- Home

- »

- Animal Health

- »

-

Veterinary Electrosurgery Market Size, Industry Report, 2030GVR Report cover

![Veterinary Electrosurgery Market Size, Share & Trends Report]()

Veterinary Electrosurgery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dual Modality Electrosurgical Generator Units, Singular Modality Electrosurgical Generator Units), By Application, By Animal Type, By End use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-944-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Electrosurgery Market Summary

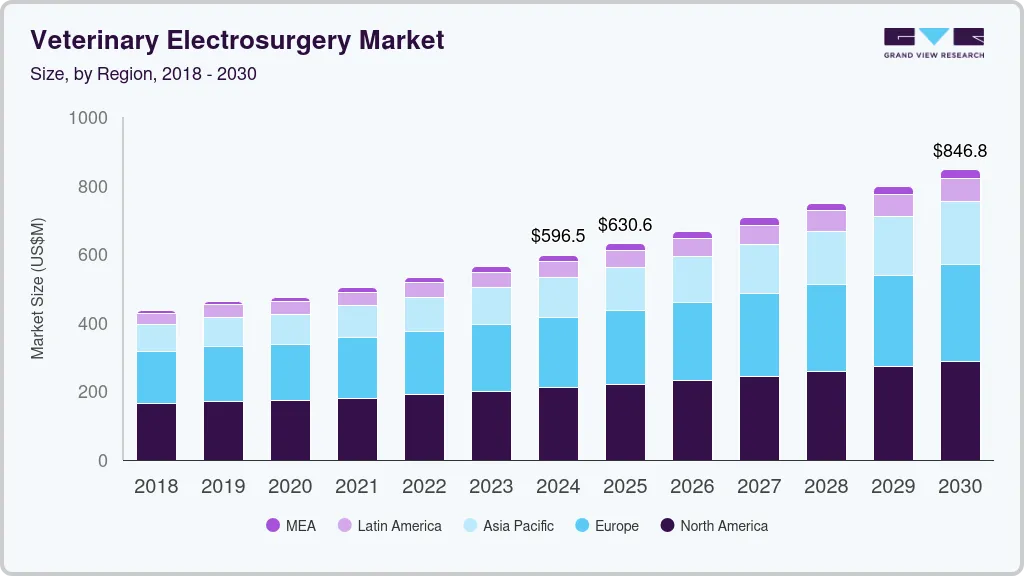

The global veterinary electrosurgery market size was estimated at USD 596.5 million in 2024 and is expected to reach USD 846.8 million by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The industry is growing due to the rising awareness of medical technologies among industry professionals and pet owners.

Key Market Trends & Insights

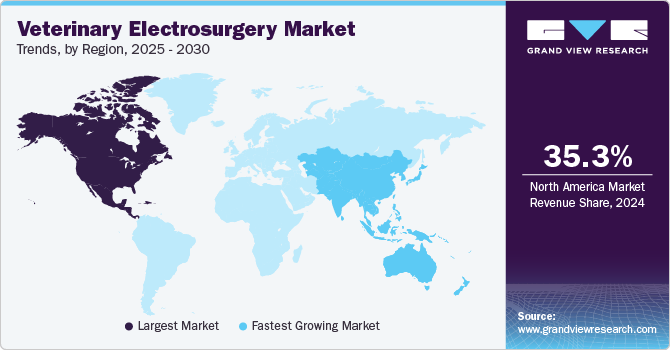

- North America dominated the veterinary electrosurgery market with the largest revenue share of 35.29% in 2024.

- The veterinary electrosurgery market in the U.S.accounted for the largest revenue share in North America in 2024.

- By product, the dual-modal electrosurgical generator units (ESU) segment led the market with the largest revenue share of 52.49% in 2024.

- By application, the general surgery segment led the market with the largest revenue share of 25.50% in 2024.

- By animal type, the small animal segment led the market with the largest revenue share of 64.44% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 596.5 Million

- 2030 Projected Market Size: USD 846.8 Million

- CAGR (2025-2030): 6.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, several animal associations, device manufacturers, and training institutions are actively conducting workshops, certifications, and seminars to educate practitioners about the benefits and proper use of electrosurgical devices. For instance, in November 2023, Freelance Surgical published a series of short videos to inform veterinarians and other people about animal electrosurgery. It is an effort to make people familiar with the technology and assure them of its safety. Such educative initiatives increase the adoption of animal electrosurgeries and drive market growth during the forecast period.

Technological advancements are vital to the veterinary electrosurgery industry, enabling more precise, efficient, and safer surgical procedures. Innovations such as energy-controlled devices, minimally invasive tools, and multifunctional electrosurgical units have enhanced surgical outcomes while reducing complications and recovery times. Research in the sector is anticipated to bring advanced electrosurgical generators and accessories needed for the procedure in the coming years. For instance, according to a June 2024 Institute of Electrical and Electronics Engineers (IEEE) publication, scientists have developed an intelligent electrosurgical knife for intraoperative margin assessment while performing surgeries. This technology can enable veterinarians to detect tumor borders and assist in completing excision procedures in animals. Owing to such upcoming technologies in the domain, the sector is expected to grow significantly in the study period.

The growing prevalence of several animal diseases is anticipated to drive the market growth. Conditions such as tumors, soft tissue injuries, and reproductive disorders in companion animals, as well as diseases requiring surgical intervention in livestock, are increasing the demand for advanced surgical solutions. For instance, according to the American Veterinary Society, approximately one in four dogs are expected to get diagnosed with cancer in a lifetime. Also, as per the data published by PubMed in April 2024, the study on the incidence rate of canine tumors among Swiss dogs concluded that most malignant tumors were found in the skin, soft tissues, and mammary glands. Thus, an increase in the incidence of such diseases is anticipated to significantly propel the demand for electrosurgeries and contribute to the growth.

Product Insights

The dual-modal electrosurgical generator units (ESU) segment led the market with the largest revenue share of 52.49% in 2024 and is expected to grow at the fastest CAGR during the forecast period. These devices can operate in both monopolar and bipolar modes, providing veterinarians greater flexibility for precision and tissue-specific procedures. For example, MB 122 by GIMA is an HF electrosurgical unit that performs monopolar or bipolar surgeries in animals. The device also has an alarm that can warn the user about any connectivity problem with a cable or neutral plate being used. Thus, such advancements in these systems make them ideal for modern animal practices, catering to small companion animals and large livestock.

The singular modality electrosurgical generator units (ESU) segment is projected to grow at a moderate CAGR during the forecast period, due to its cost-effectiveness, simplicity, and reliability. These devices are ideal for routine surgical procedures that require consistent performance, making them highly attractive to small and mid-sized clinics. The rising number of preventive and general surgeries, such as spaying, neutering, and tumor removal, has increased demand for these units. In addition, the compact design and ease of operation of single-modality ESUs make them a practical choice for veterinarians seeking efficient solutions without the complexities of dual-modality systems, further driving their market growth.

Application Insights

Based on application, the general surgery segment led the market with the largest revenue share of 25.50% in 2024. This number can be attributed to the increasing number of trauma injuries in animals due to road accidents, bites, etc. In addition, pets and working dogs in the military and police forces are at high risk of injuries that might require surgical intervention. For instance, according to the NCBI article published in October 2023, the mortality rate of dogs working in military settings was estimated to be at nearly 50%. These large amounts of accidents, injuries, and other fatal wounds can be efficiently addressed with the help of electrosurgery, thus increasing the adoption and further contributing to market growth.

The other segment is expected to grow at the fastest CAGR during the forecast period, due to the rapid increase of their application in specialized procedures such as ophthalmic, neurological, and other surgeries. As animal practices expand their offerings for various treatments, the demand for precise and minimally invasive surgical tools and devices has increased. This scenario is attributed to significantly driving the adoption of electrosurgery equipment and boosting market growth.

Animal Type Insights

Based on animal type, the small animal segment led the market with the largest revenue share of 64.44% in 2024. These high numbers are attributed to the increasing population of pets around the world. For instance, according to the data published by the American Veterinary Medical Association in October 2024 , the dog population in the U.S. has steadily increased from 52.9 million in 1996 to 89.7 million in 2024. With technological advancements, pet owners have become more aware of the industry's new treatments and medical technologies for treating their pets. This rising awareness among pet parents will impact the market growth in the coming years.

The large animal segment is expected to grow at the fastest CAGR over the forecast period. Increased zoonotic diseases and rising demand for meat, dairy, and other animal-based products have encouraged farmers and veterinarians to adopt advanced surgical tools. Electrosurgical devices are particularly valuable in addressing reproductive disorders, lameness, and orthopedic and other injuries in large animals, offering precision and reducing recovery times. Moreover, the growing awareness of animal welfare and the economic importance of maintaining herd health drive investments in modern technologies, fueling growth in this segment.

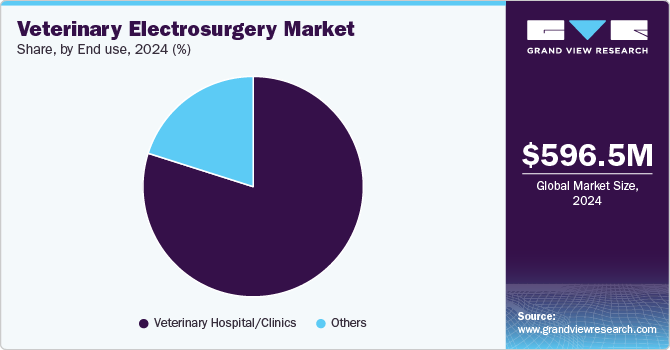

End Use Insights

Based in end use, the veterinary hospitals/clinics segment led the market with the largest revenue share of 79.90% in 2024, driven by the facilities offered by these settings, which include advanced infrastructure, skilled professionals, and the ability to perform a wide range of surgical procedures. Many injuries and medical conditions need hospital admissions or professional attention, increasing the necessity of hospitals. Additionally, the increasing number of clinics worldwide and the growing demand for specialized services further strengthen this segment's industry dominance.

The other segment is the fastest-growing segment and is expected to grow at a CAGR of 7.04% over the forecast period. This segment includes ambulatory centers, rescue centers, animal shelters, etc. Owing to factors like increasing animal population globally and rising cases of animal abandonment & cruelty, among others, it is estimated that the demand for appropriate healthcare facilities at these facilities will increase. Therefore, the End Users are expected to upgrade their animal health services, increasing the demand for proper surgical equipment & tools. Furthermore, to ensure high penetration of these services like surgery, the adoption of ambulatory centers to reach remote areas can be seen in the market, further driving it to lucrative growth.

Regional Insights

North America dominated the veterinary electrosurgery market with the largest revenue share of 35.29% in 2024, which can be attributed to the advanced healthcare infrastructure, rising adoption of pet insurance, and strategic initiatives by key players. For instan ce, as per the data updated in October 2022, Aspen Surgical Products, Inc. acquired Symmetry Surgical, a leading provider of surgical instruments and medical devices, including electrosurgery products. This acquisition expanded Aspen Surgical Products, Inc.'s product portfolio and strengthened its position. Such collaborations and acquisitions provide new growth opportunities in the region and propel the veterinary electrosurgery industry.

U.S. Veterinary Electrosurgery Market Trends

Theveterinary electrosurgery market in the U.S.accounted for the largest revenue share in North America in 2024. This is due to its advanced healthcare infrastructure, high pet ownership rates, and a strong emphasis on animal welfare. The region's well-established clinics and hospitals are equipped with state-of-the-art surgical tools, including electrosurgical devices, to meet the rising demand for precise and minimally invasive procedures. For instance, as of December 2023, there are 127,131 veterinarian practitioners in the U.S., which is projected to increase in the coming years, thus contributing to market growth.

Europe Veterinary Electrosurgery Market Trends

The veterinary electrosurgery market in Europe is driven by the region's strong emphasis on pet ownership, increasing disposable income, and high pet insurance penetration, boosting demand for non-invasive surgical tools for animal treatment. Supportive government policies, funding for animal health research, and a strong network of clinics and hospitals further contribute to market growth in Europe. For instance, according to the data published in May 2024, the European Partnership on Animal Health and Welfare (EUPAHW) is expected to gather 360 million euros of funds for seven years to develop products in various verticals like medicine and medical technology to benefit animal health.

The UK veterinary electrosurgery market is expected to grow at a significant CAGR during the forecast period, driven by the UK's stringent animal welfare regulations, and the presence of skilled professionals further enhances the utilization of precision-focused technologies like electrosurgery. In addition, increasing research and enhanced funding for innovative projects boost the introduction of new technologies in the veterinary electrosurgery sector.

The veterinary electrosurgery market in Germany is anticipated to grow at a significant CAGR during the forecast period, mainly due to various strategic initiatives undertaken by the government and other vital regional players. For instan ce, according to the data provided by Conference Alerts, the country has been hosting a large variety of conferences & training programs throughout 2024, and many more are scheduled for the rest of the year.

Asia Pacific Veterinary Electrosurgery Market Trends

The veterinary electrosurgery market in Asia Pacific is expected to grow at the fastest CAGR of 7.98% over the forecast period. The growth in the region is owing to the improved healthcare facilities in the developing nations. Many countries in this region have a significant proportion of companion and livestock animals, increasing the demand for advanced surgical tools such as electrosurgery devices and accessories. Moreover, with growing demand, there has been a substantial rise in the region's hospitals, clinics, and professionals; for instance, as per the data published by the Government of India, 81,938 registered veterinary practitioners in India as of March 2023. These high numbers contribute to the increase in revenue generation and support industry growth.

The China veterinary electrosurgery market is expected to grow at a lucrative CAGR during the forecast period. The increasing adoption of pets, rising disposable incomes in the region, and growing awareness about animal health have led to greater demand for advanced technologies. Government initiatives to improve veterinary infrastructure and promote animal welfare further support the adoption of electrosurgery technologies nationwide.

Latin America Veterinary Electrosurgery Market Trends

The veterinary electrosurgery market in Latin Americais projected to growat the fastest CAGRduring the forecast period, mainly due to the prevalence of animal diseases, increasing awareness about medical treatments, and government initiatives being undertaken. For instance, the International Conference on Veterinary Medicine, Surgery, and Medical Diagnosis (ICVMSMD) was held in June 2024 in Argentina to bring several professionals under one roof. Such informative conferences fuel the innovation and development in veterinary healthcare, including advanced surgeries such as electrosurgery, to further drive market growth.

The Brazil veterinary electrosurgery market is anticipated to grow at a significant CAGR during the forecast period. For instance, according to the data published by USDA in August 2024, Brazil is the world's third-largest cattle producer, which increases the demand for animal health treatments. In addition, the country stands second in the world regarding beef exports to fulfill the demand for animal protein. These activities in the country's veterinary sector fuel the adoption of advanced medical devices, including electrosurgery tools, to protect animals.

Middle East and Africa Veterinary Electrosurgery Market Trends

The veterinary electrosurgery market in the Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period, driven particularly by the increasing focus on livestock health, government investments, and growing pet care awareness, particularly in urban centers of the Middle East, which is contributing to the demand for modern surgical tools, including electrosurgical devices. Expanding infrastructure, government initiatives to enhance animal health, and the entry of global technology provider’s further support sector growth in this region.

The UAE veterinary electrosurgery market is growing due to the increasing focus on animal health and productivity. The country has established modern veterinary clinics and research centers with advanced diagnostic tools, telemedicine capabilities, and cutting-edge treatments, including regenerative medicine and precision therapies. For instance, according to the news published in June 2024, a British Veterinary Centre in Abu Dhabi successfully performed canine mitral valve repair surgeries. It became the first facility in the MENA region for this groundbreaking performance. These complex surgeries can be made easy and precise with the help of advanced electrosurgery tools, providing various benefits over traditional methods.

Key Veterinary Electrosurgery Company Insights

The market is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Veterinary Electrosurgery Companies:

The following are the leading companies in the veterinary electrosurgery market. These companies collectively hold the largest market share and dictate industry trends.

- Aspen Surgical Products Inc.

- Avante Animal Health

- Eickemeyer Veterinary Equipment Ltd.

- B. Braun Melsungen AG

- Medtronic

- Gima S.p.A.

- Macan Manufacturing

- Kwanza Veterinary

- Karl Storz

- Burtons Medical Equipment Ltd.

Recent Developments

-

In June 2024, Asensus Surgical announced a merger with Karl Storz, a leading medical equipment manufacturer.

-

In January 2024, KARL STORZ acquired Innersight Labs Ltd. (ISL), an innovative software manufacturer. This acquisition will use advanced software systems to expand the company's veterinary medical solutions portfolio.

-

In December 2023, MAI Animal Health acquired Delmarva 2000 to expand its veterinary product portfolio with equipment necessary for surgeries, such as electrodes.

-

In January 2023, Avante Animal Health partnered with the Nashville Zoo to provide the latter with various medical equipment and services for the HCA Healthcare Veterinary Center.

-

In October 2022, Aspen Surgical acquired Symmetry Surgical and its diverse veterinary medical equipment portfolio.

Veterinary Electrosurgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 630.56 million

Revenue forecast in 2030

USD 846.8 million

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, animal type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Aspen Surgical Products Inc.; Avante Animal Health; Eickemeyer Veterinary Equipment Ltd.; B. Braun Melsungen AG; Medtronic; Gima S.p.A.; Macan Manufacturing; Kwanza Veterinary; Karl Storz; Burtons Medical Equipment Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Electrosurgery Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary electrosurgery market report based on the product, application, animal type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dual Modality Electrosurgical Generator Units (ESU)

-

Singular Modality Electrosurgical Generator Units (ESU)

-

Consumables & Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Dental Surgery

-

Gynecological & Urological Surgery

-

Orthopedic Surgery

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animal

-

Large Animal

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The North America veterinary electrosurgery market dominated the global market and accounted for 35.29% of revenue share in 2024, which can be attributed to the advanced veterinary healthcare infrastructure, rising adoption of pet insurance, and strategic initiatives by key players.

b. Some key players operating in the veterinary electrosurgery market include Aspen Surgical Products Inc., Avante Animal Health, Eickemeyer Veterinary Equipment Ltd., B. Braun Melsungen AG, Medtronic, Gima S.p.A., Macan Manufacturing, Kwanza Veterinary, Karl Storz and Burtons Medical Equipment Ltd.

b. Key factors driving the veterinary electrosurgery market growth include increasing prevalence of animal disease and surgical needs, emphasis on awareness, education & training, integration of electrosurgery with other technologies, rising demand for veterinary health insurance, rising strategic initiatives.

b. The global veterinary electrosurgery market size was estimated at USD 596.48 million in 2024 and is expected to reach USD 630.56 million in 2025.

b. The global veterinary electrosurgery market is expected to grow at a compound annual growth rate of 6.08% from 2025 to 2030 to reach USD 846.83 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.