- Home

- »

- Sensors & Controls

- »

-

Vibration Control System Market Size, Industry Report, 2030GVR Report cover

![Vibration Control System Market Size, Share & Trends Report]()

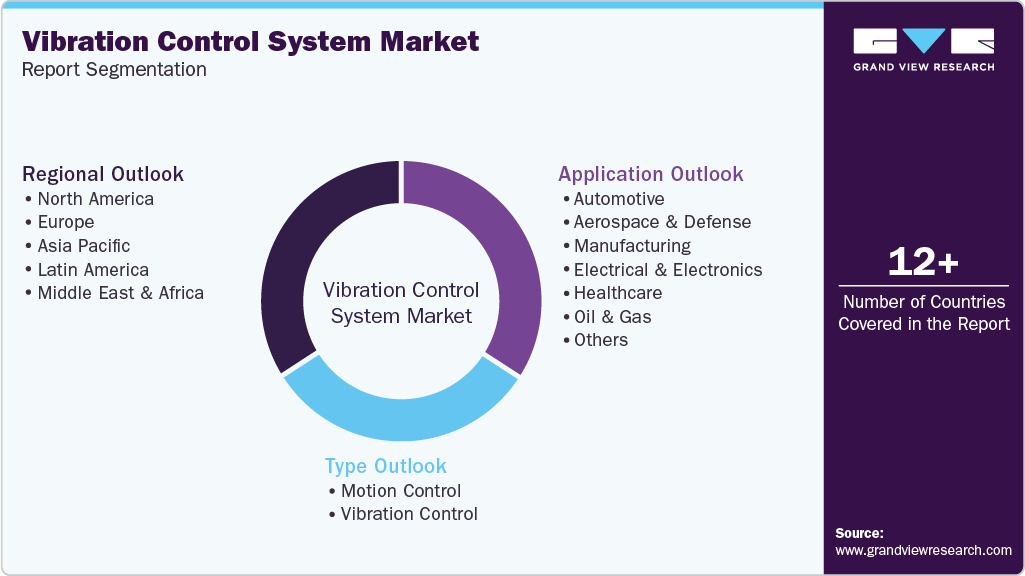

Vibration Control System Market (2025 - 2030) Size, Share & Trends Analysis Report By System Type (Vibration Control, Motion Control), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-196-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vibration Control System Market Summary

The global vibration control system market size was valued at USD 5,483.6 million in 2024 and is projected to reach USD 7,933.9 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The market is experiencing significant growth driven by accelerating demand across multiple high-growth industries such as automotive, aerospace, healthcare, and manufacturing.

Key Market Trends & Insights

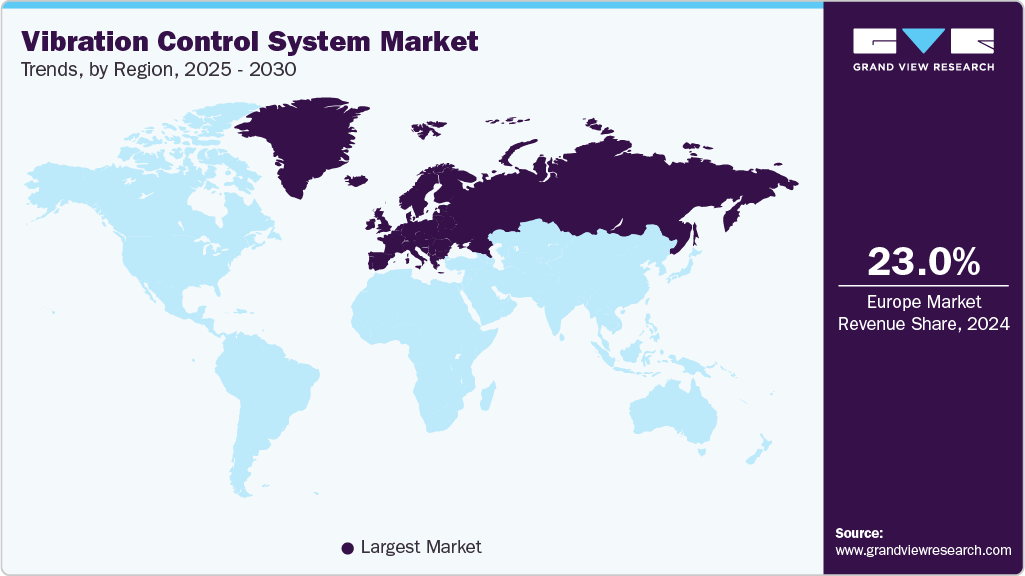

- The vibration control system market in Europe accounted for the largest revenue share of 23% in 2024.

- The U.S. vibration control system market dominated the North America market with a share of over 78% in 2024.

- Based on system type, the vibration control segment accounted for the largest revenue share of over 59% in 2024.

- Based on application, the automotive segment is expected to register the highest CAGR of 8.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,483.6 Million

- 2030 Projected Market Size: USD 7,933.9 Million

- CAGR (2025-2030): 6.4%

- Europe: Largest market in 2024

Increasing industrialization worldwide and stringent government regulations concerning noise, vibration, and harshness (NVH) reduction are major market drivers. These regulations are compelling manufacturers to adopt advanced, efficient vibration control solutions to improve machinery longevity, operational safety, and environmental sustainability.Additionally, technological advancements significantly support the vibration control system industry growth, with innovations in active vibration control systems integrating smart sensors, IoT, and AI for real-time monitoring and adaptive vibration mitigation. This foster improved performance and predictive maintenance capabilities, particularly in precision-dependent sectors such as semiconductor manufacturing, automotive safety systems, and aerospace. Moreover, the rise of electric vehicles, where quieter engines demand enhanced vibration control, further stimulates adoption and innovation in the vibration control system industry.

Additionally, companies are investing heavily in research and development to innovate advanced active vibration control solutions integrated with smart sensors, IoT, and AI technologies. These initiatives aim to offer real-time monitoring, adaptive control, and predictive maintenance capabilities tailored for high-growth sectors, including automotive, aerospace, and healthcare. Furthermore, these players are expanding their global footprint with focused activities in emerging markets where rapid industrialization and urbanization fuel demand, thereby driving the vibration control system industry growth.

Furthermore, the escalating global production demand for electric vehicle (EV) fleets is transforming the strategic landscape of the vibration control system industry. As governments and automakers worldwide commit to ambitious electrification targets, there is a pronounced surge in EV manufacturing volumes, driven by policies promoting zero-emission transportation and sustainability goals. This rapid expansion necessitates advanced vibration control solutions specifically optimized for EV architectures, which encounter unique vibration and noise challenges due to electric motors, high voltage batteries, and lightweight chassis materials.

Moreover, the growing adoption of wireless communication technology in vibration control systems has become a pivotal driver of market growth, fueled by rapid advancements in sensors and communication technologies. Wireless vibration sensors eliminate the constraints associated with traditional wired systems, offering greater flexibility, lower installation and maintenance costs, and enhanced scalability. Key industry players are leveraging wireless sensor networks utilizing protocols such as BLE and LoRaWAN, to enable real-time remote monitoring of vibration parameters even in challenging or inaccessible environments. These innovations facilitate more comprehensive and frequent data collection that bolsters predictive maintenance and fault detection capabilities.

System Type Insights

The vibration control segment dominated the market with a share of over 59% in 2024, driven by the growing demand for enhanced mechanical stability and vibration isolation across key industries such as manufacturing, automotive, aerospace, and infrastructure. This demand is fueled by the increasing adoption of advanced vibration control technologies to improve equipment performance, reduce noise and wear, and meet stringent regulatory and safety standards.

The motion control segment is expected to register a significant CAGR of over 5% from 2025-2030. The segmental growth is driven by increasing automation and precision requirements in manufacturing and robotics. Advanced vibration dampening in motion control systems improves equipment longevity and operational accuracy while minimizing downtime due to mechanical wear. The rise of Industry 4.0 and demand for smart motion solutions incorporating sensors for real-time vibration monitoring are expanding, enhancing predictive maintenance capabilities.

Application Insights

The manufacturing segment dominated the market in 2024, driven by the critical reliance of manufacturing industries on machinery and equipment that generate vibrations during operation. This created a high demand for vibration control systems to ensure operational stability, safety, and machinery longevity. Additionally, the need to meet stringent quality standards, optimize operational efficiency, and reduce risks related to equipment breakdowns and production delays contributed to this dominance. Technological advancements offering innovative, tailored vibration control solutions further propelled adoption in manufacturing facilities worldwide, thereby driving the segment growth.

The automotive segment is expected to register the fastest growth at a CAGR from 2025 to 2030, driven by the stricter government regulations on vehicle vibration and noise, rising adoption of electric and hybrid vehicles, which require advanced vibration control to compensate for quieter engines, and technological advancements such as active vibration control systems that provide real-time adaptation to vibrations. Additionally, manufacturers are focusing on lightweight vibration control components to improve fuel efficiency. At the same time, continuous investments in intelligent damping systems and smart sensor technologies contribute to reducing noise, vibration, and harshness (NVH) in vehicles.

Regional Insights

North America accounted for a share of over 20% in 2024, driven by the growing demand for advanced noise, vibration, and harshness (NVH) solutions in the automotive and aerospace sectors. The shift towards electric vehicles (EVs) and autonomous driving technologies necessitates sophisticated vibration management to enhance performance and comfort.

U.S. Vibration Control System Market Trends

The U.S. vibration control system market dominated the market with a share of over 78% in 2024, driven by the expansion of manufacturing activities and the increasing emphasis on infrastructure modernization. The rise in construction projects, particularly in urban areas, necessitates the use of vibration control solutions to mitigate the impact of machinery on surrounding structures.

Europe Vibration Control System Market Trends

Europe dominated the market with a share of over 23% in 2024, driven by stringent environmental regulations and the automotive industry's push towards electrification. The transition to electric vehicles requires the development of components that can effectively manage vibrations to ensure vehicle performance and passenger comfort. The increasing adoption of automation in manufacturing processes necessitates the integration of vibration control systems to maintain precision and reduce wear on machinery.

The Germany vibration control system market is expected to grow at the fastest rate in the coming years, driven by the country's strong automotive industry and its emphasis on precision engineering. The development of high-performance vehicles, including electric and hybrid models, requires advanced vibration control solutions to meet stringent quality standards.

The UK vibration control system market is rapidly expanding, driven by renewable energy projects, particularly offshore wind farms, which demand robust vibration management solutions to protect equipment and ensure operational efficiency. The construction sector's recovery post-pandemic also contributes to the increased need for vibration control in building foundations and heavy machinery.

Asia Pacific Vibration Control System Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR of 8.3% from 2025 to 2030, driven by the booming automotive and manufacturing industries. The shift towards electric vehicles and the expansion of industrial automation require advanced vibration management solutions to ensure product quality and operational efficiency. The region's focus on infrastructure development and urbanization fosters the demand for vibration control systems in construction and transportation projects.

The China vibration control system market is driven by the country's rapid industrialization and the government's emphasis on technological innovation. The automotive industry's transition to electric vehicles necessitates the development of components that effectively manage vibrations to enhance vehicle performance and comfort. The expansion of the aerospace sector and the need for high-precision manufacturing processes drive the demand for advanced vibration control solutions. This factor highlights the integration of vibration control in China's electric mobility sector.

The Japan vibration control system market is rapidly expanding, driven by the country's advanced technological landscape and the demand for high-precision equipment in industries such as robotics, electronics, and automotive. The development of autonomous vehicles and the integration of automation in manufacturing processes necessitate sophisticated vibration management solutions to maintain performance and reliability.

Key Vibration Control System Company Insights

Some of the key players operating in the market include ContiTech Deutschland GmbH and Fabreeka (Stabilus), among others.

-

ContiTech Deutschland GmbH, a subsidiary of Continental AG, is a global player specializing in advanced suspension and anti-vibration solutions for diverse sectors including automotive, rail, industry, and energy. Their vibration control technology focuses on reducing noise, vibration, and harshness (NVH) for enhanced safety and comfort, and the company has recently expanded its worldwide footprint through acquisitions in the anti-vibration segment. The company’s portfolio includes active and passive vibration-optimized mounting components and lightweight systems for engines, transmissions, and structural applications, supported by dedicated R&D and manufacturing across several continents.

-

Fabreeka specializes in shock control and vibration isolation for industrial, infrastructure, aerospace, automotive, mining, and high-precision laboratory markets. The company is a globally recognized supplier of custom and innovative products, notably the Fabreeka pad an early fabric-reinforced elastomer developed with MIT and Goodyear which remains a benchmark for impact and vibration absorption across a diverse portfolio. Fabreeka is driven by a customer-oriented approach, providing turnkey solutions for vibration analysis, product integration, and technical support that meet the evolving demands of Industry 4.0 and complex engineering applications.

ELESA S.p.A. and VICODA GmbH. are some of the emerging market participants in the vibration control system market.

-

ELESA S.p.A. develops high-performance vibration damping elements, mounts, buffers, pads, springs, and wire rope isolators, crafted primarily from rubber and composites for industrial machinery and equipment. Their DVA range addresses vibration, shock, and noise for conveyors, motors, presses, and sensitive instrumentation, improving operational accuracy, comfort, and the longevity of machines.

-

VICODA GmbH is a member of the LISEGA group, specializing in vibration isolation and elastic bearings for industrial applications. The company delivers turnkey services from vibration measurement and analysis to customized product design, manufacturing, installation, and system monitoring. Their product range includes pre relaxed spring mounts and viscoelastic dampers, engineered for continual performance and low-frequency vibration isolation in heavy machinery and buildings.

Key Vibration Control System Companies:

The following are the leading companies in the vibration control system market. These companies collectively hold the largest market share and dictate industry trends.

- ContiTech Deutschland GmbH

- Resistoflex

- HUTCHINSON (CK Hutchison holdings Ltd)

- Fabreeka (Stabilus)

- ELESA S.p.A.

- Sentek Dynamics Inc.

- VICODA GmbH

- Isolation Technology Inc.

- Trelleborg AB

- Kinetics Noise Control, Inc

Recent Developments

-

In October 2025, Fabreeka launched Fabreeka-TIM RF an advanced shock control and vibration isolation product line featuring high-performance materials that improve vibration-damping efficiency in heavy industrial equipment and construction machinery. These products are engineered for enhanced durability and reduced maintenance costs in demanding environments.

-

In September 2025, Sentek Dynamics Incorporated, a U.S.-based provider of vibration testing solutions, unveiled a new 200 kN vibration testing system at their laboratory in Charlotte, North Carolina.

-

In November 2024, Elesa S.p.A. acquired a 60% majority stake in Tellure Rôta S.p.A., an Italian company specializing in the design and production of wheels and castors for industrial applications.

Vibration Control System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,812.1 million

Revenue forecast in 2030

USD 7,933.9 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year of estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Russia; China; Japan; India; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

ContiTech Deutschland GmbH; Resistoflex; HUTCHINSON (CK Hutchison Holdings Ltd); Fabreeka (Stabilus); ELESA S.p.A.; Sentek Dynamics Inc.; VICODA GmbH.; Isolation Technology Inc.; Trelleborg AB; Kinetics Noise Control, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Vibration Control System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vibration control system market report based on system type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Motion Control

-

Springs

-

Hangers

-

Washers & Bushes

-

Mounts

-

-

Vibration Control

-

Isolating Pads

-

Isolators

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Manufacturing

-

Electrical & Electronics

-

Healthcare

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vibration control system market size was estimated at USD 5,483.6 million in 2024 and is expected to reach USD 5,812.1 million in 2025.

b. The global vibration control system market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 7,933.9 million by 2030.

b. The vibration control segment dominated the market, accounting for over 59% of the market share in 2024, driven by the growing demand for enhanced mechanical stability and vibration isolation across key industries, including manufacturing, automotive, aerospace, and infrastructure.

b. Some key players operating in the vibration control system market include ContiTech AG; Lord Corporation; Resistoflex (P) Ltd.; HUTCHINSON; Fabreeka; Sentek Dynamics Inc.; VICODA GmbH; Isolation Technology Inc.; Trelleborg AB; and Kinetics Noise Control, Inc.

b. Key factors that are driving the vibration control system market growth include growing emphasis on the mechanical stability and balancing of industrial machinery and automobiles, growing automotive as well as the aviation industry, rising demand for self-controlling smart & adaptive VCS, along with technological developments, such as web-based continuous machine condition monitoring and Active Noise and Vibration Control (ANVC) systems in aircraft.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.