- Home

- »

- Next Generation Technologies

- »

-

Video Surveillance-as-a-Service Market Size Report, 2030GVR Report cover

![Video Surveillance-as-a-Service Market Size, Share & Trends Report]()

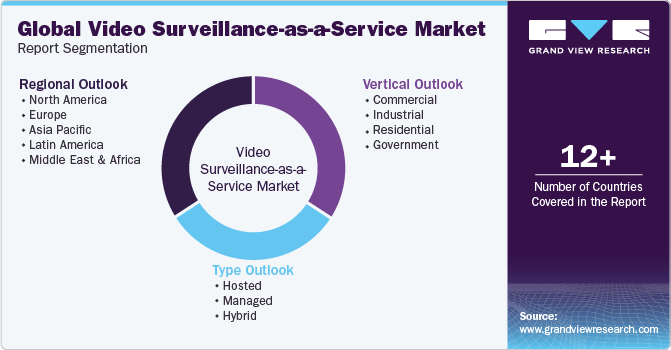

Video Surveillance-as-a-Service Market Size, Share & Trends Analysis Report By Type (Hosted, Managed, Hybrid), By Vertical (Commercial, Industrial, Residential, Government), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-133-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global video surveillance-as-a-service market size was estimated at USD 3.69 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.8% from 2023 to 2030. video surveillance-as-a-service (VSaaS) is defined as surveillance and monitoring as a cloud-based platform that helps security operatives remotely monitor numerous premises via cameras, which send video-based data to central cloud storage through the internet. The multiple factors propelling the market's growth include rising security concerns in sectors such as retail, healthcare, and transportation. VSaaS reduces the need for costly on-premises infrastructure, making it more cost-effective for all businesses.

The scalability offered by video surveillance-as-a-service to organizations allows them to scale up or down surveillance systems easily. Remote accessibility, cloud-based VSaaS provides remote access to surveillance footage, improving monitoring. Analytics & AI-based VSaaS solutions benefit from integrating analytics and AI, such as facial recognition, object detection, and others.

VSaaS is one of the fastest-growing verticals in the video surveillance market. Technology is advancing rapidly, security threats are increasing, and the demand for cost-effective, scalable video surveillance solutions is rising. Key trends boosting the market growth include Cloud VSaaS, one of the fastest-growing cloud-based software-as-a-service (SaaS) solutions. This is largely due to cloud-based solutions' scalability benefits, remote access capabilities, and low infrastructure costs. Cloud-based software as a service providers provide end-to-end solutions that are easy to deploy and implement for businesses of all sizes.

AI-driven analytics play an important role in improving video surveillance-as-a-service performance. AI-powered machine learning algorithms can quickly analyze video data, allowing for object recognition, anomaly detection, predictive maintenance, and more features. This trend is changing how video surveillance works by automating the monitoring and alerting processes. Connecting VSaaS to IoT: Integrating VSaaS and IoT opens up new opportunities for data-driven insights. IoT-enabled sensors, cameras, and intelligent analytics tools provide more comprehensive surveillance and security solutions.

Certain challenges hampering the market's growth include privacy concerns that comprise collecting large amounts of surveillance data, which gives rise to privacy concerns and may lead to regulatory issues. The VSaaS relies heavily on internet connectivity, which can be prone to outages, impacting surveillance capabilities. Bandwidth and storage concerns, large amounts of video data streaming and storing in the cloud strain network resources and lead to increased costs. Video data storage is one of the most important aspects of data security, and ensuring the protection, encryption, and secure access to this sensitive information is key to maintaining the integrity of surveillance systems and preventing unauthorized access.

Type Insights

Based on type, the hosted segment led the market and accounted for over 45% of the global revenue in 2022. The market for hosted video surveillance-as-a-service is growing rapidly due to advances in cloud technology, the need for remote monitoring solutions, and the need for scalable and affordable security solutions. Small and medium-sized businesses (SMBs) have been major contributors to the growth of this market as they often need more resources or know-how to set up and manage on-premises security solutions. VSaaS provides them with an affordable and easy-to-use alternative. Integration with the Internet of Things (IoT) and AI-hosted VSaaS vendors increasingly integrate IoT sensors and AI capabilities into their products. This enables more advanced video analytics, object recognition, and the automation of security processes.

The hybrid segment is predicted to witness significant growth over the forecast years. Hybrid video surveillance-as-a-service was becoming increasingly popular as a solution for businesses that wanted to combine the advantages of cloud-based surveillance with on-premises infrastructure. A hybrid VSaaS solution typically combines on-premises hardware (such as a camera, NVR, or DVR) with cloud-based remote access, storage, and management services. This approach enabled businesses to take advantage of existing infrastructure while also taking advantage of the scalability and availability of cloud services.

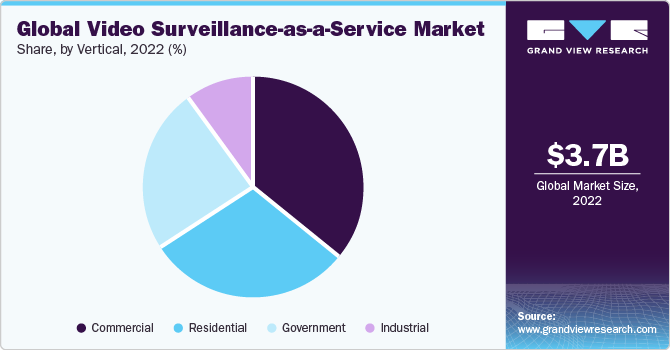

Vertical Insights

Based on vertical, the commercial segment led the market and accounted for over 37% of global revenue in 2022. Several factors drive this growth in the commercial sector owing to several advantages, such as cost-effectiveness, scalability, remote accessibility, and reduced maintenance. With sophisticated scalability with VSaaS, businesses can easily scale up or down their surveillance systems. They can add cameras and storage space as needed without large hardware upgrades. Video surveillance-as-a-service provides remote access to video streams and data via web and mobile apps. Business owners and security personnel can monitor their premises remotely with an internet connection. This improves overall security and awareness. Cloud-based surveillance systems have lower maintenance requirements than traditional on-premises systems. The VSaaS provider handles updates, patches, and system maintenance, reducing the workload of IT staff.

The industrial segment is expected to witness significant growth in the coming years. The factors propelling the segment market growth, such as a large part of the value of a VSaaS platform, lie in its analytics capabilities, which can provide industrial organizations with valuable insights. For example, video analytics can detect anomalies, track movement, and analyze patterns to enhance safety and operational efficiency. Integration and interoperability with IoT and other systems IoT and other industrial systems are becoming increasingly integrated. A VSaaS platform can integrate with access control systems, environmental monitoring, and other technologies to provide a complete security solution. Compliance with regulations and standards in certain industries, security and surveillance regulations, and standards are mandatory. This is where VSaaS features and services can help businesses comply with these requirements.

Regional Insights

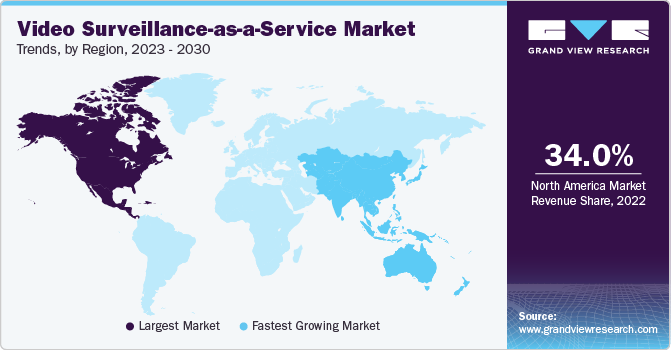

North America dominated the market and accounted for over 34% of the global revenue in 2022. The U.S. and Canada emerged as promising growth hubs in the region. The region's dominance can be attributed to the high penetration of cloud computing, the rising adoption of omnichannel practices, and the growing demand for analytics and insights in multiple sectors. In addition, numerous leading organizations further bolster North America's market position. The U.S. and Canada stand out as key contributors to this growth due to their robust and mature industries and a strong emphasis on innovation and technology, which fuels the adoption of VSaaS cloud computing solutions.

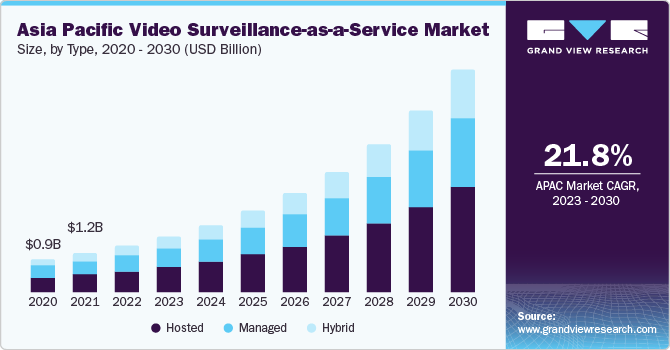

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This growth is driven by a growing demand for cloud-based services from small and medium-sized enterprises (SMEs) in Asia Pacific. Recognizing the advantages of cloud solutions, SMBs are fueling the market's expansion by embracing these technologies to enhance their operations and competitiveness. Countries such as China, India, and Japan are experiencing robust economic growth and rapidly increasing internet penetration and smartphone adoption. This, in turn, drives the demand for efficient VSaaS solutions to support the thriving e-commerce industry. In addition, the government's and businesses' significant investments in cloud-based security services further fuel the demand for security cloud solutions.

Key Companies & Market Share Insights

The VSaaS market is a rapidly evolving industry that provides cloud-based video surveillance solutions to businesses and individuals. The dominant players include Amazon Web Services, Google, Microsoft, and IBM. For instance, AWS provides video analytics and storage services in the cloud through its AWS IoT service and the Amazon Kinesis video stream service. AWS is one of the prominent providers of video surveillance-as-a-service services, offering scalable and secure cloud infrastructures for video surveillance. Google Cloud also offers VSaaS services for video surveillance. The company is well-versed in data analysis and machine learning, and its data processing and analysis capabilities are appealing to VSaaS users.

The market is witnessing fierce competition between established players and startups, leading companies to adopt various strategies for gaining a competitive edge. These strategies include mergers and acquisitions to acquire new capabilities and expand into new markets, investing in new product offerings to cater to customer needs, embracing technological advancements such as artificial intelligence and machine learning, innovating to enhance the customer experience, and expanding into new geographical markets.

Companies also prioritize security and compliance to address the increasing risk of cyberattacks. Companies must remain agile, innovative, and customer-focused to succeed in this dynamic market while keeping up with the evolving technology landscape. For instance, in July 2023, Solink Corp. announced that the company has secured USD 60 million in additional funding, aimed at supporting its worldwide reach and advancing physical security through the integration of innovative artificial intelligence-driven solutions. Some prominent players in the globalvideo surveillance-as-a-service market include:

-

ADT

-

Johnson Controls

-

Axis Communications AB

-

Avigilon

-

A Motorola Solutions Company

-

Alarm.com

-

Eagle Eye Networks, Inc.

-

Honeywell International Inc.

-

Securitas AB

-

Genetec Inc.

Video Surveillance-as-a-Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.25 billion

Revenue forecast in 2030

USD 13.38 billion

Growth rate

CAGR of 17.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

ADT; Johnson Controls; Axis Communications AB;

Avigilon; A Motorola Solutions Company; Alarm.com; Eagle Eye Networks, Inc.; Honeywell International Inc.; Securitas AB; Genetec Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Surveillance-as-a-Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the globalvideo surveillance-as-a-service market report based on type, vertical, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hosted

-

Managed

-

Hybrid

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Industrial

-

Residential

-

Government

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global video surveillance-as-a-service market size was estimated at USD 3.69 billion in 2022 and is expected to reach USD 4.25 billion in 2023.

b. The global video surveillance-as-a-service market is expected to grow at a compound annual growth rate of 17.8% from 2023 to 2030 to reach USD 13.38 billion by 2030.

b. North America dominated the market in 2022, accounting for over 34% share of the global revenue. The U.S. and Canada emerged as promising growth hubs in the region. The region's dominance can be attributed to the high penetration of cloud computing, the rising adoption of omnichannel practices, and the growing demand for analytics and insights in multiple sectors.

b. Some key players operating in the VSaaS market include ADT, Johnson Controls, Axis Communications AB., Avigilon, A Motorola Solutions Company, Alarm.com, Eagle Eye Networks, Inc., Honeywell International Inc., Securitas AB and Genetec Inc.

b. Key factors driving the video surveillance as a service (VSaaS) market growth include the low investment cost and demand for real-time data surveillance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."