- Home

- »

- Animal Health

- »

-

Veterinary Rehabilitation Services Market Size Report, 2030GVR Report cover

![Veterinary Rehabilitation Services Market Size, Share & Trends Report]()

Veterinary Rehabilitation Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Production Animals), By Therapy Type, By Indication, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-998-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

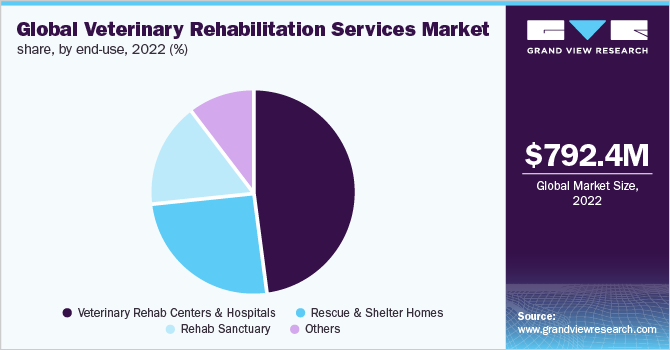

The global veterinary rehabilitation services market size was estimated at USD 792.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. The growing number of companion animals & pet humanization trends, increasing prevalence of musculoskeletal & orthopedic disorders among animals, and rising awareness among pet owners regarding physical rehabilitation as non-invasive & drug-free treatment are some of the key factors driving this market. In addition, with the growing number of people valuing wildlife conservation, the count of volunteer rehabilitators who rescue and protect wounded/injured wildlife animals is also increasing. For instance, according to a study published in March 2022, by the National Library of Medicine, millions of native animals are rescued, rehabilitated, and protected by wildlife rehabilitators each year globally.

The COVID-19 pandemic adversely impacted the veterinary rehabilitation services market, especially during the year 2020. This negative impact was majorly due to the declaration of lockdowns in various countries which resulted in the closure and restricted access to veterinary care. This circumstance has created hurdles among pet owners in accessing veterinary rehabilitation services for their beloved companions due to the cancellation and forced closure of rehab centers. Moreover, wildlife rehabilitation centers have faced severe challenges during the pandemic with disease contamination risks within the facilities and among native habitats. This concern led the wildlife rehab centers to have interrupted veterinary visits or reduced personnel by over 85% in specific cases.

According to a survey article published in July 2021 by the National Library of Medicine, the sudden outbreak of COVID-19 has negatively impacted the main income sources of Latin American wildlife rehabilitation centers in 2020. As the majority of rehabilitation expenses were covered by regular tourist visitations, funds, and donations, the pandemic reduced routine rehabilitation services to a greater extent. However, the services fairly recovered in 2021 owing to the ease of COVID-19 restrictions. For instance, the Noah’s Ark Animal Rehabilitation Center & Sanctuary, Inc. reported that their rehabilitation expenses increased from USD 1,842 in 2020 to USD 9,961 in 2021 owing to the resumption of services. On the other hand, the pandemic has sparked the public’s interest in pet ownership, and hence several countries have witnessed high dog & cat adoption rates in 2020 and 2021.

Furthermore, the growing adoption of pet insurance with rehabilitation services coverage, post-pandemic return to normality with the resumption of veterinary rehab services, expansion in the number of vet rehab centers, and increased pet healthcare expenditure are some of the other factors driving the veterinary rehabilitation services market. According to the American Pet Products Association (APPA), the pet care expenditure in the U.S. raised to reach 123.6 billion in 2021 from USD 90.5 billion in 2018. Hence, the increasing annual pet healthcare expenditure is one of the major factors in the market growth. Moreover, the gaining popularity of veterinary rehab has reflected the devotion of pet owners who have proven their willingness to invest more time and money in their pets’ healthcare. Considering the perceived applications and benefits of rehab, the sector is anticipated to grow at a fast pace in veterinary medicine.

Animal Type Insights

The companion animal segment is expected to dominate the market and accounted for the largest revenue share of 63.1 % in 2022. Increasing pet ownership rates especially in developed regions, rising pet healthcare services expenditure, growing incidence of chronic orthopedic conditions and widely arising physical rehabilitation requirements are among the factors responsible for the largest share of the segment. In addition, the growing population rate of dogs in every region further propels the market’s growth. According to the AKC (American Kennel Club), the number of U.S. households owning dogs reached 69 million (54%) in 2021 which increased from 50% in 2018. Similarly, in Europe, nearly 90 million households (46%) own at least one pet, according to FEDIAF European Pet Food Industry in 2021. In addition, the COVID-19 pandemic has encouraged most people in the world to adopt pets for psychological comfort.

The wildlife animals segment is anticipated to grow fast with a CAGR of over 12% during the forecast period owing to the rising awareness about wildlife conservation and growing government initiatives in implementing rehabilitation centers to rescue, rehabilitate, and protect wild habitats. As the rate of extinction of numerous wild species is accelerating, several countries are increasing their wildlife rescue and rehab facilities more importantly to protect endangered species. For instance, Victoria State Government, Australia, grants USD 230,000 for the country’s wildlife rehabilitators as per Wildlife Rehabilitator Grants 2022-30 program. As per the grant, each rehabilitator applicant who holds a valid authorization from the DELWP (Department of Environment, Land, Water, and Planning) is funded up to USD 3,000. Such supportive initiatives by the government are anticipated in boosting the growth of the segment.

Therapy Type Insights

The therapeutic exercises segment dominated the market and accounted for the largest revenue share of over 22% in 2022. Therapeutic or guided exercises are one of the most frequently used physical rehabilitation therapy for companion animals such as dogs. Veterinary therapeutic exercise programs comprise balance therapies, weight shifting, weight loss therapies, and several other exercises using grounded treadmills, cavalletti rails, balance discs, and peanut balls among others. These exercises enhance the body mobility, strength, flexibility, and endurance of animals that have chronic conditions such as arthritis, or those recovering from debilitating musculoskeletal or orthopedic surgery. In addition, for animal patients with neurological conditions, physical rehab exercises catalyze their healing process and speed up the return to normal physic, and promote overall energy and health.

The hydrotherapy segment held a significant market share over the forecast period with the fastest CAGR of over 12%. This is owing to the growing awareness about the potential therapeutic benefits of hydrotherapy (also called aquatic therapy) for pets affected with painful medical conditions. Two of the most common forms of veterinary hydrotherapy include underwater treadmill exercises and swimming. The water’s buoyancy enables animals with painful conditions to move their muscles with less pain & stress. In addition, the usage of warm water in most veterinary rehab centers increases the joint’s flexibility and range of movement. The growing admission rates for hydrotherapies to treat ailments such as obesity, neurological conditions, post-orthopedic surgical recovery, diabetes, atrophy, and other injuries are significantly driving the growth of the segment.

Indication Insights

The post-surgery segment dominated the market and accounted for the largest market share of over 30% in 2022. This substantial share is owing to the growing number of orthopedic surgeries performed for dogs and cats, with the increasing number of veterinarians directing pets toward rehabilitation centers after surgery. Orthopedic surgeries for companion animals are one of the common procedures that veterinarians perform to treat musculoskeletal issues. Post-operative patients are more likely to consider rehabilitation to reduce inflammation & pain and to improve the healing rate. Physical rehabilitation therapy after surgery has become more common in the veterinary field with newer advancements, which further contributes to segmental growth.

The acute & chronic disease segment is expected to grow at the fastest CAGR over the forecast period owing to its widespread nature among companion animals. Arthritis/degenerative joint disorders, neurological disorders, obesity, intervertebral disc disease, and others are some of the highly prevalent diseases seen among companion animal species. For instance, according to Parnell Living Science, 80% of the dog population shows arthritis signs regardless of age.According to the American Kennel Club, Inc., nearly one in every five dogs suffer from arthritis, which mostly affects the hips, legs, back, and other body parts. An article published by NC State University reports that 90% of cats aged above 10 years old show signs of arthritis. Therefore, the rising prevalence of such chronic diseases has increased the adoption of advanced non-invasive therapy options like physical rehabilitation to improve the quality of veterinary care.

End-use Insights

The veterinary rehab centers and hospitals segment dominated the market and accounted for the largest market share of over 45% in 2022. This is owing to a growing number of veterinary rehab hospitals and centers globally with advanced infrastructures. These centers are very crucial for veterinary rehabilitation services as they provide professional therapies with certified veterinary rehabilitators. The growing number of veterinary rehab professionals is another factor driving the segment growth in the market. According to the American Animal Hospital Association (AAHA), currently, many veterinary technicians and normal veterinarians are certified to rehabilitate animal patients in veterinary general hospitals. These affirmative factors are contributing to the segmental growth over the forecast period.

The rehab sanctuary segment is anticipated to witness the fastest CAGR of over 12% over the forecast period. This is attributed to the rising government initiatives in establishing wildlife rehab sanctuaries as a need for conserving the environment. For instance, in India, the government has taken initiatives in setting up new wildlife parks and sanctuaries as part of the Wildlife Protection Act, 1972 by the Constitution of the Indian Board of Wildlife. The act includes rehabilitation and protection services for threatened and endangered species. Such supportive acts by governments of developing countries are further propelling segmental growth.

Regional Insights

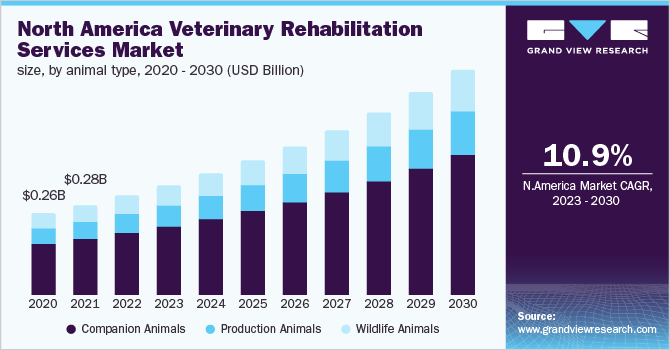

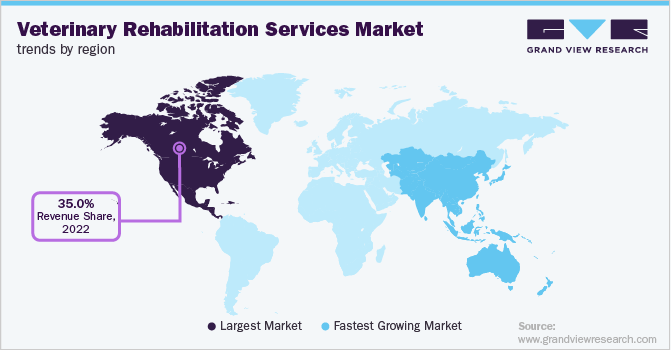

North America dominated the veterinary rehabilitation services market and accounted for a revenue share of over 35% in 2022. The high share of the region is due to the significant presence of veterinary rehabilitation centers, growing awareness among pet owners regarding physical rehab services, rising therapy availability, and increasing pet ownership & veterinary expenditure. The increasing number of veterinary hospitals with trained and licensed veterinarians who also offer rehabilitation services is another factor boosting the market growth. According to the American Veterinary Medical Association, over 110,000 registered veterinarians were estimated in the U.S. in 2020, majorly offering services to small animal patients. According to APPA a large number of these registered veterinarians are currently certified to provide rehabilitation for companion animals.

Europe region holds the second-largest share of the market. This is owing to the rising number of wildlife rehabilitation centers and shelter homes in European countries. The Asia Pacific region is estimated to grow fast with a CAGR of nearly 13% in the next few years. This is attributable to the increasing disposable income & veterinary services expenditure in key markets and growing awareness about pet rehab services in developing countries. The rising demand for proper and timely rehabilitation for companions to relieve their painful conditions, and pet humanization in developing countries like India is further boosting the growth of the market.

Key Companies & Market Share Insights

Veterinary rehabilitation centers and hospitals are constantly involved in implementing strategic initiatives such as launching new services and advancing their infrastructure with newer rehab therapeutic instruments. In addition, top veterinary product manufacturers are entering the veterinary rehabilitation market with new strategies. For instance, in July 2022, Vetoquinol, one of the major veterinary medicine manufacturers, announced the launch of their new veterinary rehabilitation program called VeRBS (Vetoquinol Rehabilitation Business Solution) which offers rehab service training with required basic instruments to veterinary clinics. Such initiatives by companies and veterinary organizations are fueling the opportunity for market growth. Some of the prominent players in the veterinary rehabilitation services market include:

-

Back on Track Veterinary Rehabilitation Center, LLC

-

Animal Acupuncture and Rehabilitation Center

-

BARC

-

Treasure Coast Animal Rehab & Fitness

-

Animal Rehab Center of Michigan

-

Blue Springs Animal Rehabilitation Center

-

Essex Animal Hospital

-

Triangle Veterinary Referral Hospital

-

Butterwick animal rehab clinic Ltd

-

Animal Rehab and Conditioning Center

Veterinary Rehabilitation Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 0.88 billion

Revenue forecast in 2030

USD 1.9 billion

Growth rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Animal type, therapy type, indication, end use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Spain; Italy; Japan; China; India; Australia; Brazil; Mexico; South Africa

Key companies profiled

Back on Track Veterinary Rehabilitation Center LLC; Animal Acupuncture and Rehabilitation Center; BARC; Treasure Coast Animal Rehab & Fitness; Animal Rehab Center of Michigan; Blue Springs Animal Rehabilitation Center; Essex Animal Hospital; Triangle Veterinary Referral Hospital; Butterwick animal rehab clinic Ltd; Animal Rehab and Conditioning Center

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Rehabilitation Services Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global veterinary rehabilitation services market report on the basis of animal type, therapy type, indication, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Production Animals

-

Wildlife Animals

-

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Exercises

-

Manual Therapy

-

Hydrotherapy

-

Hot & Cold Therapies

-

Electro Therapies

-

Acupuncture

-

Shockwave TherapyOther

-

Therapies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Post-Surgery

-

Traumatic Injuries

-

Acute & Chronic Diseases

-

Developmental Abnormality

-

Other Indications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Rehab Centers & Hospitals

-

Rescue & Shelter Homes

-

Rehab Sanctuary

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary rehabilitation services market size was estimated at USD 792.4 Million in 2022 and is expected to reach USD 0.88 billion in 2023.

b. The global veterinary rehabilitation services market is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030 to reach USD 1.91 billion by 2030.

b. North America dominated the veterinary rehabilitation services market with a share of over 38% in 2022. This is attributable to the increasing pet healthcare expenditure and a large number of veterinary rehabilitation establishments in the region.

b. Some key players operating in the veterinary rehabilitation services market include Back on Track Veterinary Rehabilitation Center, LLC; Animal Acupuncture and Rehabilitation Center; BARC; Treasure Coast Animal Rehab & Fitness; Animal Rehab Center of Michigan; Blue Springs Animal Rehabilitation Center; Essex Animal Hospital; Triangle Veterinary Referral Hospital; Butterwick animal rehab clinic Ltd; Animal Rehab and Conditioning Center.

b. Key factors that are driving the veterinary rehabilitation services market growth include the growing prevalence of acute & chronic conditions among animals coupled with rising orthopedic surgery rates. In addition, the increasing number of volunteer veterinary rehabilitators and rising rescue & shelter rehab facilities are contributing to the growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.