- Home

- »

- Animal Health

- »

-

Veterinary Infectious Disease Diagnostics Market Report 2030GVR Report cover

![Veterinary Infectious Disease Diagnostics Market Size, Share & Trends Report]()

Veterinary Infectious Disease Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Companion, Livestock), By Technology (Immunodiagnostics, Molecular Diagnostics), By Product, By Infection, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-597-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Infectious Disease Diagnostics Market Summary

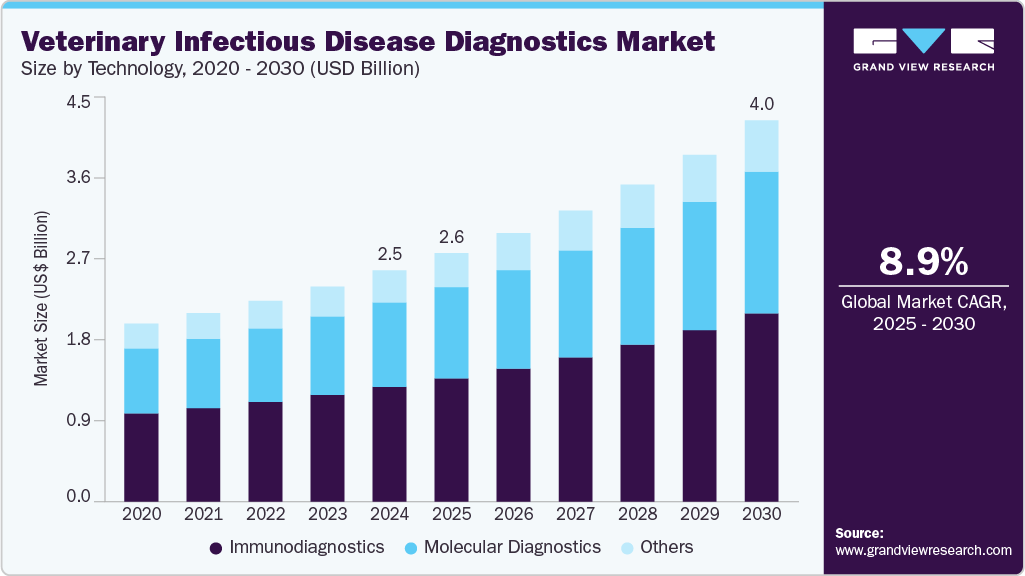

The global veterinary infectious disease diagnostics market size was estimated at USD 2.46 billion in 2024 and is projected to reach USD 4.05 billion by 2030, growing at a CAGR of 8.93% from 2025 to 2030. The market is driven by several key factors, including the rising prevalence of infectious diseases among companion and livestock animals, increasing pet ownership, and growing awareness of animal health.

Market Size & Trends:

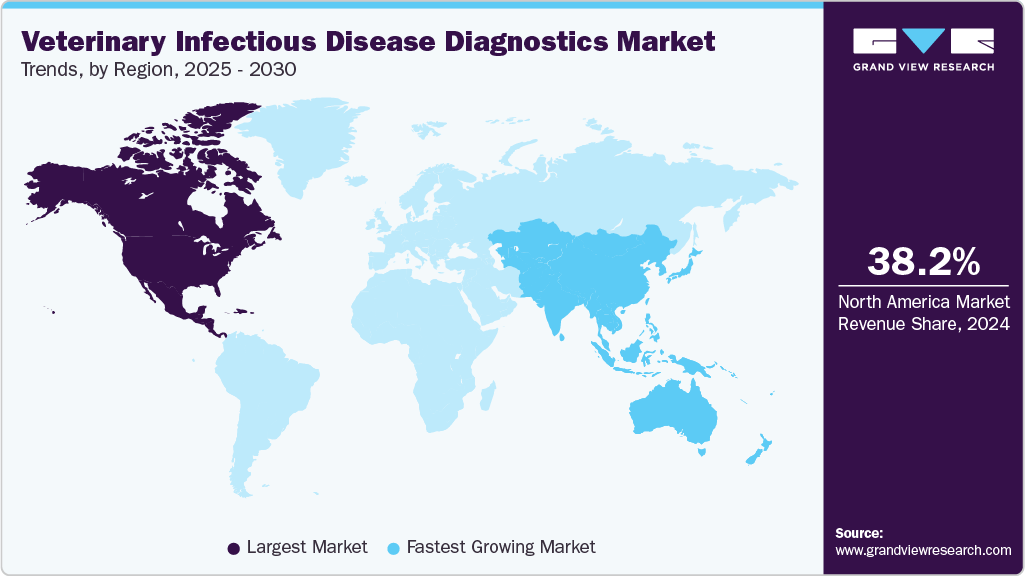

- The North America veterinary diagnostics industry led the global industry in 2024, capturing the largest revenue share of 38.25%.

- The U.S. veterinary infectious disease diagnostics industry is anticipated to grow significantly over the forecast period.

- By product, the consumables, reagents, and kits segment dominated the market and accounted for the largest revenue share in 2024.

- By animal type, the companion segment dominated the market with the largest revenue share in 2024.

- By technology, the immunodiagnostics segment dominated the market with a revenue share of over 49.00% in 2024.

Key Market Statistics:

- 2024 Market Size: $2.46 Billion

- 2030 Estimated Market Size: $4.05 Billion

- CAGR: 8.93% (2025-2030)

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The market is driven by several key factors, including the rising prevalence of infectious diseases among companion and livestock animals, increasing pet ownership, and growing awareness of animal health. For example, outbreaks of diseases such as canine parvovirus, avian influenza, and bovine tuberculosis have heightened the need for accurate and timely diagnostic tools.

Moreover, the rising prevalence of infectious diseases in both companion and livestock is a major factor propelling the market growth, as it increases the need for timely and accurate detection to prevent outbreaks, reduce mortality, and ensure public health. For instance, according to an article published by PoultryMed, in May 2025, Brazil reported its first outbreak of highly pathogenic avian influenza (HPAI) H5N1 on a commercial poultry farm, located in Montenegro in the southern state of Rio Grande do Sul. As the world’s largest poultry exporter, Brazil plays a crucial role in global poultry trade. While earlier cases detected in wild birds did not affect the country’s trade standing, the emergence of HPAI in a commercial setting may trigger trade restrictions and pose challenges to its poultry industry.

Similarly, the expansion of the livestock industry globally significantly supports the veterinary infectious disease diagnostics industry by increasing the demand for effective disease monitoring and management solutions. For instance, according to an article published by Grupo de Comunicación agriNews, SL, in April 2025, the global poultry industry is set for substantial growth in 2025, fueled by rising consumer demand, affordability, and its comparatively lower environmental footprint than other meats. The market is anticipated to grow from $384.95 billion in 2024 to $410.98 billion in 2025. Asia is projected to lead this expansion, driven by factors including population growth, increasing disposable incomes, shifting dietary habits, and rapid urbanization in the region.

As countries like China and India rapidly grow their livestock populations to meet rising protein consumption and economic development, the risk of infectious disease outbreaks also escalates, threatening animal health and food security. This drives the adoption of advanced diagnostic technologies such as PCR-based tests and rapid point-of-care assays to enable early detection and control of diseases like foot-and-mouth disease, avian influenza, and swine fever.

Furthermore, pet insurance acts as a key market enabler for veterinary infectious disease diagnostics by enhancing the affordability and accessibility of advanced diagnostic services for pet owners. As veterinary care costs rise, insurance coverage helps reduce the financial burden associated with testing and treatment, encouraging more pet owners to seek timely medical attention for their animals. This leads to increased demand for diagnostic tests to detect infectious diseases such as parvovirus, leptospirosis, and feline immunodeficiency virus. With insurance plans often covering diagnostic procedures, veterinary clinics are more likely to adopt advanced tools like PCR testing and rapid point-of-care kits, further supporting market growth. In addition, the growing popularity of comprehensive pet insurance in regions like North America and Europe contributes to higher diagnostic testing rates and improved overall animal health outcomes.

Table 1 Top 9 Milk Producing Countries, 2024

Countries

Estimated Production Volume (Million Metric Tons)

India

200

U.S.

100

China

50

Brazil

30

Russia

25

Germany

25

New Zealand

20

Argentina

10

Australia

10

Source: EssFeed, Grand View Research

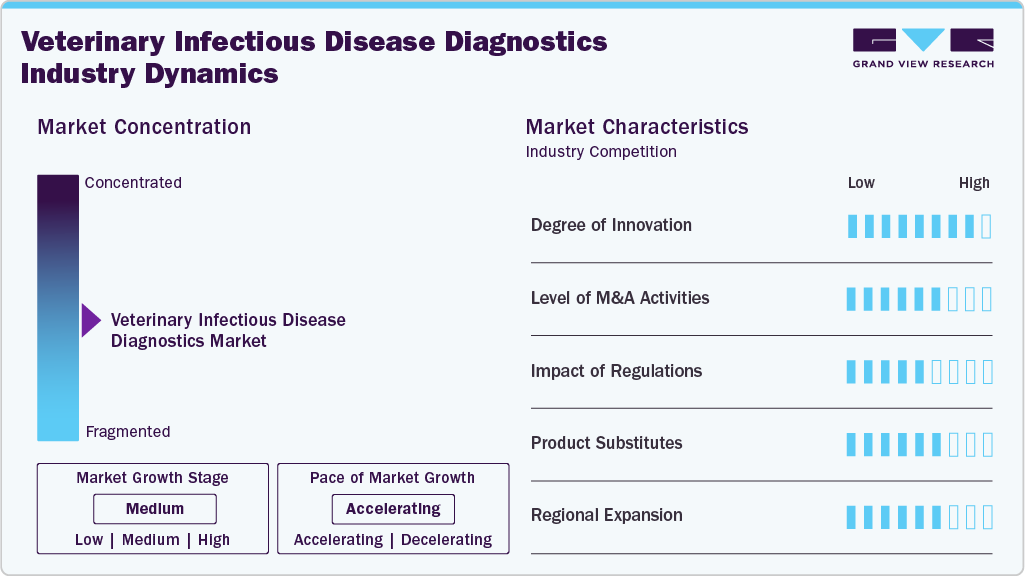

Market Concentration & Characteristics

The veterinary infectious disease diagnostics industry exhibits a high market concentration, and the pace of the market growth is accelerating. One of the key factors fueling the market growth is rapid technological advancements. For instance, according to Bentham Science, rapid and accurate pathogen identification is critical for the effective control and management of veterinary infectious diseases. The advent of nucleic acid amplification technologies, particularly PCR, has transformed laboratory diagnostics by enabling detection at the genetic level. PCR-based techniques provide unparalleled sensitivity, specificity, speed, and accuracy, capable of identifying even a single copy of a pathogen’s nucleic acid. Recent advancements in probe chemistry, multi-fluorescent channel PCR instruments, and automation have further enhanced the technology, leading to the development of quantitative PCR platforms. These innovations support high-throughput, precise quantification and differentiation of pathogens in veterinary clinical samples, driving efficiency and reliability in infectious disease diagnostics.

The degree of innovation is high, driven by advancements in biotechnology, molecular diagnostics, and point-of-care testing. These innovations aim to improve accuracy, speed, ease of use, and cost-effectiveness in diagnosing infectious diseases in animals. For example, molecular techniques such as real-time PCR and multiplex PCR are widely used for their high sensitivity and specificity, while portable PCR devices and rapid lateral flow assays, like Zoetis’ VetScan Flex4, allow on-site, quick detection of multiple pathogens.

The market experiences a moderate level of mergers and acquisitions, fueled by growing demand for advanced diagnostic solutions and efforts by major players to enhance their technological capabilities and expand their geographic footprint. For example, in August 2023, German diagnostics firm Synlab, which operates in both human and animal health, agreed to sell its animal health diagnostics division to Mars Inc. This move allows Synlab to concentrate on its core areas, while SYNLAB VET is expected to grow under Mars' ownership.

Regulations have a significant impact on the market, shaping product development, approval processes, and market access. Regulatory bodies such as the U.S. Department of Agriculture (USDA), the European Medicines Agency (EMA), and national veterinary authorities enforce strict guidelines to ensure the safety, accuracy, and reliability of diagnostic tests. These regulations mandate thorough validation and quality control procedures, which can increase the time and cost associated with bringing new diagnostics to market. However, they also enhance consumer and veterinarian confidence by ensuring diagnostic tools meet high standards.

The level of product substitutes in the market is moderate, as alternative diagnostic methods exist but often differ in accuracy, speed, and application. Traditional diagnostic techniques such as culture-based methods, microscopy, and serology serve as substitutes to advanced molecular diagnostics; however, they generally have longer turnaround times and lower sensitivity. For example, while culture tests can identify bacterial infections, they may take days compared to rapid PCR-based tests that deliver results within hours.

Companies in the veterinary infectious disease diagnostics industry are increasingly prioritizing regional expansion to capitalize on the rising demand for advanced diagnostic solutions. Leading players are targeting emerging markets in Asia-Pacific and Latin America, driven by factors such as growing pet ownership, rising spending on veterinary healthcare, and improving veterinary infrastructure in these regions.

Product Insights

The consumables, reagents, and kits segment dominated the market and accounted for the largest revenue share in 2024, as they are essential for conducting accurate and efficient tests to detect a wide range of animal diseases. These products include PCR kits, ELISA reagents, culture media, and rapid test strips that enable quick and reliable identification of pathogens such as canine parvovirus, bovine tuberculosis, and avian influenza. For example, PCR reagent kits are widely used in veterinary labs for their sensitivity and specificity in detecting viral DNA or RNA, while ELISA kits are commonly employed for antibody detection in livestock disease surveillance.

Moreover, consumables, reagents, and kits offer several advantages over instruments in the market. Unlike expensive diagnostic instruments that require significant upfront investment and ongoing maintenance, consumables are more cost-effective and accessible for a wide range of veterinary settings, including smaller clinics and field operations. They enable flexible, on-demand testing without the need for specialized equipment, which is especially valuable in remote or resource-limited areas.

Animal Insights

The companion segment dominated the market with the largest revenue share in 2024. This can be attributed to factors such as the increasing uptake of pet insurance, rising pet ownership, and increasing pet expenditure. According to an article published by PetFoodIndustry, in March 2025, pet ownership is on the rise, with 94 million U.S. households currently having at least one pet, up from 82 million in 2023. Dog ownership has increased to 51% of households, representing 68 million dogs, while cats are now present in 37% of households, amounting to 49 million cats.

The livestock segment is expected to exhibit the fastest CAGR over the forecast period. High disease susceptibility in cattle, swine, poultry, and sheep necessitates routine diagnostics to monitor and control infections such as bovine tuberculosis, swine fever, and avian influenza. For instance, regular screening for mastitis in dairy cattle using diagnostic kits helps ensure milk quality and herd productivity. In addition, government regulations and livestock export requirements often mandate disease testing, further boosting demand for veterinary diagnostics. This continuous need for disease surveillance and health management in livestock significantly propels market growth.

Technology Insights

The immunodiagnostics segment dominated the market with a revenue share of over 49.00% in 2024, due to their high sensitivity, rapid turnaround time, and broad applicability across various animal species and pathogens. Techniques such as enzyme-linked immunosorbent assay (ELISA), lateral flow assays, and immunofluorescence are widely used in both clinical and field settings to detect specific antigens or antibodies associated with infections like canine parvovirus, bovine tuberculosis, and feline leukemia virus (FeLV). For example, ELISA kits are routinely used in veterinary clinics to screen for FeLV in cats during routine checkups, while lateral flow tests allow quick diagnosis of parvovirus in puppies showing acute gastrointestinal symptoms. These tests are cost-effective, user-friendly, and often provide results within minutes, making them ideal for high-throughput screening and early detection, thus solidifying immunodiagnostics as a cornerstone of the veterinary infectious disease diagnostic industry.

The molecular diagnostics segment is anticipated to grow at the fastest CAGR over the forecast period. Techniques like PCR (polymerase chain reaction) and RT-PCR are widely used to identify infections such as canine parvovirus, feline leukemia virus, and avian influenza with high sensitivity and specificity. For example, real-time PCR kits can quickly detect foot-and-mouth disease virus in livestock, helping prevent large-scale outbreaks. These advanced tools support timely treatment decisions, reduce the spread of infections, and are increasingly adopted in veterinary clinics and diagnostic labs, thereby fueling market growth.

End Use Insights

Veterinary hospitals and clinics dominate the market due to their role as primary care centers for animal health, offering immediate access to diagnostic tools and skilled professionals. These facilities routinely perform diagnostic tests such as PCR, ELISA, and rapid immunoassays to detect diseases such as canine parvovirus, feline leukemia virus, and bovine tuberculosis. For example, when a dog shows symptoms of respiratory distress, a veterinary clinic can quickly conduct a PCR test to diagnose canine distemper, enabling timely treatment. Their integration of in-house laboratories, regular patient visits, and ability to manage both companion and livestock animals ensures a high volume of diagnostic procedures, reinforcing their central role in the market.

The others segment is expected to grow at the fastest CAGR over the forecast period. Research institutes contribute through the development of novel assays, such as next-generation sequencing or biosensor-based diagnostics, which improve accuracy and early detection of diseases like avian influenza or foot-and-mouth disease. For instance, a research institute may develop a portable device for detecting African swine fever in remote farms. Point-of-care facilities, including mobile veterinary units and rural clinics, use such technologies to deliver on-site testing for infections like bovine viral diarrhea or equine herpesvirus, ensuring immediate diagnosis and containment, particularly in livestock-dense or resource-limited areas. This combination of innovation and accessibility enhances disease surveillance and accelerates market growth.

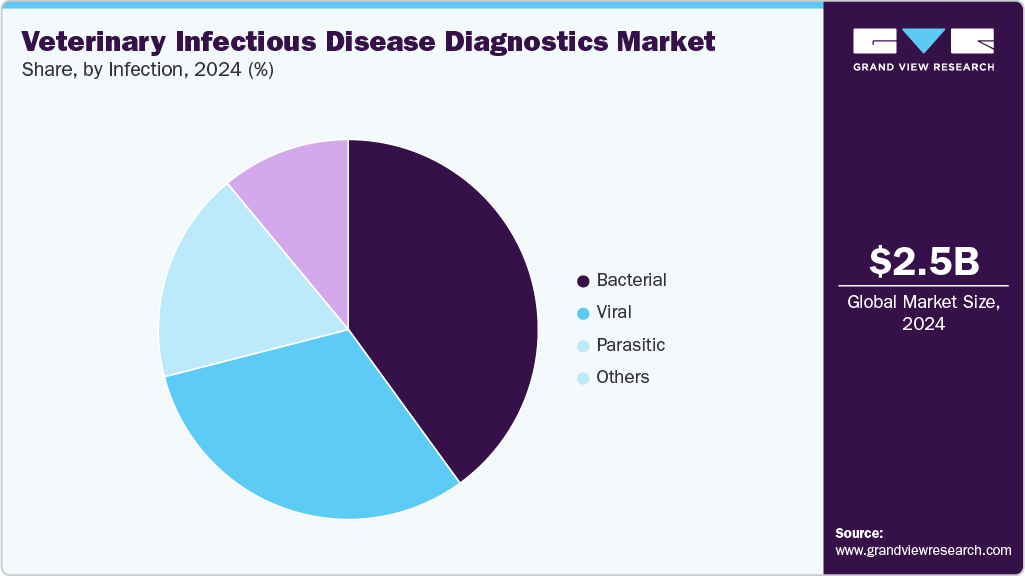

Infection Insights

The bacterial infection segment dominated the market with the largest revenue share of over 40.0% in 2024, due to their high prevalence across both companion and livestock animals and the need for rapid, accurate detection to prevent outbreaks. Common bacterial diseases such as bovine mastitis, caused by Staphylococcus aureus, and kennel cough in dogs, caused by Bordetella bronchiseptica, require timely diagnosis to ensure effective treatment and control. For instance, according to an article published by National Library of Medicine, in March 2025, bacterial skin infections are commonly identified during veterinary diagnostic evaluations in dogs and often serve as a clinical sign of deeper underlying issues, such as environmental or food allergies, hormonal imbalances, or ectoparasite infestations like fleas or mites.

The viral infection segment is expected to exhibit the fastest CAGR of over 9.57% over the forecast period. due to their rapid transmission, severe health impacts, and the lack of direct antiviral treatments, necessitating early and accurate diagnosis. Highly contagious diseases such as canine parvovirus, feline leukemia virus (FeLV), and avian influenza require prompt identification to control outbreaks and initiate supportive care. For instance, veterinary clinics routinely use ELISA or PCR tests to detect parvovirus in puppies presenting with vomiting and diarrhea, helping prevent spread in shelters.

Regional Insights

The North America veterinary diagnostics industry led the global industry in 2024, capturing the largest revenue share of 38.25%. This dominance is attributed to the region’s well-established veterinary healthcare infrastructure, widespread adoption of advanced technologies, high disposable incomes, and the presence of major industry players. Ongoing strategic initiatives by these companies are expected to further drive growth in the regional market. For instance, IDEXX Laboratories, Inc., a global leader in pet healthcare innovation, introduced the Catalyst Pancreatic Lipase Test a single-slide solution designed for dogs and cats suspected of pancreatitis. Thanks to the innovative load-and-go workflow of Catalyst analyzers, this test can be performed seamlessly alongside chemistry profiles, enabling quicker diagnoses and improved patient outcomes.

U.S. Veterinary Infectious Disease Diagnostics Market Trends

The U.S. veterinary infectious disease diagnostics industry is anticipated to grow significantly over the forecast period. The country’s large pet population and increasing pet expenditure are key drivers of market growth. For example, the APPA projects’ pet spending is to reach USD 157 billion by 2025. As more households welcome pets, the demand for regular health checkups, disease screenings, and early diagnosis rises. At the same time, pet owners are investing more in veterinary care, fueled by growing pet humanization and an emphasis on preventive health. This trend motivates veterinary clinics and reference laboratories to adopt diagnostic tools that provide faster results, greater accuracy, and remote consultation options, thereby enhancing overall animal care.

Europe Veterinary Infectious Disease Diagnostics Market Trends

The veterinary infectious disease diagnostics industry in Europe is projected to experience lucrative growth, driven by the escalating prevalence of infectious diseases, rising pet ownership rates, and increased adoption of pet insurance. According to the 2024 FEDIAF report, approximately 50% of European households own pets, accounting for 166 million out of the 352 million pets across Europe, reflecting a growing pet owner base. As more households embrace pets as integral family members, the demand for comprehensive healthcare services including routine screenings and early detection of infectious diseases, increases substantially. This cultural shift fosters greater awareness and willingness among pet owners to invest in preventive care, prompting veterinary clinics and laboratories to adopt advanced, accurate, and rapid diagnostic technologies.

The UK veterinary infectious disease diagnostics industry is driven by the presence of key insurance providers offering extensive coverage for veterinary diagnostic services, playing a crucial role in driving market growth in the country. Companies like PetPlan offer comprehensive insurance policies that cover a wide range of veterinary needs, including diagnostic tests, physical and online consultations, surgeries, and various therapeutic treatments for pets. By mitigating the high out-of-pocket expenses typically associated with advanced diagnostic procedures, these insurance plans lower financial barriers for pet owners, enabling them to seek timely and regular veterinary care. This increased accessibility promotes the adoption of sophisticated diagnostic tools and technologies by veterinary clinics, as insured pet owners are more likely to opt for thorough testing and early disease detection.

Asia Pacific Veterinary Infectious Disease Diagnostics Market Trends

The Asia Pacific veterinary infectious disease diagnostics industry is projected to experience the fastest CAGR during the forecast period, driven by a combination of rising pet ownership, expanding livestock production, and increasing awareness of advanced animal healthcare solutions. Rapid urbanization in countries such as China, India, and Japan has led to a significant rise in the adoption of companion animals, which in turn is fueling the demand for precise, timely, and accessible diagnostic services to ensure effective disease management and preventive care. In addition, growing concerns over zoonotic diseases and food safety are pushing both the public and private sectors to invest in veterinary diagnostics. Government initiatives aimed at improving animal health infrastructure, coupled with the strategic presence and expansion activities of leading market players, are further catalyzing growth across the region.

The Asia Pacific veterinary infectious disease diagnostics industry is growing at a rapid pace, due to the increasing prevalence of cancers in pets. For instance, according to an article published by Ministry of Fisheries, Animal Husbandry & Dairying, in April 2025, Avian Influenza is a highly contagious viral disease primarily affecting birds, with occasional transmission to mammals. Since its initial detection in India in 2006, the country has experienced recurring outbreaks across various states each year. In 2025, the virus demonstrated cross-species transmission, affecting not only poultry but also wild birds and, in some regions, even big cats. Presently, six active outbreak zones have been identified in Jharkhand, Telangana, and Chhattisgarh. These outbreaks not only threaten animal health and farm productivity but also pose serious public health risks due to zoonotic potential, prompting the need for early detection and containment. Consequently, there is a growing demand for accurate, rapid, and scalable diagnostic solutions to monitor, prevent, and manage infectious diseases in poultry, thereby fueling the expansion of the veterinary diagnostics market.

Latin America Veterinary Infectious Disease Diagnostics Market Trends

The veterinary infectious disease diagnostics industry in Latin America is poised for substantial growth, driven by expanding livestock production and increased investment in veterinary healthcare infrastructure. Countries such as Brazil and Argentina are experiencing heightened demand for advanced diagnostic technologies to support both companion animal care and livestock health management. Moreover, growing awareness of zoonotic diseases and their economic implications is prompting stakeholders to adopt rapid, high-throughput diagnostic solutions capable of early detection and precise disease monitoring. This shift toward proactive animal health management, supported by government initiatives and private sector engagement, is expected to significantly accelerate the adoption of veterinary diagnostic tools across the region.

Brazil veterinary infectious disease diagnostics industry is driven by the continuous development of its veterinary healthcare infrastructure and the increasing frequency of infectious disease outbreaks among animals. A notable example illustrating this trend occurred in May 2025, when the Brazilian Ministry of Agriculture and Livestock confirmed an outbreak of Highly Pathogenic Avian Influenza (H5N1) at the Sapucaia do Sul Zoo in the state of Rio Grande do Sul. The outbreak led to the deaths of 38 swans and ducks, raising serious public and animal health concerns. In response to the situation, the Ministry of Environment and Infrastructure of Rio Grande do Sul ordered the immediate closure of the zoo to prevent further spread and ensure containment of the virus. This incident underscores the critical need for advanced and rapid diagnostic tools to enable early detection, control, and monitoring of infectious diseases in both wildlife and domestic animals.

Middle East & Africa Veterinary Infectious Disease Diagnostics Market Trends

The Middle East & Africa (MEA) veterinary infectious disease diagnostics industry comprising countries such as South Africa, Saudi Arabia, the UAE, and Kuwait, is expected to witness steady growth over the forecast period. This growth is primarily driven by increasing awareness of zoonotic diseases and a heightened focus on improving livestock health. With rising concerns over public health risks stemming from outbreaks like avian influenza and rabies, the need for timely, accurate disease detection in animals is gaining urgency. Governments and veterinary stakeholders are increasingly investing in diagnostic technologies to enhance early intervention capabilities and safeguard both animal and human health.

South Africa veterinary infectious disease diagnostics industry is driven by its growing emphasis on animal health surveillance, government-led disease control programs, and rising awareness of zoonotic threats. The country’s robust livestock industry, particularly in cattle, poultry, and sheep, necessitates efficient diagnostic tools to manage disease outbreaks and ensure food security. For instance, in recent years, South Africa has faced multiple outbreaks of foot-and-mouth disease (FMD), prompting the Department of Agriculture, Land Reform and Rural Development (DALRRD) to implement strict containment and testing protocols. These recurring incidents highlight the need for advanced diagnostic solutions that enable rapid detection and response, thereby supporting the expansion of the veterinary diagnostics market.

Key Veterinary Infectious Disease Diagnostics Company Insights

The veterinary infectious disease diagnostics industry is moderately competitive, characterized by the presence of both established and emerging players. Competition is largely driven by rapid technological advancements and the continuous need for innovation. To strengthen their market position and broaden their product offerings, major companies are actively pursuing strategies such as mergers and acquisitions, strategic collaborations, and the introduction of cutting-edge diagnostic solutions. These efforts enable firms to enhance their capabilities, cater to evolving customer demands, and maintain a competitive edge in a dynamic market landscape.

Key Veterinary Infectious Disease Diagnostics Companies:

The following are the leading companies in the veterinary infectious disease diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories Inc.

- Zoetis Services LLC.

- Thermo Fisher Scientific, Inc.

- Virbac

- bioMérieux SA

- IDvet

- Neogen Corporation

- Agrolabo S.p.A.

- Bio-Rad Laboratories, Inc

- Antech Diagnostics, Inc.

Recent Developments

-

In February 2024, MiDOG Animal Diagnostics introduced an advanced All-in-One Diagnostic Test capable of rapidly detecting bacterial and fungal infections, including antibiotic resistance, across various animal species. This innovation aims to enhance veterinary care by replacing traditional testing methods with efficient molecular-based diagnostics, supporting comprehensive treatment strategies for diverse animals, from pets to exotic species.

-

In February 2024, BioStone Animal Health launched AsurDx Rabies Antibody Test Kit, specifically designed to detect rabies virus antibodies in mammalian serum samples. The rabies virus belongs to the order Mononegavirales, comprising viruses characterized by nonsegmented, negative-sense RNA genomes.

-

In March 2025, Antech, a leading global company in veterinary diagnostics, technology, and imaging, launched trūRapid FOUR, a comprehensive in-house screening test for canine vector-borne diseases (CVBD).

-

In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

Veterinary Infectious Disease Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.64 billion

Revenue forecast in 2030

USD 4.05 billion

Growth Rate

CAGR of 8.93% from 2025 to 2030

Historical Period

2018 - 2023

Actual data

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, technology, infection, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IDEXX Laboratories Inc.; Zoetis Services LLC.; Antech Diagnostics, Inc.; Virbac; Thermo Fisher Scientific, Inc; bioMérieux SA; Neogen Corporation; Agrolabo S.p.A.; IDVet; Bio-Rad Laboratories, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Infectious Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary infectious disease diagnostics market report based on animal, product, technology, Infection, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables, Reagents & Kits

-

Equipment & Instruments

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunodiagnostics

-

Lateral Flow Assays

-

ELISA Test

-

Others

-

-

Molecular Diagnostic

-

Polymerase Chain Reaction (PCR) Tests

-

Microarrays

-

Others

-

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Livestock

-

Poultry

-

Cattle

-

Swine

-

Others

-

-

Companion

-

Canine

-

Feline

-

Equine

-

Others

-

-

-

Infection Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacterial

-

Viral

-

Parasitic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals and Clinics

-

Veterinary Reference Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary infectious disease diagnostics market size was estimated at USD 2.46 billion in 2024 and is expected to reach USD 2.64 billion in 2025

b. The global veterinary infectious disease diagnostics market is expected to grow at a compound annual growth rate of 8.93% from 2025 to 2030 to reach USD 4.05 billion by 2030.

b. North America dominated the veterinary infectious disease diagnostics market with a share of 38.25% in 2024. This is attributable to the region’s well-established veterinary healthcare infrastructure, widespread adoption of advanced technologies, high disposable incomes, and the presence of major industry players.

b. Some key players operating in the veterinary infectious disease diagnostics market include IDEXX Laboratories Inc., Zoetis Services LLC., Antech Diagnostics, Inc., Virbac, Thermo Fisher Scientific, Inc, bioMérieux SA, Neogen Corporation, Agrolabo S.p.A., IDVet, Bio-Rad Laboratories, Inc

b. Key factors that are driving the market growth include including the rising prevalence of infectious diseases among companion and livestock animals, increasing pet ownership, and growing awareness of animal health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.