- Home

- »

- Animal Health

- »

-

Veterinary Biomarkers Market Size And Share Report, 2030GVR Report cover

![Veterinary Biomarkers Market Size, Share & Trends Report]()

Veterinary Biomarkers Market Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Production Animals), By Product Type, By Application, By Disease Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-960-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Veterinary Biomarkers Market Size & Trends

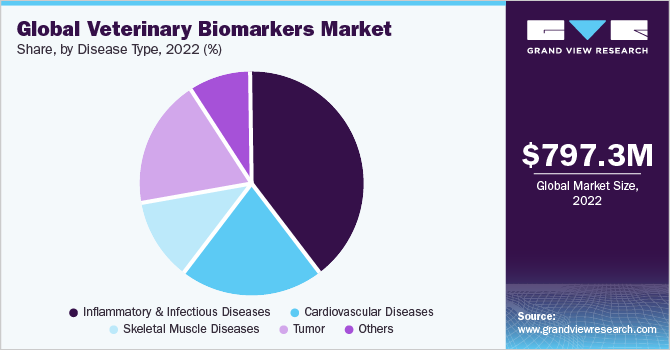

The global veterinary biomarkers market size was estimated at USD 797.33 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.61% from 2023 to 2030. The increasing prevalence of chronic conditions such as cancer and cardiovascular diseases in animals are major factors driving the demand for biomarker-based assay diagnostic kits. These are used in veterinary applications to predict diseases in their early stages. The R&D activities implemented by key companies to enhance biomarker portfolios are fueling the market growth. In addition, the growing companion animal population and rising pet adoption rates are other factors boosting the growth of the market.

For instance, in November 2021, American Veterinary Medical Association reported that the companion animal population has increased significantly from 2016 to 2020. Moreover, as per the APPA National Pet Owners Survey (2023-2024), 86.9 million households own a pet, which is over 66% of the total households. This is expected to contribute to market growth.

The COVID-19 pandemic resulted in the decline of the veterinary biomarkers market, especially in 2020. This unfavorable impact was mainly due to the lockdown declarations in various countries and the respective restricted access to and closure of veterinary services. The pandemic also created obstacles for animal owners in accessing better veterinary care due to the forced limitation and cancellation of veterinary appointments. According to American Veterinary Medical Association, in the U.S., the veterinary service during the pandemic was a challenge for veterinarians. This is despite the fact that veterinary practices are considered an essential healthcare business in the country.

The key market players faced difficulties in supplying veterinary products due to the uncertainty in distribution channels. However, the key players and government agencies have adopted various measures to continue their animal healthcare business throughout the pandemic. For instance, Merck & Co., Inc took comprehensive steps to overcome the pandemic challenges and has significantly maintained its animal health business. The company reported worldwide sales of USD 12.5 billion in the final quarter of 2020. This was a 5% increase from the previous year.

Some of the key drivers propelling the veterinary biomarkers market include the increasing adoption of R&D by key companies, expansion of product offerings, increased animal healthcare expenditure, and post-pandemic return to normal. For instance, according to the 2023 report published by the American Pet Products Association, the pet industry expenditure in the U.S. increased from USD 90.5 billion in 2018 to USD 136.8 billion in 2022. This is further expected to reach USD 143.6 billion by the end of 2023. Similarly, as per FEDIAF, in 2020, nearly 21.8 billion was spent on pet-food products, and 21.2 billion was spent on pet-related services and products in Europe. These affirmative factors are attributed to the growth of the market during the forecast period.

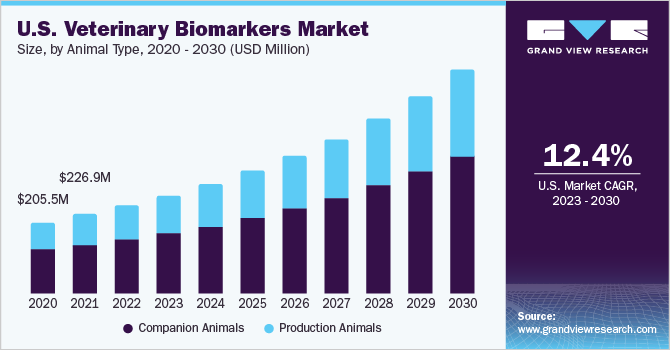

Animal Type Insights

The companion animals segment dominated the global veterinary biomarkers market with the highest share by animal type in 2022. This is due to the rising adoption rates of dogs and the significant disease prevalence rates that were seen among them. According to the American Kennel Club (AKC), the number of U.S. households that owned a dog increased from 50% in 2018 to 54% in 2021. As per the 2022 FEDIAF European Pet Food Industry, 90 million households (which is 46%) in Europe owned a pet, and the dog population in the region was estimated to be 92.9 million in 2021. In addition, the COVID-19 pandemic encouraged many people in the world to adopt dogs for psychological comfort.

The production animal segment is growing with a significant share by animal type in 2022, owing to the growing population of production animals such as cattle and other livestock in developing countries such as China, India, and Japan. For instance, according to the national dairy development board, the cattle population in India grew from 185 million in 2003 to 193 million in 2019. Similarly, the total bovine population increased from 283 million in 2003 to 302 million in 2019. In addition, the growing prevalence of serious infectious diseases such as tuberculosis among the production animals is a major concern to increase the deployment of numerous diagnostic approaches.

Product Type Insights

The biomarkers, kits & reagents segment held the largest market share in 2022 by product type. This is owing to the wide availability of major brands of biomarkers and test kits launched by key players in the market. Veterinarians prefer sensitive and accurate disease diagnostic approaches using biomarker test kits. This is key to understanding the progression of disorders and providing accurate treatments targeting the biological indicator of the disease. In addition, the growing awareness of biomarker application in the veterinary field in developing countries is fueling the growth of the market in recent years.

The biomarker readers are expected to hold a significant market share over the forecast period owing to the growing diagnosis rate in veterinary practices. As human biomarker readers are not accurate and calibrated for animal readings, specific veterinary biomarker readers have been launched by the key players. For instance, Virbac launched an intuitive and compact laser-based fluorescent reader called ‘speed reader’ that exactly measures the biomarker concentration in animal serums or plasma samples. This factor is fueling the growth of the segment in the market.

Application Insights

The disease diagnostics segment held the largest market share in the application segment. This is owing to the growing number of veterinary admissions in both developed and developing countries for numerous diseases diagnosis. In addition, the rising number of veterinary clinics and hospitals with trained veterinarians is another factor that boosts the growth of the segment. For instance, according to the Federation of Veterinarians of Europe, the number of veterinarians stood at 263 million in Europe in 2019.

The preclinical research segment held a significant market share over the forecast period and grew at the fastest CAGR owing to the increasing research and development activities in veterinary biomarkers and post-genomic technologies. The advanced strategies initiated by animal health key players to identify novel biomarkers or disease indicators further enhance the opportunity for segment growth. For instance, Boehringer Ingelheim announced in April 2022 that the company welcomes any partnership or collaboration to develop novel cancer therapeutic concepts with a specific biomarker-based approach.

Disease Type Insights

The inflammatory & infectious diseases segment held the largest market share of over 35% in the disease type segment. This is owing to the growing prevalence of various types of infectious diseases that arises among companion and production animals. The concern of the government to prevent zoonotic disease transmission from animals to humans has led to various diagnostic strategies in many countries. The penetration of biomarker-based diagnostic kits is rising in such activities, thereby widening the scope of the products in the market.

Other disease types, such as cardiovascular diseases and cancer are commonly prevailing among animals and demand more attention for proper diagnosis. Most of these diseases are commonly asymptomatic and widely ignored until the progression of serious stages. For instance, according to the University of Kentucky, most of the cattle infected with cancer show no sign, thereby being neglected for timely treatments leading to 5-20% of sudden death cases. Hence, the demand for accurate diagnostic tests to predict progressing diseases and their risk factors in benign stages is growing rapidly.

Regional Insights

North America held more than a 35% share of the veterinary biomarkers market in 2022. The high share of the region is due to the significant presence of key players, the adoption of various strategies initiated by key companies to increase market penetration, rising research activities, rising diagnostic rates, and increasing animal population & vet care expenditure. The growing number of veterinary clinics with licensed and trained veterinarians in the countries is another factor to boost the growth of the market. According to the AVMA, in 2020, there were nearly 118,624 licensed veterinarians in the U.S. which majorly catered to companion animal patients.

The Europe region holds the second-largest share of the market. This is owing to the presence of major key players such as Virbac; ACUVET BIOTECH; and others in European countries. The Asia Pacific region is estimated to grow fast, with a CAGR of over 13.8% in the next few years. This is attributable to the rising animal healthcare expenditure & disposable income in key markets coupled with rising awareness for biomarkers in veterinary practices.The growing demand for the proper and timely diagnosis of numerous diseases and pet humanization in developing countries like India are further boosting the growth of the market.

Key Companies & Market Share Insights

The veterinary biomarkers industry is emerging and consolidated. Leading players deploy numerous strategic initiatives, that include competitive pricing strategies, partnerships, product expansion, sales & marketing initiatives, and mergers & acquisitions. For instance, in October 2021, Zoetis opened a new manufacturing site in Ireland. This expanded its capacity for manufacturing monoclonal antibodies. Similarly, the producers are launching novel biomarker-based products that boost their leadership position in the market. For instance, in August 2019, Zoetis launched Stablelab hand-held biomarker reader, which detects the Serum Amyloid A biomarker to diagnose inflammation conditions in horses. It expanded the equine portfolio of the company. Such activities are increasing their share in the market. Some of the prominent players in the global veterinary biomarkers market include:

-

Zoetis

-

Virbac

-

Life Diagnostics

-

ACUVET BIOTECH

-

Merck & Co., Inc.

-

IDEXX Laboratories, Inc.

-

MI:RNA Diagnostics Ltd.

-

Mercodia AB

-

Antech Diagnostics, Inc.

-

Avacta Animal Health Limited

Veterinary Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 888.91 million

Revenue forecast in 2030

USD 2.04 billion

Growth Rate

CAGR of 12.61% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Animal type, product type, application, disease type, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Zoetis; Virbac; Life Diagnostics; ACUVET BIOTECH; Merck & Co., Inc.; IDEXX Laboratories, Inc.; MI:RNA Diagnostics Ltd.; Mercodia AB; Antech Diagnostics, Inc; Avacta Animal Health Limited.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Biomarkers Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global veterinary biomarkers industry report based on animal type, product type, application, disease type, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Others

-

-

Production Animals

-

Cows

-

Pigs

-

Others

-

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomarkers, Kits & Reagents

-

Biomarker Readers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Diagnostics

-

Preclinical Research

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inflammatory & Infectious Diseases

-

Cardiovascular Diseases

-

Skeletal Muscle Diseases

-

Tumor

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

- MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global veterinary biomarkers market size was estimated at USD 797.33 million in 2022 and is expected to reach USD 888.91 million in 2023.

b. The global veterinary biomarkers market is expected to grow at a compound annual growth rate (CAGR) of 12.61% from 2023 to 2030 to reach USD 2.04 billion by 2030.

b. North America dominated the veterinary biomarkers market with a share of over 35% in 2022. This is attributable to the significant advancements in research & development of veterinary science in the region coupled with the presence of major players.

b. Some key players operating in the veterinary biomarkers market include Zoetis, Virbac, Life Diagnostics, ACUVET BIOTECH, Merck & Co., Inc., IDEXX Laboratories, Inc., MI:RNA Diagnostics Ltd., Mercodia AB, Antech Diagnostics, Inc., and Avacta Animal Health Limited.

b. Key factors driving the veterinary biomarkers market growth include the growing prevalence of various diseases in animals and the requirement of specific diagnostic approaches coupled with the increasing R&D activities in post-genomic technologies and the growing animal population with healthcare expenditures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."