- Home

- »

- Automotive & Transportation

- »

-

Vehicle Tracking System Market Size & Share Report, 2030GVR Report cover

![Vehicle Tracking System Market Size, Share & Trends Report]()

Vehicle Tracking System Market (2023 - 2030) Size, Share & Trends Analysis Report By Vehicle Type, By End Use, By Technology, By Type, By Component, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-822-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vehicle Tracking System Market Summary

The vehicle tracking system market size was estimated at USD 21.54 billion in 2022 and is projected to reach USD 60.89 billion by 2030, growing at a CAGR of 14.1% from 2023 to 2030. The rising adoption of advanced technology and growing concern for the security and safety of vehicles are factors driving the market's growth.

Key Market Trends & Insights

- The North America dominated the market with the largest revenue share of 32.7% in 2022.

- The Asia Pacific is expected to grow at the fastest CAGR of 17.7% during the forecast period.

- Based on technology, the GPS/satellite segment held the largest market share of 49.8% in 2022.

- Based on vehicle type, the passenger vehicles segment accounted for the largest revenue share of over 43.1%.

- Based on type, the active segment accounted for the largest share of around 84.3% of the market in 2022.

- Based on component, the software segment held a considerable market share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 21.54 Billion

- 2030 Projected Market Size: USD 60.89 Billion

- CAGR (2023-2030): 14.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The rise in fleet operations in emerging nations, coupled with government regulations to install vehicle tracking devices in passenger and commercial vehicles, is fueling the growth. Furthermore, the growing adoption of car leasing and rental services has compelled rental companies to integrate tracking devices to enhance their services, further driving the market's growth.

The increase in the number of road accidents has led fleet management companies and government authorities to make installing tracking devices in all vehicles to track their location and speed mandatory. Additionally, the rising uptake of the intelligent transport system and the emergence of 5G into vehicle connectivity are anticipated to propel market growth. The increasing demand for semi-autonomous and autonomous vehicles also contributes to the demand for advanced and standard vehicle tracking systems.

In early 2020, the outbreak of the COVID-19 pandemic brought unprecedented challenges for industries around the world. To contain the aggressive spread of the virus, governments worldwide have to introduce lockdown and social distancing mandates. The lockdowns forced industries such as the automotive industry to halt manufacturing, assembly, and production in Europe, America, and Asia. The lockdown also negatively impacted the demand for passenger and commercial vehicles. The vehicle tracking system software and hardware production also experienced the impact induced by low demand for the product.

In 2021, as the lockdown mandates were lifted owing to COVID-19's subsiding effects, the demand for automobiles witnessed a surge, creating a demand for vehicle tracking system technologies. Still, the demand surge was met with a disrupted supply chain of semiconductor chips. Regardless of vehicle type, the semiconductor's chips are integral to the vehicle tracking system. The absence of semiconductor chips resulted in a production timeline delay. Therefore, the pandemic and the repeated supply chain and production disruption caused a restriction in the growth of the vehicle tracking system market.

Over time, as business and trade started expanding beyond regional boundaries, the import and export of different cargo also increased by volume. The growing volume of trade worldwide has also upsurged the need for a commercial vehicle fleet dedicated to logistics. The major market participants are dedicating resources to developing products that provide seamless fleet management to companies. For instance, Geotab has developed fleet maintenance software that uses predictive analytics by analyzing data to identify potential and critical mechanical issues and prioritize repairs. The software studies and compares data from engines and other components using sensors to predict the issues that might occur.

The software then alerts the fleet owners with a detailed record of the component problem. This helps the fleet owner to optimize time management and reduce repair expenditure. The software also notifies the owner about possible wear and tear caused due to hard driving, irregular maintenance, and adverse weather conditions. The software shows the record of the health level of each fleet vehicle, indicating any wear and beyond a certain level. The software also provides remote diagnostics and schedules fleet maintenance cycles and expenditure reports. Applying software coupled with sensors creates a smooth operation and maintenance cycle, which helps decrease downtime and operational costs.

The application of vehicle tracking systems is not only restricted to road transportation, but technological modification in tracking technology has also expanded its usage to the aviation industry. Aviation not only facilitates passenger transportation, but it also supports trade worldwide. However, logistics service through air transport is also an affair that involves cargo worth billions being imported and exported between different countries. This has prompted the major players to develop a comprehensive vehicle and asset monitoring and tracking system dedicated to air transportation while driving market growth.

Teltonika has developed its vehicle tracking device, which supports the NB IoT and LTE M1 connectivity. It is equipped with Bluetooth to connect with external devices and low-energy sensors, which helps track the ground support vehicle effortlessly. The sensors help gather combined and analyzed data with location details to provide accurate monitoring without any discrepancies. The Bluetooth low-energy radio transmitter beacons are also implemented for tracking indoor positions of airport fleets, which helps in theft protection and decreases asset search time.

The increase in data privacy violations is the major reason discouraging end-user from using vehicle tracking systems, as the data contains personal information such as driver and vehicle details and routes traveled are restraining the market growth. Furthermore, the rise in data privacy violations is preventing end-users from utilizing vehicle tracking systems, as the data comprises personal information such as driver and vehicle details and the route followed. Due to a lack of cellular or wireless network connectivity, GPS and cellular-based trackers fail, and the R&D costs connected with the system act as a barrier for new market competitors.

Moreover, rising environmental concerns usually lead to unclear communication and poor user experience. As a result, vehicle tracking devices are rarely used. The growing environmental issues frequently result in muddled communication, which leads to a bad user experience. As a result, the use of vehicle tracking systems is limited. These tracking systems use GPS, if an object is within its path, it diverges the signal, resulting in a poor connection. These factors restrain the growth of the market for vehicle tracking systems.

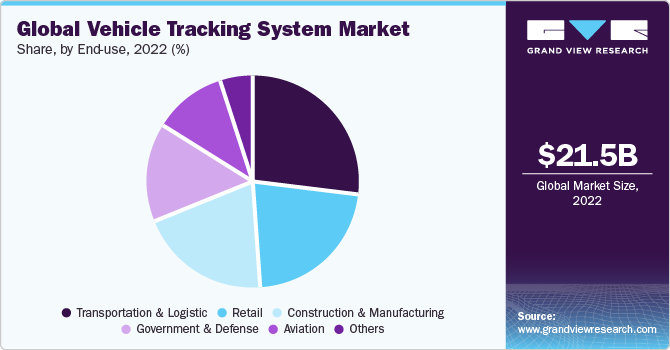

End-use Insights

The transportation & logistics segment dominated the market with the highest revenue share of 27.3% in 2022 and is anticipated to register the fastest CAGR of 18.0% over the forecast period. This can be attributed to the increasing fleet size and fleet operators; the usage of a global positioning system for logistics and transportation tracking worldwide has seen an application surge.

The vehicle tracking system offers advantages such as fleet management, ensuring the safety of the driver and the cargo, enhancing efficiency due to real-time traffic alerts and accurate route planning, monitoring fuel levels, distance traveled, and speed of the vehicles, and managing administrative costs. The advantages provided by the system create a positive impact on the growth of the market.

The retail segment is expected to witness a significant CAGR of 14.4% over the forecast period. The ever-growing influence and dependence on e-commerce have prompted retail companies to expand their delivery services and deliver fleets based on their delivery region parameter. The e-commerce delivery companies use the tracking system to gather data for creating delivery timelines, operation cost optimization, and enhanced productivity.

Technology Insights

Based on technology, the market is segmented into GPS/ satellite, GPRS/ cellular network, and dual-mode. The GPS/satellite segment held the largest market share of 49.8% in 2022and is expected to register the fastest CAGR of 15.9% over the forecast period. The growth can be accredited to a surge in commercial vehicle sales and cloud technology and IoT adoption in the healthcare, automotive, logistics, and defense industries. The compatibility of GPS with network technologies such as WiMAX, GSM, and LTE. Furthermore, the changes in the size of the GS tracker, which has a longer battery life and application along with durability, are also propelling the growth.

The dual mode segment is expected to register a significant CAGR over the forecast period. The dual-mode application offers both GPS and GPRS-based tracking systems. The dual-mode technology is inexpensive, easy to install, and establishes reliable connectivity between the server and vehicle tracking device. This factor is expected to contribute to the segment's growth over the forecast period.

Regional Insights

North America dominated the market with the largest revenue share of 32.7% in 2022. Intelligent systems' emergence has led to the adoption of fleet management technologies. Furthermore, growing concerns over carbon emissions and awareness of vehicle fleet and cargo technology. The mandatory norms over safety norms by the government are also driving the market growth.

The Asia Pacific is expected to grow at the fastest CAGR of 17.7% during the forecast period. Factors such as technological iteration in networking, a surge in commercial and passenger vehicle sales, stringent government mandates, the growing popularity of the e-commerce sector in the region, and increasing trade activities are driving the market growth. Moreover, the rising acceptance of technologies such as cloud, IoT, connected cars, and autonomous vehicles in the region further drives the market growth.

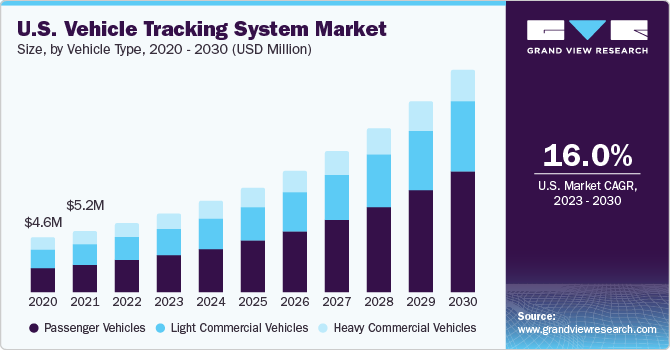

Vehicle Type Insights

The passenger vehicles segment accounted for the largest revenue share of over 43.1%. The segment also is expected to register the fastest CAGR of 17.1% over the forecast period. Using a tracking system by app-based transportation car leasing and renting businesses such as Ola; Uber; Careem; and Lyft, Inc., for smooth operational control is driving the segment's growth. The tracking system enables the companies to gather data such as average speed and distance traveled number of rides per day, and idle time to improve operational efficiency and profitability.

The light commercial vehicles segment is projected to register a significant CAGR over the forecast period. The increased logistic shipments across domestic and international borders via road transport are expected to contribute to this growth. Commercial vehicles for delivery services, trading, and courier services are further expected to propel the demand for tracking systems. The tracking system is especially useful when transporting high-value assets such as industrial machinery, defense ammunition, and ammunition. The relevant party can track the vehicle for timely delivery and safety purposes.

Type Insights

The active segment accounted for the largest share of around 84.3% of the market in 2022 and is anticipated to register the fastest CAGR of 14.8% over the forecast period. The active and passive vehicle tracking systems have the same functionality. However, the active system tracks real-time data transferred via satellite or cellular networks to a computer system or a data analysis center. The active tracking system has complete functions, but it carries the advantage of offering effortless access to tracking information and compatibility with different networks. The advantages of an active tracking system are expected to boost its demand across major market regions.

The passive segment is estimated to register a significant CAGR over the forecast period. The passive vehicle tracking devices record the data collected from the vehicle and store it on a memory card or a hard drive. After some time, the data can be downloaded through the auto-download feature, which transmits the vehicle data to the computer system. The system is affordable and does not depend on the cellular network.

Component Insights

The software segment held a considerable market share in 2022. Features such as fleet analytics, real-time alerts for traffic and maintenance, vehicle diagnostics, driver behavior monitoring, and measuring vehicle utilization which indicates the vehicle efficiency and the total cost of vehicle ownership, are included in tracking software and are leading to significant growth. The end-users have access to data they can review and analyze, facilitating the maintenance of operational synergy, enhancing performance, monitoring employee behavior, and optimizing costs for management.

The hardware segment is expected to register a significant CAGR over the forecast period. The segment comprises an Onboard Diagnostics Device (OBD)/tracker and a standalone tracker. The device functions based on sensors, an electronic control unit, and a diagnostic trouble code, among other components, which help analyze and regulate the vehicle system and alert the driver in case of any issues. Its features, such as buzzer support, sleep mode on low power, and efficient cellular and GPS performance, drive its market growth.

Key Companies & Market Share Insights

The major market players aim to provide tracking, fleet management, and telematics solutions based on the different end-use applications. They have also developed an extensive portfolio that continuously improved through R&D to provide quality products. For instance, ORBCOMM has launched an IoT-based telematics device aimed at creating a fleet management system for refrigerated containers-CT 3500 telematics device. The device is capable of smart management regardless of transportation mode and is compatible with wireless technology such as Bluetooth 5, NFC, and LoRa. The device uses wireless sensors, which provide actionable insights about the fleet.

To extend their footprint in the market, the major players resort to mergers, acquisitions, and strategic partnerships. For instance, CalAmp and Moregon have announced partnerships for delivering predictive maintenance and remote diagnostics for fleet operators. The partnership will create a blend between the functionalities of CalAmp iOn, a fleet management software, cloud platform, and edge computing, and Noregon Trip Vision which can run diagnostics remotely to alert the driver of a vehicle and provide alerts before any serious issues happen in the vehicles. These major players contribute to the market growth through their efforts for product launches and partnerships.

Key Vehicle Tracking System Companies:

- Verizon

- Geotab Inc.

- TomTom International BV.

- CalAmp

- TELTONIKA

- ORBCOMM

- Sensata Technologies Inc.

- Laipac Technology Inc.

- CompTrackimo9

Recent Developments

-

In April 2023, iTecknologi Group joined forces with Vehari Police to introduce Advanced Vehicle Tracking Services to enhance the safety and monitoring of the police fleet. This collaboration will provide real-time tracking capabilities, enabling the police to have up-to-date information about the location of their vehicles.

-

In January 2023, West Bengal Chief Minister inaugurated a new system in Kolkata. The system aims to bring significant benefits to the transportation sector in the state. In its first phase, approximately 160,000 vehicles will be covered under this initiative. The inauguration of this system marks a significant step towards enhancing the efficiency and effectiveness of transportation in West Bengal.

-

In August 2022, ineedatracker.com partnered with Global Telemetrics. This collaboration marks a significant transition for ineedatracker.com as it moves from its current position as a retailer to a provider of monitored vehicle tracking systems.

Vehicle Tracking System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.18 billion

Revenue forecast 2030

USD 60.89 billion

Growth Rate

CAGR of 14.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, vehicle type, technology, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Cartrack; Verizon; Geotab Inc.; TomTom International BV.; CalAmp; TELTONIKA; ORBCOMM; Sensata Technologies Inc.; Laipac Technology Inc.; Trackimo

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Tracking System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle tracking system market based on component, vehicle type, technology, type, end-use, and region:

-

Component Outlook (Revenue in USD Million, 2018 - 2030)

-

Hardware

-

OBD Device/ Tracker and Advance Tracker

-

Standalone Tracker

-

-

Software

-

Performance Management

-

Vehicle Diagnostics

-

Fleet Analytics & Reporting

-

Driver Behaviour Monitoring

-

Others

-

-

-

Vehicle Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Technology Outlook (Revenue in USD Million, 2018 - 2030)

-

GPS/Satellite

-

GPRS/Cellular Network

-

Dual Mode

-

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Active

-

Passive

-

-

End Use Outlook (Revenue in USD Million, 2018 - 2030)

-

Transportation & Logistic

-

Construction & Manufacturing

-

Aviation

-

Retail

-

Government & Defense

-

Other

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The North American region has registered the highest market share of 32.7% in 2022 and is expected to maintain the growth pace over the forecast period. The mandatory norms over safety norms by the government are driving the market growth.

b. Some key players operating in the vehicle tracking system market include Verizon Communications, Inc., Sierra Wireless, Inc., TomTom International B.V., Cartrack (Pty) Ltd, AT&T Inc., ORBCOMM INC; Calamp Corp, and Geotab Inc., among others.

b. Key factors driving the vehicle tracking systems market growth include rising security and safety concerns among passengers and fleet owners coupled with increased demand for intelligent transportation systems.

b. The global vehicle tracking system market size was estimated at USD 21.54 billion in 2022 and is expected to reach USD 24.18 billion in 2023.

b. The global vehicle tracking system market is expected to grow at a compound annual growth rate of 14.1% from 2023 to 2030 to reach USD 60.89 billion by 2030.

b. The passenger vehicles segment accounted for the dominant share of over 40.0% in 2022, in the vehicle tracking systems market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.