- Home

- »

- Biotechnology

- »

-

Viral Vector And Plasmid DNA Manufacturing Market Report, 2030GVR Report cover

![Viral Vector And Plasmid DNA Manufacturing Market Size, Share & Trends Report]()

Viral Vector And Plasmid DNA Manufacturing Market (2024 - 2030) Size, Share & Trends Analysis Report By Vector Type (AAV, Lentivirus), By Workflow, By Application, By End-use, By Disease, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-695-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Viral Vector And Plasmid DNA Manufacturing Market Summary

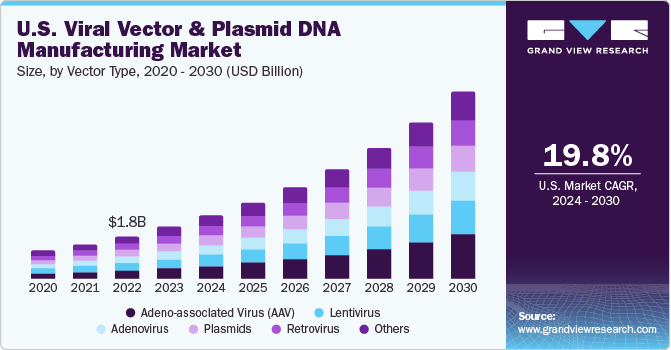

The global viral vector and plasmid dna manufacturing market size was estimated at USD 5.33 billion in 2023 and is projected to reach USD 19.5 billion by 2030, growing at a CAGR of 20.2% from 2024 to 2030. One of the primary factors driving the market is the advancement in gene therapy, as the development of new gene therapies is heavily reliant on high-quality viral vectors and plasmid DNA.

Key Market Trends & Insights

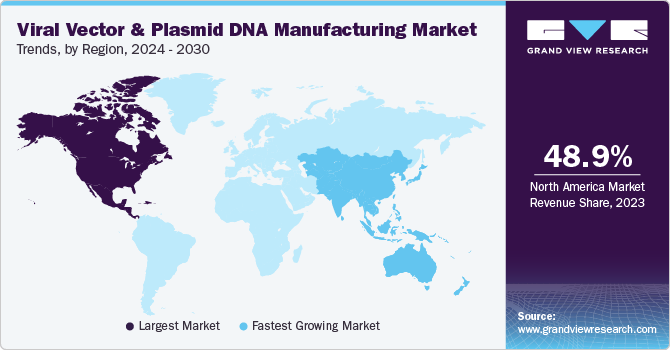

- The North America dominated the market and accounted for 48.96% share in 2023.

- Based on vector type, the adeno-associated virus (AAV) segment led the market with a largest revenue share of 20% in 2023.

- Based on workflow, the downstream processing segment dominated the market in 2023 with a largest revenue share of 53.3%.

- Based on application, the vaccinology segment dominated the market in 2023 with a largest revenue share of 22.0%.

- Based on end use, the research institutes segment dominated the market with the largest revenue share of 58.0% in 2023.

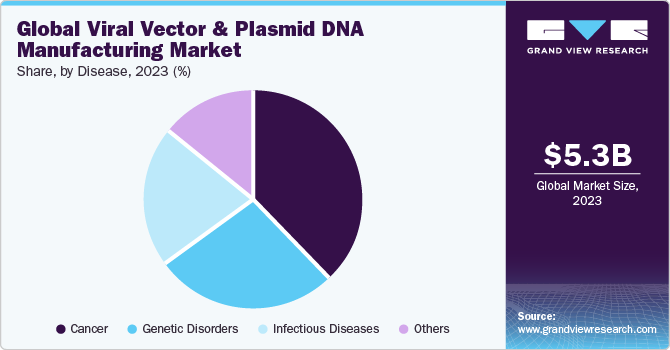

- Based on disease, the cancer segment dominated the market in 2023 with a largest revenue share of 37.9%.

Market Size & Forecast

- 2023 Market Size: USD 5.33 Billion

- 2030 Projected Market Size: USD 19.5 Billion

- CAGR (2024-2030): 20.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, improvements in manufacturing processes have made it possible to produce viral vectors and plasmid DNA more efficiently at larger scales, while also reducing costs and improving overall quality.

Increase in investments in cell and gene therapy research space, there is exceptional demand for viral vectors in the market. Owing to this, various organizations are providing funds to accelerate developments in the manufacturing processes for viral vectors. For instance, in September 2019, Next Generation Manufacturing Canada provided USD 1.89 million to a consortium led by iVexSol Canada. This fund was provided for the development of an advanced manufacturing process for lentiviral vectors. 2iVexSol Canada is a vector manufacturing company that has collaborated with several companies to develop an advanced LVV manufacturing platform.

Furthermore, an increase in the adoption of single-use equipment coupled with the use of suspension-based cell culture is the current industry trend. Utilizing disposable equipment improves productivity and flexibility, resulting in high final product yields. Thus, advancements in single-use technology directly impact the vector production market. Pall Corporation—one of the key companies—offers single-use equipment suitable for viral vector manufacturing. The PALL iCELLis is a single-use fixed-bed bioreactor that offers large-scale manufacturing of viral vectors in an adherent environment. Thus, an increase in the implementation of single-use technology in vector production facilities is expected to impact market growth in the coming years significantly.

The COVID-19 pandemic has created lucrative opportunities for market players by allowing them to shift their business focus toward the development of viral vectors for the SARS-CoV-2 vaccine. Viral vectors are commonly employed tools used in the discovery and development of vaccines against SARS-CoV-2. The ongoing COVID-19 pandemic has encouraged investment in this space in search of a vaccine as viral vector-based vaccines can be manufactured and designed relatively quickly with the use of same building blocks. However, viral vectors were being studied extensively by research communities well before the COVID-19 pandemic. This is because of their proven efficiency and successful application in gene and cell therapies. With the COVID-19 outbreak, applications of viral vectors were repurposed to manufacture vaccines. Although successful, viral vector manufacturing workflows face considerable challenges concerning process and scale. Thus, technology and platform developers are making significant attempts to simplify the viral vector production process.

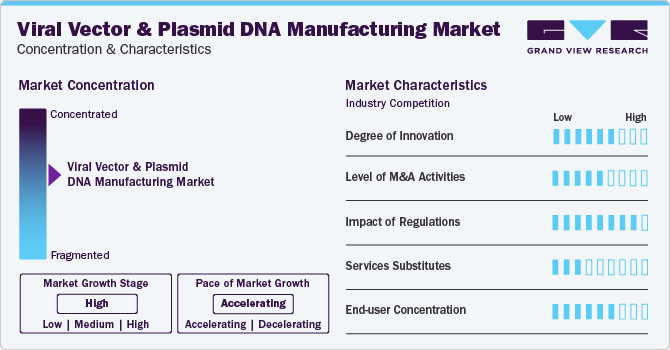

Market Concentration & Characteristics

The viral vectors and plasmid DNA manufacturing market has witnessed a significant degree of innovation in recent years. With the increasing demand for advanced gene therapy and vaccine development, manufacturers are constantly exploring new and efficient ways to produce viral vectors and plasmid DNA. One of the key innovations in this market is the use of transient transfection technology for the large-scale production of viral vectors. Another area of innovation is the use of suspension cell culture systems for viral vector production.

Large pharmaceutical and biotechnology companies are increasingly acquiring smaller vector and plasmid DNA manufacturers to access their proprietary technologies, expertise, and production capacity. This leads to consolidation within the market, giving established players greater control over pricing and market share. Smaller companies benefit from the resources and infrastructure of larger acquirers, enabling them to scale up their operations and reach a wider audience. For instance, in February 2022, Merck KGaA acquired Exelead for about USD 780 million. This would further enhance Merck’s Life Science portfolio to offer end users complete end-to-end CDMO services across the mRNA value chain.

The impact of regulations on the viral vectors and plasmid DNA manufacturing market is significant, influencing product development, manufacturing processes, and market dynamics. Compliance with regulatory standards is essential for ensuring patient safety, maintaining product quality, and gaining market access. Manufacturers need to navigate these regulatory landscapes effectively to bring innovative gene therapies to patients while meeting the stringent requirements set by regulatory agencies.

As of now, viral vectors and plasmid DNA remain a crucial component of many gene therapy treatments and there is no direct substitute available in the market that can match their effectiveness.

The end user concentration in the viral vectors and plasmid DNA manufacturing market varies depending on the specific application. In some cases, academic and research institutions are the primary end users, while in others, biopharmaceutical companies and contract manufacturing organizations (CMOs) may dominate. However, with the increasing focus on gene therapy and the growing demand for viral vectors and plasmid DNA, it is expected that biopharmaceutical companies will become the major end users shortly.

Vector Type Insights

Based on the vector type, the adeno-associated virus (AAV) segment led the market with a largest revenue share of 20% in 2023. AAVs are in huge demand and their utilization in clinical trials is increasing rapidly as these viruses offer maximum precision in delivering the gene to the region of interest. The increasing adoption is due to clinical trials relating to the development of orthopedic and ocular gene therapy therapies exhibiting increased efficiency and efficacy. In August 2022, an article published in Springer stated that AAV-mediated gene therapy could prevent acquired hearing loss. Application of AAV is rising significantly across various therapeutic areas, thereby witnessing a boost in its adoption rate.

The lentivirus segment is expected to grow at a significant CAGR over the forecast period. Increasing use of lentiviral vectors in ongoing research areas, the research industry is focusing on advancements in these vectors. For instance, scientists are studying the potential of non-integrating lentiviral vectors (NILVs) as a tool to avoid insertional mutagenesis. NILVs can transduce both non-dividing and dividing cells. These vectors have potential applications in CAR-T cell therapy research. Furthermore, a recent study published in June 2022 stated that lentiviral vectors are being used to develop vaccines that specifically target dendritic cells and stimulate a powerful T-cell immune response. These factors are expected to support market growth in the forecast years.

Workflow Insights

Based on the workflow, the downstream processing segment dominated the market in 2023 with a largest revenue share of 53.3%, owing to highly complex procedures carried out for polishing and purification of clinical grade final products. Increase in demand for clinical grade viral vectors, manufacturers are involved in development of novel economic downstream processes to address the challenges associated with conventional lab-scale manufacturing of vectors and is expected to support market growth. For example, combining a fed-batch fermentation technique and genetically optimized cell systems with conventional and novel technologies for the purification of vectors.

The upstream processing segment is expected to grow at significant CAGR over the forecast period. Upstream processing involves infecting cells with virus, cultivating of cells, and harvesting the virus from cells. Advanced product development, such as ambr 15 microbioreactor system for high-throughput upstream process development, is expected to drive the segment. ambr 15 microbioreactor system allows efficient cell culture processing with automated experimental set up and sampling, which requires less labor and laboratory space and time taken for cleaning and sterilization is also very less.

Application Insights

Based on the application, the vaccinology segment dominated the market in 2023 with a largest revenue share of 22.0%. The increasing demand for vaccines for various diseases, such as cancer and infectious diseases like COVID-19, primarily drives this growth. Viral vectors and plasmid DNA are widely used in the development of vaccines, and the increasing emphasis on research and development of new vaccines is expected to drive the growth of this market segment. In addition, the availability of government funding for vaccine development programs is also contributing to the growth of the vaccinology application in the viral vectors and plasmid DNA manufacturing market.

The cell therapy segment is expected to grow at the fastest CAGR over the forecast period owing to increase in personalized cancer treatments. Moreover, the success of Chimeric Antigen Receptor (CAR)-based cell therapies for cancer treatment is expected to further fuel the market growth.

End-use Insights

Based on the end use, the research institutes segment dominated the market with the largest revenue share of 58.0% in 2023. Research activities carried out pertaining to improvement in vector production by research entities is driving the segment. For instance, in July 2021, Bluebird Bio and the Institute for NanoBiotechnology entered a research collaboration to develop novel technologies that boost the production of viral vectors for development of novel gene therapies. The researchers at Institute of NanoBiotechnology developed a highly effective and shelf-stable formulation of ready-to-dose form of DNA particles for producing viral vectors. Increasing number of such research collaborations are expected to fuel market growth.

The pharmaceutical and biotechnology companies segment is expected to grow significant CAGR over the forecast period. This can be attributed to continuous introduction of advanced therapies coupled with subsequent increase in the number of gene therapy-based research programs by pharmaceutical firms. The number of biotech companies that are employing vectors for therapeutics production continues to increase over time.

Disease Insights

Based on the disease, the cancer segment dominated the market in 2023 with a largest revenue share of 37.9%. According to Globocan, the number of new cancer cases is anticipated to reach 28.4 million within the next two decades, with a rise of 47% from 2020, owing to adoption of western lifestyle, high consumption of alcohol, smoking, poor diet choices, and physical inactivity. Growing number of cancer cases is projected to propel the demand for gene therapies to treat cancer patients, consequently, increasing demand for viral vectors and plasmid DNA for the development of these gene therapies.

The genetic disorders are expected to register the significant CAGR during the forecast period. Genetic disorders are the most focused area of application for gene therapy, with more than 10% of ongoing clinical trials directed toward the same. This makes gene therapy for genetic disorders one of the most crucial markets in the forecast years and it expected to support growth of viral vectors and plasmid DNA manufacturing market.

Regional Insights

North America dominated the market and accounted for 48.96% share in 2023. This can be attributed to the growing engagement of companies in research and product development in gene & cell therapy coupled with a substantial number of contract development organizations in the region. In addition, homegrown companies are expanding their manufacturing facilities in the region.The U.S. held the highest revenue share in North America viral vectors and plasmid DNA manufacturing market owing to the presence of key market players, including CDMOs offering GMP manufacturing services, and the adoption of highly innovative manufacturing technologies for production.

Asia Pacific is expected to be the fastest-growing region with a CAGR during the forecast period. China is one of the leading countries due to advancements in the regulatory framework for cell-based research activities in the country contributing to the Asia Pacific market growth. Increasing development and commercialization of novel vaccines in the China is also expected to contribute to market growth. For instance, in January 2021, Advaccine Biopharmaceuticals Suzhou Co., Ltd and INOVIO signed licensing agreement to commercialize INO-800—a COVID-19 DNA vaccine—in greater China area, including Taiwan, Hong Kong, Macao, and Mainland China.

The viral vectors and plasmid DNA manufacturing market in China is experiencing significant growth due to increased demand for gene therapies, advancements in biotechnology, and supportive government initiatives. The country's expanding biopharmaceutical sector, coupled with a large patient population, creates a robust market for the manufacturing of viral vectors and plasmid DNA, driving industry growth.

Key Viral Vector And Plasmid DNA Manufacturing Company Insights

Some of the key players operating in the market include Charles River Laboratories, Waisman Biomanufacturing, Genezen laboratories, Batavia Biosciences, Miltenyi Biotec GmbH, Wuxi Biologics, RegenxBio, Inc., Merck KGaA, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Inc. Major companies are focusing on collaborations, partnerships, and expansions to compete in the global market.

Key Viral Vector And Plasmid DNA Manufacturing Companies:

The following are the leading companies in the viral vector and plasmid DNA manufacturing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these viral vector and plasmid DNA manufacturing companies are analyzed to map the supply network.

- Merck KGaA

- Lonza

- FUJIFILM Diosynth Biotechnologies

- Thermo Fisher Scientific

- Cobra Biologics

- Catalent Inc.

- Wuxi Biologics

- Takara Bio Inc.

- Waisman Biomanufacturing

- Genezen laboratories

- Batavia Biosciences

- Miltenyi Biotec GmbH

- SIRION Biotech GmbH

- Virovek Incorporation

- BioNTech IMFS GmbH

- Audentes Therapeutics

- BioMarin Pharmaceutical

- RegenxBio, Inc.

Recent Developments

-

In October 2023, AGC Biologics announced that they will be expanding their pDNA manufacturing facility in Germany. This is expected to help the company to reduce the time required for manufacturing

-

In February 2023, BioNTech SE announced that they have completed the setup of first plasmid DNA manufacturing plant of theirs in Germany. This has enabled the company to manufacture pDNA independently for clinical and commercial applications

-

In April 2022, FUJIFILM Holdings Corporation acquired a cell therapy manufacturing unit from Atara Biotherapeutics, Inc. The company will help the manufacturing of Atara's commercial-and clinical stage allogeneic cell therapies at the unit as part of the manufacturing and services agreement

-

In July 2022, Charles River Laboratories announced the launch of the Plasmid DNA Centre of Excellence in the UK. The expansion comes after Charles River acquired Cognate BioServices and Cobra Biologics, two innovative contract development and production companies for plasmid DNA, viral vectors, and cell therapy (CDMOs)

-

In January 2022, WuXi Biologics entered a long-term collaboration with Shanghai BravoBio Co., Ltd to accelerate the development of innovative vaccines, to address the growing challenge of infectious diseases

Viral Vector And Plasmid DNA Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.47 billion

Revenue forecast in 2030

USD 19.5 billion

Growth rate

CAGR of 20.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Report updated

January, 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vector type, workflow, application, end-use, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Merck KGaA, Lonza; FUJIFILM Diosynth Biotechnologies; Thermo Fisher Scientific; Cobra Biologics; Catalent Inc.; Wuxi Biologics; TakarBio Inc.; Waisman Biomanufacturing; Genezen laboratories; Batavia Biosciences; Miltenyi Biotec GmbH; SIRION Biotech GmbH; Virovek Incorporation; BioNTech IMFS GmbH; Audentes Therapeutics; BioMarin Pharmaceutical; RegenxBio, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Viral Vector And Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the viral vector and plasmid DNA manufacturing market report based on vector type, workflow, application, end use, disease, and region:

-

Vector Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adenovirus

-

Retrovirus

-

Adeno-Associated Virus (AAV)

-

Lentivirus

-

Plasmids

-

Others

-

-

Workflow Outlook (Revenue, USD Billion, 2018 - 2030)

-

Upstream Manufacturing

-

Vector Amplification & Expansion

-

Vector Recovery/Harvesting

-

-

Downstream Manufacturing

-

Purification

-

Fill Finish

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Antisense & RNAi Therapy

-

Gene Therapy

-

Cell Therapy

-

Vaccinology

-

Research Applications

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Research Institutes

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Genetic Disorders

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global viral vector and plasmid DNA manufacturing market size was estimated at USD 5.33 billion in 2023 and is expected to reach USD 6.47 billion in 2024.

b. The global viral vector and plasmid DNA manufacturing market are expected to witness a compound annual growth rate of 20.2% from 2024 to 2030 to reach USD 19.5 billion by 2030.

Which vector type accounted for the largest viral vector and plasmid DNA manufacturing market share?b. AAV is expected to witness a compound annual growth rate of 23.6% owing to the development of ocular and orthopedic gene therapy treatment exhibiting increased efficacy and efficiency.

b. Merck, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Cobra Biologics, Catalent Inc., Wuxi Biologics, Takara Bio Inc., and Waisman Biomanufacturing are some key companies operating in the viral vector and plasmid DNA manufacturing market.

b. The viral vectors and plasmid DNA manufacturing market report scope covers segmentation by vector type, workflow, application, end-use, disease, and region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.