- Home

- »

- Medical Devices

- »

-

Vital Signs Monitoring Devices Market Size Report, 2030GVR Report cover

![Vital Signs Monitoring Devices Market Size, Share & Trends Report]()

Vital Signs Monitoring Devices Market Size, Share & Trends Analysis Report By Product (BP Monitors, Pulse Oximeters), By End-use (Hospitals, Ambulatory Centers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-973-9

- Number of Report Pages: 111

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global vital signs monitoring devices market size was valued at USD 9.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. Constant innovation in products, increasing demand for home healthcare services, rising number of healthcare settings, primarily hospitals, and rising prevalence of chronic disorders are key drivers responsible for the lucrative growth of the industry. Vital signs monitoring devices have evolved over a short duration of time from individual devices measuring blood pressure (BP), pulse, and temperature to a combined all-in-one device. In addition, there has been an increasing number of innovations in this product category, which is fueling the growth of products in this category.

The demand for vital sign monitoring devices like blood pressure monitors, pulse oximeters, and temperature monitoring devices escalated drastically due to the onset of COVID-19 in 2020 as there were crucial parameters to be looked for in identifying the presence of the virus. As per Sharp Health News, around 103 million people in the U.S. suffer from hypertension, and as COVID-19 has been reported as dangerous for people with heart disease and related conditions, especially high BP, the demand for BP monitoring devices increased. The others product segment in the U.S. market will have significant growth over the forecast period.

Other key growth factors include increasing demand for personalized healthcare, a growing number of geriatric patients, rising penetration of medical insurance, and blooming medical tourism in developing countries. Medical tourism is in a steep growth phase in countries, such as Singapore, Canada, Costa Rica, Ecuador, India, Israel, Jordan, Malaysia, Mexico, Singapore, South Korea, Taiwan, Thailand, and Turkey. These countries are the key regional vital sign monitors market. The rising global prevalence of lifestyle-associated chronic disorders is expected to positively impact the industry.

With the increasing awareness, the demand for personalized and accurate vital sign monitoring devices is expected to grow lucratively in the coming years. According to the Global Health Observatory data, in 2019, 71% of the deaths were due to Non-CommunicableDiseases (NCDs). The major NCDs are Cardiovascular Diseases (CVDs), which caused 45.0% of all NCD deaths, cancer caused 22.0% of all NCD deaths, and Chronic Obstructive Pulmonary Disease (COPD) caused 10.0% of all NCD deaths, and diabetes caused 4.0% of all NCD deaths. In recent years, home healthcare services have evolved as important end-user of these devices. Home healthcare offers long-term care at a comparatively lower cost than hospitals. The largest market segment of nursing and assisted living homes is in the U.S. and the U.K. In addition, countries like Japan and Sweden, where the average lifespan of the population is higher, also serve as major segments for assisted living homes.

These markets are therefore expected to be potentially important regions for the market of vital sign monitors. The COVID-19 pandemic also escalated the product demand as a continuous measurement of vital signs like temperature, respiration rate, pulse rate, etc. proved to be an efficient infection-detection system for people infected with the virus. The product usage for at-home settings and the demand for wearable monitoring devices have increased, keeping in mind the importance of patient-provider safety. When used in conjunction with predictive platforms, users of wearable devices could be alerted when changes in their metrics match those associated with COVID-19.

Moreover, the FDA also facilitated to expand of the availability and capability of patient monitoring devices due to the pandemic and stated that modified use of patient monitoring devices may increase access to important patient physiological data and facilitate patient management by healthcare providers while reducing the need for in-office or in-hospital services. Manufacturers like Nihon Kohden, Phillips, and Masimo have also reported an increase in the global sales of patient monitoring systems with an average of 30% during the pandemic. These aforementioned factors played a crucial role in increasing product demand during COVID-19.

Product Insights

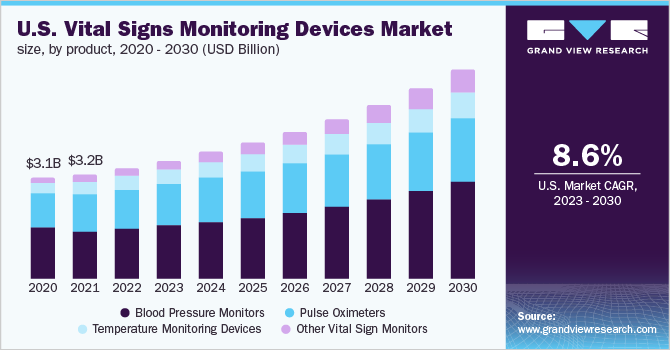

The blood pressure monitors (sphygmomanometers) segment held the largest share of more than 48.5% in 2022 and is also anticipated to grow at a healthy CAGR 9.3% from 2023 to 2030. This can be attributed to the increasing BP monitoring due to the rapidly rising prevalence of hypertension. In addition, with the increasing awareness, patients today are keeping an eye on blood pressure as a precautionary or preventive measure. This further led to an increase in demand for self-operational digital blood pressure monitors. The pulse oximeters segment also held a significant share in 2022.

The segmentis further categorized into table-top/bedside, fingertip, hand-held, wrist-worn, pediatric pulse oximeters, and their accessories. Fingertip pulse oximeters are likely to witness lucrative growth as these devices are portable and wireless, due to which they offer more patient compliance. Temperature monitoring devices are categorized into digital thermometers, mercury-filled thermometers, infrared thermometers, liquid crystal thermometers, and temperature monitoring device accessories. Due to mercury being hazardous to the environment and also to the patients in case of accidental breakage in the body cavity, there was innovation in this product segment to reduce the risk of mercury, giving rise to digital thermometers that could measure the temperature more accurately and safely.

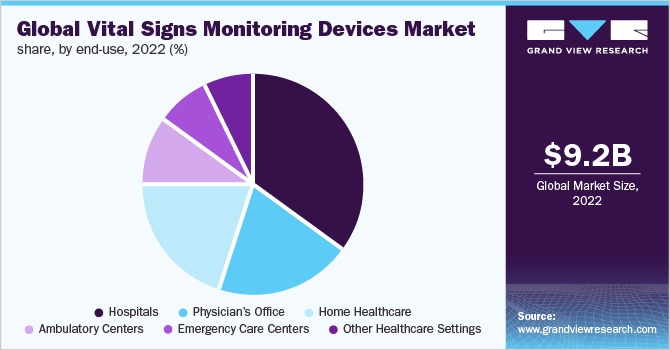

End-use Insights

The hospitals end-use segment accounted for the largest share of 35.4% in 2022 due to their large patient pool and greater financing capability for these devices. These devices can now be connected to a comprehensive platform through software wherein hospital staff can easily monitor patients’ vital signs in a single dashboard. Hospitals require all categories of vital sign monitors. They require these devices in large quantities as well, as vital sign monitors are required in each room, nurse’s station, operation theater, emergency room, outpatient clinics, and in the hospital’s ambulatory services.

The product demand for in-home healthcare settings is likely to increase as patients are preferring to take treatment and have a post-surgical recovery at home and avail long-term care. The option of home healthcare is cost-efficient compared to the hospital stay. In addition, developed regions, such as the U.S. and the U.K., have streamlined policies for the reimbursement of home healthcare medical devices including vital signs monitoring devices. Thus, as the disease burden of NCDs is increasing, there may be an increase in demand for these devices for the home healthcare sector.

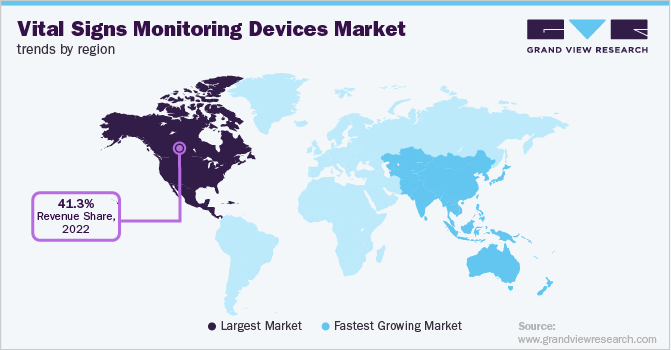

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest share of more than 41.3% of the overall revenue. The region is likely to expand further at a steady CAGR maintaining its leading position throughout the forecast period. The growing geriatric population, rising occurrences of interminable disorders, and developing interest in remote and wireless devices combined with streamlined coverage policies are the main considerations credited to its share. The region also has high awareness and access to healthcare services with strong reimbursement coverage for essential medical devices, thereby leading to high demand.

Europe, particularly the Western European nations, is projected to remain the second-most profitable region over the forecast period because of the higher death rate and rising demand for cost-efficient treatment. Asia Pacific is likely to register the fastest growth rate over the forecast period. This can be attributed to the extensive unmet needs in this region including primary healthcare, especially in developing markets, such as India and China. Moreover, the rising medical tourism and improving healthcare sectors in this region have a lot to offer the market players over the forecast period.

Key Companies & Market Share Insights

New product developments, collaborations, regional expansion, and mergers are key strategic initiatives undertaken by companies. For instance, in January 2021, Mindray launched its new VS 9 and VS 8 Vital Signs Monitors, which are now available in Europe, Australia, and other selected regions. Other key players are focused on partnerships and mergers that will allow them to introduce new products in different markets. In February 2021, Philips announced plans to acquire BioTelemetry, Inc. This acquisition is expected to aid Philips to increase its patient monitoring portfolio by adding BioTelemetry’s cardiac diagnostics and monitoring devices. Some of the prominent players in the global vital signs monitoring devices market include:

-

Koninklijke Philips N.V.

-

Medtronic

-

Nihon Kohden Corp.

-

GE Healthcare

-

Masimo

-

Omron Healthcare

-

Contec Medical Systems Co. Ltd.

-

A&D Company Ltd.

-

Nonin Medical Inc.

-

SunTech Medical, Inc.

Vital Signs Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.8 billion

Revenue forecast in 2030

USD 17.4 billion

Growth rate

CAGR of 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; Medtronic; Nihon Kohden Corporation; GE Healthcare; Masimo; Omron Healthcare; Contec Medical Systems Co. Ltd.; A&D Company Ltd.; Nonin Medical Inc.; SunTech Medical, Inc.; Spacelabs Healthcare, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vital Signs Monitoring Devices Market Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global vital signs monitoring devices market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Pressure Monitors

-

Aneroid Blood Pressure Monitors

-

Digital Blood Pressure Monitor

-

Ambulatory Blood Pressure Monitors

-

Blood Pressure Instrument Accessories

-

Instrument & Accessories

-

-

Pulse Oximeters

-

Table-top/Bedside Pulse Oximeters

-

Fingertip Pulse Oximeter

-

Hand-held Pulse Oximeters

-

Wrist-worn Pulse Oximeters

-

Pediatric Pulse Oximeters

-

Pulse Oximeter Accessories

-

-

Temperature Monitoring Devices

-

Mercury Filled Thermometers

-

Digital Thermometers

-

Infrared Thermometers

-

Liquid Crystal Thermometer

-

Temperature Monitoring Device Accessories

-

-

Other Vital Sign Monitors

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Physician’s Office

-

Home Healthcare

-

Ambulatory Centers

-

Emergency Care Centers

-

Other Healthcare Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vital signs monitoring devices market size was estimated at USD 9.3 billion in 2022 and is expected to reach USD 10.0 billion in 2023.

b. The global vital signs monitoring devices market is expected to grow at a compound annual growth rate of 9.4% from 2023 to 2030 to reach USD 18.8 billion by 2030.

b. North America dominated the vital signs monitoring devices market with a share of 41.3% in 2022. This is attributable to Expanding the base of the geriatric populace, rising occurrences of interminable disorders, and developing interest in remote and wireless devices combined with streamlined coverage policies.

b. Some key players operating in the vital signs monitoring devices market include Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, GE Healthcare, Masimo, Omron Healthcare, Contec Medical Systems Co. Ltd, A&D Company Ltd., Nonin Medical Inc., and SunTech Medical, Inc.

b. Key factors that are driving the vital signs monitoring devices market growth include increasing innovation, rising number of healthcare settings, increasing prevalence of chronic disorders, leading to needing of constant monitoring, and increasing need for home healthcare devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."