- Home

- »

- Medical Devices

- »

-

Video Laryngoscope Market Size, Industry Report, 2033GVR Report cover

![Video Laryngoscope Market Size, Share & Trends Report]()

Video Laryngoscope Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Rigid, Flexible), By Application (Reusable, Disposable), By Device (Cart-based, Handheld), By Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-455-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Laryngoscope Market Summary

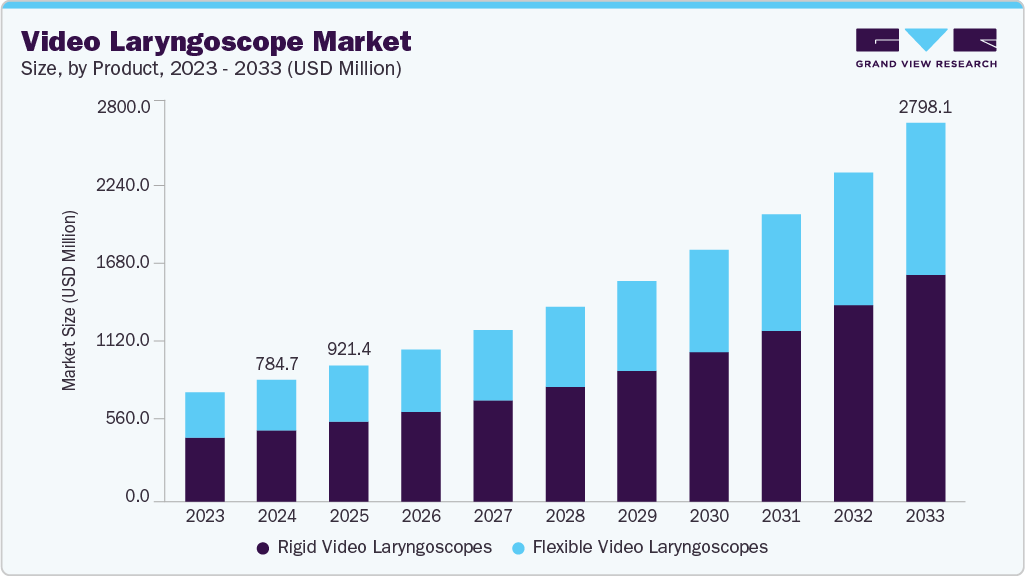

The global video laryngoscope market size was estimated at USD 784.66 million in 2024 and is projected to reach USD 2.80 billion by 2033, growing at a CAGR of 14.89% from 2025 to 2033. Market growth is driven by the rising need for reliable airway management in emergency and critical care, heightened infection-control measures promoting single-use designs, and rapid integration of advanced imaging and wireless technologies

Key Market Trends & Insights

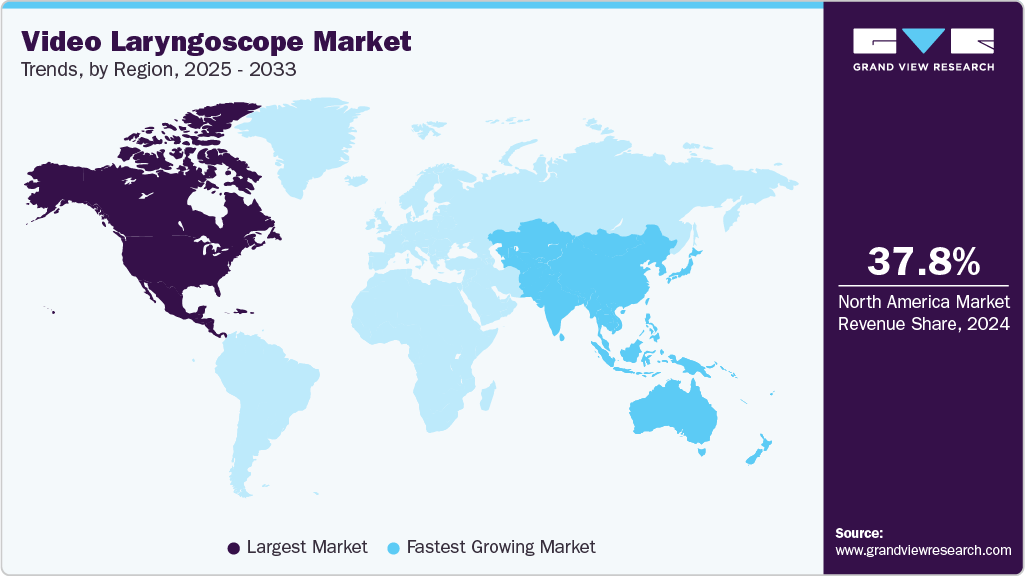

- The North America video laryngoscope market dominated the global market in 2024 and accounted for the largest revenue share of 37.77%.

- Canada video laryngoscope market is anticipated to register the fastest growth rate during the forecast period.

- In terms of product segment, the rigid segment held the largest revenue share of 60.42% in 2024.

- In terms of application segment, the reusable segment held the largest revenue share of 77.68% in 2024.

- In terms of device segment, the cart-based segment held the largest revenue share of 63.77% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 784.66 Million

- 2033 Projected Market Size: USD 2.80 Billion

- CAGR (2025-2033): 14.89%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hospitals are prioritizing video-assisted intubation for its higher accuracy and patient safety benefits. In May 2023, the U.S. Department of Health and Human Services reported over 25 million Americans with asthma and 16 million with COPD, highlighting the urgent need for better respiratory health strategies. The growing prevalence of respiratory diseases, trauma cases, and critical care admissions has amplified the demand for effective and reliable airway management tools. Video laryngoscopes enable clinicians to perform intubations with enhanced visualization and accuracy, reducing complications in high-risk or emergency scenarios. Their use is becoming standard in ICUs and emergency departments as healthcare systems emphasize patient safety, faster intervention, and improved clinical outcomes in airway management. In May 2025, according to the U.S. Environmental Protection Agency’s America’s Children and the Environment report, 6.5% of U.S. children aged 0 to 17 had asthma, while emergency room visits for respiratory diseases reached 369 per 10,000 children, including 47 per 10,000 for asthma. The EPA noted that traffic pollution and indoor allergens remain key contributors despite improvements in air quality.Clinicians are increasingly favoring minimally invasive airway techniques as they offer reduced tissue trauma, quicker recovery, and more controlled airway access. Improved visualization tools and streamlined device designs are supporting this shift, making these approaches more reliable across emergency and operative settings. In June 2023, Teleflex partnered with Insighters Medical for exclusive U.S. distribution of the Insighters Video Laryngoscope System, designed to enhance airway inspection and endotracheal intubation. The system supports various intubation scenarios with interchangeable components and real-time imaging, aiming to improve glottic view and reduce airway trauma.

Recent innovations in imaging, sensor integration, and device ergonomics are elevating the performance of airway management systems. Enhanced optics, real-time feedback, and stronger material engineering are enabling more precise, consistent, and efficient airway procedures. In October 2024, Verathon introduced its first eco-focused single-use video laryngoscope, the Spectrum QC eco, built with a high proportion of bio-based plastics. Designed to deliver the same performance standards as traditional GlideScope devices, it reduces environmental impact through a substantially lower carbon footprint while supporting greener airway management practices.

Case Study: Combined Use of Video Laryngoscope and Video Stylet for Endotracheal Intubation in a Patient with Laryngeal Carcinoma

Background

Airway management in patients with laryngeal tumors is challenging due to altered anatomy and risk of bleeding. Advanced visualization tools, including video laryngoscopes and video stylets, can facilitate safer and faster intubation in difficult airway scenarios.

Patient Profile

-

Age/Sex: 60-year-old female

-

ASA Classification: III

-

Presentation: Pharyngeal discomfort for ~1 year, hemoptysis 1 month prior

-

Diagnosis: Laryngeal carcinoma on the anterior epiglottis, extending into the aryepiglottic folds

-

Imaging: Tumor 26 × 25 mm × 18 mm; no bone or lymph node involvement

-

Airway Assessment: Normal mouth opening, slightly limited neck extension, Mallampati IV, upper lip bite test I

Challenge

-

Difficult airway due to thickened and displaced epiglottis

-

Tumor prone to bleeding

-

Need for atraumatic, fast, and successful intubation

Intervention

-

Technique: Asleep intubation using a combination of video laryngoscope and video stylet

-

Procedure Highlights:

-

Standard monitoring and preoxygenation

-

Induction with propofol, remifentanil, and rocuronium

-

Bag-mask ventilation confirmed feasible

-

Video laryngoscope was introduced to visualize epiglottis

-

Video stylet advanced alongside to navigate posterior pharyngeal wall

-

Steerable tip allowed full visualization of arytenoids and vocal cords

-

Endotracheal tube advanced atraumatically into trachea on the first attempt

-

-

Outcome: Intubation was fast, atraumatic, and successful; anesthesia, surgery, and recovery were uneventful

Discussion

-

Combination technique improves visualization and maneuverability in difficult airways

-

Advantages of video stylet:

-

Rigid shaft for easy navigation

-

Steerable tip for precise control

-

Allows single-operator intubation

-

Minimizes trauma to vascular tumors

-

-

Requires preoperative imaging and collaboration with ENT specialists

-

Learning curve: 3-5 normal airway intubations recommended before use in complex cases

Outcome

-

First-attempt successful intubation

-

No perioperative complications

-

Postoperative follow-up: Patient asymptomatic; radiotherapy initiated

Key Takeaways

-

Combined video laryngoscope and video stylet is effective for a difficult airway due to laryngeal tumors.

-

Preoperative assessment and ENT collaboration are critical.

-

Allows fast, atraumatic, and potentially single-operator intubation.

-

Technique requires some prior practice to overcome learning curve.

Community-Funded Video Laryngoscopes

Video laryngoscopes are increasingly recognized as vital tools for improving airway management, providing clinicians with enhanced visualization during intubation, reducing procedural risks, and improving patient safety. Their adoption is growing not only in hospitals but also in emergency care settings and smaller clinics, where precision and speed are critical. Community initiatives and fundraising efforts sometimes play a key role in acquiring these advanced devices, especially in regional or resource-limited hospitals. In November 2025, funds raised by the Road to Recovery team enabled Midland Regional Hospital Portlaoise to acquire a McGrath Video Laryngoscope. This state-of-the-art device assists staff in performing safer, more efficient intubations, enhancing visibility and precision during airway management.

“These pieces of equipment will make a real and immediate difference to families during some of their most vulnerable moments, and we are so thankful to Toney and his family for choosing the Friends as their beneficiaries for the Road Run this year.”

-Portlaoise Hospital

Funding Initiatives and Grants for Video Laryngoscopes

Month-Year

Funder / Location

Amount

Items Funded

Notes

August-2025

UVMC Community Benefit Fund - Piqua, Ohio

Up to USD 10,000

4 video laryngoscope kits (chargers, blades, carrying cases)

Each medic unit is equipped separately.

July-2023

Jackson County Fire Rescue - Florida

USD 95,000

Video laryngoscopes for all front-line ambulances

State grant from the Florida Dept. of Health; improves first-pass intubation.

External funding through grants and initiatives is a key driver in expanding access to video laryngoscopes, especially for hospitals, EMS services, and regional healthcare facilities. Such financial support from government programs, healthcare foundations, or community-backed grants enables organizations to acquire advanced airway management tools, improving intubation success, patient safety, and operational efficiency. These initiatives help bridge gaps where budget constraints might otherwise limit the adoption of life-saving medical technologies. In February 2024, Barwon Health received part of USD 2.5 million diverted from the Good Friday Appeal to support regional pediatric services, including the purchase of a video laryngoscope. The device will allow trainees and junior doctors to observe intubations of premature babies in real time, improving skills through live guidance from senior clinicians.

“We will utilise the funds to help us support and sustain our workforce by providing opportunities to upskill staff with the knowledge and skills needed to deliver expert care to children. Barwon Health works in partnership with The Royal Children’s Hospital, and we are pleased to be partnering now with the Good Friday Appeal, which will help us support more families to access care closer to home.”

- Barwon Health chief executive officer

Technology Trends in Video Laryngoscopes

Video laryngoscopes are evolving rapidly with features that enhance usability and clinical outcomes. Wireless connectivity, HDMI output, and integrated video displays allow multiple clinicians to observe procedures in real time, improving training and patient safety. Channeled and ergonomically designed blades are increasingly common, enabling faster, more precise intubation while reducing the risk of airway trauma. In March 2024, Verathon, Inc. unveiled the findings of a large-scale study that demonstrates the ability of GlideScope hyperangulated video laryngoscopy to significantly improve the first-pass endotracheal intubation success rate compared to traditional direct laryngoscopy.

Regulatory Guidance and Standardization for Video Laryngoscopes

Regulatory directives play a key role in ensuring safe and consistent use of video laryngoscopes across healthcare and pre-hospital settings. By defining approved devices, minimum inventory requirements, and usage standards, agencies help maintain readiness, support clinical best practices, and reduce variability in airway management. Such policies also facilitate training, improve patient safety, and ensure emergency medical services are equipped with reliable, standardized tools. In February 2025, the Santa Clara County Emergency Medical Services Agency issued Administrative Order 2024-002 mandating minimum inventory standards and approved devices for video laryngoscopes across pre-hospital care assets. The directive ensures standardization of equipment and supports the supply chain impacts of airway management tools.

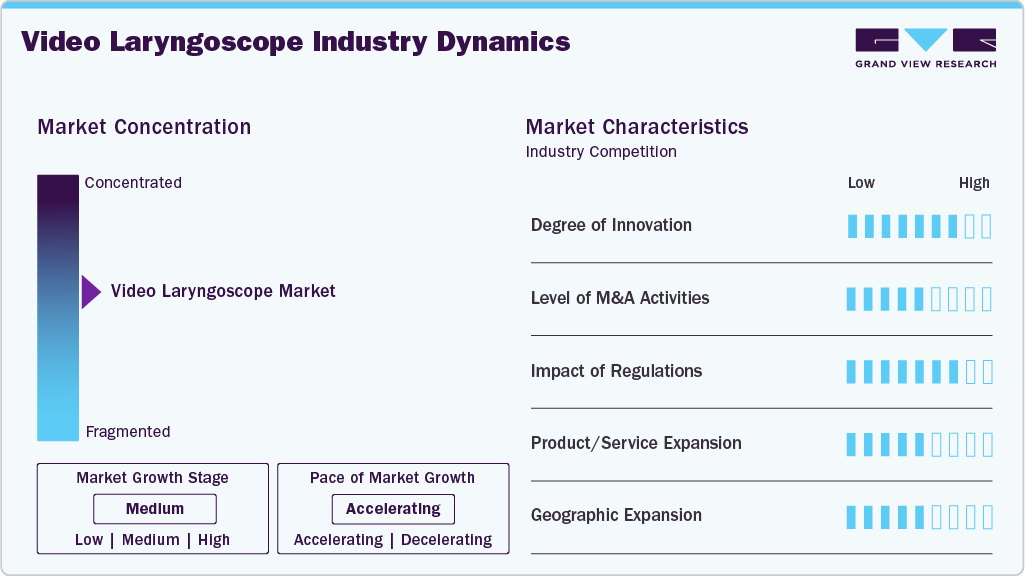

Market Concentration & Characteristics

Innovation in video laryngoscopes is high, driven by sharper imaging sensors, improved anti-fog optics, modular blade systems, and integrated recording and feedback features. Advances such as AI-assisted visualization, low-profile blades, and wireless connectivity are improving first-pass success rates in both routine and difficult airways. The pace of innovation is also widening the gap between video platforms and traditional laryngoscopy, making older tools steadily less relevant in advanced airway protocols. In January 2023, William & Mary highlighted the Britescope, an AI-enhanced video laryngoscope designed for emergency intubation, featuring a camera connected to an iPad and AI guidance to assist operators in accurately navigating the airway.

M&A activity is medium, with companies pursuing targeted acquisitions to integrate imaging technologies, expand single-use blade portfolios, and strengthen distribution networks. These deals help vendors accelerate development cycles and reduce manufacturing constraints linked to disposable components. Most acquisitions are focused on enhancing visualization and infection-control capabilities rather than large-scale consolidation.

Regulatory impact on video laryngoscopes is high, as agencies require detailed validation of optical clarity, sterility, durability, and electrical safety. The critical nature of airway management pushes manufacturers toward rigorous quality controls and repeated testing to ensure consistent performance. Compliance also influences hospital purchasing behavior, as institutions increasingly prioritize devices with strong regulatory histories for emergency and high-risk settings.

Substitution pressure is medium, with direct laryngoscopes and supraglottic devices present, but unable to match the visualization benefits of video systems. In difficult airways, video laryngoscopy continues to demonstrate superior clinical outcomes, reducing reliance on older alternatives. This creates a growing shift in training programs, where video laryngoscopes are becoming the default teaching standard.

Geographical expansion potential is medium, supported by growing demand in Asia-Pacific, the Middle East, and Latin America as hospitals standardize their airway management practices. Adoption increases fastest where single-use blades are available at accessible price points, and local distributors support training. Growth is also linked to rising accreditation requirements that encourage hospitals to maintain video-enabled airway readiness.

Product Insights

The rigid segment held the largest market share of 60.42% in 2024. This growth is driven by superior image quality, durable design, and extensive use in emergency and operating rooms. Enhanced glottic visualization and compatibility with imaging systems further support adoption. Its lower maintenance needs and suitability for repeated sterilization make it cost-effective for high-volume hospitals. Increasing use in teaching and training programs also boosts demand. In September 2023, Penlon launched the Diamond Video Laryngoscope, a portable device offering high-definition imaging and a wider field of view through a distal-end camera. Equipped with a 3.5-inch touchscreen, rechargeable battery, and single-use blades for adult and pediatric patients, the system enhances visualization and training in airway management.

The flexible segment in the market is anticipated to witness the fastest growth over the forecast period. It allows users to identify biopsy tissue and irregularities. It also assists in eliminating undesired growths, such as tumors. The added benefit is that the camera can be accurately controlled, giving the doctor a thorough and unobstructed view of the vocal cords' movement. In August 2023, Ambu showcased the use of its single-use aScope 4 RhinoLaryngo Slim for flexible laryngoscopy procedures, highlighting ease of use and improved patient safety. The demonstration emphasized minimally invasive airway visualization for ENT and pulmonology applications.

Application Insights

The reusable segment held the largest market share of 77.68% in 2024. The device's ability to be reused is a crucial factor influencing the buying choices of healthcare professionals, organizations, and facilities. Using reusable laparoscopic instruments lowers the expense of laparoscopic surgery while still maintaining the safety of patients and the involved medical staff. In January 2023, Timesco Healthcare unveiled its Optima View video laryngoscope at Arab Health 2023, featuring a high-resolution camera and rotatable 3.75” LCD to improve intubation in difficult airways, offered as a reusable system to support sustainable clinical use.

Disposable is anticipated to grow at the fastest CAGR over the forecast period. Increasing efforts to reduce operational expenses by preventing reprocessing costs have led to growing utilization in pre-hospital environments. Key benefits such as enhanced intubation success rates, less head/neck manipulation, and reduced required force are expected to generate greater demand for this market in the coming years. In April 2022, OMNIVISION introduced ready-to-use reference designs for high-definition single-use video laryngoscopes, aimed at helping OEMs accelerate development with clearer imaging and a wider field of view. The launch highlighted rising demand for disposable devices, improved airway visualization, and faster, more reliable intubations in difficult cases.

Device Insights

Cart-based held the largest market share of 63.77% in 2024. This type of laryngoscope is widely used in hospitals for most intubation and airway procedures. Cart-based video laryngoscopes provide an enhanced view of the airway, improving tracheal tube insertion accuracy. Technological advancements and imaging integration are driving adoption in critical care and surgery. Rising demand for minimally invasive procedures is further boosting the segment’s growth.

The handheld segment is anticipated to grow at the fastest CAGR over the forecast period, owing to its increased usage in emergency facilities. The market growth for handheld video laryngoscopy is driven by key factors such as compact and lightweight, improved visualization, accommodating a wide range of blade sizes and types, and being suitable for various patient populations. In January 2025, Ambu launched its SureSight Connect video laryngoscopy solution, fully integrated with the aView 2 Advance and aBox 2 platforms; the system supports efficient routine and difficult intubations and expands Ambu’s airway portfolio with a one-lung ventilation-capable, digitally connected visualization suite.

Channel Insights

By channel, non-channeled held the largest market share of 52.95% in 2024. Faster glottis recognition time is one of the key advantages associated with non-channeled laryngoscopes. Aspects such as ease of use, reduced time for glottis visualization, and increasing adoption are expected to generate growth for this segment during the forecast period. In May 2025, Ambu expanded its Ambu SureSight Connect video laryngoscopy solution with five new blades specifically designed for paediatric patients, broadening the device’s applicability from neonates to teenagers. The updated offering continues to integrate with Ambu’s digital platforms, enhancing workflow efficiency and airway visualization in clinical settings.

The channeled segment is anticipated to grow at the fastest CAGR over the forecast period. Channeled blades help in overcoming the limitations of non-channeled blades. In contrast, using channeled blades reduces the time and potential for injury when navigating the tracheal tube compared to using non-channeled blades in the initial insertion phase. Channeled video laryngoscopes eliminate the need for a flexible style to guide and shape the tracheal tube based on the curvature of the blade. In April 2022, Rice University bioengineering students developed a low-cost, wireless video laryngoscope with a tapered straight-blade design to simplify intubation and improve patient safety. The device streams high-resolution video to tablets, allowing remote guidance and reducing clinician exposure to aerosolized particles.

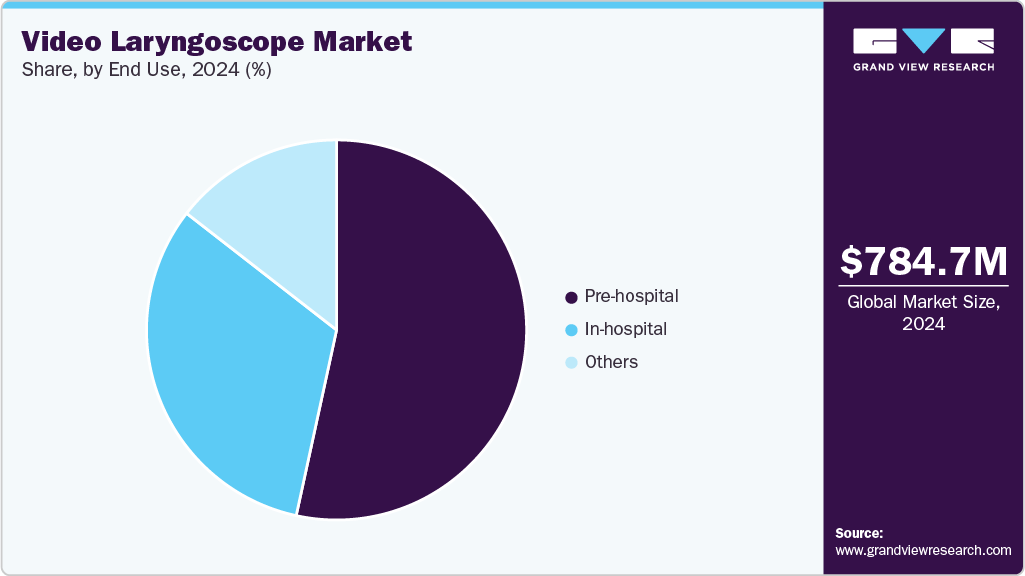

End Use Insights

The in-hospitals segment held the largest market share of 53.41% in 2024. This is attributed to the growing number of procedures in advanced healthcare facilities such as specialty hospitals, including video laryngoscopes. The adoption of video laryngoscopes is growing constantly due to enhanced visualization and higher success rates in first-attempt intubation. In June 2025, Ambu expanded its Ambu Recircle Program to include blades from the Ambu SureSight Connect video laryngoscope, allowing hospitals to recycle single-use blades alongside endoscopes, promoting sustainable practices while maintaining high standards of patient care.

The pre-hospital segment is expected to experience the fastest market growth over the forecast period. Some of the key aspects contributing to its development include enhanced first-pass success rates, improved visualization of airways, and an increasing number of emergency cases associated with laryngoscopy. Increased accessibility and availability of training services provided to medical professionals regarding using video laryngoscopes during emergencies are expected to generate demand for this segment in the upcoming years. In July 2024, Tri-Anim Health Services introduced the OneScope Pro video laryngoscope line, designed to support rapid and reliable intubation in emergency and first-response settings. This launch targets the prehospital segment, emphasizing ease of use and enhanced patient safety for clinicians in urgent care scenarios.

Regional Insights

North America dominated the video laryngoscope market in 2024 and accounted for the largest revenue share of 37.77% due to strong adoption of advanced airway technologies and well-established critical care infrastructure. This is attributed to the strong presence of leading manufacturers, rapid adoption of advanced airway management technologies, and favorable reimbursement frameworks that support hospital procurement of high-end visualization devices. In January 2025, according to the National Cancer Institute’s SEER program, an estimated 13,020 new cases of laryngeal cancer and 3,910 deaths are expected in the U.S., representing about 0.6% of all cancer cases and deaths.

U.S. Video Laryngoscope Market Trends

The video laryngoscope market in the U.S. is driven by the rapid integration of visualization tools into emergency and prehospital protocols. Growth is reinforced by increased demand for single-use systems in infection-sensitive environments. Rising emphasis on difficult airway management training also boosts recurring purchases. In September 2023, Olympus launched the Vathin E-SteriScope single-use flexible video rhinolaryngoscope in the U.S., offering portability, easy connectivity, and procedural efficiency for ENT diagnostics and treatments.

"We know that many factors influence clinical workflow, including portability, efficiency, and connectivity. The E-SteriScope single-use flexible video rhinolaryngoscope gives health care providers flexibility and choice when balancing these factors and deciding on the best pathway to diagnosis and treatment."

- Senior Vice President for Therapeutic Solutions at Olympus Corporation

Europe Video Laryngoscope Market Trends

The video laryngoscope market in Europe is anticipated to register a significant growth rate during the forecast period. This is attributed to rising alignment with standardized airway guidelines and higher investments in ICU modernization. Disposable blade adoption is increasing as hospitals tighten infection-control policies. In February 2025, University College Hospital London (UCHL) acquired 19 Verathon GlideScope video laryngoscopes to expand accessibility in its 26 operating theatres, enhancing training and patient care by enabling real-time airway visualization during intubation.

Germany video laryngoscope market is anticipated to register a considerable growth rate during the forecast period as hospitals transition from direct to video laryngoscopy for routine intubations. In August 2023, the Journal of Clinical Medicine published a pilot study on GlideScope videolaryngoscopy in patients with severely restricted mouth openings (1.1-3.0 cm). The study found that videolaryngoscopic intubation was feasible and safe, with 90% first-attempt success, though tube placement was more challenging in patients with inter-incisor gaps <2 cm, particularly for nasotracheal intubations.

Asia Pacific Video Laryngoscope Market Trends

The video laryngoscope market in the Asia Pacific is anticipated to be the fastest-growing region in the global market, fueled by rising emergency care capacity and wider availability of affordable video systems. Governments are investing in critical care upgrades, particularly in China and India. Broader access to single-use blades is also enabling faster penetration into mid-tier hospitals. In November 2023, a video published in Anaesthesia showcased the use of a videolaryngoscope, highlighting how operators still needed to bend their heads to view the separate screen, illustrating ergonomic challenges compared with emerging augmented reality systems.

Japan video laryngoscope market is expected to grow over the forecast period as aging population trends increase surgical and ICU caseloads. The country is also adopting compact, high-precision systems suitable for smaller clinical settings. Greater emphasis on preparedness for airway emergencies further elevates demand. In March 2023, Resuscitation Plus published an article comparing video laryngoscopes and Macintosh laryngoscopes for prehospital tracheal intubation in Hiroshima, Japan, reporting higher success rates and lower complication rates with video laryngoscopes in out-of-hospital cardiac arrest patients.

Latin America Video Laryngoscope Market Trends

The video laryngoscope market in Latin America is anticipated to register a considerable growth rate during the forecast period, driven by the gradual modernization of hospital anesthesia departments. Increasing awareness of the benefits of video-assisted intubation is supporting early-stage adoption. In October 2023, the Annals of Emergency Medicine published a study from Brazil comparing videolaryngoscope (VL) versus direct laryngoscope (DL) use across 11 emergency departments. The video-supported data highlighted that VL achieved a higher first-pass success rate (85.1%) than DL (76.7%), although adverse events were similar between the two methods.

Brazil video laryngoscope market is expected to grow over the forecast period, largely supported by investments in tertiary care centers and the expansion of emergency response systems. Increasing preference for durable, mid-priced video platforms is improving overall accessibility. In July 2025, Scientific Reports published an article discussing the development of a low-cost 3D-printed videolaryngoscope for tracheal intubation, highlighting its affordability and potential for widespread use in Brazil. The study reported that each device could be produced for approximately USD 30, making it accessible for low- and middle-income healthcare settings.

Middle East And Africa Video Laryngoscope Market Trends

The video laryngoscope market in the Middle East and Africa is anticipated to register a considerable growth rate during the forecast period as healthcare systems prioritize emergency readiness and advanced airway equipment. Wealthier Gulf countries are leading early adoption, especially in trauma and critical care units. The gradual expansion of private hospitals is further supporting market penetration. In April 2025, Healthcare published a prospective randomized trial comparing McGrath Mac and HugeMed videolaryngoscopes in children under 3 years, reporting that McGrath Mac provided superior glottic visualization with better Cormack-Lehane and POGO scores, while intubation success rates and complications were similar between devices.

The UAE video laryngoscope market is anticipated to register a considerable growth rate during the forecast period as hospitals increasingly standardize video laryngoscopy for routine and complex intubations. In 2023, HOFF Medical Technology in Dubai, UAE, showcased a portable handheld video laryngoscope designed for emergency and difficult airway management. The device features high-definition imaging, a 3.5-inch display, reusable and disposable blades, anti-fog and anti-microbial components, and one-shot recording functionality to enhance intubation success and efficiency.

Key Video Laryngoscope Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Video Laryngoscope Companies:

The following are the leading companies in the video laryngoscope market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- NIHON KOHDEN CORPORATION

- Verathon, Inc.

- AAM Healthcare

- KARL STORZ

- Hebei Vimed Medical Device Company, Ltd.

- Ambu A/S

- Medtronic

- Prodol Meditec

- Teleflex Incorporated

Recent Developments

-

In November 2025, Penlon launched the Diamond Video Laryngoscope on the NHS Supply Chain, with single-use Macintosh-style blades for adults and children and an optional difficult-intubation blade. It features a 3.5-inch HD touchscreen, HDMI/Wi-Fi connectivity, and a rechargeable battery for up to 4 hours, with easy cleaning between procedures.

-

In April 2025, KARL STORZ introduced the Slimline C-MAC S single-use video laryngoscope, designed with a slimmer blade to improve visibility and access during intubation. The system combines a reusable imager with a disposable blade to enhance sustainability without compromising durability or image quality.

-

In January 2025, IVOS Medical announced its BOSS G4, a single-use video-laryngoscope sheath designed to improve safety in high-risk intubations by maintaining a clear view and continuous oxygen delivery. The company has begun commercialization and plans full market entry in 2026, positioning the device as a low-cost upgrade compatible with existing platforms.

Video Laryngoscope Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 921.41 million

Revenue forecast in 2033

USD 2.80 billion

Growth rate

CAGR of 14.89% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, device, channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; NIHON KOHDEN CORPORATION; Verathon, Inc.; AAM Healthcare; KARL STORZ; Hebei Vimed Medical Device Company, Ltd.; Ambu A/S; Medtronic; Prodol Meditec; Teleflex Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Laryngoscope Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the video laryngoscope market report based on product, application, device, channel, end use, and region:

-

Product Outlook (Revenue USD Million, 2021 - 2033)

-

Rigid Video Laryngoscopes

-

Flexible Video Laryngoscopes

-

-

Application Outlook (Revenue USD Million, 2021 - 2033)

-

Reusable Video Laryngoscopes

-

Disposable Video Laryngoscopes

-

-

Channel Outlook (Revenue USD Million, 2021 - 2033)

-

Non-Channeled Video Laryngoscopes

-

Channeled Video Laryngoscopes

-

-

Device Outlook (Revenue USD Million, 2021 - 2033)

-

Cart-based Video Laryngoscopes

-

Handheld Video Laryngoscopes

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Pre-hospital

-

In-hospital

-

Others

-

-

Regional Outlook Revenue USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.