capture the tiniest of impurities efficiently, is projected to drive market growth over the forecast period. Moreover, these factors are also positively influencing the vacuum cleaner bags market, as consumers increasingly seek efficient filtration solutions to enhance indoor air quality and overall cleanliness.

In the past few years, robotic vacuum cleaners are seeing rapid growth in demand due to their cleaning ability with less or no human intervention. Such vacuum cleaners are equipped with advanced sensors and offer functionalities, including multi-surface cleaning with powerful suction, remote-controlled cleaning, long battery life, and auto-recharging. These technological advancements and convenience-driven features are significantly contributing to the expansion of the robotic vacuum cleaner market worldwide. For instance, in September 2021, iRobot Corp., a consumer robots company, launched the Roomba j7+ robot vacuum to provide its customers with more control and new features powered by iRobot Genius 3.0 Home Intelligence.

Modern vacuum cleaners use high-efficiency particulate air filtration technology that removes airborne particles from an indoor space. These filters can capture smaller particulates that might otherwise not be trapped by the vacuum bags. Such vacuum cleaners are being preferred by allergy sufferers and end users seeking cleaner air. Meanwhile, the demand for replacement components is rising, positively impacting the vacuum cleaner bags market as consumers look for efficient and compatible solutions to maintain their appliances.

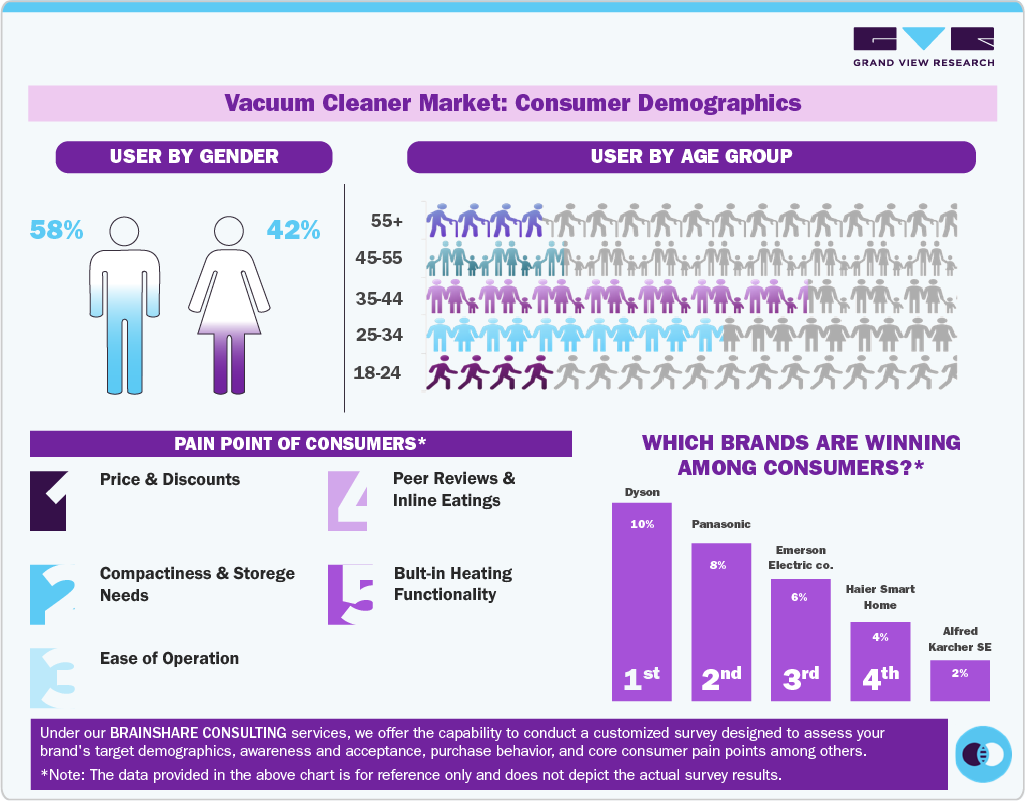

Consumer Insights for Vacuum Cleaner:

Product Insights

The canister vacuum cleaner market accounted for the largest share of 25.7% of the revenue in 2025. The canister vacuum cleaners are efficient than upright vacuum cleaners and offer better flow-rate and suction. Also, these machines are able to easily vacuum dust from areas such as stairs, underneath furniture, and hard-to-reach corners. Such features are responsible for the growth of this segment. Furthermore, the development of canister vacuum cleaners equipped with a HEPA filter, which has a significantly lower risk of causing pulmonary side effects such as allergies and asthma, is expected to work in favor of the segment’s future growth prospects.

The drum vacuum cleaner market is projected to grow at the fastest CAGR of 10.8% from 2026 to 2033. The demand for drum vacuum cleaners is driven by their powerful suction and ability to handle large volumes of dust and debris efficiently. Rising awareness of hygiene and cleanliness in residential and commercial spaces is boosting their adoption. In addition, the versatility of drum vacuum cleaners for wet and dry cleaning applications makes them highly preferred. The availability of advanced models with durable construction and user-friendly features further supports market growth.

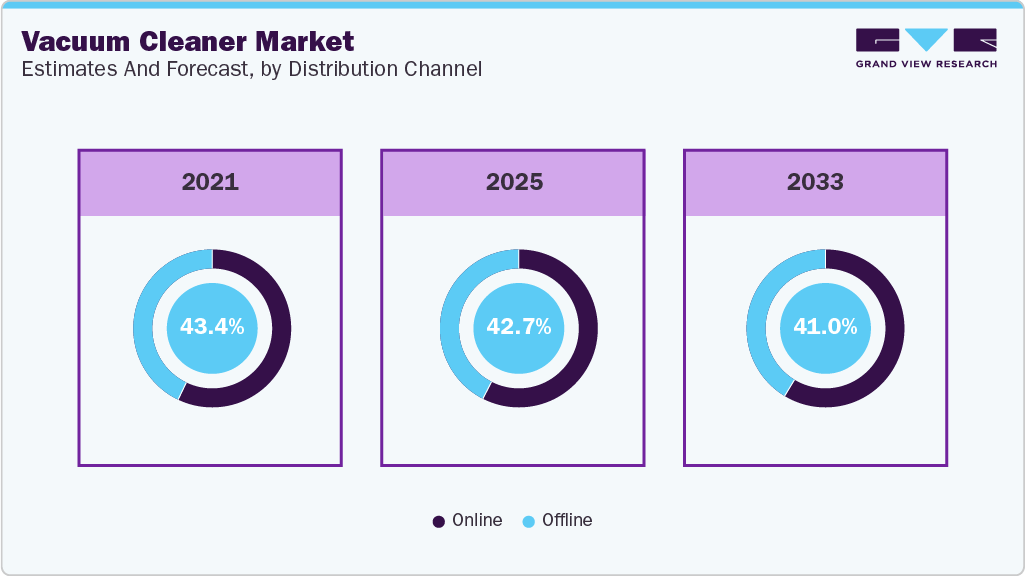

Distribution Channel Insights

The vacuum cleaner market through online channels accounted for the largest share of around 57.3% of the global revenue in 2025, owing to the wide availability of vacuum cleaners across retail stores. Several consumers prefer buying electronic gadgets directly through the stores as it allows them to check and try the products, which, in turn, quickens the purchasing decision. Besides, several electronic retail stores offer competitive prices and attractive discounts, which makes the offline distribution channel still a preferred option among consumers, thereby driving the segmental growth.

The vacuum cleaner market through the offline channel segment is expected to grow at a CAGR of 9.6% from 2026 to 2033. The growing consumer proclivity toward online purchases of electronic gadgets is positively influencing segmental growth. The wide availability of vacuum cleaners on the e-commerce platforms, as well as online sales channels of the manufacturers at attractive price points, is expediting the growth of the online segment further. For instance, in February 2022, Fantasia Trading LLC, which develops smart-home devices, added its eufy cordless handheld vacuum cleaner for sale on Amazon to provide an improved and seamless customer experience.

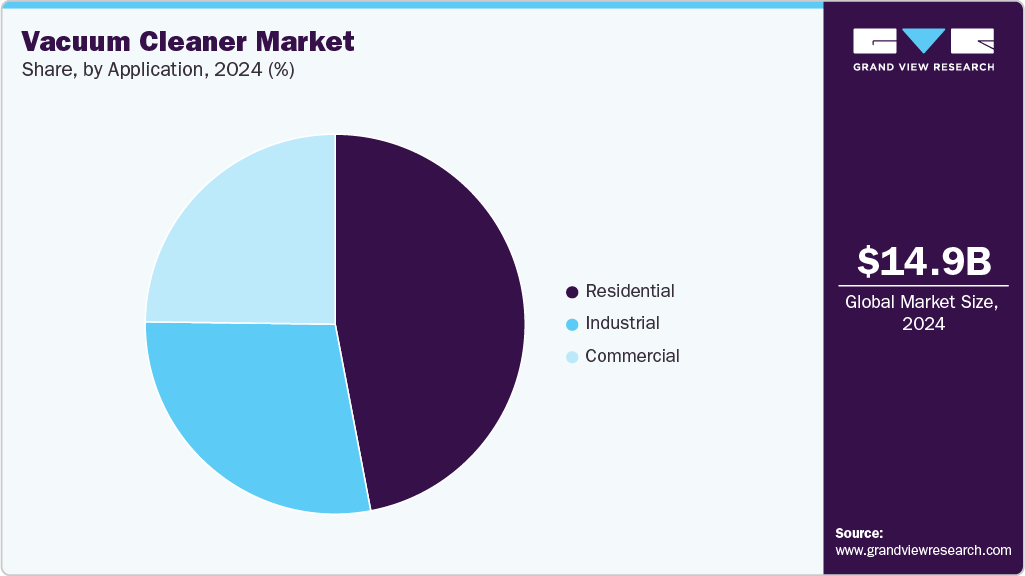

Application Insights

The residential vacuum cleaner market accounted for the largest share of around 47.1% of the global revenue in 2025, owing to the rising popularity of vacuum cleaners as household appliances that offer greater convenience amid busy schedules and changing lifestyle patterns among people. Moreover, increasing incidences of allergy and asthma caused due to the dust and dirt in residential settings, coupled with the need to keep homes disease-free, are driving the demand for residential vacuum cleaners. Furthermore, the rising availability of advanced products that can capture the tiniest of impurities efficiently is driving the market growth in residential applications.

The commercial vacuum cleaner market is projected to grow at a significant CAGR of 10.4% from 2026 to 2033, owing to increasing demand for cleaning equipment across commercial settings in line with the growing awareness regarding hygiene and cleanliness. This is urging the manufacturers to develop innovative offerings that can meet consumer demands. For instance, in March 2022, Creative Newtech Limited launched a robotic vacuum cleaner, Dustor, built with LiDAR technology. Designed especially for healthcare facilities, this device maps the space and then cleans the surfaces and difficult corners. It can also be used at any time as per the schedule and accessed from anywhere at your convenience.

Regional Insights

The North American vacuum cleaner market accounted for a share of 27.7% in 2025. The growth is attributed to the increasing demand for technologically advanced products with enhanced features such as IoT connectivity, voice control, and remote control, as well as the rising consumer awareness regarding indoor air quality and cleanliness. In addition, the growth of the e-commerce sector and the availability of a wide range of vacuum cleaners through online channels is also favoring regional market growth. Moreover, these trends are significantly boosting the robotic vacuum cleaner market in North America, as consumers increasingly adopt automated cleaning solutions for convenience and efficiency.

U.S. Vacuum Cleaner Market Trends

The U.S. led the North American vacuum cleaner market in 2025, holding the largest market share with 79.0% of the region’s total revenue. The vacuum cleaner market in the U.S. is driven by increasing consumer awareness about indoor air quality, the need for efficient and effective cleaning products, and technological advancement. The trend toward smart home automation and the popularity of handheld and cordless vacuum cleaners are also expected to contribute to the market's growth. The U.S. vacuum cleaner market is expected to grow during the forecast period due to several factors, such as technological advancements, changing consumer preferences, and increasing concerns about health and hygiene.

Europe Vacuum Cleaner Market Trends

The vacuum cleaner market in Europe held a significant market share of 24.1% in the global market. The market is seeing increased demand from the residential, commercial, and industrial sectors. The market is driven by factors such as the need for energy-efficient and eco-friendly vacuum cleaners due to urbanization. The market is also influenced by technological advancements such as the development of cordless and robot vacuum cleaners. These products have gained significant popularity among consumers due to their ease of use and convenience. Furthermore, the growing focus on home cleanliness and hygiene is positively impacting the residential vacuum cleaner market across Europe.

Vacuum cleaner market in Germany held the largest market share of 25.3% in the European market. In Germany, corded vacuum cleaners are still the most popular type, but cordless and robot vacuum cleaners are gaining popularity due to their ease of use and convenience. German consumers also value high-quality and durable products, which has led to a rise in demand for premium vacuum cleaner brands. Moreover, the German vacuum cleaner market is heavily influenced by regulations such as the E.U. Ecodesign Directive, which aims to improve the energy efficiency of household appliances, including vacuum cleaners. This has led to the market's development of energy-efficient and eco-friendly cleaners. Additionally, the increasing preference for lightweight and portable cleaning solutions is driving growth in the stick vacuum cleaner market in Germany.

Asia Pacific Vacuum Cleaner Market Trends

Vacuum cleaner market in APAC is projected to grow at the fastest CAGR of 10.8% from 2026 to 2033. The market is one of the fastest-growing markets globally, driven by increasing urbanization, rising disposable incomes, and the growing awareness about hygiene and cleanliness. The market is also seeing the emergence of new players offering innovative and technologically advanced products.

China and Japan are the largest markets for vacuum cleaners in the Asia-Pacific region. Both countries have a large population and an increasing demand for high-quality, durable household appliances. In addition, India is also a significant market for vacuum cleaners with a growing middle class and increasing disposable incomes. Moreover, the expanding industrial sector in the region is driving demand in the industrial vacuum cleaner market, as factories and manufacturing units seek efficient cleaning solutions.

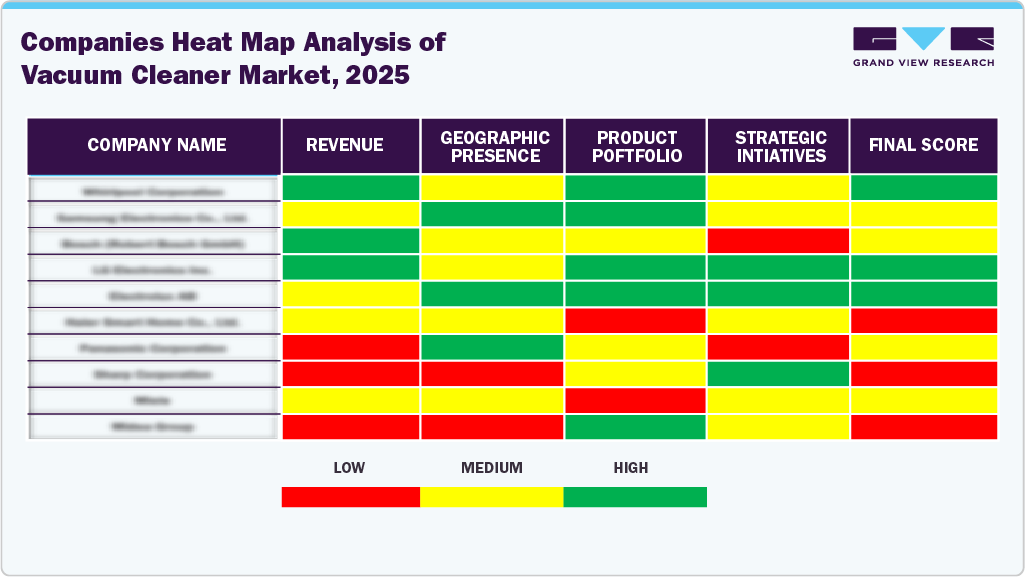

Key Vacuum Cleaner Company Insights

Many brands in the vacuum cleaner market have recognized untapped opportunities within their end-use portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Vacuum Cleaner Companies:

The following are the leading companies in the vacuum cleaner market. These companies collectively hold the largest market share and dictate industry trends.

- Alfred Karcher SE & Co. KG

- BISSELL Inc.

- CRAFTSMAN (Black and Decker)

- Dreame International (Hongkong) Limited

- DeWALT (Black and Decker)

- Dyson

- ECOVACS

- Emerson Electric Co.

- Haier Smart Homes Co. Ltd.

- iRobot Corporation

- Neato Robotics Inc.

- Nilfisk Group

- Panasonic Corporation

- Snow Joe LLC

- Samsung Electronics Co., Ltd.

Recent Developments

-

In February 2025, Nilfisk unveiled three new next‑generation professional vacuum cleaners (VP300, VP400 and the cordless VU200), designed for greater simplicity, performance and efficiency based on extensive customer research. These models, part of Nilfisk’s 2025 product lineup, aim to enhance usability and versatility for professional cleaning tasks and are now available to customers.

-

In January 2024, Dreame International, Ltd. introduced its complete range of smart home products at the CES 2024 event. The company unveiled various new smart cleaning appliances, such as DreameBot X30 Ultra, DreameBot L10s Pro Ultra, DreameBot L20 Ultra, Dreame H13 Pro Wet and Dry Vacuum, Dreame Z10 Station Cordless Vacuum Cleaner.

-

In January 2024, Samsung Electronics Co., Ltd. announced to launch a new vacuum cleaner rangeBespoke Jet Bot Combo, equipped with advanced artificial intelligence features at CES 2024. This new range is a vacuum and mop robot cleaner that offers steam cleaning and improved AI features to help gain an easier cleaning experience for the customers.

-

In June 2023, Dyson launched the new generation of cord free vacuums with the Dyson Gen5outsize and Gen5detect. The latter is a powerful cordless vacuum that features a fifth-generation Hyperdymium motor, delivering 280 air watts of powerful suction. These machines provide a fully sealed HEPA filtration system designed to collect 99.9% of viruses and 99.99% of particles down to 0.1 microns.

Vacuum Cleaner Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 18.00 billion

Revenue Forecast in 2033

USD 35.37 billion

Growth rate (Revenue)

CAGR of 10.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative (Revenue) units

Revenue in USD Million/Billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, application, region

Regional Scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; South Africa

Key companies profiled

Alfred Karcher SE & Co. KG; BISSELL; CRAFTSMAN; DEWALT; Dreame International (Hongkong) Limited; Dyson; Ecovacs; Emerson Electric Co.; Haier Smart Homes Co. Ltd; iRobot Corporation; Neato Robotics Inc.; Nilfisk Group; Panasonic Corporation; Samsung Electronics Co., Ltd.; Snow Joe LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacuum Cleaner Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the vacuum cleaner market report on the basis of product, distribution channel, application, and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Canister

-

Central

-

Drum

-

Robotic

-

Upright

-

Wet & Dry

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Hospitals

-

Retail Stores

-

Hospitality

-

Shopping Malls

-

Others

-

-

Residential

-

Industrial

-

Manufacturing

-

Food & Beverage

-

Pharmaceuticals

-

Constructions

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vacuum cleaner market size was estimated at USD 16.38 billion in 2025 and is expected to reach USD 18.00 billion in 2026.

b. Some key players operating in the vacuum cleaner market include Alfred Karcher SE & Co. KG; BISSELL; CRAFTSMAN; DEWALT; Dreame International (Hong Kong) Limited; Dyson; Ecovacs; Emerson Electric Co.; Haier Group; iRobot Corporation; Neato Robotics, Inc.; Nilfisk Group; Panasonic Corporation; and Samsung Electronics Co., Ltd.

b. The global vacuum cleaner market is expected to grow at a compound annual growth rate of 10.1% from 2026 to 2033 to reach USD 35.37 billion by 2033.

b. The Asia Pacific region dominated the global vacuum cleaner market, with China being the leading market.

b. Key factors driving growth in the vacuum cleaner market include increasing urbanization and rising standards of cleanliness, leading to higher adoption of advanced home cleaning appliances. Technological innovations such as smart, robotic, and energy-efficient vacuum cleaners are attracting tech-savvy consumers. Additionally, expanding commercial spaces, hospitality sectors, and e-commerce availability are supporting sustained market growth across regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.