- Home

- »

- Medical Devices

- »

-

Vascular Imaging Market Size, Share & Growth Report, 2030GVR Report cover

![Vascular Imaging Market Size, Share & Trends Report]()

Vascular Imaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Modality (CT, MRI, Ultrasound, Nuclear Medicine), By End-Use (Hospitals, Imaging Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-020-0

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vascular Imaging Market Size & Trends

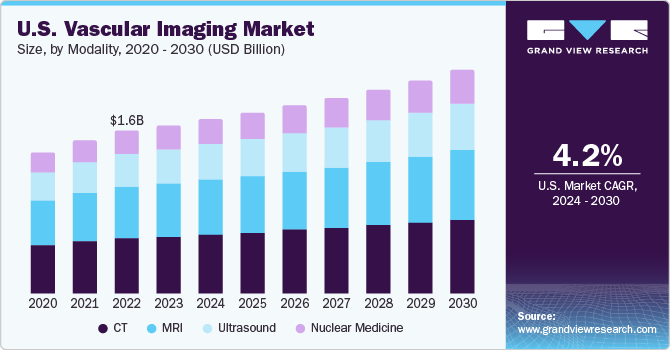

The global vascular imaging market size was valued at USD 6.43 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.19% from 2024 to 2030. Increasing incidences of diabetes, hypercholesterolemia, and hypertension are the main factors anticipated to fuel market expansion during the projected period. These illnesses raise the risk of vascular diseases, which are the main uses for vascular imaging technology, and include carotid blockage, aneurysms, deep vein thrombosis, and atherosclerosis.

The number of vascular imaging procedures in both developed and developing countries is predicted to rise significantly due to the growing adoption of preventive healthcare practices and increased awareness of the importance of early diagnosis and intervention to reduce mortality and morbidity. Furthermore, it is expected that ongoing technological advancements aimed at delivering safer diagnoses with the shortest turnaround times and maximum efficiency are anticipated to impact market growth significantly. To enhance patient satisfaction, sophisticated CT scanners feature sensitive detectors and dual sources able to scan quickly and effectively with minimal radiation exposure.

The field of vascular research is broad and multifaceted, to improve fundamental imaging parameters such as field-of-view, signal-to-noise ratio, conspicuity, and temporal and spatial resolution. Vascular imaging techniques are moving toward quantification, although the vascular system can still be assessed qualitatively and quantitatively. In addition to enhancing the traditional flow metrics of velocity and volume flow, novel metrics like flow complexity and vorticity, perfusion, and vessel density and tortuosity are being studied. As more sophisticated imaging techniques have been developed, the emphasis on flow visualization and assessment has increased, as this special edition reflects. Therefore, new techniques for vascular imaging are expected to enhance patient outcomes by providing new insights into pathology and enabling faster, more accurate diagnosis. Thus, growing research in the field of vascular imaging is expected to drive market growth over the forecast period.

Moreover, the market is driven by increased use of vascular imaging modalities in trauma cases and pre-, post-, and intraoperative procedures. For example, pre-operative coronary vascular imaging can indicate whether stenting is necessary. In contrast, post-operative vascular images can provide insight into the success of the cardiac grafts or stenting that was done. Coronary artery bypass grafting (CABG) is the most widely used cardiac surgery procedure globally, accounting for 200,000 isolated cases annually in the U.S. and 62 incidences per 100,000 people on average in Western European nations. Thus, a rising number of heart-related surgeries like CABG is projected to propel market.

Market Concentration & Characteristics

The market is characterized by moderate-to-high levels of innovation, including the frequent development and introduction of novel techniques and diagnostic technologies like CT and MRI scans, define the global vascular imaging market. Industry participants are investing in innovative techniques and technologies to meet the global demand of vascular imaging.

The market is also characterized by the leading players' moderate levels of merger and acquisition (M&A) activity. Market players like GE Healthcare, Abbott, Koninklijke Philips N.V., and Hologic Inc. are involved in merger and acquisition activities. Through strategic activities like M&A, partnership, and collaboration, these companies can expand their geographic reach and enter new territories.

Stricter regulations for medical imaging devices have been emphasized increasingly by regulatory bodies like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). This covers vascular imaging technologies, guaranteeing quality, safety, and efficacy standards. Global regulatory standards are being standardized to expedite the approval process for vascular imaging devices. This is meant to help manufacturers enter the market more quickly while upholding strict guidelines for patient safety and product quality.

A wide range of substitute products for vascular imaging are accessible to fulfill the varied imaging requirements of patients. For example, blood flow can be measured non-invasively using Doppler ultrasonography. Blood flow direction and velocity are determined by Doppler ultrasound by measuring the frequency shift of sound waves reflected by moving blood cells.

The end-user concentration factor is crucial for any company in the vascular imaging space. Vascular imaging technologies are highly utilized by hospitals. These facilities use imaging modalities for monitoring vascular conditions in different patient populations, interventional procedures, and diagnostic purposes.

Modality Insights

The nuclear medicine segment dominated the market and accounted for 32.88% of the global revenue in 2023. Nuclear medicine is one of the most ideal modalities for non-invasive molecular imaging of vascular inflammation because of its high sensitivity for tissue probe detection. Furthermore, it is the most popular radiopharmaceutical for molecular imaging of vascular inflammatory diseases, including atherosclerosis and large-vessel vasculitis. In recent years, positron emission tomography (PET) imaging has become a potent tool for identifying and tracking non-invasively inflammatory activities. However, it has several drawbacks, such as poor specificity and a strong background in various localizations.

CT (computed tomography) scan is expected to register the fastest CAGR during the forecast period. In many vascular disorders, dynamic CT angiography (CTA) offers helpful, temporal resolution dynamic information, especially when MRI is impossible due to contraindications or artifacts. Dynamic CTA is frequently used in vascular imaging to detect vascular malformations, peripheral arterial disease, and endoleaks. The growing application of CT scans in vascular imaging is expected to boost market growth.

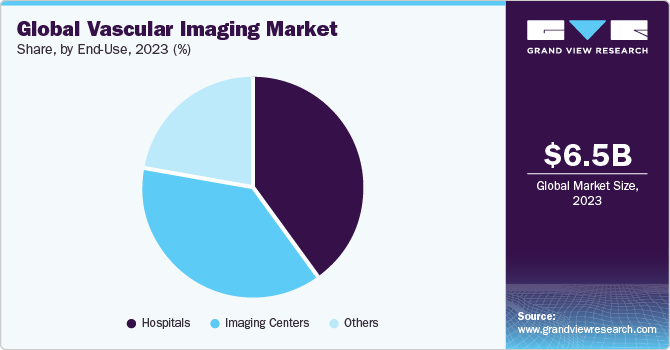

End-Use Insights

Hospitals accounted for largest market revenue share in 2023. Large patient pools, financial resources for purchasing innovative equipment, and intense competition among healthcare providers contribute to this market segment's growth. Furthermore, the need for vascular imaging modalities in emergency departments will increase due to the rise in hospital emergency admissions for ailments like chest pain, stroke, and abdominal discomfort. Acute chest pain causes over 7.6 million emergency admissions in U.S. annually, according to UpToDate reports. To prevent complications, this condition needs to be diagnosed quickly and accurately. Hence, the demand for portable and rapid imaging devices is expected to increase in the coming years.

Imaging Centers is expected to register the fastest CAGR during the forecast period. The growth of the segment is attributed to several factors, including the existence of diagnostics accreditation boards, the low cost of CT/MRI scans, and improving accessibility in developing nations like China and India.

Regional Insights

North America dominated the market and accounted for a 33.24% share in 2023. The region's growth is anticipated to be fueled by the presence of major players, rising stroke incidence, simplified reimbursement policies, and prevalence of cardiovascular disorders. The U.S. accounted for the largest share of the North American region in 2023. This can be attributed to the increased cardiovascular health programs for diagnosis and treatment and well-established diagnostic infrastructure.

Asia Pacific is anticipated to witness significant growth in the market. This growth is driven by several factors, such as the rising prevalence of cardiovascular diseases, obesity, and diabetes. This is mostly because risky behaviors like drinking alcohol, smoking, eating poorly, and adopting sedentary lifestyles are becoming more common. China dominates vascular imaging market in Asia Pacific region in 2023. This dominance is attributed to the high prevalence of CVD and the large patient pool. According to NCBI reports, it was estimated that around 330 million people in China were affected by CVD.

Key Vascular Imaging Market Company Insights

Some of the key players operating in the market include Abbott Laboratories, GE Healthcare, Koninklijke Philips N.V., and Hologic Inc. These companies have a large geographic presence and operate in more than 100 countries. They have a strong product portfolio and are engaged in strategic such as acquisitions, partnerships, collaborations, and new product development to maintain their dominating market share.

Some of the emerging market players include Carestream Health Inc., AngioDynamics, Pie Medical Imaging,and Arterys (Acquired by Tempus Labs). These players are focused on developing innovative technologies such as integration of AI to make their product standout.

Key Vascular Imaging Companies:

The following are the leading companies in the vascular imaging market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these vascular imaging companies are analyzed to map the supply network.

- Siemens Healthineers

- Abbott Laboratories

- GE Healthcare

- Koninklijke Philips N.V.

- Hitachi Medical Corporation

- Samsung Medison Co., Ltd

- Shimadzu Corporation

- Hologic Inc.

- Carestream Health Inc.

Recent Developments

-

In October 2023, Abbott launched Ultreon 1.0 Software in India. This software combines optical coherence tomography (OCT) with artificial intelligence (AI) power.

-

In November 2023, BD launched its new advanced ultrasound system SiteRite 9 for helping with vascular access device placement.

-

In August 2023, GE Healthcare launched Vscan Air SL, a handheld, wireless ultrasound imaging system for rapidly assessing vascular and cardiac patients. This approval is expected to drive market growth in both regions.

Vascular Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.66 billion

Revenue forecast in 2030

USD 8.52 billion

Growth Rate

CAGR of 4.19% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthineers; Abbott Laboratories; GE Healthcare; Koninklijke Philips N.V..; Hitachi Medical Corporation; Samsung Medison Co., Ltd; Shimadzu Corporation; Hologic Inc.; Carestream Health Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vascular Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vascular imaging market report based on modality, end-use, and region.

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

CT

-

MRI

-

Ultrasound

-

Nuclear Medicine

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Increasing incidences of diabetes, hypercholesterolemia, and hypertension are the main factors anticipated to fuel market expansion during the projected period.

b. The global vascular imaging market size was estimated at USD 6.43 billion in 2023 and is expected to reach USD 6.66 billion in 2024.

b. The global vascular imaging market is expected to grow at a compound annual growth rate of 4.19% from 2024 to 2030 to reach USD 8.52 billion by 2030.

b. The nuclear medicine segment dominated the market and accounted for 32.88% of the global revenue in 2023. Nuclear medicine is one of the most ideal modalities for non-invasive molecular imaging of vascular inflammation because of its high sensitivity for tissue probe detection.

b. Some key players operating in the vascular imaging market include Siemens Healthineers; Abbott Laboratories; GE Healthcare; Koninklijke Philips N.V..; Hitachi Medical Corporation; Samsung Medison Co., Ltd; Shimadzu Corporation; Hologic Inc.; Carestream Health Inc..;

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.