- Home

- »

- Animal Health

- »

-

Veterinary Furniture Market Size And Share Report, 2030GVR Report cover

![Veterinary Furniture Market Size, Share & Trends Report]()

Veterinary Furniture Market Size, Share & Trends Analysis Report By Product, By Usage (Veterinarian/ Technician Use, Patient Use), By Sales Channel, By Purchasing Channel, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-120-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global veterinary furniture market size was valued at USD 1.91 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.41% from 2023 to 2030. The rise in veterinary facility visits & expenditures and the need for innovative furniture in veterinary hospitals primarily drive the market. Growing spending on veterinary visits results in the advancement of veterinary establishments. Therefore, as veterinary facilities develop, there is a corresponding rise in demand for veterinary furniture to improve patient compliance. For instance, according to a report from the American Veterinarian Medical Association released in October 2022, the average amount spent by households with one dog on veterinarian appointments increased from $224 in 2020 to $362 in 2022. Similarly, households with cats spend $321 in 2022 and $189 in 2020 on veterinarian appointments. This increase in spending results in the improvement of veterinary facilities.

The increase in customized furniture manufacturing is expected to boost the demand for the veterinary furniture market during the forecast period. Several key players are manufacturing large animal surgical tables with adjustable heights, technological rigor, side panels, and head support for ease of patient placement. Furthermore, when operating on animals that are quite heavy, veterinarians encounter enormous difficulties. Therefore, specialized tables are developed to facilitate the entire surgical process and provide doctors and nurses with uninterrupted patient access.

Furthermore, the increase in the number of veterinary establishments, increasing demand for companion animals, an increase in the number of veterinarians, and their level of profitability in developed regions are also driving the growth of the market throughout the forecast period. In addition, veterinary clinics have expanded due to increased demand for exam tables that offer the veterinarian practitioner several advantages. The veterinarian can avoid musculoskeletal issues and injury to him and the animal being checked using height-adjustable examination tables. As a result, he can deliver high-quality treatment and concentrate on the animal rather than adopting bad posture due to inadequate equipment.

During the early stages of the COVID-19 pandemic, there was a rise in pet adoption. As new owners took advantage of the flexible work constraints created by the pandemic. For instance, Animal Medicines Australia reported a considerable increase in pet adoption. In Australia, 6.9 million homes had 28.7 million pets in 2022. As a result, there was a rise in veterinary visits due to a surge in the pet population and increased awareness of animal health. But now that the epidemic has faded, the market is anticipated to rise steadily throughout the forecast period. In addition, two studies released by the BluePearl Specialty and Emergency Pet Hospital claim that COVID-19 has significantly increased demand for veterinary services across the US. Moreover, rising veterinarian visits cause an increase in the use of veterinary furniture, which propels the market growth.

Product Insights

The tables segment dominated the market with a share of over 27% in 2022. Most veterinary practitioners are investing in the purchase of veterinary tables since the position of the animal and the surgeon is crucial. These tables are designed to simplify draping the surgical area and give the surgical assistant access. Furthermore, launching innovative height-adjustable tables in veterinary practice has increased segment share.

The workstation segment is projected to grow at the highest CAGR of around 7% during the forecast period. Numerous veterinarians and the people who work with them suffer from the repetitive actions of lifting, reaching, and twisting while providing treatment for patients. For enhanced worker safety and comfort, veterinary workstations are intended to support ergonomics. Due to several benefits provided by using workstations, it is expected to grow during the forecast period.

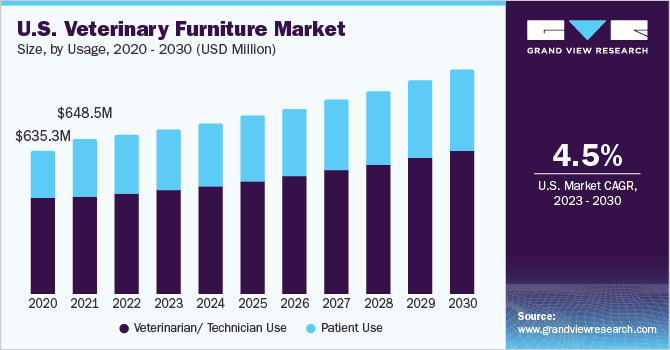

Usage Insights

In 2022, veterinarian/ technician use held the largest market share and is anticipated to grow at the fastest CAGR of nearly 5.5% over the forecast period. There is a considerable increase in consumer desire for creative and affordable products like veterinary furniture. Veterinary furniture has undergone a major global change in recent years. Manufacturers in this market are concentrating on developing popular, multifunctional products that may meet veterinary needs, thus increasing in demand for veterinary furniture specifically used for veterinarian/ technician use.

Sales Channel Insights

By sales channel, the offline segment held the highest share of over 63% of the market in 2022. Some factors aiding the growth of the offline sales channel segment include the real-time experience, higher purchasing assurance, reduced rate of rejection, accessibility to customized options, immediate delivery, sales professional help, full installation support, and simple returns.

The online segment is estimated to witness the fastest growth of about 5.9% shortly due to several factors like the simplicity of comparison, accessibility to a wide range of product selections, availability of consumer feedback, and excellent deals & discounts on products.

Purchasing Channel Insights

In 2022, the direct segment held the largest market share and is anticipated to grow at the fastest CAGR of nearly 5.4% over the forecast period. The affordability of purchasing veterinarian furniture straight from the manufacturer is the key factor responsible for segment growth. Direct purchase of veterinary furniture from the manufacturer reduces furniture costs since no middleman provider pays a commission; thus, purchasing from direct channels is growing globally.

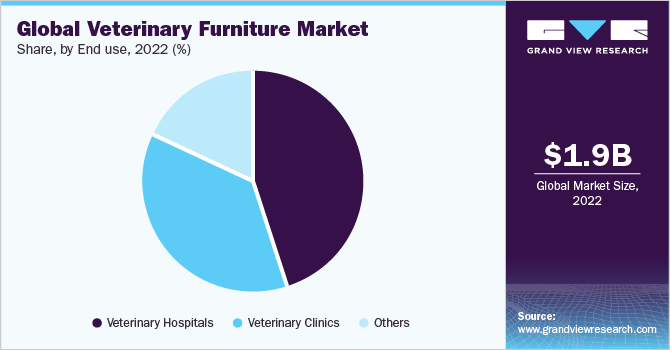

End Use Insights

The veterinary hospital segment dominated the market with a share of over 45% in 2022. The number of patients visiting veterinary hospitals is increasing; there are more concerns about their safety and mobility, and the segment is dominating since veterinary furniture offers good support for animal health examinations. The rise in technical development and the general awareness of the availability of outstanding veterinary care services contribute to the growth of veterinary hospitals. These factors are predicted to contribute to a future increase in the number of high-tech veterinary facilities in developed nations.

The veterinary clinics segment is projected to expand at the highest CAGR of around 5.5% during the forecast period. Over the past two years, there has been a noticeable growth in the number of sales at veterinary clinics. One important factor contributing to this surge is the rising number of pets in the U.S. This has enabled individuals to spend more time taking care of their four-legged companions due to policies that encourage stay-at-home employment, raising the need for veterinary clinics. Additionally, the growing number of veterinary clinics necessitates using proper furniture to lessen the strain on veterinarians.

Regional Insights

North America held the largest share of more than 39% of the total market by region in 2022. With rising pet owner spending on veterinary care, rising awareness of animal health issues, and the need for regular animal health checkups, the region is expected to continue its dominance over the forecast period. Additionally, growing innovations in veterinary furniture utilized often in veterinary practices are expected to fuel expansion throughout the forecast period.

On the other hand, the Asia Pacific region is estimated to expand at the highest CAGR of more than 7% from 2023 to 2030. Growing government initiatives to improve animal health infrastructure in conjunction with rapid economic development, particularly in rural parts of developing nations like China and India, is expected to create huge opportunities in the regional market.

Key Companies & Market Share Insights

The global market is fragmented with several key players operational at regional level. These players are imbibing growth initiatives, including the launch of new products, partnering up with other companies, establishing partnerships, expanding their business, and merging with competitors. Some of the major companies have introduced storage options intended to support the animal health industry and for community-improved usability. For instance, Midmark Corp. introduced Synthesis Wall-Hung Cabinetry in January 2022. The new line includes a range of cabinets that attach to walls to give animal health personnel better visibility as well as accessibility to supplies. Some of the prominent players in the global veterinary furniture market include:

-

Midmark Corporation

-

TECHNIK Ltd

-

OLYMPIC VETERINARY

-

Covetrus

-

Suburban Surgical Co., Inc.

-

GPC Medical Limited

-

David Bailey Furniture Systems Ltd

-

Everest-Tecnovet, SL

-

VETINOX

-

DRE Veterinary

-

PetLift

Veterinary Furniture Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.99 billion

Revenue forecast in 2030

USD 2.88 billion

Growth Rate

CAGR of 5.41% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, usage, sales channel, purchasing channel, end use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Norway; Denmark; Sweden; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Midmark Corporation; TECHNIK Ltd; OLYMPIC VETERINARY; Covetrus; Suburban Surgical Co., Inc.; GPC Medical Limited; David Bailey Furniture Systems Ltd; Everest-Tecnovet; SL; VETINOX; DRE Veterinary; PetLift

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Furniture Market Report Segmentation

This report forecasts revenue growth at the regional & country level and analyzes the latest trends and opportunities in each sub-segment from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary furniture market based on product, usage, sales channel, purchasing channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tables

-

Exam Tables

-

Surgery Tables

-

Other Categories

-

-

Lift Tables

-

Mobile/ Procedure Carts

-

Workstation

-

Boarding & Containment

-

Chairs & Stools

-

Others (e.g., Scales, Sinks & Tubs)

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinarian/ Technician Use

-

Patient Use

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Purchasing Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct

-

Distributor

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary furniture market size was estimated at USD 1.91 billion in 2022 and is expected to reach USD 1.99 billion in 2023.

b. The global veterinary furniture market is expected to grow at a compound annual growth rate of 5.41% from 2023 to 2030 to reach USD 2.88 billion by 2030.

b. North America dominated the veterinary furniture market with a share of 39% in 2022. With rising pet owner spending on veterinary care, rising awareness of animal health issues, and the need for regular animal health checkups, the region is expected to continue its dominance over the forecast period.

b. Some key players operating in the veterinary furniture market include Midmark Corporation, TECHNIK Ltd, OLYMPIC VETERINARY, Covetrus, Suburban Surgical Co., Inc., GPC Medical Limited, David Bailey Furniture Systems Ltd, Everest-Tecnovet, SL, VETINOX, DRE Veterinary, PetLift

b. Key factors that are driving the veterinary furniture market growth include a rise in veterinary facility visits and expenditures, the need for innovative furniture in veterinary hospitals, an increase in the number of veterinary establishments, increasing demand for companion animals, an increase in the number of veterinarians, and their level of profitability in developed regions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."