- Home

- »

- Consumer F&B

- »

-

Vegan Food Market Size And Share, Industry Report, 2033GVR Report cover

![Vegan Food Market Size, Share & Trends Report]()

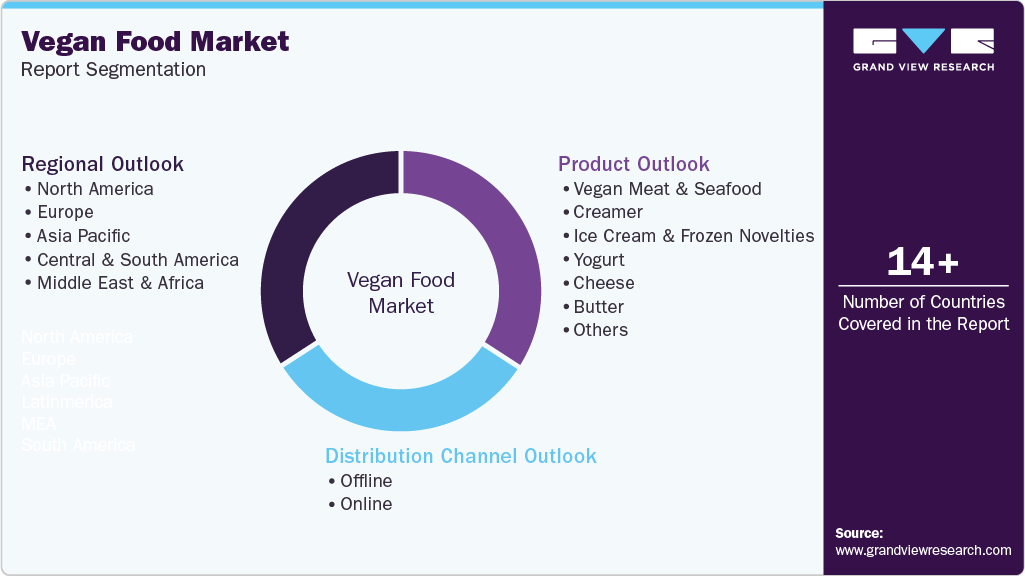

Vegan Food Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Vegan Meat & Seafood, Creamer, Yogurt, Cheese, Butter, Meals, Protein liquids And powders, Protein Bars), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-103-0

- Number of Report Pages: 83

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Food Market Summary

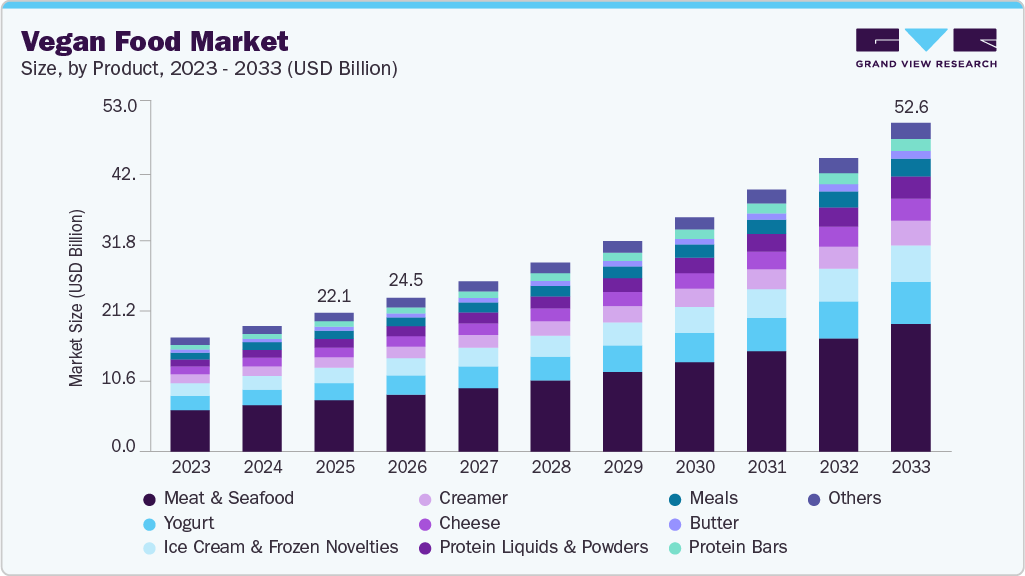

The global vegan food market size was estimated at USD 22.14 billion in 2025 and is projected to reach USD 52.56 billion by 2033, growing at a CAGR of 11.5% from 2026 to 2033. As more consumers become aware of the links between diet and chronic diseases such as cardiovascular disease, type 2 diabetes, and certain cancers, plant-based diets are increasingly viewed as a cleaner and healthier alternative.

Key Market Trends & Insights

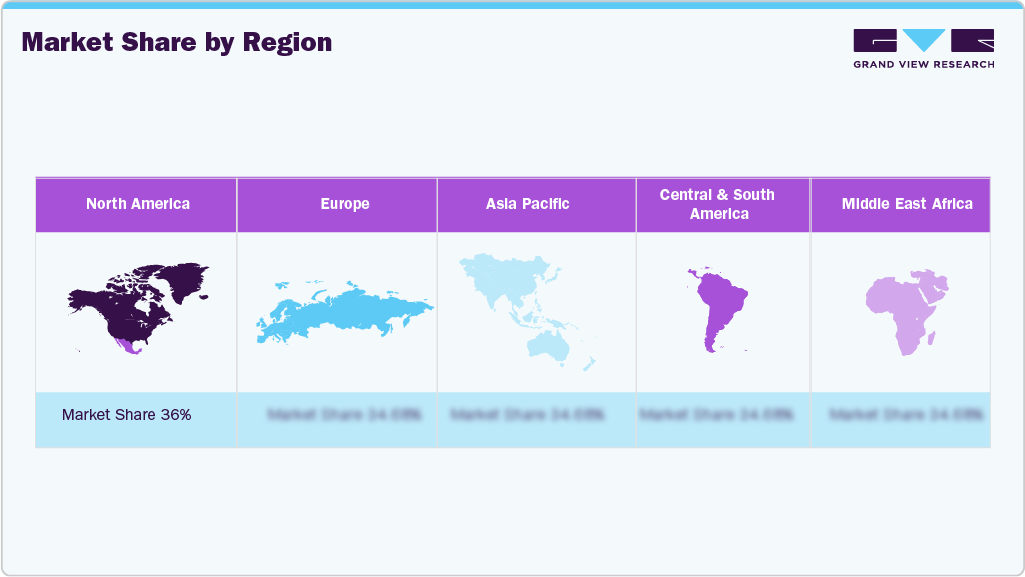

- By region, North America led the market with a share of 36.8% in 2025.

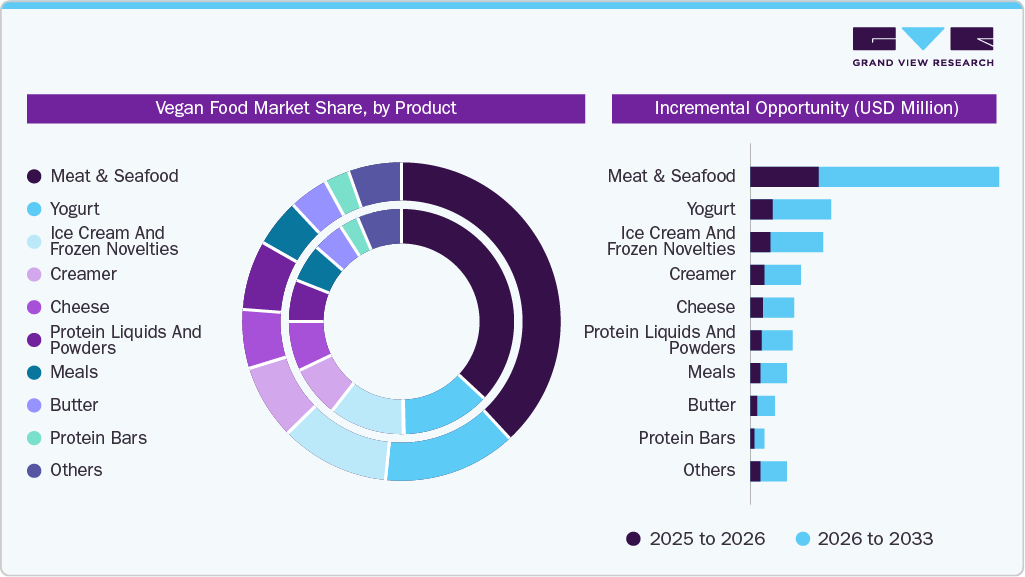

- By product, vegan meat & seafood segment led the market and accounted for a share of 36.9% in 2025.

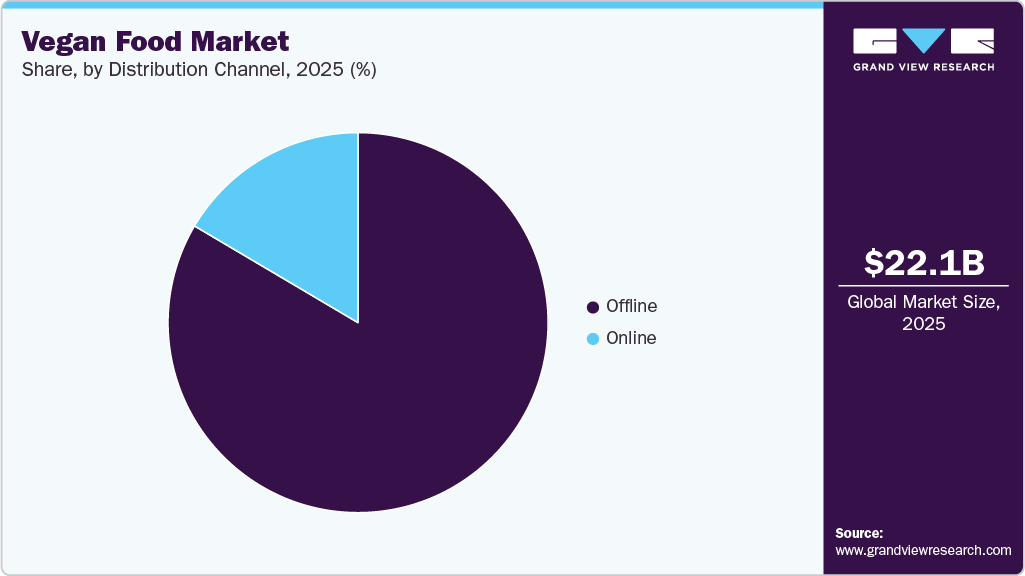

- By distribution channel, offline segment led the market and accounted for a share of 83.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 22.14 Billion

- 2033 Projected Market Size: USD 52.56 Billion

- CAGR (2026-2033): 11.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Studies citing the benefits of higher fiber intake, lower saturated fats, and nutrient-dense plant foods have accelerated this perception. Meanwhile, intolerances such as lactose sensitivity and dairy allergies are pushing consumers to naturally shift toward plant-based milks, yogurts, and cheeses, making vegan diets an accessible solution for many. Environmental and sustainability concerns are another powerful catalyst behind the rise of vegan food. Public awareness about climate change, greenhouse gas emissions, water consumption, and land degradation linked to livestock farming has grown rapidly. As sustainability moves from an activist space to a mainstream value, consumers especially in urban and developed markets are consciously reducing their reliance on animal products. Vegan food is increasingly framed as a “planet-friendly” option, and this association has become one of the strongest motivations among environmentally conscious buyers, particularly Millennials and Gen Z.

Ethical and animal-welfare considerations have also gained visibility in recent years. Media exposure around factory farming, industrial livestock practices, and the ethics of animal cruelty has made many consumers uncomfortable with traditional meat and dairy production systems. While a small proportion of the population identifies as strict vegans for ethical reasons, a much larger group, often labelled as “flexitarian,” avoids or reduces meat consumption for moral reasons while still purchasing vegan alternatives regularly. This shift has widened the addressable market far beyond the vegan community.

The rapid improvement in product quality and innovation has played an equally important role. Earlier plant-based alternatives often struggled with taste and texture, but food-tech advancements, fermentation technologies, and new processing techniques have dramatically improved the sensory experience of vegan products. This has led to broader retail adoption, with supermarkets, quick-service restaurants, cafés, and even gourmet establishments offering high-quality vegan options. Accessibility is now easier than ever: online grocery platforms, D2C vegan brands, and subscription-based meal services have expanded availability, making trial and adoption frictionless.

Consumer Insights

Consumer interest in vegan food has risen sharply in recent years, driven primarily by a growing emphasis on personal health and wellness. Many buyers now perceive plant-based foods as cleaner, lighter, and better suited for long-term health, particularly for managing weight, improving digestion, and reducing risks linked to animal-based diets such as high cholesterol or cardiovascular disease. Younger consumers, especially Gen Z and Millennials, associate vegan diets with holistic wellness rather than strict dietary rules, and therefore integrate vegan meals into their weekly routines even if they are not fully vegan.

The rise of flexitarianism is perhaps the most influential trend in the vegan food market today. Most people purchasing vegan products are not strict vegans; rather, they are flexitarians who are seeking to reduce meat intake without eliminating it entirely. They opt for vegan foods for convenience, variety, and taste, and because modern plant-based alternatives are far more advanced in texture, flavor, and nutritional profile than they were even five years ago. The rapid improvement and innovation in plant-based meats, dairy alternatives, and ready meals have significantly lowered the barrier for mainstream adoption.

The growth of veganism is also supported by social factors, with influencers, athletes, and celebrities promoting plant-based lifestyles through digital platforms. This continuous visibility makes vegan eating feel modern, aspirational, and aligned with global lifestyle trends. Meanwhile, the affordability and availability of vegan options have improved, with supermarkets, quick-service restaurants, and convenience stores offering dedicated plant-based ranges that cater to both health-conscious and price-sensitive consumers.

Country

Vegan Population (%)

Total Vegans

India

9%

121,500,000

Mexico

9%

11,250,000

UK

4.7%

2,500,000

Germany

4%

1,660,000

U.S.

2%

5,000,000

Source: World Population Review

As urbanization accelerates and dietary habits become more health-conscious and convenience-oriented, many consumers are seeking alternatives that align with both wellness goals and ethical values. Busy schedules, long working hours, and the rising participation of women in the workforce have reduced the time available for traditional meal preparation, making plant-based ready meals, dairy alternatives, and vegan snacks increasingly attractive. These products offer a convenient way to incorporate nutritious, plant-based eating into everyday routines without the need for elaborate cooking.

Product Insights

The vegan meat & seafood food products segment dominated the market with a share of 36.9% in 2025, as consumers seek products that replicate the taste, texture, and culinary versatility of traditional animal proteins without the associated health, ethical, or environmental concerns. Many flexitarian consumers who are not fully vegan but aim to reduce meat consumption are driving this growth by actively choosing plant-based substitutes that allow them to maintain familiar eating habits while adopting a healthier or more sustainable lifestyle. Advances in food technology have also enabled manufacturers to create highly realistic plant-based meat and seafood analogs, making these products more appealing and accessible across mainstream retail and foodservice channels.

The protein liquids and powders segment is predicted to grow at a CAGR of 11.9% from 2026 to 2033. Many individuals adopting vegan or flexitarian diets seek convenient, high-quality protein sources to support muscle recovery, weight management, and overall wellness. Plant-based protein formats such as pea, soy, rice, and mixed-blend powders are perceived as clean, allergen-friendly, and environmentally sustainable, aligning with broader lifestyle trends around ethical eating and reduced animal-product consumption. Moreover, the rise of sports nutrition, meal-replacement drinks, and on-the-go functional beverages has further accelerated demand for vegan protein formats that can be easily incorporated into daily routines.

Distribution Channel Insights

Sales of vegan food through the offline channel accounted for a share of 83.5% in 2025. Demand for vegan food is increasing through offline channels as consumers become more health-conscious and actively seek plant-based options during routine grocery trips. Supermarkets, specialty stores, and hypermarkets have expanded their vegan assortments, making these products more visible and accessible on shelves. In-store placement, sampling, and dedicated vegan aisles further influence impulse purchases and encourage trial. Additionally, many consumers still prefer offline shopping for food categories where they want to check freshness, ingredients, and packaging in person, which supports higher offline adoption of vegan and plant-based products.

In terms of revenue, the online distribution channel is expected to grow at a CAGR of 11.8% from 2026 to 2033. The demand for vegan food is increasing online as consumers become more health-conscious, environmentally aware, and open to plant-based lifestyles. E-commerce platforms make it easier for shoppers to access a wider variety of vegan products, many of which may not be available in local supermarkets, while offering detailed product information, reviews, and transparent ingredient lists that support informed decision-making. Additionally, the rise of social media, digital influencers, and recipe content has accelerated interest in plant-based eating, encouraging consumers to try new products and order them conveniently through online channels.

Regional Insights

North America Vegan Food Market Trends

The North American vegan food market accounted for a share of 36.8% in 2025. Consumers are becoming more aware of the links between plant-based diets and improved health outcomes, including lower risks of heart disease, obesity, and diabetes. At the same time, heightened focus on sustainability and climate impact has encouraged many households to reduce meat consumption and explore plant-based alternatives. The rapid expansion of high-quality vegan products in supermarkets and foodservice, from meat analogues to dairy-free beverages, has also made adoption easier and more accessible. In addition, a growing number of younger consumers in the U.S. and Canada identify as flexitarian, seeking plant-forward diets without fully eliminating animal products, which has significantly broadened the addressable market for vegan foods.

U.S. Vegan Food Market Trends

Growing awareness of the health benefits of plant-based diets, such as improved heart health and weight management, has encouraged more Americans to reduce or eliminate animal products. At the same time, concerns about environmental impact, including carbon emissions and resource use associated with livestock production, are pushing consumers toward more sustainable food choices. Additionally, the availability of tastier, more convenient plant-based alternatives in supermarkets, restaurants, and fast-food chains has normalized vegan options, making them accessible to a broader audience.

Europe Vegan Food Market Trends

Europe vegan food market is expected to grow at a CAGR of 11.8% from 2026 to 2033. The demand for vegan food in Europe has been increasing steadily, driven by rising health consciousness, environmental awareness, and ethical considerations among consumers. A growing share of Europeans is shifting toward plant-based diets to reduce carbon footprints and improve long-term well-being. According to the Smart Protein Project, 22% of European consumers purchased more plant-based foods in 2023 than the previous year, with the highest adoption seen in Germany, the UK, and the Netherlands.

Asia Pacific Vegan Food Market Trends

Asia Pacific is expected to register the fastest CAGR of 12.3% from 2026 to 2033, primarily driven by growing health consciousness, increasing lactose intolerance awareness, and a strong shift toward plant-forward lifestyles among younger consumers. Urban millennials in countries such as China, India, Australia, and South Korea are adopting vegan and flexitarian diets as cleaner, more sustainable alternatives, while social media and celebrity influence continue to accelerate the trend. This shift is reinforced by concerns around food safety and animal welfare, particularly in China and Southeast Asia. In addition, over 60% of consumers in markets such as India and China report actively reducing meat consumption, highlighting a broad structural shift toward plant-based eating in the region.

Key Vegan Food Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the vegan food market. Players in the market are diversifying their service offerings in order to maintain market share.

Key Vegan Food Companies:

The following key companies have been profiled for this study on the vegan food market.

- Amy's Kitchen

- Danone S.A

- Daiya Foods Inc.

- Beyond Meat

- Tofutti Brands Inc.

- Plamil Foods Ltd

- VBites Foods Limited

- Eden Foods Inc.

- VITASOY International Holdings Limited

- SunOpta

Recent Developments

-

In November 2025, Eat Just launched its new vegan chicken called Just Meat, made from wheat and soy protein, in over 3,000 Walmart stores across the US after outperforming regular chicken in taste tests. The product offers 24g protein per 100g, is available in four flavors, and will soon expand to foodservice locations. Eat’s Just Egg, a popular plant-based egg, is set to launch in Europe in January, and the company continues to focus on expanding its cultivated chicken and protein powder offerings.

-

In April 2025, Vegan Food Group (VFG) and Eat Just have formed a new partnership in which VFG will exclusively manufacture and supply Eat Just’s plant-based egg product "Just Egg" across Europe, backed by an £11.25 million investment in advanced automation and production facilities in Germany and the UK. Commercial production is set to start in late 2025, aiming to meet rising demand for innovative, sustainable plant-based foods in the European market.

Vegan Food Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 24.50 billion

Revenue forecast in 2033

USD 52.56 billion

Growth rate

CAGR of 11.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia & New Zealand; South Africa; Brazil

Key companies profiled

Amy's Kitchen; Danone S.A; Daiya Foods Inc.; Beyond Meat; Tofutti Brands Inc.; Plamil Foods Ltd; VBites Foods Limited; Eden Foods Inc.; VITASOY International Holdings Limited; SunOpta

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Food Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the vegan food market based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vegan Meat & Seafood

-

Creamer

-

Ice cream and frozen novelties

-

Yogurt

-

Cheese

-

Butter

-

Meals

-

Protein liquids and powders

-

Protein Bars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vegan food market size was estimated at USD 22.14 billion in 2025 and is expected to reach USD 24.50 billion in 2026.

b. Some key players operating in the vegan food market include Amy's Kitchen, Danone S.A, The Archer Daniels Midland Company, Daiya Foods Inc., Beyond Meat, Tofutti Brands Inc., Plamil Foods Ltd, VBites Foods Limited, Eden Foods Inc., and VITASOY International Holdings Limited

b. Key factors that are driving the market growth include increasing awareness about the benefits of following vegan diet and growing awareness about animal health and animal cruelty in the food industry.

b. The global vegan food market is expected to grow at a compound annual growth rate of 11.5% from 2026 to 2033 to reach USD 52.56 billion by 2033.

b. The vegan meat & seafood segment dominated the vegan food products market with a share of 36.9% in 2025, as consumers seek products that replicate the taste, texture, and culinary versatility of traditional animal proteins without the associated health, ethical, or environmental concerns. Many flexitarian consumers who are not fully vegan but aim to reduce meat consumption are driving this growth by actively choosing plant-based substitutes that allow them to maintain familiar eating habits while adopting a healthier or more sustainable lifestyle.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.