- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Vitamin Supplements Market Size And Share Report, 2030GVR Report cover

![Vitamin Supplements Market Size, Share & Trends Report]()

Vitamin Supplements Market Size, Share & Trends Analysis Report By Type (Multivitamin, Vitamin A To K), By Form (Powder, Tablets, Capsules), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-386-7

- Number of Report Pages: 133

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Vitamin Supplements Market Size & Trends

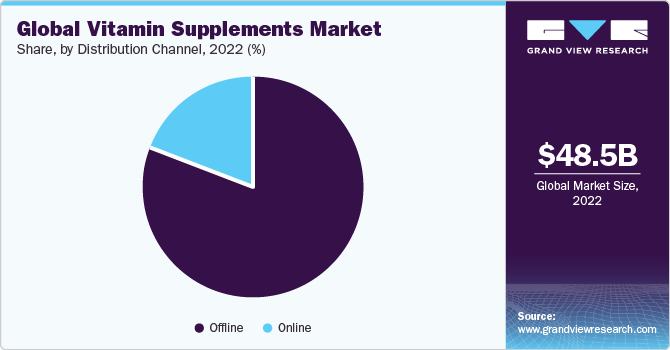

The global vitamin supplements market size was estimated at USD 48.51 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Increasing awareness among consumers regarding nutrition, health, and wellness is a key factor driving the vitamin supplements industry. Campaigns run by non-government organizations (NGOs), government agencies, and companies have heightened consumer awareness about the nutritional benefits of dietary supplements, including vitamin supplements, which is anticipated to propel market growth.

In March 2023, the U.S. Food and Drug Administration (FDA) launched a new webpage called the Dietary Supplement Ingredient Directory. This directory allows people to look up the ingredients used in dietary supplements and find information about the FDA's actions and communication regarding each ingredient. The directory aims to be a one-stop shop for ingredient information that was previously scattered across different FDA web pages.

In addition, product launches by large and small companies in recent years have included organic and natural ingredients, which has boosted interest in vitamin supplements. Apart from this, the use of attractive packaging methods has also led to increased consumer awareness, which, in turn, has triggered spending on such supplements. A large number of consumers are becoming health conscious and prefer products that comprise minimal synthetic chemicals. Increasing preference for healthy food and the willingness to pay a premium price for such products with better nutritional value, especially when buying products such as gummies and candies for children, are also important factors that propel the demand for vitamin supplements.

Both electronic and print media have been promoting the uptake of vitamin supplements, strongly influencing consumer purchasing behavior. Rising per capita healthcare expenditure has made people conscious of the increasing costs of obtaining proper medical care. This has resulted in the need to be more proactive toward chronic health problems, spurring the demand for vitamin supplements in essential ingredients. Moreover, the growing trend of personalized nutrition is expected to have a positive impact on product demand.

The shift of consumers from pharmaceutical products to nutraceutical products is further driving the global market. The nutraceutical industry is an evolving and dynamic sector, which offers novel opportunities to collaborate scientific discovery with growing consumer interest in health-enhancing supplements and foods. It tracks and monitors consumer trends and relationships with mass distributors. Thus, the products developed in this industry are a response to direct demand. It may be used to improve health, delay the aging process, prevent chronic diseases, increase life expectancy, and support the structuring and functioning of the body.

Growing awareness among consumers regarding health and wellness is resulting in the “prevention is better than cure” ideology. This has led to more consumers relying on nutraceuticals, functional foods, vitamins, and dietary supplements to lead healthy and disease-free lives. Nutraceuticals, in particular, have received immense focus in the recent past owing to their nutritional and pharmaceutical benefits, along with being safe for consumption without major side effects. This is expected to result in explosive growth of the nutraceutical market over the forecast period.

Nutraceuticals are quickly replacing pharmaceuticals in the management and prevention of chronic and acute health problems, and they have ample scope to flourish as therapeutic agents with curative and preventive properties. The global pharmaceutical market was worth over USD 516.48 billion in 2022 and is expected to grow at a moderate pace of 7.63% CAGR during 2023-2030. The growth rate comparison highlights the rapid growth potential of the nutraceutical market. The high cost of prescription pharmaceuticals and the reluctance of insurance companies to cover the cost of drugs have helped the nutraceuticals market solidify its presence globally. Increasing hospitalization costs are also driving consumers toward nutraceutical and health supplements.

Form Insights

Based on form, the tablet segment was valued at USD 20.30 billion in 2022 and is expected to grow at a CAGR of 7.1% over the forecast period. The demand for tablets is poised to experience growth over the forecast period, because of the use of high-quality excipients that enhance tablet absorption and disintegration. Tablets offer convenience, making them an ideal choice for individuals with busy lifestyles. Tablets can be precisely formulated to deliver accurate dosages, a critical factor for supplements requiring specific dosing for both efficacy and safety. While natural coatings may enhance dissolution, factors such as overall efficacy and quality also influence absorption rates.

Vitamin supplements in gummies form is expected to grow at a CAGR of 8.1% from 2023 to 2030. Gummies are chewy vitamin supplements enriched with essential nutrients, resembling candies in appearance and texture. Gummies have gained popularity across different demographics due to their easy consumption and appealing appearance. They also provide a substantial dose of essential vitamins and minerals necessary for overall health. Vitamin gummies, which play a crucial role in supporting metabolic health, regulating glycemic index, and increasing folic acid levels in the body, are likely to find favor among working individuals due to their convenience and ease of consumption.

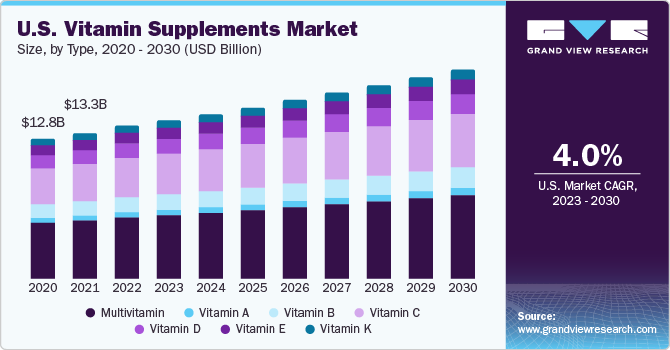

Type Insights

Based on type, the multivitamin supplements segment was valued at USD 21.70 billion in 2022 and is expected to grow at a CAGR of 7.5% over the forecast period. The growing adoption of preventive healthcare products for a healthier lifestyle and to reduce the risk of various illnesses has promoted the use of multivitamin supplements. Moreover, increased consumer awareness regarding the association between diet and health has fueled the demand for multivitamin supplements.

Multivitamin supplements are widely consumed by various groups, including working professionals and sports athletes. The National Institute for Health and Care Excellence (NICE) in the UK emphasizes that multivitamins and vitamin D are crucial for bone and muscle health, and they help boost the body's immune response to respiratory viruses. Therefore, the COVID-19 crisis boosted the consumption of multivitamin supplements as awareness of their benefits in supporting overall health and immunity grew.

The vitamin D supplements segment is expected to grow at a CAGR of 7.6% over the forecast period. Vitamin D helps the body absorb calcium, a vital component for maintaining strong and healthy bones. There are multiple forms of vitamin D, with vitamin D3 and vitamin D2 being the most common. While the primary source of vitamin D is exposure to sunlight, individuals living in regions with limited sunlight or those who spend most of their time indoors do not receive enough vitamin D. Consequently, they often rely on vitamin D supplements to maintain their health and overall well-being, contributing to the growing demand for vitamin D supplements.

Distribution Channel Insights

Offline distribution channels accounted for the largest market share of 80.7% in 2022 and are anticipated to grow with a CAGR of 7.0% over the forecast period from 2023 to 2030. Offline channels, encompassing hypermarkets, supermarkets, specialty stores, and pharmacies, play a pivotal role in offering consumers a diverse range of vitamin supplements. The continued growth and enhancement of the retail sector have become a driving force behind the increased sales of health and wellness products. These retail establishments feature a selection of global brands, contributing to the broader accessibility of various health products.

The sales through online channel is projected to grow at a CAGR of 8.1% from 2023 to 2030. Online channels are time-saving when compared to visiting physical stores, providing a convenient way to order required supplements directly from websites. Moreover, many online platforms offer free shipping and home delivery services, further enhancing their appeal to consumers. The increasing influence of social media and promotional efforts by brands on various social media platforms have also driven the growth of this segment. Brands are increasingly launching their products exclusively on e-commerce websites as a strategy to attract a broader consumer base.

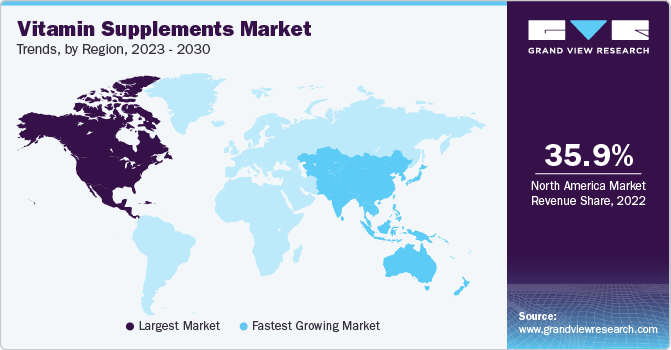

Regional Insights

North America accounted for a 35.9% share of the global revenue in 2022 and is expected to grow with a CAGR of 4.2% over the forecast period. The prevalence of obesity and lifestyle-related diseases has risen in North America. As a result, the general populace is opting for functional foods & supplements that provide a variety of health benefits above and beyond basic nutrition. The consumption of products such as fortified, enriched, and enhanced, along with nutritional supplements, as part of a varied diet regularly can have favorable influences on health. Multivitamins have emerged as a significant segment in the North American market owing to rising awareness about their benefits in overall health & bodily maintenance.

Asia Pacific region is expected to grow at a CAGR of 11.1% from 2023 to 2030. In Asia Pacific, the demand for vitamin supplements is expected to increase as key players adopt strategies such as introducing their brands to untapped economies of the Southeast Asian countries. Asia Pacific has the largest market for vitamin supplements in China, India, and Japan due to their large populations and high consumption levels. Countries such as Japan and Australia have experienced heightened awareness regarding the product's health benefits over the years, which is expected to strengthen regional growth over the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence. These steps include strategies such as partnerships, mergers & acquisitions, development & launch of new products, global expansions, redesigning their packaging, and others. In February 2023, Amway Corp. introduced a new range of nutrition supplements under its Nutrilite brand. The products, including gummies and jelly strips, are designed to meet the nutritional needs of busy millennials. The range includes supplements for overall health and immunity, bone health, and eye health.

In February 2023, Bayer AG announced the expansion of its "Nutrient Gap Initiative" to improve access to nutrition. It aims to expand access to essential vitamins and minerals to 50 million individuals in underserved communities by 2030. The program primarily emphasizes nutritional supplementation as a vital tool in establishing a robust defense against malnutrition within these populations. Similarly, in October 2022, Pfizer Inc. acquired Global Blood Therapeutics, Inc., a biopharmaceutical firm focused on pioneering treatments to transform the lives of underserved patient populations, particularly those affected by sickle cell disease (SCD). This acquisition underscores Pfizer's dedication to addressing SCD and further solidifies its extensive 30-year history in the field of rare hematology.

Key Vitamin Supplements Companies:

- Glanbia plc

- Pfizer Inc.

- Bayer AG

- Amway Corp.

- GlaxoSmithKline plc.

- Good Health New Zealand

- The Nature's Bounty Co.

- NOW Foods

- Abbott

- Herbalife Nutrition

- Nature's Sunshine Products, Inc.

- NU SKIN

- RBK Nutraceuticals Pty Ltd.

- American Health, Inc.

- Pharmavite

Vitamin Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 51.90 billion

Revenue Forecast in 2030

USD 84.95 billion

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form , distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; Chile; South Africa; UAE

Key companies profiled

Glanbia plc; Pfizer Inc.; Bayer AG; Amway Corp.; GlaxoSmithKline plc.; Good Health New Zealand; The Nature's Bounty Co.; NOW Foods; Abbott; Herbalife Nutrition; Nature's Sunshine Products, Inc.; NU SKIN; RBK Nutraceuticals Pty Ltd.; American Health, Inc.; Pharmavite

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

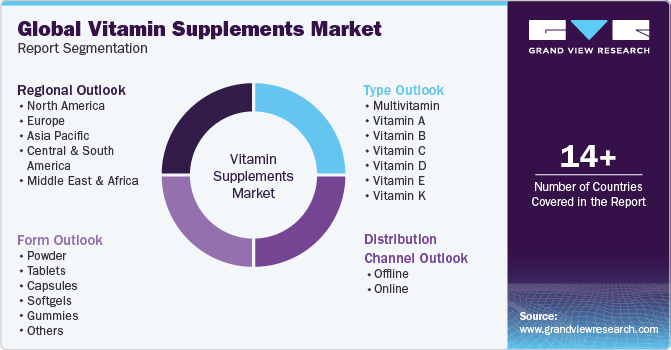

Global Vitamin Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vitamin supplements market report based on type, form, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

-

-

Form Outlook (Revenue, USD Billion, 2017 - 2030)

-

Powder

-

Tablets

-

Capsules

-

Softgels

-

Gummies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offline

-

Pharmacies & Drugstores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vitamin supplements market size was estimated at USD 48.51 billion in 2022 and is expected to reach USD 51.90 billion in 2023.

b. The global vitamin supplements market is expected to grow at a compounded growth rate of 7.3% from 2023 to 2030 to reach USD 84.95 billion by 2030.

b. North America dominated the global vitamin supplements market with a share of 35.9% in 2022. The prevalence of obesity and lifestyle-related diseases has risen in North America. As a result, the general populace is opting for functional foods & supplements that provide a variety of health benefits above and beyond basic nutrition.

b. Some key players operating in the vitamin supplements market include Glanbia plc, Pfizer Inc., Bayer AG, Amway Corp., GlaxoSmithKline plc., Good Health New Zealand, The Nature's Bounty Co., NOW Foods, Abbott, Herbalife Nutrition, Nature's Sunshine Products, Inc., NU SKIN, RBK Nutraceuticals Pty Ltd., American Health, Inc., and Pharmavite

b. Increasing consumer awareness among consumers regarding nutrition, health, and wellness is a key factor driving the vitamin supplements market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."