- Home

- »

- Next Generation Technologies

- »

-

Video Surveillance Market Size, Share, Industry Report, 2030GVR Report cover

![Video Surveillance Market Size, Share & Trends Report]()

Video Surveillance Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Vertical (Commercial, Residential), By System (Analog Video Surveillance, IP Video Surveillance), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-122-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Surveillance Market Summary

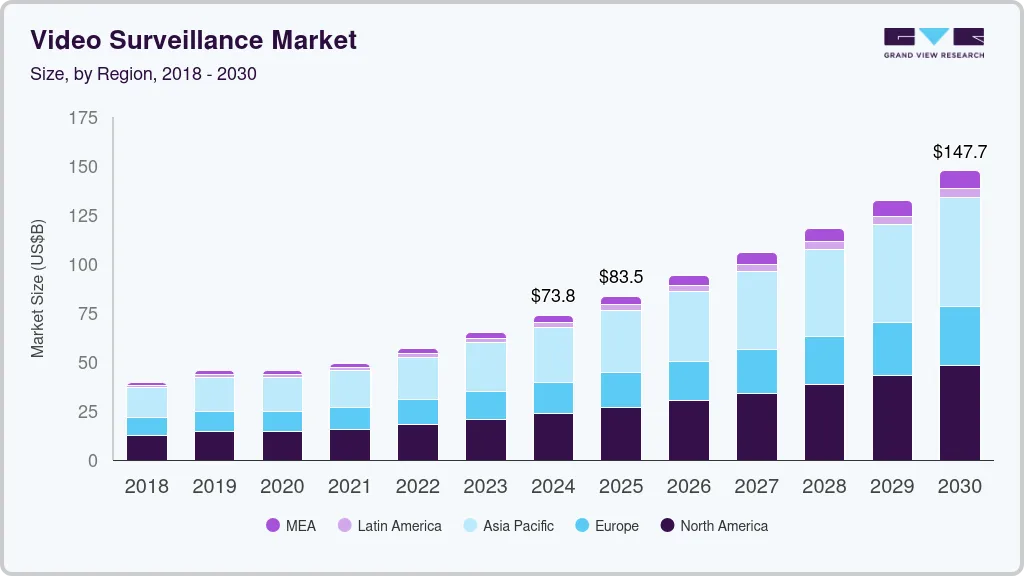

The global video surveillance market size was estimated at USD 73.75 billion in 2024 and is estimated to reach USD 147.66 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The growth is driven by advancements in technology and rising security concerns across various sectors.

Key Market Trends & Insights

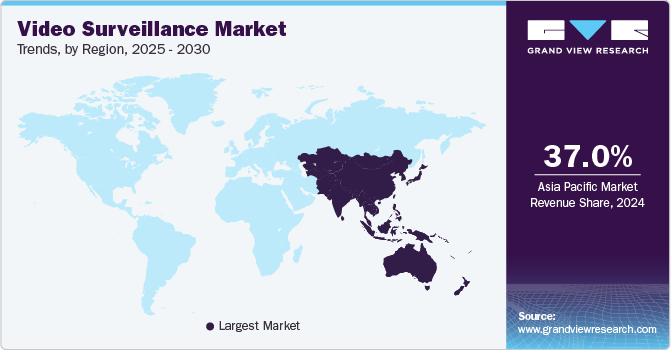

- Asia Pacific video surveillance market dominated globally with a revenue share of over 37% in 2024.

- The U.S. video surveillance market is expected to grow at a significant CAGR from 2025 to 2030.

- By component, the hardware segment led the market in 2024, accounting for over 71% share of the global revenue.

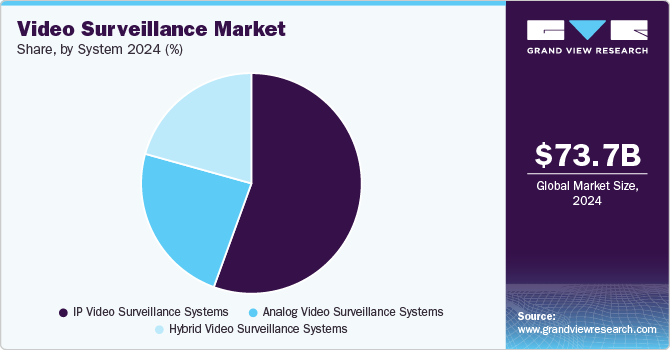

- By system, the IP video surveillance systems segment accounted for the largest market revenue share in 2024.

- By vertical, the commercial segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 73.75 Billion

- 2030 Projected Market Size: USD 147.66 Billion

- CAGR (2025-2030): 12.1%

- Asia Pacific: Largest market in 2024

It encompasses hardware like cameras and recorders, as well as software solutions such as video management and analytics. Increasing urbanization, infrastructure development, and the heightened need for safety have fueled demand for more sophisticated and automated surveillance systems.Sectors such as retail, transportation, and banking have become pivotal adopters, while government initiatives for smart city projects and public safety further accelerate the market's expansion. Artificial intelligence (AI) and machine learning (ML) have revolutionized the market landscape, enabling smart surveillance solutions capable of facial recognition, behavior analysis, and real-time threat detection. The integration of the Internet of Things (IoT) with surveillance systems has facilitated seamless connectivity, allowing users to monitor environments remotely. The rising prevalence of cloud-based video surveillance solutions has also boosted growth, as these offer scalability, efficient data storage, and cost-effectiveness.

Businesses are investing in AI-equipped and future-proof video surveillance systems. AI-driven video analytics automate tasks such as object and facial recognition, liberating human operators for more critical duties such as addressing security alerts. The capacity of AI to uncover imperceptible threats like unauthorized presence or leftover objects enhances security. Furthermore, AI enhances scalability by efficiently processing substantial video data, allowing deployment in expansive environments such as airports and stadiums. Embracing AI ensures adaptability to evolving technologies, enabling businesses to maintain security excellence and stay at the forefront of safety measures.

Component Insights

The hardware segment led the market in 2024, accounting for over 71% share of the global revenue. The segment's growth is primarily attributed to the robust demand for surveillance cameras, monitors, and storage devices. Surveillance cameras are pivotal in monitoring diverse environments, spanning businesses, residences, educational institutions, and public spaces. Their capabilities continue to advance, incorporating features such as night vision, motion sensing, and facial recognition. Monitors serve to observe real-time feeds from surveillance cameras, usually stationed in control rooms or dedicated monitoring areas. Moreover, storage devices are essential in archiving recorded footage captured by surveillance cameras, facilitating applications like crime investigation and suspect identification.

The services segment is anticipated to grow significantly in the coming years, driven by a surge in demand for video surveillance systems, necessitating specialized skills for installation and configuration. Moreover, the rising popularity of video surveillance as a service (VSaaS) contributes to this trend, offering a more economical and scalable alternative to traditional on-premises setups. The adoption of video analytics is also on the rise, creating a demand for professional services to implement and manage these advanced features. Furthermore, the increasing requirement for security consulting and seamless system integration services drives the anticipated expansion of the services segment in the market.

System Insights

The IP video surveillance systems segment accounted for the largest market revenue share in 2024. This is attributed to rising demand for high-quality video surveillance solutions, cost reductions in IP cameras, and the surging trend of cloud-based video surveillance. IP video surveillance systems utilize digital technology for transmitting and receiving video signals over IP networks, offering enhanced scalability and flexibility compared to traditional analog video surveillance systems. IP cameras allow control and remote monitoring, making them well-suited for distributed and large environments.

The hybrid video surveillance systems segment is anticipated to witness significant growth in the coming years. This is due to the increasing popularity of hybrid video surveillance systems, which offer the flexibility of analog systems and the advanced features of IP systems. These hybrid solutions find application across diverse environments such as residences, educational institutions, and enterprises. Moreover, their user-friendly installation and maintenance contribute to their cost-effectiveness, making them a cost-effective option for businesses seeking efficient video surveillance solutions.

Vertical Insights

The commercial segment accounted for the largest market revenue share in 2024. The high share can be attributed to the growing demand for video surveillance systems across diverse commercial applications. These applications include retail environments for theft deterrence and customer behavior analysis, data centers and enterprises for safeguarding critical infrastructure, banking and finance buildings for crime prevention and fraud mitigation, and hospitality establishments and warehouses for guest safety, staff monitoring, and security enhancement.

The industrial segment is likely to show notable growth over the forecast period. This growth is driven by the growing demand for security within industrial facilities to safeguard against theft, vandalism, and other criminal activities. In addition, the increasing adoption of smart manufacturing technologies is fueling the demand for video surveillance systems essential for monitoring and managing operations. The growing necessity to conform to safety regulations, particularly concerning occupational health and environmental protection, further contributes to this upsurge. Moreover, integrating technological advancements such as artificial intelligence and deep learning into video surveillance enhances its efficiency in the industrial sector.

Regional Insights

The video surveillance market in the North America region is expected to witness significant growth over the forecast period. The rapid adoption of advanced surveillance technologies, including AI-powered analytics and cloud-based solutions, is fueling market growth. Rising concerns over public safety, increased crime rates, and the need for stringent monitoring in both public and private sectors have also heightened demand. In addition, significant investments in smart city projects and infrastructure development further contribute to this expansion. Government regulations promoting enhanced surveillance for homeland security, alongside technological advancements, are creating lucrative market opportunities across the region.

U.S. Video Surveillance Market Trends

The U.S. video surveillance market is expected to grow at a significant CAGR from 2025 to 2030. The increasing need for advanced security solutions across sectors such as government, retail, and transportation is a key driver. Significant investments in upgrading surveillance infrastructure, coupled with the integration of AI and machine learning for intelligent video analytics, are boosting market prospects. The rise of smart city initiatives and homeland security measures further propels demand. In addition, the U.S. government's emphasis on enhancing critical infrastructure security and public safety, along with advancements in cloud-based surveillance technologies, is creating lucrative opportunities.

Asia Pacific Video Surveillance Market Trends

Asia Pacific video surveillance market dominated globally with a revenue share of over 37% in 2024. China, Japan, and India are the major countries driving this regional dominance, fostering a substantial demand for video surveillance systems to enhance public safety and security. The region's focus on smart city projects has propelled the integration of video surveillance as a pivotal component for monitoring traffic, crime, and various activities within these initiatives. Moreover, the Asia Pacific region is witnessing growing retail chains and small businesses progressively adopting video surveillance solutions to safeguard assets and deter criminal activities. In addition, favorable government initiatives, such as China's policies promoting video surveillance adoption in public spaces such as schools and hospitals, further drive the market's growth in the region.

Europe Video Surveillance Market Trends

The video surveillance market in the Europe region is expected to witness significant growth over the forecast period. The increasing focus on public safety and the adoption of advanced surveillance technologies are major contributors. Rising concerns about terrorism and crime have led governments to strengthen security measures, spurring demand for sophisticated video surveillance systems. In addition, the rapid implementation of smart city projects and stringent regulations related to security and data protection are accelerating market expansion. Technological advancements, such as AI-based video analytics and cloud-based surveillance solutions, along with investments in infrastructure modernization, are creating lucrative opportunities in the region.

Key Video Surveillance Company Share Insights

Some of the key players in the video surveillance industry include Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, Robert Bosch GmbH, and Axis Communications AB.

-

Dahua Technology Co., Ltd. is a global provider of video-centric smart IoT solutions and services prominently recognized in the video surveillance industry. The company is known for its comprehensive portfolio, which includes advanced video surveillance equipment, such as high-definition cameras, network recorders, and intelligent video analytics. The company has been at the forefront of technological innovation, integrating AI, deep learning, and IoT capabilities into its products to deliver smarter and more efficient security solutions.

-

Robert Bosch GmbH is a multinational engineering and technology company. In the video surveillance industry, Bosch is a prominent player, offering a wide range of advanced security and safety solutions. The company is known for its high-quality video surveillance systems, including intelligent cameras, video analytics software, and integrated security platforms. Bosch leverages cutting-edge technologies, such as artificial intelligence and IoT, to deliver solutions that provide superior image quality, advanced data processing, and proactive threat detection. With a strong focus on innovation and sustainability, Bosch caters to sectors like critical infrastructure, transportation, retail, and industrial facilities.

Key Video Surveillance Companies:

The following are the leading companies in the video surveillance market. These companies collectively hold the largest market share and dictate industry trends.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd

- Robert Bosch GmbH

- Axis Communications AB.

- Motorola Solutions, Inc.

- Zhejiang Uniview Technologies Co., Ltd.

- Tiandy Technologies Co., Ltd.

- TKH Group N.V.

- Hanwha Vision Co., Ltd.

- Infinova

Recent Developments:

-

In August 2024, Robert Bosch GmbH, a global provider of innovative safety and security solutions, launched an assembly line in India dedicated to video systems and solutions featuring the FLEXIDOME IP Starlight 5000i cameras. This strategic move underscores Bosch India's ongoing commitment to localization, strengthening its footprint across various product verticals.

-

In May 2024, Hanwha Vision Co., Ltd. introduced an AI Box, AIB-800, designed to transform any standard ONVIF-compatible video surveillance camera into an AI-powered analytics device. This AI Box offers a cost-effective solution for businesses to upgrade their existing camera systems, allowing them to harness AI capabilities without modifying or fully replacing their current security infrastructure, according to the company.

-

In April 2024, Axis Communications AB launched an open cloud-based platform, Axis Cloud Connect, designed to deliver more secure, flexible, and scalable security solutions. Tailored for seamless integration with Axis devices, Axis Cloud Connect offers businesses a robust suite of managed services, including system and device management, video, and data delivery, while addressing the growing demand for advanced cybersecurity.

Video Surveillance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.49 billion

Revenue forecast in 2030

USD 147.66 billion

Growth Rate

CAGR of 12.1% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, system, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Hangzhou Hikvision Digital Technology Co., Ltd.; Dahua Technology Co., Ltd; Robert Bosch GmbH; Axis Communications AB.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co., Ltd.; Tiandy Technologies Co., Ltd.; TKH Group N.V.; Hanwha Vision Co., Ltd.; Infinova

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

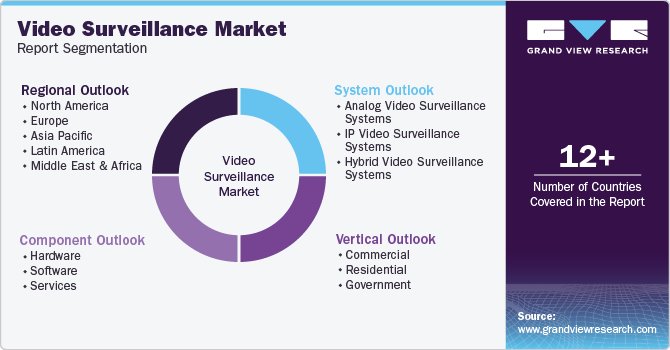

Global Video Surveillance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global video surveillance market report based on component, system, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Camera

-

Monitors

-

Storage Devices

-

Others

-

-

Software

-

Services

-

-

System Outlook (Revenue, USD Billion, 2017 - 2030)

-

Analog Video Surveillance Systems

-

IP Video Surveillance Systems

-

Hybrid Video Surveillance Systems

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Retails Stores & Malls

-

Data Centers & Enterprises

-

Banking & Finance Building

-

Hospitality Centers

-

Warehouses

-

Others

-

-

Industrial

-

Residential

-

Government

-

Healthcare Buildings

-

Educational Buildings

-

Religious Buildings

-

Government Buildings

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global video surveillance market size was estimated at USD 73.75 billion in 2024 and is expected to reach USD 83.49 billion in 2025.

b. The global video surveillance market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 147.66 billion by 2030.

b. Asia Pacific dominated the market in 2024, accounting for 38.0% share of the global revenue. China, Japan, and India are the major countries driving this regional dominance, fostering a substantial demand for video surveillance systems to enhance public safety and security.

b. Some key players operating in the video surveillance market include Hangzhou Hikvision Digital Technology Co., Ltd.; Dahua Technology Co., Ltd; Robert Bosch GmbH; Axis Communications AB.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co., Ltd.; Tiandy Technologies Co., Ltd.; TKH Group N.V.; Hanwha Vision Co., Ltd.; Infinova.

b. Key factors driving the video surveillance market growth include the growing demand for security concerns and the emergence of AI in the video surveillance market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.