- Home

- »

- Animal Health

- »

-

Veterinary Hospital Market Size, Share, Growth Report, 2030GVR Report cover

![Veterinary Hospital Market Size, Share & Trends Report]()

Veterinary Hospital Market Size, Share & Trends Analysis Report By Animal Type (Companion, Farm), By Type (Surgery, Medicine), By Sector (Public, Private), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-910-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Veterinary Hospital Market Size & Trends

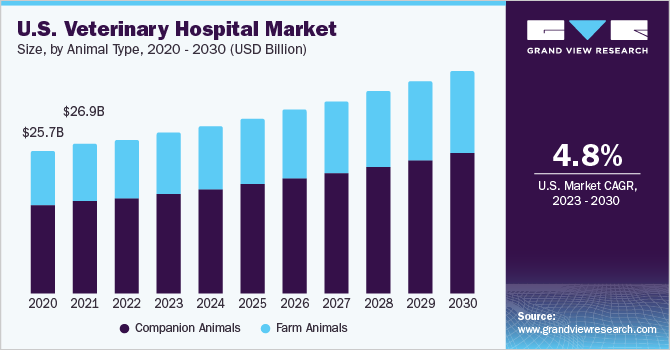

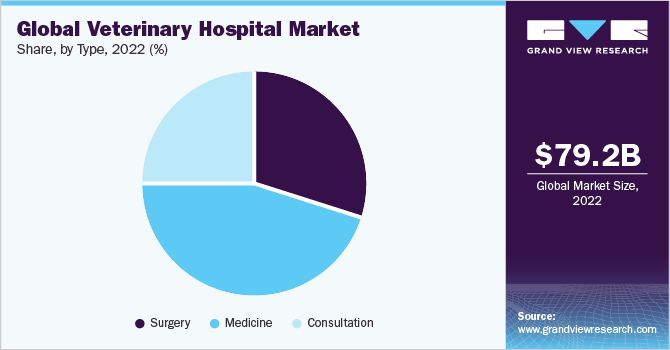

The global veterinary hospital market size was valued at USD 79.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.80% from 2023 to 2030. The market is primarily driven by the increasing consolidation of animal hospitals, the rising companion animal population coupled with enhanced pet adoption rates, growing awareness about animal healthcare, and the rising adoption of pet insurance. For instance, in December 2022, Trupanion, a pet insurance company, reported a rise in pet insurance enrollments to 1.53 million, registering 31% growth from the previous year. The growing number of pet owners is subsequently increasing awareness about animal care. In developed countries such as the U.S., numerous pet health awareness programs such as National Pet Week are often organized. Increasing awareness about veterinary healthcare, coupled with the implementation of stringent regulations to prevent animal diseases, is likely to drive market growth. A growing number of government initiatives to promote veterinary services in hospitals & clinics is expected to fuel the market growth over the forecast period.

Government organizations are issuing guidelines to promote veterinary health, which is likely to contribute to market growth. For example, the OIE International Standards, a part of the WTO framework, issued guidelines to improve veterinary services and promote international animal health. Such measures can facilitate early detection, control, & reporting of pathogenic agents and prevent their transmission through the rejection of products that are not in line with established standards. Thus, the penetration of veterinary services is anticipated to increase, which is expected to boost the demand for established veterinary hospitals.

The growing pet humanization and ownership in various countries have increased pet insurance enrollment rates globally. Pet owners are increasingly opting for insurance policies to reduce their out-of-pocket expenditure for diagnosis and treatments of various indications. For instance, the treatment of diabetes might require multiple veterinary visits and insulin injections in a year. As the prevalence of the disease is significant in pets, owners are widely adopting insurance policies for the same.

Pet insurance policies can cover veterinary fees, which include the diagnosis and treatments for injuries/illnesses. The core coverage provided by the majority of pet insurers also includes consultation fees, medications, bandages, surgery prices, hospitalization costs, and tests. Diagnostic techniques such as X-rays, CTs, and MRIs are routinely performed and are highly expensive. Therefore, pet insurance enables pet owners to consult veterinarians cost-effectively.

Furthermore, some extensive animal insurance policies provide multiple benefits with lifetime coverage for animals. As pet insurance adoption reimburses the costs of diagnosing & treating unexpected illnesses, the rate of insurance adoption has increased in the past few years. This factor is expected to improve the convenience of pet owners in consulting for routine primary care for animals.

Veterinary hospitals have registered steady growth in the countries such as Canada over the past few decades. According to Canadian Veterinary Medical Association, there were approximately 15,322 veterinarians in Canada in 2022, with approximately 3,825 of them working in clinical practice. The growth of veterinary hospitals in Canada is due to the increasing importance that people place on their pets and the expanding role that pets play in Canadian households. As a result, there has been an increase in demand for veterinary services, including preventative care, medical treatment, and surgery.

In addition, advances in veterinary medicine and technology have allowed for more effective and specialized treatments, which in turn have increased the demand for veterinary specialists and specialty clinics. Furthermore, many veterinary hospitals have expanded their services to include boarding, grooming, and training to provide more comprehensive care for pets.

The impact of covid-19 on veterinary hospitals was minimal. Veterinary practice activity in the U.S. has fluctuated, but in general, demand remains high. According to the Veterinary Industry Tracker, revenue per practice was up 13.3% year-over-year (November 2020 to November 2021). Client visits increased by 5.1% during the same period. There was strong demand in April 2021 in both categories.

While negative growth was observed in visits in December 2020, January 2021, and February 2021. Despite the difficulties and new ways of working due to the COVID-19 pandemic, for numerous hospitals, the patient base kept growing. According to VETSURVEY 2020, more than two in three veterinary practices in Canada, the U.S., Australia, and the Netherlands reported an increase in clients since before the pandemic. Russia reported the highest level of decrease in client numbers.

Animal Type Insights

The companion animals segment held the largest market share in 2022 and is expected to witness the fastest growth at a CAGR of 5.9% over the forecast period. This is due to the increasing pet population, growing awareness, and rising demand for efficient animal care. The segment is inclusive of species such as dogs, cats, horses, rabbits, hamsters, and other pets. Rising pet ownership & adoption rates globally have increased the willingness of people to spend more time and money on the health of their beloved companions.

According to The World Animal Foundation, in 2022, 70% of households with pets were home to pets that were domesticated, numbering roughly 90.5 million. Additionally, with 69 million dogs and more than 45.3 million cats, ownership remains more widespread. Additionally, according to NAPHIA, more dogs than cats are insured each year. California prioritizes pet ownership and sets the bar for insurance spending. Additionally, several states, including California (19.2%), Florida (5.8%), and New York (8.7%) treat pet insurance with the same urgency as pet products.

Sector Insights

The private veterinary sector accounted for the dominant revenue share with over 60.0% in 2022 and is expected to grow at a significant rate over the forecast period. In the past few years, the improvement in socio-economic factors and rising disposable income have led individuals to spend more on high-quality veterinary services offered in the private sector. In addition, the willingness of pet owners to provide premium services for their beloved companions is further supporting segment growth. For instance, Premium Vet Care, Florida, U.S., is a mobile companion animal hospital that offers a wide range of services with the help of mobile veterinarians.

The growing number of mobile pet care hospitals can be attributed to rising technological advancements and increasing awareness among people for available premium vet care services. These factors are anticipated to further increase the number of private veterinary clinics in developed countries in the near future. In addition, a shift from the public centers to the private sector is another potent factor for segment growth. For instance, VCA Animal Hospitals was a publicly traded business until its acquisition by Mars, Inc., one of the world’s leading privately held companies. As of July 2021, Mars Incorporated owned over 2,500 veterinary clinics/hospitals around the world.

Type Insights

The medicine segment is expected to dominate the market with the highest share of over 45.0% in 2022, owing to its significant distribution in veterinary pharmacies. Some commonly sold medicines in veterinary hospitals are vaccines, parasiticides, flea or tick control medicines, worm care products, NSAIDs, analgesics, dental care products, and wound care products. Growing demand for animal products, such as meat, egg, and milk, is encouraging farmers to adopt necessary vaccinations for their animals to gain a healthy production rate and higher profitability. Moreover, growing awareness about zoonotic diseases and the interconnectedness between animal health & human health has resulted in greater attention to necessary veterinary medicines in hospitals.

The surgery segment is expected to witness the fastest growth at a CAGR of 6.7% over the forecast period. The surgical procedures performed in veterinary hospitals are categorized majorly into two sectors: urgent and elective procedures. Some of the common elective surgeries performed for companion animals are spaying & neutering, benign skin growths, and dental extractions. The commonly admitted urgent care surgeries include skin abscesses, internal bleeding, tumor removal, fracture repair, intestinal obstruction, and torn cruciate, among others.

Some risk factors, such as obesity, are causing pets to be more vulnerable to orthopedic diseases like cranial cruciate ligament rupture, elbow dysplasia, bone fracture, shoulder Osteochondritis Dissecans (OCD), etc., which often require surgery. In addition, road accidents involving animals are on the rise in developed and burgeoning countries, which is further increasing the requirements for surgeries in emergency care hospitals.

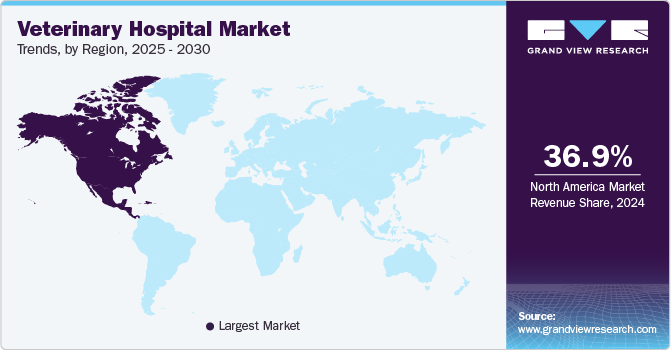

Regional Insights

North America dominated the market in 2022, accounting for the largest market share of over 43%, and is anticipated to maintain this position over the forecast period. North America has a large and well-established veterinary industry, with numerous veterinary hospitals and clinics throughout the region. These hospitals vary in size and scope, with some specializing in specific areas of veterinary medicine, such as oncology, dermatology, or dentistry.

The veterinary industry in North America is regulated by various organizations, including the American Veterinary Medical Association (AVMA) in the U.S. and the Canadian Veterinary Medical Association (CVMA) in Canada. These organizations work to establish standards of care for animals and promote the veterinary profession. Overall, the main drivers that are expected to fuel growth in the North America veterinary hospital industry are increasing pet ownership, advances in veterinary medicine, growing demand for specialized services, and an increase in pet insurance coverage that makes it easier for pet owners to afford veterinary care.

Latin America is expected to witness the fastest growth at a CAGR of 7.2% over the forecast period. The demand for better veterinary care solutions and centers in the Latin America market is projected to increase over the forecast period. This can be attributed to the growing animal population, awareness about various ailments in companion animals at early stages, rising animal services expenditure, and advancing veterinary healthcare infrastructure. In terms of country, Brazil dominated the market in 2022 owing to a notably high pet population and growing veterinary visits in hospitals. Mexico is anticipated to grow at the fastest CAGR over the forecast period. In recent years, the region was highly recognized for offering cheaper veterinary services with advanced technologies in hospitals & clinics. According to the World Organization for Animal Health, the countries in Latin America improved their animal healthcare status via both private and public organization efforts.

Key Companies & Market Share Insights

The market is fairly competitive. Market participants undertake strategic initiatives such as research & development, manufacturing and new product launches, distribution network development, and facility expansion. Hospitals are constantly involved in mergers, acquisitions, and new service launches, to gain a higher market share. For instance, in February 2021, the CVS group announced the purchase of the Market Hall Vets, a first opinion practice functioning in three locations across Carmarthenshire in southwest Wales. Some prominent players in the global veterinary hospital market include:

-

CVS Group Plc

-

Greencross Vets

-

National Veterinary Associates, Inc. (NVA)

-

Pets at Home Group PLC

-

Mars Incorporated

-

Animal Hospital, Inc.

-

All Pets Veterinary Hospital

-

Innovative Petcare

-

Blaine Central Veterinary Clinic

-

Belltowne Veterinary Center

Veterinary Hospital Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 83.3 billion

The revenue forecast in 2030

USD 123.8 billion

Growth rate

CAGR of 5.80% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Animal type, type, sector, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

CVS Group Plc; Greencross Vets; National Veterinary Associates, Inc. (NVA); Pets at Home Group PLC; Mars Incorporated; Animal Hospital, Inc.; All Pets Veterinary Hospital; Innovative Petcare; Blaine Central Veterinary Clinic; Belltowne Veterinary Center

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

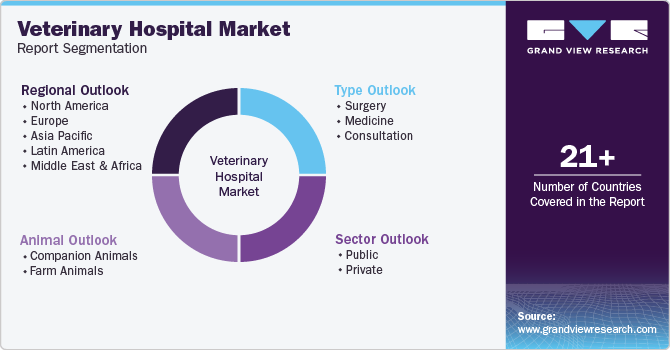

Global Veterinary Hospital Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global veterinary hospital market report based on animal type, sector, type, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Farm Animals

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Medicine

-

Consultation

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary hospital market size was estimated at USD 79.2 billion in 2022 and is expected to reach USD 83.30 billion in 2022.

b. The global veterinary hospital market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 123.8 billion by 2030.

b. Companion Animals dominated the veterinary hospitals market with a share of over 63% in 2021. The growing prevalence of infectious diseases amongst pets is also one of the high-impact rendering growth drivers for this segment. This increase in prevalence is expected to broaden the prospects for hospital visits for routine vaccinations or routine health checkups.

b. Some key players operating in the veterinary hospital market include CVS Group PLC, Greencross Vets, Ethos Veterinary Health, Pets At Home Group PLC, Mars, Incorporated, Animal Hospital Inc., All Pets Animal Hospital, Cahaba Valley Animal Clinic, Blaine Central Veterinary Clinic, Belltowne Veterinary Center.

b. Key factors that are driving the veterinary hospital market growth include increasing animal population, humanization of pets, advancement in veterinary care, growing demand for pet insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."