- Home

- »

- Biotechnology

- »

-

Virus Filtration Market Size, Share & Growth Report, 2030GVR Report cover

![Virus Filtration Market Size, Share & Trends Report]()

Virus Filtration Market Size, Share & Trends Analysis Report By Product, By Technology (Filtration, Chromatography), By Application (Biologicals, Medical Devices, Water Purification), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-570-0

- Number of Report Pages: 138

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

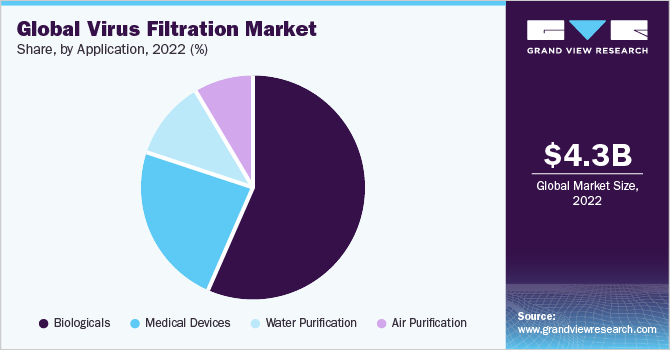

The global virus filtration market size was estimated at USD 4.26 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.1% from 2023 to 2030. The rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is anticipated to propel the demand for biologics. According to the World Health Organization (WHO), around 422 million people globally are affected by diabetes. Rapid prevalence is observed in low- and middle-income nations compared to high-income nations. Amputation of the lower limbs is a common complication of diabetes, as are kidney disease, cardiac arrest, stroke, and blindness. According to the WHO, between 2000 and 2019, the mortality rates from diabetes rose by 3% for each age group and an estimated 2 million people died in 2019 from diabetes-related kidney disease.

The COVID-19 pandemic positively impacted the market of virus filtration. The market is expected to grow significantly in the coming years, as the COVID-19 pandemic has highlighted the importance of sterilizing biopharmaceutical products, vaccines, medical devices, and air and water systems from viral contaminants. Virus filtration is a crucial step in ensuring the safety and efficacy of biopharmaceuticals and vaccines, as well as preventing the transmission of infectious diseases.

Another significant factor anticipated to increase market growth is adherence to regulatory frameworks for drug development and production, such as Current Good Manufacturing Practice (cGMP) regulations. The virus safety of these products is guaranteed by the manufacturers through a variety of quality control procedures, including monitoring and quality checking of raw materials, validating and putting into practice effective virus clearance technology, and validating the finished product for the absence of virus contamination. As a result, there is a huge market for these products in both manufacturing and R&D.

High-Efficiency Particulate Air (HEPA) filters had a boost in demand due to HEPA H13 being able to filter out the SARS-CoV-2 virus from the air, making the air sterile. Manufacturers such as Clean Liquid Systems, Liberty Industries, Inc., and Filtration Technology Inc. saw exponential growth in the market of HEPA H13 filters.

Clinical Research Organizations (CROs) are collaborating with biotechnology and biopharmaceutical companies for the development of novel drugs and therapies, which is also expected to support market growth. For instance, in May 2023, CRO firm IQVIA announced its partnership with RED, an organization that aims to fight AIDS and the injustices that help the COVID-19 virus to spread, to help the laboratory system strengthen.

Biologics, such as biopharmaceutical drugs, require more time, and money, and is complex to develop than chemical medications. Producing the same drug as the original is very challenging because every biopharmaceutical is distinct. The efficacy, quality, and safety of medicine could change as a result of even a minor change in the protein structure. To prevent protein denaturation or variation in protein structure, which could negatively impact the demand for these products, filtration products like chromatography reagents and kits must be used very carefully.

Product Insights

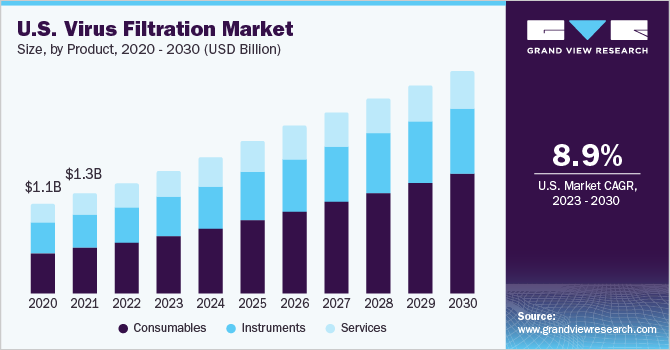

The consumables segment dominated the market with the largest revenue share in 2022 owing to the rising demand for these products for virus filtration. The demand for consumables such as reagents, kits, and membranes is anticipated to increase the production of vaccines, protein therapeutics, blood-related products, cellular therapy products, genetic therapy products, tissue products, and embryonic stem cell products.

Several leading vendors including Merck KGaA, Danaher, and Sartorius AG provide a broad range of reagents, kits, and other consumables for virus filtration. For instance, Merck offers a wide range of resins and media such as Eshmuno A Resin, ProSep Ultra Plus resin, ProSep-vA Ultra resin, ProSep-vA Ultra chromatography media, Eshmuno IEX Chromatography Resins, and Fractogel Ion Exchange Chromatography Resins.

The services segment is expected to grow at the fastest CAGR over the forecast period from 2023 to 2030. This is due to the increased outsourcing of R&D and drug development services from CROs by biotechnology companies. In addition, CROs are collaborating with biotechnology and biopharmaceutical companies for the development of novel drugs and therapies, which is expected to support the segment growth.

Technology Insights

The filtration segment dominated the market with the largest revenue share in 2022 owing to the increased adoption of these products in the manufacturing of biologics and medical devices and research. Furthermore, it offers numerous benefits, including the preservation of protein integrity in both products and samples, along with the provision of excellent efficiency and purity in both laboratory and large-scale settings. Due to increased vendor R&D spending and product developments, the filtration segment is predicted to expand at a profitable rate during the forecast period.

Companies invest a large amount of money in R&D to cater to the unmet needs of biopharmaceutical, biotechnology, and medical device manufacturers. For instance, in May 2023 Merck KGaA invested USD 37.5 million in biosafety testing at Glasgow & Stirling sites in Scotland. To ensure that medicines are both safe and effective as well as compliant with regulatory standards, biosafety testing is an essential step in the drug development and manufacturing process.

The chromatography segment is expected to grow at the fastest CAGR during the forecast period, owing to product advancements and increasing R&D and production of biologics. For instance, in June 2018, Novasep, a provider of services and technology for the life sciences industry, announced the launch of BioSC Pilot, a downstream processing (DSP) system for pharmaceuticals that utilizes batch and continuous chromatography in between purification phases. The removal of contaminants of biomolecules such as monoclonal antibodies (mAbs), recombinant proteins, and blood factors is a focus of BioSC Pilot from the early pilot phase to small commercial production.

End-use Insights

The biopharmaceutical and biotechnology companies segment dominated the virus filtration market with the largest revenue share in 2022 owing to increasing R&D activities, production of biologics, as well as growth in the biopharmaceutical industry. Increasing demand for innovative drugs and vaccines, advancements in scientific research and development, and supportive governmental schemes and policies are some of the drivers.

The CROs segment is expected to grow at the fastest CAGR over the forecast period, due to the trend of outsourcing R&D and manufacturing to CROs. An increase in the number of vaccines and therapeutic protein manufacturing companies has resulted in rising demand for outsourcing services that cater to the specific needs of these companies.

The medical device companies segment is projected to witness a significant CAGR during the forecast period. Viral removal products are widely used in various medical devices including anesthesia systems and ventilators. For instance, Humid-Vent HEPA is a mechanical viral and bacterial filter indicated for application in bacterial/viral filtration and humidification in ventilator and anesthesia systems.

Application Insights

The biologicals segment held the largest revenue share of 56.6% in 2022 and is expected to grow at the fastest CAGR of 10.9% over the forecast period. This can be attributed to the rising prevalence of chronic diseases such as deficiency of growth hormones, blood disorders, cancer, diabetes, and autoimmune disorders that boost the demand for biologics. According to the World Health Organisation (WHO), 8.5% of individuals aged 18 and older had diabetes in 2014. 48% of the 1.5 million diabetes-related deaths that occurred in 2019 occurred in people under the age of 70.

Diabetes is thought to be responsible for 460,000 fatalities from kidney disease and 20% of deaths from cardiovascular disease. Leading biotechnology and biopharmaceutical companies such as F. Hoffmann-La Roche Ltd.; Eli Lilly and Company; Merck KGaA; Amgen Inc.; Pfizer; and Novo Nordisk A/S are continuously making efforts for the development of new drugs. For instance, Pfizer Inc. declared in May 2023 that the Food and Drug Administration (FDA) had authorized the company's bivalent RSV prefusion F (RSVpreF) vaccine, ABRYSVO (Respiratory Syncytial Virus Vaccine), for use in preventing lower respiratory tract disease in people aged 60 and over.

The medical device segment held a significant revenue share of 23.6% in 2022 and is expected to grow at a lucrative CAGR of 9.7% over the forecast period from 2023 to 2030. Various manufacturers are introducing advanced virus clearance products, such as the MockV, a Retrovirus-like Particles (RVLP) Kit by Cygnus Technologies, which is a spiking agent for viral elimination testing that uses not transmissible RVLP, which is derived endogenously from Chinese Hamster Ovary (CHO) cell culture and are compatible with BSL-1.

Regional Insights

North America dominated the market with the largest revenue share of 41.2% in 2022. The established biotechnology and biopharmaceutical sectors in the U.S. have increased the region's demand for advanced viral clearance products for research and development and biologics manufacturing.

Asia Pacific is estimated to grow at the fastest CAGR of 12.0% over the forecast period from 2023 to 2030 due to the growing number of road accidents and trauma cases. The presence of untapped growth opportunities in the rapidly growing Asian economies such as China, India, and Indonesia is estimated to propel regional growth. Rising government support for industrialization, the growing presence of CROs, the availability of labor at low cost, and a relatively less stringent regulatory environment are attracting manufacturers of biologics and medical devices for market expansion in these regions.

According to the World Health Organization's 2019 statistics, Thailand and Vietnam were the most dangerous nations in the region, with death rates of 32.2 and 30.5 per 100,000 people, respectively. Malaysia at 22.4%, Myanmar at 20.3%, Cambodia at 19.5%, and Laos at 17.8% follow in this order. Comparatively, the average number of traffic fatalities per 100,000 Singaporeans is only 2.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. The market players are indulging themselves in the constant development of new and better virus filtration. Major manufacturers provide advanced products through strong distribution channels across the globe. For instance, Sartorius has a presence in more than 110 countries with around 30 sales offices and 20 manufacturing sites worldwide. Leading manufacturers are involved in mergers and acquisitions, strategic collaborations, and novel product development to gain revenue share in the industry.

Mergers and acquisitions help companies expand their existing businesses and geographical reach. For instance, in May 2022, AbbVie Inc., a pharmaceutical company based in the U.S., announced the acquisition of Allergan PLC, a pharmaceutical company involved in the marketing, manufacturing, development, and acquisition of medical devices and brand-name drugs.The acquisition promotes a substantial expansion and diversification of AbbVie Inc.'s revenue foundation, effectively complementing its current dominant presence in immunology through notable products such as Humira, Skyrizi, and Rinvoq, as well as in hematologic oncology with Imbruvica and Venclexta. Allergan brings forth fresh avenues for growth in the field of neuroscience, with its offerings such as Botox Therapeutics, Vraylar, and Ubrelvy, alongside an aesthetics business featuring renowned brands like Botox and Juvederm. Some prominent players in the global virus filtration market include:

-

Merck KGaA

-

Danaher

-

Sartorius AG

-

Thermo Fisher Scientific Inc.

-

GE Healthcare

-

Charles River Laboratories

-

Asahi Kasei Medical Co., Ltd.

-

WuXi AppTec

-

Lonza

-

Clean Biologics

Virus Filtration Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.8 billion

Revenue forecast 2030

USD 9.5 billion

Growth Rate

CAGR of 10.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Merck KGaA; Danaher; Sartorius AG; Thermo Fisher Scientific Inc.; GE Healthcare; Charles River Laboratories; Asahi Kasei Medical Co., Ltd.; WuXi AppTec; Lonza; Clean Biologics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virus Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virus filtration market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Kits and Reagents

-

Others

-

-

Instruments

-

Filtration Systems

-

Chromatography Systems

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Filtration

-

Consumables

-

Instruments

-

Services

-

-

Chromatography

-

Consumables

-

Instruments

-

Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologicals

-

Vaccines and Therapeutics

-

Blood and Blood Products

-

Cellular and Gene Therapy Products

-

Tissue and Tissue Products

-

Stem Cell Products

-

-

Medical Devices

-

Water Purification

-

Air Purification

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Medical device companies

-

Academic Institutes & Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global virus filtration market size was estimated at USD 4.26 billion in 2022 and is expected to reach USD 4.8 billion in 2023.

b. The global virus filtration market is expected to grow at a compound annual growth rate of 10.1% from 2023 to 2030 to reach USD 9.5 billion by 2030.

b. The consumables segment dominated the market with a share of 46.5% in 2022. This is attributable to their continuous usage by pharmaceutical and biopharmaceutical companies and rises in R&D spending for the purpose of new drug development.

b. Some key players operating in the virus filtration market include Sartorius AG, Merck KGaA, Parker Hannifin, Rad Source Technologies, Clean Cells, WuXi PharmaTech (Cayman) Inc., and Danaher.

b. Key factors that are driving the virus filtration market growth include the global rise in the number of pharmaceutical and biopharmaceutical companies, increasing investment in the life sciences sector, rise in the number of drug launches & approvals, increase in funding by government for the development of pharmaceutical and biopharmaceutical industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."