- Home

- »

- Communication Services

- »

-

Video As A Service Market Size, Share, Industry Report, 2030GVR Report cover

![Video As A Service Market Size, Share & Trends Report]()

Video As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Application, By Cloud Deployment Mode (Public Cloud, Private Cloud), By Vertical (BFSI, Education), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-523-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Video As A Service Market Size & Trends

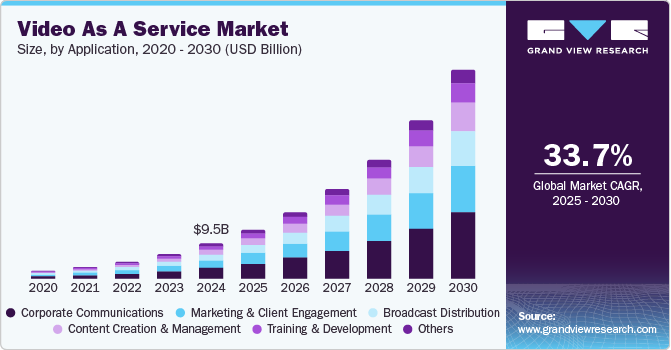

The global video as a service market size was valued at USD 9.45 billion in 2024 and is projected to grow at a CAGR of 33.7% from 2025 to 2030. This surge can particularly be attributed to the COVID-19 pandemic, which accelerated the adoption of remote communication technologies. Moreover, as businesses and educational institutions shifted to virtual operations, the demand for reliable video conferencing solutions skyrocketed. The need for effective remote interactions has made Video as a Service (VaaS) an essential component of modern business infrastructure, enabling seamless communication across various sectors.

Furthermore, technological advancements have played a crucial role in shaping the current state of video as a service industry. Innovations in cloud computing, video streaming quality, and integration with digital tools have enhanced user experiences, making VaaS solutions more accessible and efficient. For instance, the introduction of Artificial Intelligence (AI) and Machine Learning (ML) technologies into VaaS platforms has improved functionalities such as real-time transcription and automated meeting analytics. For instance, Zoom announced plans to allow users to create AI avatars of themselves to send short video messages to their teams. This feature aims to enhance communication efficiency and provide a more engaging way to interact with colleagues. These enhancements are streamlining communication and increasing productivity across various sectors, including healthcare and education.

The rollout of 5G technology is anticipated to significantly enhance cloud computing capabilities by providing faster data transmission and lower latency, enabling smoother video communications and facilitating more complex applications in various industries. In addition, as organizations continue to embrace digital transformation, there will be a growing demand for scalable and cost-effective video solutions. The subscription-based model offered by VaaS providers allows businesses to expand their services without incurring substantial upfront costs, making it an attractive option for companies of all sizes.

Application Insights

The corporate communications segment dominated the market with a revenue share of 30.0% in 2024. This dominance can be attributed to the increasing reliance on video conferencing tools for internal and external communications within organizations. Companies are leveraging VaaS solutions to enhance collaboration, improve information retention, and facilitate quicker decision-making. The effectiveness of visual communication over traditional text-based methods has led many businesses to adopt video solutions as a core component of their communication strategies, thereby solidifying this segment's leading position in the VaaS industry.

The broadcast distribution segment is projected to grow at a significant CAGR during the forecast period as media companies increasingly adopt VaaS solutions for content delivery. The shift toward digital platforms and the rising demand for high-quality streaming services are driving this growth. As consumers continue to favor on-demand video content, broadcasters are investing in scalable VaaS solutions that can efficiently manage live broadcasts and streaming services. This trend is expected to enhance viewer engagement and expand reach, positioning the broadcast distribution segment for substantial growth in the coming years. For instance, NBCUniversal achieved a milestone by live streaming the Super Bowl to 6 million concurrent viewers and the Olympic Games to 1.5 million users via its Peacock platform and direct-to-consumer applications.

Cloud Deployment Mode Insights

The hybrid cloud segment dominated the market with the highest revenue share in 2024, which can be attributed to its ability to offer flexibility and scalability to organizations. Hybrid cloud solutions allow businesses to combine on-premises infrastructure with cloud services, enabling them to optimize their video communication capabilities while maintaining control over sensitive data. This model particularly engages enterprises looking to balance performance with cost efficiency, allowing them to scale resources based on demand without incurring excessive costs. As more organizations recognize these benefits, the hybrid cloud segment is expected to maintain its strong position in the VaaS landscape.

The public cloud segment is expected to grow at the highest CAGR over the forecast period, driven by its cost-effectiveness and ease of deployment. These solutions eliminate the need for extensive infrastructure investments, making them accessible to businesses of all sizes. The increasing adoption of remote work and digital collaboration tools further fuels this growth as organizations seek reliable and scalable video communication options. As more enterprises migrate to public cloud environments, the demand for VaaS solutions will likely continue to rise, reinforcing this segment's rapid expansion in the video as a service industry.

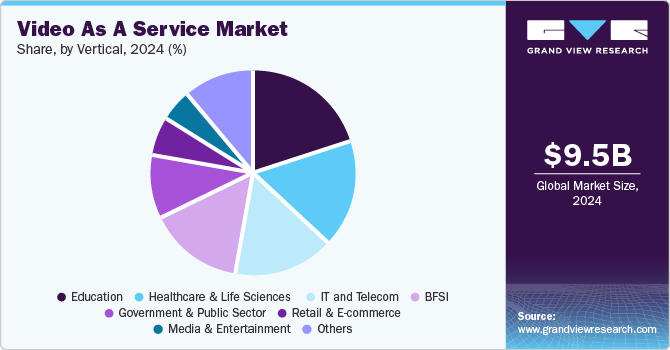

Vertical Insights

The education segment dominated the market with the highest revenue share in 2024, primarily due to the accelerated adoption of online learning platforms and virtual classrooms. The COVID-19 pandemic significantly shifted educational institutions toward remote learning, necessitating effective video communication tools for lectures, discussions, and interactive learning experiences. VaaS solutions facilitate real-time engagement between educators and students, allowing for dynamic collaboration and enhanced accessibility to educational resources. This trend is expected to continue as institutions increasingly recognize the benefits of integrating video technology into their teaching methodologies.

The media & entertainment segment is expected to grow at the fastest CAGR over the forecast period, driven by the rising demand for on-demand video content and live-streaming services. As consumer preferences shift toward digital media consumption, companies in this sector are leveraging VaaS solutions to deliver high-quality video experiences across various platforms. The increasing popularity of virtual events, webinars, and interactive content further fuels this growth. For instance, Teleparty allows users to host watch parties for up to 1,000 participants, enabling them to enjoy streaming services such as Netflix, Disney Plus, and Hulu together. In addition, advancements in technology, such as improved streaming capabilities and enhanced user interfaces, are enabling media companies to engage audiences more effectively, positioning the media and entertainment segment for rapid expansion within the video as a service industry.

Regional Insights

North America video as a service market dominated the global market with a revenue share of 38.5% in 2024, primarily due to the region's robust technological infrastructure and high demand for cloud-based video solutions. The presence of numerous large enterprises and significant competition encourage innovation and rapid adoption of advanced video technologies. For instance, many organizations transitioned to VaaS platforms during the pandemic to facilitate remote work, significantly enhancing communication and collaboration.

U.S. Video As A Service Market Trends

The U.S. video as a service market dominated the regional video as a service market in 2024. It comprises a highly developed digital ecosystem characterized by widespread internet connectivity and advanced telecommunications infrastructure. This enables seamless video communication across diverse geographical areas. Furthermore, cultural trends favoring remote work and virtual collaboration have led to a surge in demand for VaaS solutions among businesses in the technology, finance, healthcare, and education sectors. A notable example is the healthcare industry, where telemedicine relies on VaaS for virtual consultations, ensuring continuity of care while maintaining patient safety.

Europe Video As A Service Market Trends

Europe video as a service market is witnessing significant growth driven by the increasing adoption of cloud-based solutions and the need for efficient communication across geographically dispersed teams. Major countries such as Germany, France, and the UK are leading this trend as organizations seek to enhance collaboration and reduce operational costs through VaaS. The cloud-based model is particularly appealing due to its accessibility and lower total cost compared to traditional on-premises systems. In addition, government initiatives promoting digital transformation create a favorable environment for VaaS providers, further propelling market expansion.

Asia Pacific Video As A Service Market Trends

Asia Pacific video as a service market is anticipated to grow at the highest CAGR during the forecast period, supported by advancements in IT infrastructure and increasing internet penetration. Countries such as India, Japan, and Australia are actively adopting video solutions to enhance business communication and collaboration. The trend of remote work has significantly boosted the demand for VaaS platforms, enabling organizations to maintain productivity despite geographical challenges. This trend is expected to continue as more companies recognize the value of flexible video communication tools in their operations.

China video as a service market dominated the Asia Pacific region in 2024 by a surge in online education and remote work practices. For instance, during the COVID-19 pandemic, many educational institutions transitioned to online learning platforms that utilized VaaS solutions to ensure continuity in education. This shift improved access to learning resources and highlighted the critical role of video technology in modern education. As China continues to invest in digital infrastructure and remote collaboration tools, the demand for VaaS solutions is expected to grow significantly in the coming years.

Key Video As A Service Company Insights

The video as a service market is characterized by several key players that significantly influence its dynamics. Some major companies in the market are Adobe; Cisco Systems, Inc.; Zoom Communications, Inc.; and Avaya, LLC, which are known for their innovative technologies and extensive product offerings. These firms are actively involved in developing advanced video communication solutions that cater to the growing demand for seamless connectivity in various sectors. As organizations increasingly adopt cloud-based services, these companies play a crucial role in shaping the future of video collaboration.

-

Cisco Systems, Inc. is a multinational technology company specializing in networking hardware, telecommunications equipment, and high-technology services and products. In the video-as-a-service industry, Cisco offers a range of cloud-based video solutions that facilitate video conferencing and collaboration for businesses. Its services are designed to enhance communication efficiency and support remote work environments, leveraging its extensive experience in networking and security to provide reliable and scalable video solutions.

-

Zoom Communications, Inc. primarily provides cloud-based video conferencing and collaboration services. Known for its user-friendly platform, Zoom has gained significant traction in the VaaS industry by offering features that cater to both personal and professional communication needs. The company is focused on providing high-quality video and audio experiences, making it a popular choice for virtual meetings, webinars, and online events.

Key Video As A Service Companies:

The following are the leading companies in the video as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Alphabet, Inc.

- Amazon Web Services, Inc.

- Avaya, LLC

- Cisco Systems, Inc.

- GoTo

- HP Development Company, L.P.

- RingCentral, Inc.

- Zoho Corporation Pvt. Ltd.

- Zoom Communications, Inc.

Recent Development

-

In September 2024, Zoom Video Communications, Inc. and Mitel announced a strategic partnership to provide enterprises worldwide with a hybrid cloud solution integrating Zoom AI Companion and Zoom Workplace with Mitel's flagship communications platform. This collaboration seeks to meet the increasing demand for hybrid Unified Communications (UC) by offering a solution that combines security and control for critical communications with enhanced collaboration capabilities.

-

In October 2024, Cisco introduced new AI-powered innovations, including the AI Agent Studio and Webex AI Agent, designed to enhance customer interactions within the Webex Contact Center. These solutions utilize advanced conversational intelligence and automation to streamline issue resolution and improve customer satisfaction. The Webex AI Agent is a self-service concierge that addresses customer inquiries through natural dialogue, reduces wait times, and expedites resolutions.

Video As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.19 billion

Revenue forecast in 2030

USD 56.34 billion

Growth Rate

CAGR of 33.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, cloud deployment mode, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Adobe; Alphabet, Inc.; Amazon Web Services, Inc.; Avaya, LLC; Cisco Systems, Inc.; GoTo; HP Development Company, L.P.; RingCentral, Inc.; Zoho Corporation Pvt. Ltd.; Zoom Communications, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video As A Service Market Report Segmentation

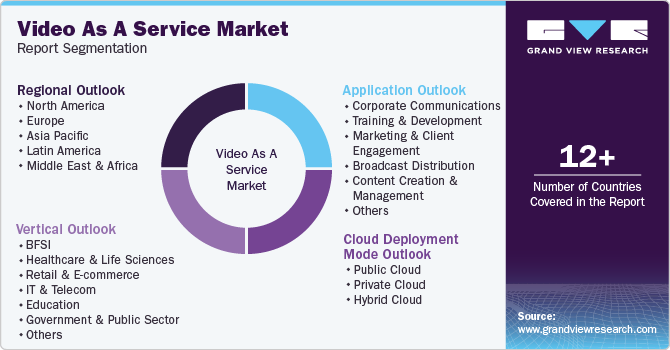

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video as a service market report based on application, cloud deployment mode, vertical, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate Communications

-

Training and Development

-

Marketing and Client Engagement

-

Broadcast Distribution

-

Content Creation and Management

-

Others

-

-

Cloud Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare and Life Sciences

-

Retail and E-commerce

-

IT and Telecom

-

Education

-

Government and Public Sector

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.