- Home

- »

- Display Technologies

- »

-

Virtual Mirror Market Size And Share, Industry Report, 2030GVR Report cover

![Virtual Mirror Market Size, Share & Trends Report]()

Virtual Mirror Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Solution, Services), By Technology, By Deployment, By Industry (Retail), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-763-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Mirror Market Size & Trends

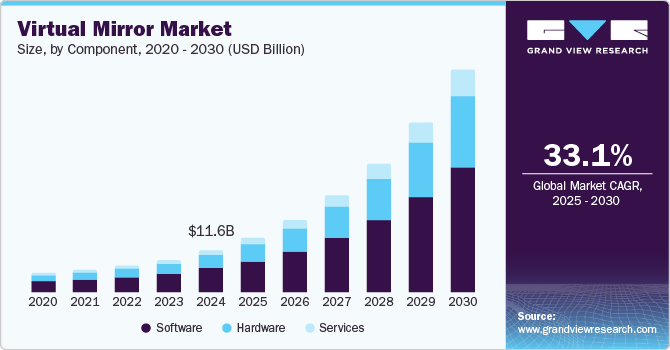

The global virtual mirror market size was valued at USD 11.57 billion in 2024 and is projected to grow at a CAGR of 33.1% from 2025 to 2030. Technological advancements in augmented reality (AR) and virtual reality (VR) are revolutionizing the retail landscape by enabling virtual try-ons for clothing, accessories, and cosmetics. This innovation meets the rising consumer demand for personalized shopping experiences, allowing users to visualize products on themselves without physical trials.

The global virtual mirror market is witnessing substantial growth, primarily driven by the increasing demand for enhanced customer experiences in retail environments. Virtual mirrors enable customers to try on clothing, accessories, and cosmetics virtually, significantly improving engagement and satisfaction. This technology aligns with consumer preferences for convenience and personalization, allowing retailers to differentiate their offerings in a competitive landscape.

Moreover, the rapid advancement of technology, particularly in mobile applications and AR capabilities, is leading to market expansion. As smartphones become more prevalent, consumers increasingly utilize apps that incorporate virtual mirror technology to experiment with various looks from home. This trend is bolstered by the rise of e-commerce, where online retailers adopt virtual fitting rooms to mitigate return rates and enhance conversion rates. By accurately visualizing products through virtual mirrors, retailers can address common consumer hesitations associated with online shopping, thereby driving market growth. For instance, Snap Inc. announced in April 2023 the introduction of augmented reality mirrors in selected Nike stores across the United States, allowing shoppers to visualize clothing without trying them on physically.

Furthermore, sustainability concerns also play a crucial role in the virtual mirror market's development. As consumers become more environmentally conscious, retailers are seeking innovative solutions that minimize waste and promote sustainable practices. Virtual mirrors contribute to this goal by reducing the need for physical samples and returns, thus lowering carbon footprints in retail operations. Additionally, the increasing adoption of cloud-based solutions enhances the scalability and accessibility of virtual mirror technologies, allowing retailers to integrate these systems more efficiently into their existing frameworks. This combination of technological advancements and evolving consumer expectations positions the virtual mirror industry for significant growth in the coming years.

Component Insights

The software segment dominated the market with a revenue share of 56.1% in 2024 due to its integral role in creating interactive and personalized shopping experiences. This segment encompasses the algorithms and applications that power virtual try-on features, enabling users to visualize how clothing, accessories, and cosmetics will look on them. As retailers increasingly seek to enhance customer engagement and satisfaction, the demand for sophisticated software solutions that provide seamless integration with existing retail systems continues to rise. The ability of software to facilitate real-time image processing, body tracking, and user interaction makes it a critical component of the overall functionality of virtual mirrors, ensuring its leading position in the market.

The hardware segment is projected to grow at the highest CAGR during the forecast period. This growth is driven by advancements in display technologies and sensor capabilities that enhance the effectiveness of virtual mirrors in retail environments. As retailers invest in high-quality hardware solutions such as interactive screens and multi-sensor systems, they are able to offer more immersive and engaging experiences for customers. For instance, H&M launched smart mirrors in its new Soho store in New York City, marking the first full implementation of this technology. These mirrors identify items brought in by customers, provide product recommendations and allow requests for different sizes or colors directly from the fitting room. Moreover, the increasing adoption of virtual mirrors across various industries, including automotive and hospitality, further fuels this growth as businesses recognize the value of hardware that complements sophisticated software applications.

Technology Insights

The 3D augmented reality & virtual reality segment dominated the market in 2024, reflecting consumers' growing demand for immersive shopping experiences. This segment's dominance is attributed to its ability to provide realistic visualization that enhances customer engagement and satisfaction. By leveraging AR and VR technologies, retailers can create interactive environments where users can virtually try on products, significantly improving the online and in-store shopping experience. For instance, IKEA has implemented augmented reality through its IKEA Place app, which allows customers to visualize how furniture will look in their homes before making a purchase. This AR technology enhances customer engagement by providing realistic visualizations, significantly improving the online shopping experience. As consumers increasingly seek personalized and engaging interaction, integrating 3D AR and VR solutions in virtual mirrors is expected to remain a key driver of market growth.

The 3D body scanning segment is projected to grow at a significant CAGR during the forecast period. This rapid growth is fueled by advancements in scanning technologies that enable precise measurements and detailed representations of the human body. As retailers and brands recognize the potential of 3D body scanning to offer custom-fit clothing and personalized shopping experiences, the demand for this technology is surging. For instance, Zalando, a major European online fashion retailer, acquired Fision, a startup specializing in 3D body scanning technology, to enhance its virtual fitting room capabilities. This integration allows customers to receive custom fit recommendations based on precise 3D measurements of their bodies, addressing the need for personalized shopping experiences. Additionally, applications in fitness assessment, health monitoring, and virtual try-on solutions are expanding the use cases for 3D body scanning, making it essential to enhance customer satisfaction and reduce return rates in the retail sector.

Deployment Insights

The cloud segment dominated the market in 2024, reflecting the growing preference for cloud based solutions among retailers and consumers alike. This dominance can be attributed to the numerous advantages offered by cloud deployment, including scalability, flexibility, and cost-effectiveness. By utilizing remote servers managed by third-party providers, businesses can access virtual mirror applications without the need for extensive on-site hardware or software maintenance. This reduces operational costs and facilitates easier integration and updates, making it an attractive option for retailers looking to enhance their customer experience through advanced virtual technologies.

The on premise segment is projected to grow at a significant CAGR during the forecast period, driven by businesses that prefer to maintain control over their data and systems. This approach allows companies to customize their virtual mirror solutions according to specific operational needs and security requirements. As industries such as retail and automotive increasingly recognize the value of personalized customer interactions, the demand for on premise installations is expected to rise. Companies may opt for on premise solutions to ensure data privacy and compliance with regulations while leveraging virtual mirrors to create unique shopping experiences that cater to their clientele. For instance, BMW opted for on premise installations of virtual mirror solutions within its showrooms to maintain control over customer data and ensure compliance with privacy regulations. This strategy allows BMW to customize its virtual experiences while ensuring data security.

Industry Insights

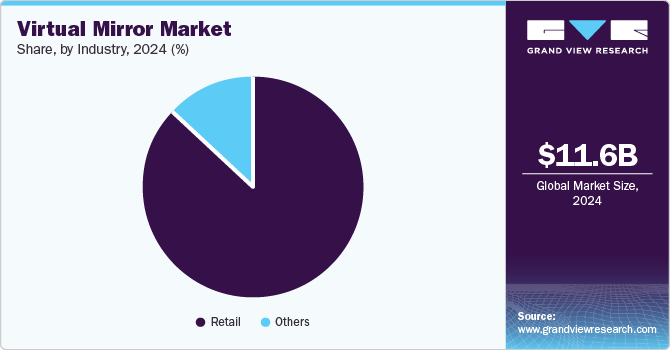

The retail segment dominated the market in 2024 due to the increasing demand for immersive shopping experiences. Retailers are adopting virtual mirrors to enhance customer engagement by allowing consumers to try on clothing, accessories, and cosmetics virtually. This trend has been accelerated by the COVID-19 pandemic, which prompted a shift towards contactless shopping solutions. For instance, in September 2022, Walmart introduced a virtual fitting tool that allows customers to visualize how clothing items would look on their bodies. This innovative solution, developed using technology from Zeekit, enhances customer engagement and satisfaction by providing a convenient way to try on apparel without the need for physical fittings. As consumers increasingly seek personalized interactions that blend online and offline experiences, the integration of augmented reality (AR) technology into retail environments has become essential for improving customer satisfaction and loyalty. The widespread availability of smartphones and internet access further supports this growth, enabling consumers to utilize virtual mirrors seamlessly in both physical stores and online platforms.

The others segment is projected to grow at a significant CAGR during the forecast period due to the expanding recognition of virtual mirrors' potential across various industries beyond retail, such as automotive and hospitality. Businesses in these sectors are beginning to adopt similar technologies to enhance customer engagement and personalization. For instance, in the automotive industry, companies are integrating virtual mirrors for interactive showrooms that allow customers to visualize vehicle features dynamically. In addition, the hospitality sector is exploring virtual mirrors to provide personalized experiences for guests, such as virtual concierge services or interactive room features. As more industries recognize the value of innovative technologies such as virtual mirrors for improving customer interactions and experiences, the demand for these solutions is expected to rise significantly, contributing to overall market growth.

Regional Insights

The virtual mirror market in North America is experiencing notable growth, driven by advancements in augmented reality (AR) technology and a rising demand for personalized shopping experiences. Retailers are increasingly adopting virtual mirrors to enhance customer engagement by allowing shoppers to try on products virtually before purchasing. This technology improves the shopping experience and aligns with the growing trend of contactless solutions in retail. As consumers seek more interactive and convenient ways to shop, the virtual mirror industry is expected to experience significant growth in the coming years.

U.S. Virtual Mirror Market Trends

The U.S. virtual mirror market is witnessing significant advancements, particularly in the retail sector, where major brands are leveraging augmented reality (AR) technologies to enhance customer experiences. For instance, Macy's has implemented virtual mirrors in select stores, allowing customers to try on clothing and accessories virtually. This integration improves customer engagement and helps reduce return rates by providing a more accurate representation of how products will look when worn. The growing emphasis on personalized shopping experiences and the increasing adoption of e-commerce solutions are further driving the demand for virtual mirrors across the United States.

Asia Pacific Virtual Mirror Market Trends

The Asia Pacific dominated the virtual mirror industry in 2024 with a revenue share of 49.3%. This dominance is largely driven by the rapid expansion of e-commerce, particularly in countries such as China, which is recognized as the world's fastest-growing e-commerce market. Major platforms such as Alibaba and Baidu Inc. are increasingly integrating virtual mirror technologies, enhancing consumer engagement through innovative shopping experiences.

In the Asia Pacific region, China stands out as a powerhouse for the virtual mirror market, driven by its status as the fastest-growing e-commerce market globally. Major platforms such as Alibaba are pioneering the use of virtual mirrors in their online shopping experiences, enabling consumers to try on clothing and accessories virtually through their mobile devices. This capability enhances user engagement and addresses common challenges associated with online shopping, such as sizing and fit issues. As Chinese consumers increasingly embrace digital solutions, the demand for virtual mirrors is expected to soar, making China a critical player in the global virtual mirror landscape and setting trends that could influence neighboring markets in the region.

Europe Virtual Mirror Market Trends

In Europe, the virtual mirror market is thriving, especially within the fashion industry, where retailers are adopting innovative technologies to attract consumers. A notable example is Zara, which has begun using smart mirrors in its flagship stores in Spain. These mirrors allow customers to see themselves in different outfits and receive recommendations based on their selections. This technology enhances the in-store experience by combining digital interaction with traditional shopping, catering to the rising consumer expectations for personalized and engaging retail environments. The European market is expected to grow as more retailers explore similar solutions to stay competitive.

The virtual mirror market in Europe is particularly vibrant in France, where the fashion and luxury sectors are leveraging advanced technologies to enhance customer experiences. Renowned brands such as Chanel and Louis Vuitton are incorporating virtual mirrors into their flagship stores, allowing customers to try on products and receive personalized recommendations virtually. This integration not only attracts tech-savvy shoppers but also aligns with the growing trend of sustainability by reducing the need for physical samples. The French market's focus on innovation and customer engagement positions it as a leader in adopting virtual mirror technology, reflecting broader European trends of integrating augmented reality into retail environments.

Key Virtual Mirror Company Insights

In the virtual mirror industry, key companies are maintaining significant market shares due to their innovative technologies and strong brand presence. Major players such as Cisco Systems Inc., My Size Inc., and Virtusize Co. Ltd. are at the forefront, leveraging augmented reality (AR) and virtual reality (VR) to enhance customer experiences across various sectors, particularly in retail and automotive applications. The market is witnessing a notable shift towards integrating these technologies into e-commerce platforms, driven by consumer demand for personalized shopping experiences and the need for sustainable practices that minimize waste.

-

Cisco Systems Inc. is recognized for its advanced AR solutions that enhance customer engagement in retail environments. The company has focused on integrating virtual mirrors into e-commerce platforms, allowing users to virtually try on products, thereby improving the online shopping experience. Their collaboration with various retailers has positioned Cisco as a key player in driving the adoption of virtual mirror technology.

-

My Size Inc. has made notable strides with its interactive touch screen mirrors designed for retail applications. Launched at the National Retail Federation 2022, their FirstLook Smart Mirror empowers brands to offer customers a seamless omnichannel shopping experience by bridging the gap between online and in store interactions. My Size's commitment to enhancing user experience through innovative solutions has solidified its standing in the market, making it a prominent competitor alongside Cisco in the rapidly evolving virtual mirror landscape.

Key Virtual Mirror Companies:

The following are the leading companies in the virtual mirror market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems Inc.

- DigitalDM

- My Size Inc.

- Zugara Inc.

- ViuBox

- Astrafit

- Virtual On Ltd

- Terawe Corp, Ltd.

- Fits.me

- MirrAR

Recent Developments

-

In October 2023, In October 2023, Fittingbox acquired Ditto Technologies Inc., a company specializing in virtual eyewear try-on technology. This acquisition underscores the increasing interest in virtual mirror technology within the fashion sector. It represents Fittingbox's first acquisition since its inception and is expected to significantly improve its product range by merging resources and technologies. By incorporating Ditto's capabilities, Fittingbox intends to develop the largest customer base in the digital eyewear market, extending its presence in global regions such as the United States, Europe, and Japan.

-

In April 2023, Snap Inc. revealed plans to expand its augmented reality (AR) mirror technology into additional retail sectors beyond fashion, specifically targeting home goods and furniture stores. This initiative aims to allow consumers to visualize how products will look in their homes before making a purchase, further driving the adoption of virtual mirrors in diverse industries.

Virtual Mirror Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.21 billion

Revenue forecast in 2030

USD 63.61 billion

Growth Rate

CAGR of 33.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, industry, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia , UAE, South Africa

Key companies profiled

Cisco Systems Inc.; DigitalDM; My Size Inc.; Zugara Inc.; ViuBox; Astrafit; Virtual On Ltd; Terawe Corp, Ltd.; Fits.me; MirrAR

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Mirror Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual mirror market report based on component, technology, deployment, industry, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Firmware/Platform

-

Mobile Application

-

-

Services

-

Integration and Upgradation

-

Consultation, Maintenance and Repair

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

3D Body Scanning

-

Photo Accurate VFR

-

3D Augmented Reality & Virtual Reality

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Brick & Mortar

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.