- Home

- »

- Consumer F&B

- »

-

Vitamin And Mineral Premixes Market Size Report, 2030GVR Report cover

![Vitamin And Mineral Premixes Market Size, Share & Trends Report]()

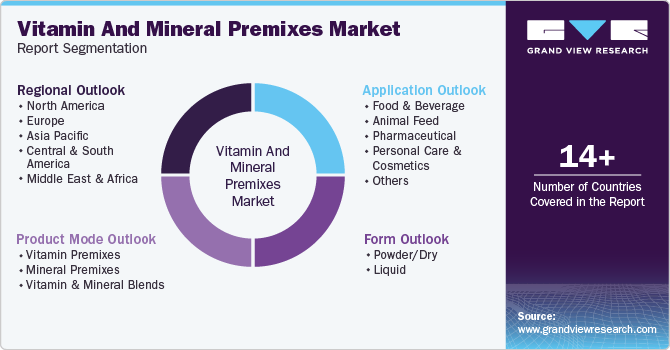

Vitamin And Mineral Premixes Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Pharmaceutical, Animal Feed), By Form (Powder/Dry, Liquid), By Product (Vitamin & Mineral Blends), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-494-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitamin And Mineral Premixes Market Summary

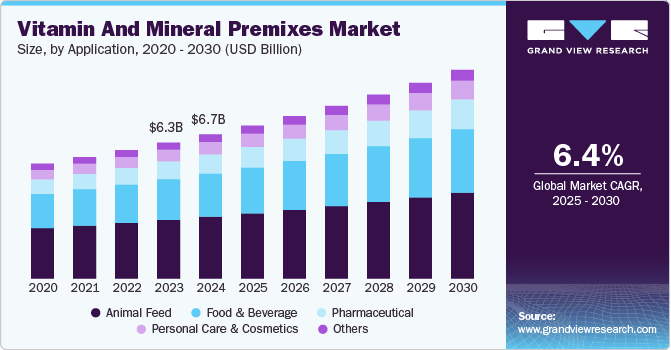

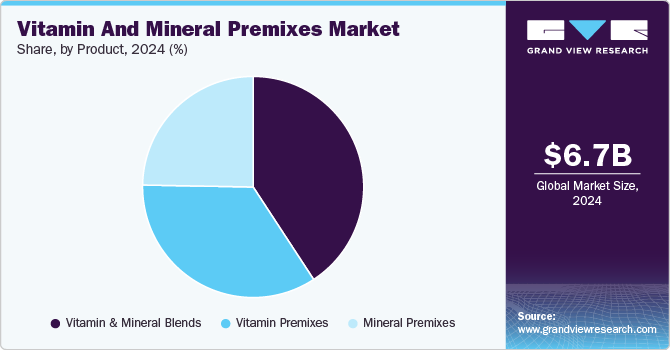

The global vitamin & mineral premixes market size was estimated at USD 6.72 billion in 2024 and is projected to reach USD 9.73 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The market is driven by rising health awareness, growing demand for fortified foods and beverages, and increasing focus on preventive healthcare.

Key Market Trends & Insights

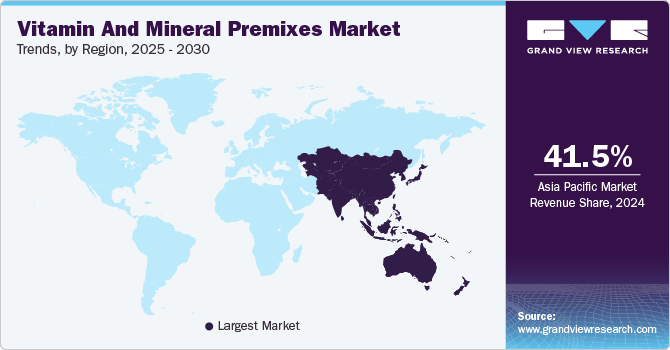

- The Asia Pacific accounted for a share of 41.48% of the global market in 2024.

- India is expected to register the highest CAGR from 2025 to 2030.

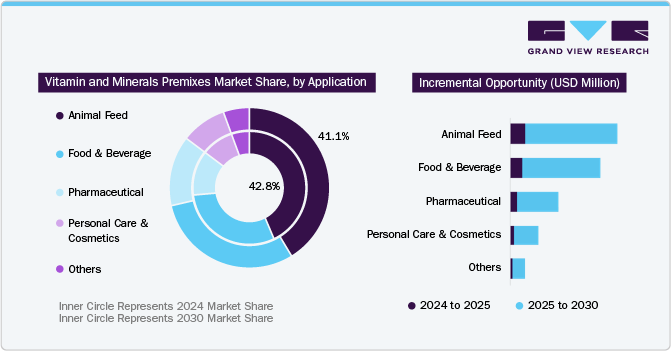

- By application, animal feed segment accounted for a 42.88% share of the global revenue in 2024.

- By form, powder/Dry segment accounted for a share of 75.16% in 2024.

- By product, vitamin and mineral blends segment accounted for a 40.78% share of global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.72 Billion

- 2030 Projected Market Size: USD 9.73 Billion

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

Consumers are seeking products that support immunity, energy, and overall wellness, prompting food, beverage, and supplement manufacturers to incorporate tailored premixes. Additionally, the aging population, changing lifestyles, and expanding pet nutrition and animal feed industries are further boosting demand for customized premix solutions worldwide.

The global vitamin and mineral premixes industry is witnessing significant growth, primarily driven by rising health awareness among consumers. With increasing focus on preventive healthcare, individuals are actively seeking products that enhance immunity, boost energy, and support overall well-being. This shift in consumer preferences is encouraging food, beverage, and supplement manufacturers to incorporate customized nutrient blends into their offerings, creating strong demand for vitamin and mineral premixes across multiple categories. According to a 2023 report by the International Food Information Council (IFIC), about 72% of consumers stated they actively look for foods that provide health benefits beyond simple nutrition.

Fortified foods and beverages are becoming mainstream, as they offer an easy and accessible way for consumers to meet their daily nutritional needs. This trend is particularly prominent in functional foods, sports nutrition, and ready-to-drink products. Manufacturers are leveraging premixes to ensure consistent nutrient delivery, simplify production, and meet specific health claims. The growing awareness of micronutrient deficiencies and personalized nutrition is further propelling the use of tailored premix solutions in product development.

Notably, two-thirds of U.S. adults seek foods and drinks fortified with vitamins and minerals, per The Hartman Group. This has led to increased use of tailored premix formulations across categories. For example, Kellogg’s Special K cereal includes a vitamin and mineral blend that delivers 100% of the Daily Value of essential nutrients like vitamins B6, B12, and E, along with iron, zinc, and folate-catering to consumers seeking functional benefits like energy and immunity. This widespread adoption of fortified foods reflects a structural demand shift, positioning vitamin and mineral premixes as essential inputs for innovation and health-centric product development.

The increasing global focus on preventive healthcare is another major factor propelling the growth of the vitamin and mineral premixes market. Micronutrient deficiencies remain a widespread issue-often referred to as “hidden hunger.” According to the World Health Organization (WHO), more than 2 billion people suffer from deficiencies in key nutrients such as iron, vitamin D, and folate. These deficiencies can lead to serious health conditions, including anemia, impaired immune function, and developmental disorders. For instance, the National Family Health Survey (NFHS-5) in India (2021) found that 59.1% of women aged 15-49 were anemic, highlighting the urgent need for fortified food products and supplements enriched with iron and folic acid.

The growing intensity of livestock and aquaculture production is a key driver of the vitamin and mineral premix market, as producers seek to optimize animal health, growth, and productivity. With rising global demand for meat, dairy, and eggs-especially in emerging markets-there’s increasing pressure on feed manufacturers to develop nutrient-dense, scientifically formulated feeds that improve feed conversion ratios and reduce disease risks.

Vitamin and mineral premixes are critical in supporting immune function, bone development, metabolism, and reproduction in animals, making them essential in modern animal feed and nutrition strategies. As intensive farming expands, premixes offer a cost-effective and reliable way to ensure consistent micronutrient delivery across large-scale operations.

Application Insights

Vitamin and mineral premixes for animal feed accounted for a 42.88% share of the global revenue in 2024, due to the growing demand for high-quality animal protein and the need to improve livestock health, productivity, and feed efficiency. As global consumption of meat, dairy, and eggs continues to rise, particularly in emerging markets, producers are investing in nutrient-dense, scientifically formulated feed to enhance animal growth, immunity, and reproductive performance. These premixes offer a cost-effective way to ensure consistent delivery of essential micronutrients, reduce disease risks, and optimize production outcomes, making them a critical component in modern animal nutrition strategies.

Industry players are actively expanding their presence. For instance, in September 2024, DSM-Firmenich, a prominent player in nutrition, health, and beauty, opened a new Animal Nutrition & Health premix and additives plant in Sadat City, Egypt. The facility aims to meet rising demand from mid- to large-scale livestock farms and feed millers across Egypt, the Middle East, Southern Europe, and Africa.

Vitamin and mineral premixes for the pharmaceutical market are expected to grow at a CAGR of 7.8% from 2025 to 2030. Vitamin and mineral premixes in the pharmaceutical market are expected to grow at a CAGR of 7.8% from 2025 to 2030, mainly due to rising cases of micronutrient deficiencies, growing demand for over-the-counter multivitamin supplements, and increased focus on preventive healthcare. According to The Lancet Global Health, over 5 billion people lack adequate intake of key micronutrients like iron, calcium, and vitamin E, prompting pharmaceutical companies to develop targeted formulations that address widespread nutritional gaps efficiently.

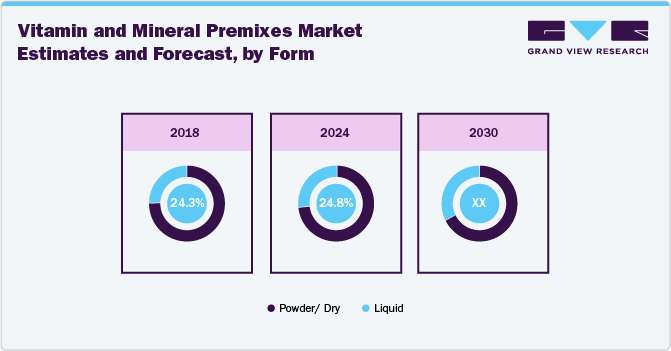

Form Insights

Powder/Dry vitamin and mineral premixes accounted for a share of 75.16% in 2024, owing to their superior stability, longer shelf life, cost-effectiveness, and ease of transport and storage compared to liquid forms. These premixes are widely preferred across food, beverage, pharmaceutical, and feed industries for their flexibility in blending, compatibility with various production processes, and ability to maintain nutrient integrity under high-heat or dry conditions. Their use in applications like bakery products, powdered beverages, infant formula, and animal feed further reinforces their leading position in the market.

Powder/Dry vitamin and mineral premixes are projected to grow at a CAGR of 6.8% from 2025 to 2030, due to their superior stability, longer shelf life, ease of storage, and compatibility with a wide range of manufacturing processes.

Food, beverage, supplement, and animal feed producers increasingly prefer dry premixes because they blend uniformly with bulk ingredients, support accurate nutrient dosing, and reducethe risk of contamination or degradation during production. Additionally, dry formats are more cost-effective in terms of transportation and handling, especially for large-scale operations.

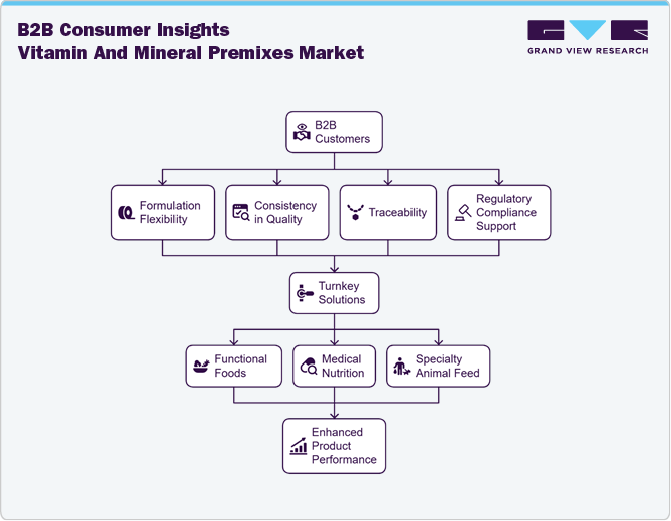

Product Insights

Vitamin and mineral blends accounted for a 40.78% share of global revenue in 2024, largely because B2B manufacturers prefer turnkey, pre-formulated solutions that streamline production and ensure formulation accuracy. These blends reduce R&D costs, minimize ingredient handling, and improve batch-to-batch consistency, critical in high-volume sectors like supplements, functional foods, beverages, and pharmaceuticals. Their flexibility also allows businesses to tailor products to specific health claims or regulatory standards across markets, making them a highly efficient and scalable option for manufacturers worldwide.

Vitamin premixes are expected to grow at a CAGR of 6.3% from 2025 to 2030. The demand is rising due to rising B2B demand for cost-effective, ready-to-use formulations that simplify the production of fortified foods, beverages, dietary supplements, and pharmaceuticals. Manufacturers are increasingly turning to premixes to meet consumer demand for products supporting immunity, energy, and overall wellness, especially in the wake of heightened health awareness post-COVID. Premixes also offer regulatory compliance, precise nutrient delivery, and production efficiency, making them a preferred solution in large-scale, health-focused product development.

Regional Insights

The Asia Pacific vitamin and mineral premixes market accounted for a share of 41.48% of the global market and held a market size of USD 2.79 billion in 2024, driven by rapid population growth, rising disposable incomes, and increased demand for fortified foods, supplements, and animal feed across countries like China, India, and Southeast Asia. The region’s expanding middle class and growing focus on preventive health have pushed manufacturers to incorporate premixes into consumer products, while large-scale livestock and aquaculture industries rely on nutrient-dense feed solutions to boost productivity, making Asia Pacific a key hub for B2B premix demand.

Europe Vitamin and Mineral Premixes Market Trends

The Europe vitamin and mineral premixes market is projected to grow at a CAGR of 5.4% from 2025 to 2030. The vitamin and mineral premixes market in Europe is experiencing rapid growth due to the region’s strong focus on health and wellness, which fuels demand for functional foods and dietary supplements. With an aging population, there is a rising need for products that support bone health, cognitive function, and immunity. In May 2022, SternVitamin GmbH & Co. KG launched individual micronutrient premixes at VitaFoods Europe, enabling the manufacturers to support the mental health and well-being of their customers.

North America Vitamin and Mineral Premixes Market Trends

The North America vitamin and mineral premixes market is projected to grow at a CAGR of 5.7% from 2025 to 2030. This can be attributed to the region's strong focus on health and wellness, as well as the growing demand for personalized nutrition. Consumers in the U.S. and Canada are increasingly seeking fortified foods and supplements that support specific health needs, such as immunity and energy. Additionally, the expansion of the sports nutrition industry, with a rising number of active consumers, is boosting the demand for premixes tailored to enhance athletic performance and recovery. The region’s well-established food and beverage industry further drives the adoption of premixes in both consumer and animal nutrition products.

The U.S. vitamin and mineral premixes industry demonstrates robust growth. The rising prevalence of chronic health issues and micronutrient deficiencies compels companies to integrate more vitamins and minerals into their offerings. The U.S. food and beverage sector and the growing sports nutrition market seek to differentiate themselves with specialized formulations, driving the need for customized premixes. Moreover, regulatory standards and consumer expectations for transparency and product quality are prompting B2B suppliers to provide higher-quality, compliant premixes that meet industry standards.

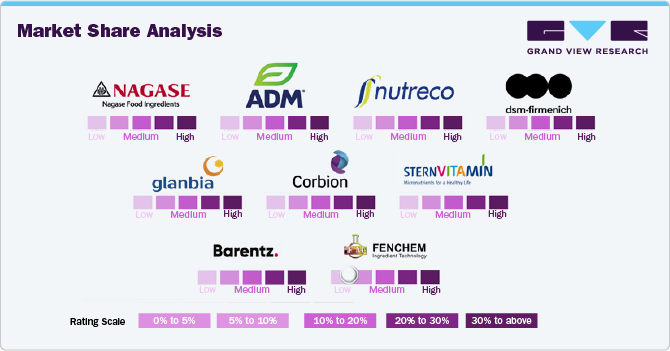

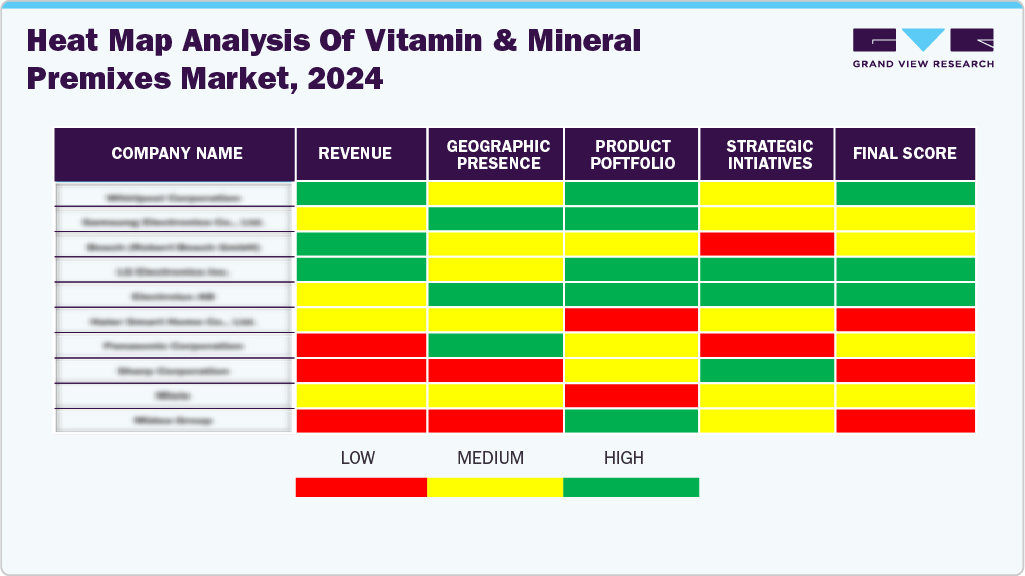

Key Vitamin And Mineral Premixes Company Insights

The vitamin and mineral premixes market is significantly competitive, driven by varying regional and cultural preferences, which lead brands and local producers to customize their offerings. As a highly innovative category, vitamin and mineral premixes see the constant introduction of new varieties, ingredients, and formulations to attract consumers, fueling the emergence of new products and brands and further contributing to market fragmentation. Manufacturers are expanding distribution, boosting brand visibility with strategic marketing, ensuring competitive pricing through efficient production, and adopting sustainable practices to attract eco-conscious consumers. Brand share analysis plays a crucial role in understanding market dynamics, helping businesses assess competitive positioning and identify growth opportunities.

Key Vitamin And Mineral Premixes Companies:

The following are the leading companies in the vitamin and mineral premixes market. These companies collectively hold the largest market share and dictate industry trends.

- NAGASE & CO., LTD.

- Archer Daniels Midland Company (ADM)

- Nutreco

- dsm-firmenich

- Glanbia PLC

- Corbion

- SternVitamin GmbH & Co. KG

- Barentz

- FENCHEM

- AMINO GmbH

Recent Developments

-

In November 2024, SternVitamin GmbH & Co. KG presented nutrient premixes for meal replacement products and snacks at Food Ingredients Europe (FiE), showcasing solutions for the global food and beverage and dietary supplements industries.

-

In July 2024, Barentz acquired Anshul Life Sciences, an Indian-based company, to strengthen its presence in India and create a leading life science distribution platform. With the acquisition, the company aims to unlock significant growth potential across the Asia Pacific region.

-

In November 2023, SternVitamin GmbH & Co. KG introduced 3 micronutrient premixes in Europe- SternCogni+ for enhancing cognitive performance, infused with vitamins B3, B6, B7, and B12; SternHolisticBeauty, to support intestinal immune system and promote skin health; and SternVitamin’s, infused with vitamins B & C and pantothenic acid, to reduce fatigue and enhance performance.

Vitamin And Mineral Premixes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.13 billion

Revenue forecast in 2030

USD 9.73 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, form, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; Australia; South Korea; Brazil; and South Africa

Key companies profiled

NAGASE & CO., LTD.; Archer Daniels Midland Company (ADM); Nutreco; dsm-firmenich; Glanbia PLC; Corbion; SternVitamin GmbH & Co. KG; Barentz; FENCHEM; AMINO GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vitamin And Mineral Premixes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vitamin and mineral premixes market report based on the application, form, product, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder/Dry

-

Liquid

-

-

Product Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin Premixes

-

Mineral Premixes

-

Vitamin & Mineral Blends

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vitamin and mineral premixes market was valued at USD 6.72 billion in 2024 and is expected to reach USD 7.13 billion in 2025.

b. The global vitamin and mineral premixes market is expected to grow at a CAGR of 6.4% from 2025 to 2030 to reach USD 9.73 billion by 2030.

b. Vitamin premixes was the most extensive product category for the market with revenue of USD 4.15 billion in 2024. The growth of the vitamin premixes market is significantly driven by rising health consciousness among consumers and an increasing demand for fortified foods and dietary supplements. As individuals become more aware of the importance of nutrition in maintaining overall health, there is a growing preference for products that provide essential vitamins and minerals.

b. Some key players operating in the vitamin and mineral premixes market include DSM; Glanbia Plc; Corbion; Vitablend Nederland BV; SternVitamin GmbH & Co. KG; ADM; Wright Enrichment Inc.; Nutreco; Farbest-Tallman Foods Corporation; Barentz; RITS Lifesciences Private Limited; Bioven Ingredients; NAGASE & CO., LTD.; AMINO GmbH; Jubilant Life Sciences

b. Consumer health and wellness awareness is a significant vitamin and mineral premixes market driver. As individuals become more conscious of their nutritional intake, a growing demand for fortified foods and dietary supplements enhances overall health. This trend is particularly pronounced in developed countries where consumers actively seek products to help prevent deficiencies and improve their well-being. The emphasis on preventive healthcare has increased interest in vitamin and mineral premixes, which offer a convenient way to ensure adequate nutrient intake.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.