- Home

- »

- Advanced Interior Materials

- »

-

Variable Refrigerant Flow System Market Size Report, 2030GVR Report cover

![Variable Refrigerant Flow System Market Size, Share & Trends Report]()

Variable Refrigerant Flow System Market (2025 - 2030) Size, Share & Trends Analysis Report By System Type (Heat Pump, Heat Recovery System), By Capacity, By End use (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-372-8

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Variable Refrigerant Flow System Market Summary

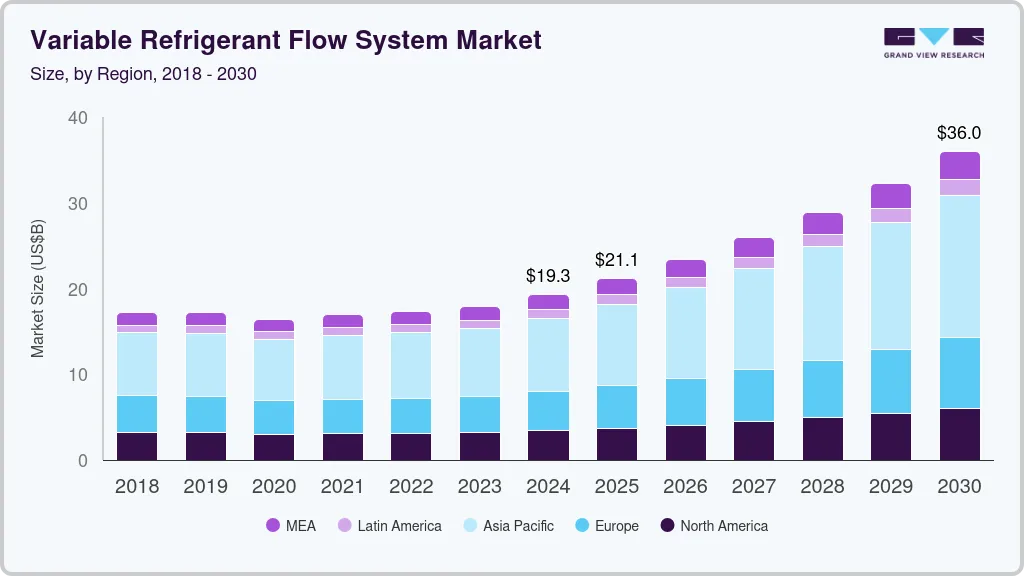

The global variable refrigerant flow system market size was estimated at USD 19,254.0 million in 2024 and is projected to reach USD 35,969.0 million by 2030, growing at a CAGR of 11.2% from 2025 to 2030. The market is primarily driven by several key factors, making it a popular choice for modern heating, ventilation, and air conditioning (HVAC) solutions.

Key Market Trends & Insights

- Asia Pacific variable refrigerant flow system market accounted for 44.5% share of the overall industry in 2023.

- The variable refrigerant flow system market in China is estimated to grow at a significant CAGR of 11.6% over the forecast period.

- By system type, the heat pump segment led the market and accounted for 59.4% of the global revenue share in 2023.

- By capacity, the up to 10 tons segment accounted for 40.2% of the global revenue share in 2023.

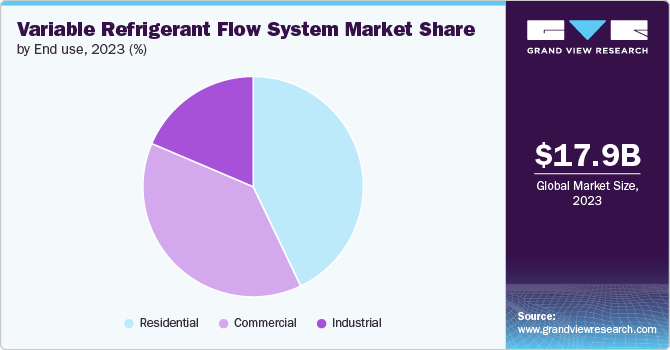

- By end use, the residential segment accounted for 42% of the global market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 19,254.0 Million

- 2030 Projected Market Size: USD 35,969.0 Million

- CAGR (2025-2030): 11.2%

- Asia Pacific: Largest market in 2023

The increasing demand for energy-efficient heating and cooling systems is a major market driver. VRF technology is known for its ability to precisely control the amount of refrigerant flowing to multiple indoor units, optimizing the energy consumption based on the actual needs of each zone or room. This capability reduces energy waste and leads to significant cost savings over time, making variable refrigerant flow (VRF) systems beautiful to environmentally conscious and cost-aware customers.

According to the United Nations by 2050, the world's population will surge to 9.7 billion, marking an increase of 2 billion over the next three decades. This significant growth is driven by higher living standards, longer life expectancies, lower mortality rates, and continuous advancements in medical technologies and treatments. Consequently, there is a global push to launch new housing initiatives to accommodate this increase. This trend is anticipated to drive market expansion positively. The demand for energy-efficient solutions, such as heat pumps, is set to rise in the residential sector, fueled by rapid urbanization and the growing need for such products. Additionally, government policies and tax incentives promoting energy-saving appliances likely to boost demand for these products.

Drivers, Opportunities & Restraints

The growing emphasis on comfortable indoor environments in various types of buildings, from commercial and residential to institutional, further fuels the demand for VRF systems. These systems can provide superior comfort by allowing individualized temperature control in different rooms or zones through a single outdoor unit. This level of customization enhances user comfort and satisfaction, thereby driving the adoption of VRF technology. Additionally, the flexibility and scalability of VRF systems make them ideal for a wide range of applications, including new constructions and retrofit projects. The ease of installation, along with the minimal disruption caused during setup, particularly in retrofit scenarios, positions VRF systems as a preferred choice among building owners and contractors.

Regulatory pressures and incentives also significantly influence the adoption of VRF systems. Governments and international bodies are implementing stricter regulations on energy consumption and greenhouse gas emissions, compelling businesses and homeowners to invest in greener technologies. In many regions, incentives such as tax rebates, grants, and subsidies are offered to encourage the installation of energy-efficient HVAC systems like VRFs. This regulatory environment, combined with growing awareness of the environmental impact of HVAC systems, drives consumers towards VRF technologies, which are perceived as more environmentally friendly and cost-effective in the long run.

One of the primary market restraints for variable refrigerant flow systems is the high initial investment cost. Although VRF systems boast significant energy efficiency and long-term operational cost savings, the upfront expense of purchasing and installing these systems can be prohibitive for some end-users.

System Type Insights

“The demand for heat recovery system segment is expected to grow at a CAGR of 11.4% from 2024 to 2030 in terms of revenue”

The heat pump segment led the market and accounted for 59.4% of the global revenue share in 2023. VRF heat pumps stand out for their energy efficiency, utilizing variable motor speed and refrigerant flow to precisely match the cooling or heating demand of the building, thus reducing energy waste and optimizing operational costs. This efficiency, coupled with the capability for simultaneous heating and cooling in different zones, has made VRF heat pumps increasingly popular in diverse settings, from office buildings and hotels to apartment complexes. The flexibility in design and installation, minimal operational noise, and advanced control features enhance user comfort and convenience, propelling the demand for VRF system heat pumps in the evolving market.

The market is witnessing substantial growth, driven by the increasing demand for energy-efficient climate control solutions in both commercial and residential sectors. Heat recovery systems within the VRF framework elevate energy efficiency by capturing waste heat from cooling processes to heat other parts of the building, thereby significantly reducing the energy consumption and operational costs associated with heating and cooling.

Capacity Insights

“The demand for 11 to 18 tons segment is expected to grow at a CAGR of 11.7% from 2024 to 2030 in terms of revenue”

The up to 10 tons segment accounted for 40.2% of the global revenue share in 2023. These systems offer superior energy efficiency, as they are designed to provide the exact amount of cooling or heating needed at any given time, reducing energy waste and operating costs. Additionally, VRF systems can support multiple indoor units connected to a single outdoor unit, allowing for a customizable approach to temperature control within different zones of a building. This capability, combined with their compact size, makes them particularly attractive for retrofitting in existing buildings where space might be limited, and efficiency improvements are sought.

The 11 to 18 tons capacity segment is the growing need for scalable and flexible HVAC solutions in commercial buildings, such as offices, hotels, and retail spaces. These mid-range VRF systems are particularly well-suited to structures that demand sophisticated climate control solutions across multiple zones or floors without the need for extensive ductwork. Their adaptability allows for individualized comfort settings in different areas while optimizing energy consumption, leading to lower operational costs and improved environmental profiles.

End use Insights

“The demand from commercial end use segment is expected to grow at a significant CAGR of 11.9 % from 2024 to 2030 in terms of revenue”

The residential end use segment accounted for 42% of the global market revenue share in 2023. The residential end-use segment has been witnessing significant growth, driven by the increasing demand for efficient and customizable heating, ventilation, and air conditioning (HVAC) solutions in the residential sector. Homeowners are progressively looking for systems that not only offer superior energy efficiency to reduce utility bills but also provide improved indoor air quality and comfort levels.

The commercial end-use segment is experiencing robust growth, largely fueled by the increasing demand for energy-efficient and flexible heating, ventilation, and air conditioning (HVAC) solutions. Commercial buildings, such as offices, hotels, and shopping centers, are rapidly adopting VRF systems due to their ability to offer precise temperature control, scalability, and reduced operational costs. This growing preference is further supported by a heightened emphasis on sustainability and energy savings in the commercial sector, propelling VRF technology to the forefront of HVAC solutions for commercial applications.

Regional Insights

“China to witness fastest market growth at 11.6% CAGR from 2024 to 2030”

The Asia Pacific region variable refrigerant flow system market is witnessing a remarkable expansion, driven by rapid urbanization, booming construction activities, and increasing awareness about energy-efficient building solutions. Countries like China, Japan, and South Korea are at the forefront, leveraging their technological advancements in HVAC systems and stringent environmental regulations to foster the adoption of VRF systems. This market growth is further propelled by the rising demand for comfortable living conditions and the need for more sophisticated climate control solutions in the growing commercial and residential sectors. Moreover, government initiatives and incentives aimed at reducing carbon footprints and promoting sustainable energy use are encouraging the deployment of VRF systems.

The variable refrigerant flow system market in China is estimated to grow at a significant CAGR of 11.6% over the forecast period. China is experiencing rapid growth, fuelled by the country's swift urbanization, escalating construction activities, and increasing emphasis on energy conservation and emission reduction. As one of the world's largest markets for HVAC systems, China's push towards green building standards and the government's stringent energy efficiency regulations are major catalysts driving the adoption of VRF systems.These systems are favored for their ability to offer precise temperature control, lower energy consumption, and installation flexibility, making them particularly suitable for China's diverse and often space-constrained urban landscapes.

North America Variable Refrigerant Flow System Market Trends

The variable refrigerant flow system market in North America is experiencing significant growth, driven by the region's increasing focus on energy efficiency and the need for flexible HVAC solutions in both commercial and residential sectors. U.S. and Canada are witnessing a surge in the adoption of VRF technologies, spurred by growing environmental awareness, stringent energy regulations, and incentives for green building practices. VRF systems, known for their ability to offer precise temperature control, scalability, and operational efficiency, align well with the North American market's demand for sustainable and cost-effective climate control solutions. Moreover, the versatility of VRF systems in accommodating the unique needs of diverse building types.

Europe Variable Refrigerant Flow System Market Trends

Europe variable refrigerant flow system market is driven by the growing awareness of the benefits of energy-efficient HVAC solutions and the incentives provided by governments for the adoption of greener technologies. Moreover, the expansion of commercial sectors such as hospitality, retail, and offices, alongside the residential sector's need for more advanced climate control solutions, is further propelling the market growth. As Eastern Europe continues to prioritize sustainability and energy efficiency, the VRF system market is expected to see a positive trajectory, contributing to the region's energy goals and economic development

Key Variable Refrigerant Flow System Company Insights:

Some key players operating in the market include Carrier Corporation, Daikin Industries, Ltd., and Haier Group among others.

-

Carrier Corporation, a global leader in high-technology heating, air-conditioning, and refrigeration solutions, is actively expanding its presence in the Variable Refrigerant Flow (VRF) system market. The company is known for its innovation and sustainability, thereby offers a comprehensive range of VRF systems designed to meet the diverse needs of commercial, residential, and industrial sectors. Carrier’s VRF systems are celebrated for their energy efficiency, reliability, and versatility in providing customized climate control solutions.

-

Daikin Industries, Ltd is renowned for its pioneering role in developing and manufacturing variable refrigerant flow (VRF) systems. Daikin's VRF systems, marketed under the brand name VRV (Variable Refrigerant Volume), offer a flexible and scalable solution for a wide range of applications—from residential to large commercial buildings. These systems are distinguished by their advanced inverter technology and intelligent control systems, which optimize energy consumption and ensure precise temperature regulation across multiple zones.

LG Electronics, Johnson Controls, and Mitsubishi Electric Corporation are some emerging market participants in the market.

-

LG Electronics is engaged in the business of consumer electronics and HVAC market. LG's VRF technology is engineered to offer maximum efficiency, flexibility, and control for both commercial and high-end residential applications. The Multi V series is renowned for its energy-saving technologies, incorporating LG’s innovative inverter compressors which enhance operational efficiency and minimize energy consumption.

-

Johnson Controls International plc operates at the forefront of building products and technology, HVAC equipment, and energy storage and management solutions, demonstrating a steadfast commitment to sustainability and innovation. With its foundation rooted in producing the first electric room thermostat, the company has evolved into a global leader, offering a comprehensive array of services and products designed to increase energy efficiency and lower operating costs in buildings of all types.

Key Variable Refrigerant Flow System Companies:

The following are the leading companies in the variable refrigerant flow system market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier Corporation

- Daikin Industries, Ltd.

- Fujitsu

- Haier Group

- Blue Star Limited.

- Hitachi Ltd.

- Johnson Controls

- LG Electronics

- Trane

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- SAMSUNG

Recent Developments

-

In September 2023, Johnson Controls-Hitachi Air Conditioning unveiled a new variable refrigerant flow heat pump, tailor-made for cold weather conditions. This innovative cold-climate heat pump is crafted to provide outstanding heating efficiency and energy savings, even in extremely low temperatures. It stands as a perfect solution for both commercial and residential buildings situated in colder areas.

-

In February 2023, Hitachi introduced the VRF air365 Max HVAC product. The air365 Max is designed to offer unparalleled efficiency and performance, catering to the demanding needs of both commercial and large-scale residential environments.

Variable Refrigerant Flow System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21,140.3 million

Revenue forecast in 2030

USD 35,969.0 million

Growth rate

CAGR of 11.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

System type, capacity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Carrier Corporation; Daikin Industries, Ltd.; Fujitsu; Haier Group; Blue Star Limited.; Hitachi Ltd.; Johnson Controls; LG Electronics; Mitsubishi Electric Corporation; Rheem Manufacturing Company; SAMSUNG; Trane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Variable Refrigerant Flow System Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global variable refrigerant flow system market based on the system type, capacity, end use, and region:

-

System Type Outlook (Revenue, USD Million, 2018 -2030)

-

Heat Pump

-

Heat Recovery System

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 10 Tons

-

11 to 18 Tons

-

19 to 26 Tons

-

Above 26 Tons

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global variable refrigerant flow system market size was estimated at USD 17.87 billion in 2023 and is expected to reach USD 19.25 billion in 2024.

b. The global variable refrigerant flow system market, in terms of revenue, is expected to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 35.97 billion by 2030.

b. Asia Pacific dominated the variable refrigerant flow system market with a revenue share of 44.5% in 2023. The market driven by rapid urbanization, booming construction activities, and increasing awareness about energy-efficient building solutions. Countries like China, Japan, and South Korea are at the forefront, leveraging their technological advancements in HVAC systems and stringent environmental regulations to foster the adoption of VRF systems.

b. Some of the key players operating in the variable refrigerant flow system market include Carrier Corporation; Daikin Industries, Ltd.; Fujitsu; Haier Group; Blue Star Limited.; Hitachi Ltd.; Johnson Controls; LG Electronics; Mitsubishi Electric Corporation; Rheem Manufacturing Company; SAMSUNG; Trane

b. The variable refrigerant flow system market is primarily driven by several key factors, making it a popular choice for modern heating, ventilation, and air conditioning (HVAC) solutions. Firstly, the increasing demand for energy-efficient heating and cooling systems is a major market driver.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.