- Home

- »

- Next Generation Technologies

- »

-

Virtual Studio Market Size & Share, Industry Report, 2033GVR Report cover

![Virtual Studio Market Size, Share & Trends Report]()

Virtual Studio Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-Premises, Cloud-based), By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-320-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Studio Market Summary

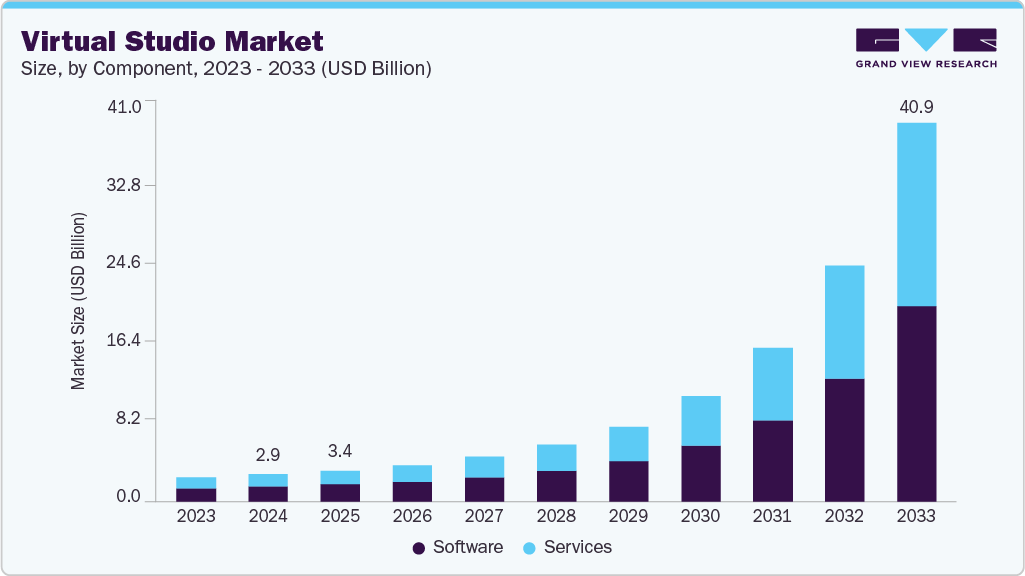

The global virtual studio market size was estimated at USD 2,959.2 million in 2024, and is projected to reach USD 40,894.6 million by 2033, growing at a CAGR of 36.5% from 2025 to 2033. The market growth is primarily driven by the growing integration of real-time rendering, augmented reality (AR), virtual reality (VR), and artificial intelligence (AI).

Key Market Trends & Insights

- North America dominated the global virtual studio market with the largest revenue share of 32.6% in 2024.

- The virtual studio market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the software segment led the market, holding the largest revenue share of 56.9% in 2024.

- By deployment, the on-premises segment held the dominant position in the market and accounted for the leading revenue share of 52.4% in 2024.

- By deployment, the cloud-based segment is expected to grow at the fastest CAGR of 38.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2,959.2 Million

- 2033 Projected Market Size: USD 40,894.6 Million

- CAGR (2025-2033): 36.5%

- North America: Largest market in 2024

Additionally, the shift towards remote work and digital collaboration has accelerated the adoption of virtual studios, which is leading to the expansion of the virtual studio industry.Cloud-based virtual studio platforms are gaining traction in the virtual studio industry, owing to their scalability, flexibility, and cost-effectiveness. These platforms allow content creators and production teams to access sophisticated virtual production tools without significant investment in physical infrastructure. Moreover, cloud solutions facilitate remote collaboration, allowing teams to work together seamlessly across different locations. This capability is particularly beneficial in today's globalized production environment, where teams are often dispersed across various geographies. Cloud-based platforms also support real-time data sharing and rendering, enhancing workflow efficiency and reducing production timelines.

Moreover, the increasing development of user-friendly software and the plummeting costs of technology have opened up virtual production to a wider array of creators, such as independent filmmakers, educators, and small businesses. The democratization of virtual production is also evident in educational settings, where institutions are incorporating virtual production techniques into their curricula. By providing students with hands-on experience in virtual production, educational institutions are preparing the next generation of content creators to harness these technologies effectively, further expanding the reach and impact of virtual production across various sectors and thereby driving the virtual studio industry expansion.

Furthermore, the widespread availability of high-speed internet and 5G networks is revolutionizing virtual studio production by enabling seamless real-time collaboration across geographically dispersed teams. With 5G's ultra-low latency and high bandwidth, creative professionals can engage in synchronized editing, rendering, and motion capture without the delays associated with traditional networks. This advancement allows for streaming high-resolution 3D models and animations directly from the cloud, facilitating instantaneous feedback and iterative development. This trend is expected to drive virtual studio industry growth in the coming years.

Moreover, companies are adopting multifaceted strategies to enhance their competitive edge and meet the increasing demand for immersive content creation. Key strategies include forming strategic partnerships, investing in research and development, and expanding service offerings. The growing collaborations between technology providers and production studios aim to develop advanced virtual production solutions that integrate real-time rendering and LED wall technologies, enhancing creative capabilities while reducing production costs and time. Such strategies from key players are anticipated to propel the virtual studio industry in the upcoming years.

Component Insights

The software segment dominated the market with a share of over 56% in 2024, owing to advancements in real-time rendering, AI-driven visual effects, and immersive technologies. These innovations enable content creators to produce high-quality visuals efficiently. The increasing demand for dynamic and interactive content across various industries, including entertainment, advertising, and education, further propels the adoption of sophisticated virtual studio software solutions.

Services components are expected to register the fastest CAGR of over 38% from 2025-2033. fueled by the increasing complexity of virtual production workflows and the demand for specialized expertise. Companies are increasingly seeking professional services for consulting, integration, and support to optimize their virtual studio setups. This trend is particularly evident in broadcasting and live events sectors, where high-quality production is paramount. The need for tailored solutions that address specific production requirements, such as real-time rendering, motion capture integration, and virtual set design, has led to a surge in demand for specialized services.

Deployment Insights

On-premises deployment dominated the market in 2024, owing to its advantages in data security, customization, and control over infrastructure. Industries with stringent regulatory requirements, such as healthcare and finance, prefer on-premises solutions to ensure compliance and safeguard sensitive information. The ability to tailor virtual studio setups to specific organizational needs, coupled with the control over hardware and software configurations, allows enterprises flexibility to optimize performance and integrate seamlessly with existing IT ecosystems, thereby driving segmental growth.

Cloud-based deployment segment is expected to register the fastest CAGR from 2025 to 2033, owing to the flexibility, scalability, and reduced upfront costs that cloud services offer. These solutions allow businesses to access advanced virtual production tools without significant upfront investments in hardware, democratizing access to high-quality production capabilities. Additionally, the cloud enables seamless collaboration among distributed teams, facilitating real-time editing, feedback, and content delivery. These factors are expected to drive segmental growth in the coming years.

Enterprise Size Insights

Large enterprises dominated the market in 2024, driven by the need to produce high-quality content efficiently on scale. These organizations leverage advanced technologies such as real-time rendering, motion capture, and AI-driven visual effects to streamline production processes and reduce costs. The adoption of cloud-based platforms enables seamless collaboration across global teams, facilitating immersive content creation for various media channels. Additionally, the ability to host virtual events and conferences allows large enterprises to engage with a broader audience, enhancing their brand presence and reach.

SMEs segment is expected to register the fastest CAGR from 2025 to 2033, owing to scalable, cost-effective access to advanced virtual production tools without the need for significant upfront investments in hardware, democratizing access to high-quality production capabilities. This flexibility allows SMEs to produce professional-grade content efficiently, enhancing their competitiveness in the market. Additionally, the growing demand for dynamic and interactive content across various industries, including entertainment, advertising, and education, propels the adoption of sophisticated virtual studio software solutions.

Application Insights

Post-production editing applications dominated the market in 2024, driven by the increasing demand for high-quality, efficient editing workflows. Cloud-based platforms enable editors to collaborate remotely, accessing advanced editing tools and storage solutions from anywhere. This flexibility allows for real-time editing and feedback, reducing turnaround times and enhancing productivity. Additionally, advancements in GPU-accelerated editing software, such as Adobe Premiere Pro and DaVinci Resolve, enable editors to handle high-resolution footage and complex effects with greater speed and precision, further streamlining the post-production process and driving the segmental growth.

The live streaming and broadcasting application segment is expected to register the fastest CAGR from 2025 to 2033. This explosive growth is largely driven by the global shift towards digital platforms and the increasing popularity of online streaming services. As audiences worldwide continue to favor real-time content over traditional media, the demand for live streaming and broadcasting solutions is soaring. These platforms not only cater to entertainment and social networking but are also becoming integral for businesses, educational institutions, and event organizers seeking innovative ways to engage with their audiences.

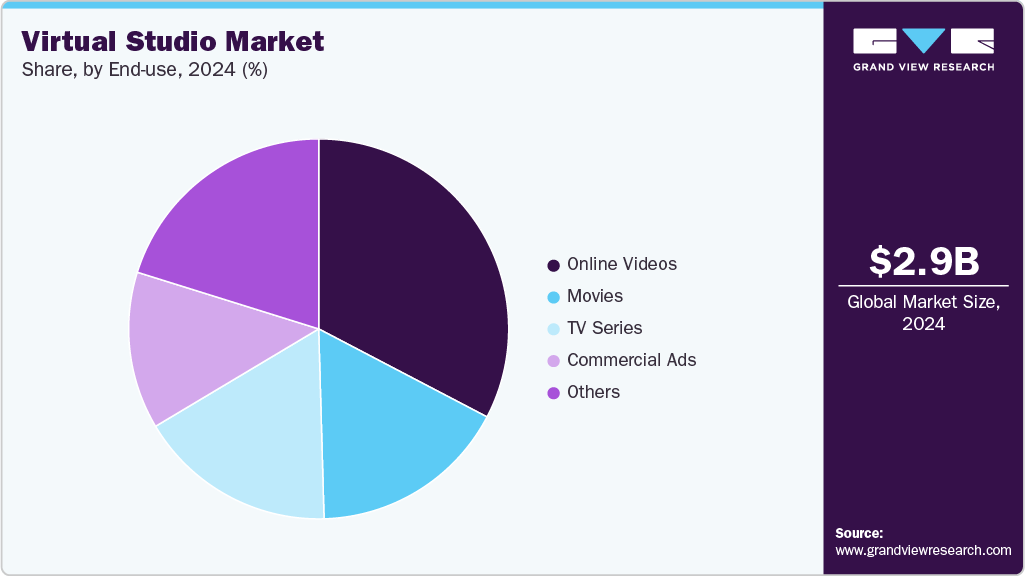

End Use Insights

The online video segment dominated the market in 2024, driven by the increasing demand for high-quality, engaging content across digital media platforms. Platforms such as YouTube, Vimeo, and social media have become central to content consumption, prompting creators to seek professional-grade production tools. Virtual studios facilitate the creation of realistic and interactive environments without the need for physical sets, offering a cost-effective and flexible solution for producing a wide range of content. This capability allows content creators to produce polished, professional-looking videos that attract and retain viewers, thereby enhancing their digital presence and engagement.

The commercial ads segment is expected to grow at a significant CAGR from 2025 to 2033. In the commercial advertising sector, virtual studios are revolutionizing content creation by enabling the production of high-quality advertisements without the constraints of traditional physical sets. This flexibility allows advertisers to craft immersive and dynamic ad experiences that capture audience attention more effectively. The integration of advanced technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) into virtual studios further enhances the creative possibilities, enabling the development of interactive and personalized advertisements. These innovations improve the visual appeal of ads and facilitate more targeted and engaging campaigns, leading to higher viewer retention and conversion rates.

Regional Insights

North America virtual studio market dominated the market with a share of over 32.6% in 2024, driven by significant technological advancements and the region's strong presence of major entertainment and technology companies. The integration of real-time rendering engines, motion capture systems, and LED wall technologies has revolutionized virtual production workflows, enabling filmmakers to achieve higher levels of realism and creativity. Additionally, the increasing adoption of virtual production in commercial advertisements and live events has further fueled market growth, as businesses seek innovative ways to engage audiences and enhance content delivery.

U.S. Virtual Studio Market Trends

The U.S. virtual studio market dominated with a share of over 74% in 2024. The growing emphasis on AI-driven automation and cloud-based collaboration platforms is driving market growth. The rise of virtual events and live streaming has also contributed to the adoption of virtual production, as content creators seek to deliver interactive and engaging experiences to audiences.

Europe Virtual Studio Market Trends

The Europe virtual studio market accounted for a significant share of over 26% in 2024. The market is focusing on the enhancement of technological innovation and integrating various solutions, strengthening partnerships with content creators and broadcasters to expand the client base. The company in the market is prioritizing trading and support to ensure user proficiency and satisfaction, leveraging market strategies targeting key industries such as gaming, entertainment, and corporate events.

Germany virtual studio market is expected to witness a CAGR of over 36% from 2025 to 2033. The market’s key initiatives, including investing in advanced virtual production tools, enhancing infrastructure to support high-quality content creation, and strategic partnerships with various firms in the market. Germany aims to establish itself as a hub for virtual studio excellence.

The virtual studio market in UK accounted for a significant share in 2024, driven by the growing advancements in virtual reality and augmented reality technologies. These technologies are revolutionizing the production landscape, offering more immersive and interactive experiences for content creators.

Asia Pacific Virtual Studio Market Trends

The Asia Pacific virtual studio market is expected to grow at the fastest CAGR of over 40% from 2025 to 2033, driven by technological advancements and the rising demand for high-quality video content. The rapid adoption of digital technologies has seen a surge in the use of technology in film production, news broadcasting, and online education, among others. The market also remains a vibrant innovation hub, catering to a growing clientele that seeks advanced content creation solutions.

China virtual studio market is driven by the country’s massive internet population and its avid consumption of digital content, which has created a huge demand for innovative and engaging entertainment. The emergence and popularity of OTT platforms in China have significantly boosted the demand for high-quality digital content production.

The virtual studio market in Japan is rapidly expanding. Japanese broadcasters and content creators are leveraging technology to produce engaging content efficiently and cost-effectively, responding to changing viewer preferences toward interactive and visually rich media. The advanced technological infrastructure and robust gaming and animation industry complement and enhance the development of the technologies.

Key Virtual Studio Company Insights

Some of the key players operating in the market include Adobe Inc., Autodesk Inc., Microsoft Corporation, and Unity Technologies, among others.

-

Adobe Inc. is a global player in software solutions for creative professionals, offering a comprehensive suite of tools for video editing, graphic design, and digital content creation through its Digital Media segment. The company provides advanced virtual production solutions via its Adobe Creative Cloud and Adobe Document Cloud platforms.

-

Autodesk, Inc. is a multinational software corporation specializing in design, engineering, and entertainment software. In the virtual studio market, the company is renowned for its Media & Entertainment division, which offers industry-standard tools such as Maya, 3ds Max, and Arnold that are widely used for 3D animation, visual effects, and virtual production. The company recently expanded its capabilities by acquiring Wonder Dynamics, a cloud-based AI-powered 3D animation and VFX platform, enhancing its ability to simplify and accelerate virtual content creation.

Luxion, Inc. and Harmonic, Inc. are some of the emerging market participants in the virtual studio market.

-

Luxion, Inc. is an emerging player in advanced 3D rendering and computer-based lighting simulation technologies. The company is known for its flagship products, KeyShot and KeyVR, which provide real-time ray tracing and photorealistic visualization tools widely used by industrial designers, marketers, and product developers worldwide. Luxion’s software enables users to create highly realistic 3D visuals and immersive virtual reality experiences, streamlining product design and marketing workflows.

-

Harmonic Inc. specializes in video streaming and broadcast delivery solutions. The company’s hybrid cloud streaming solutions, AI-driven ad insertion, and GPU-based cloud transcoding are driving cost efficiencies and enhanced viewer engagement. The company also unveiled new live and time-shift origin capabilities on its XOS Advanced Media Processor, optimizing video distribution efficiency for various broadcast standards and reducing infrastructure costs. Additionally, Harmonic’s GPU-based cloud transcoding allows for live video processing at significantly lower costs, supporting scalable, high-quality streaming experiences.

Key Virtual Studio Companies:

The following are the leading companies in the virtual studio market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Autodesk, Inc.

- Avid Technology, Inc.

- Blackmagic Design Pty Ltd

- Chaos Group Ltd.

- Emerson Electric Co.

- Epic Games, Inc.

- Foundry Visionmongers Ltd.

- Harmonic Inc.

- Luxion, Inc.

- Maxon Computer GmbH

- Microsoft Corporation

- Monarch Innovative Technologies Pvt. Ltd.

- Nippon Control System Corporation

- OTOY Inc.

- PreSonus Audio Electronics, Inc.

- SideFX Software Inc.

- Unity Technologies

Recent Developments

-

In April 2025, Adobe, Inc. introduced significant AI-powered advancements in its video editing tools, Premiere Pro and After Effects, enhancing creative workflows for professionals. The standout feature, Generative Extend, utilizes Adobe's Firefly Video Model to seamlessly add 4K video and audio extensions, enabling editors to bridge gaps and smooth transitions effortlessly.

-

In April 2024, Vū Technologies Corp. expanded its network of virtual studios in North America, Europe, and Asia. This expansion helps make the organization’s advanced creative technology more accessible to brands, filmmakers, and content creators.

-

In March 2024, RT Software Ltd. released a new feature to its virtual studio software, Swift Studio. It allows operators to interact with Unreal Engine’s graphics live on air through their familiar Swift Live browser interface.

Virtual Studio Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,394.2 million

Revenue forecast in 2033

USD 40,894.6 million

Growth rate

CAGR of 36.5% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; the Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Adobe Inc.; Autodesk Inc.; Avid Technology; Blackmagic Design; Chaos Group; Emerson; Epic Games; Foundry Visionmongers Ltd.; Harmonic Inc.; Luxion; Maxon; Microsoft Corporation; Monarch Innovative Technologies Pvt. Ltd.; Nippon Control System Corporation; OTOY Inc.; PreSonus Audio Electronics Inc.; SideFX; Unity Technologies.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Virtual Studio Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global virtual studio market report based on component, deployment, enterprise size, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-based

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

SMEs

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Virtual Sets and Environments

-

Motion Capture and Tracking

-

Rendering and Animation

-

Live Streaming and Broadcasting

-

Post-Production Editing

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Movies

-

TV Shows

-

Commercial Ads

-

Online Videos

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual studio market size was estimated at USD 2,959.2 million in 2024 and is expected to reach USD 3,394.2 million in 2025.

b. The global virtual studio market is expected to grow at a compound annual growth rate of 36.5% from 2025 to 2033 to reach USD 40,894.6 million by 2033.

b. North America accounted for a market revenue share of 32% in 2024, driven by targeted marketing campaigns emphasizing cost-effectiveness, flexibility, and the ability to produce high-quality content remotely will attract diverse industries.

b. Some key players operating in the virtual studio market include Adobe Inc., Autodesk Inc., Microsoft Corporation, Unity Technologies, Blackmagic Design, Chaos Group, Luxion, and among others.

b. Technological trends which are enhancing the growth of the market include advancement in computer graphics and real time rendering, integration of AR and VR technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.