- Home

- »

- Plastics, Polymers & Resins

- »

-

Wafer Cases Market Size, Share And Growth Report, 2030GVR Report cover

![Wafer Cases Market Size, Share & Trends Report]()

Wafer Cases Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Stainless Steel, Polycarbonate, Polypropylene), By Application (Wafer Transport, Wafer Storage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-452-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wafer Cases Market Summary

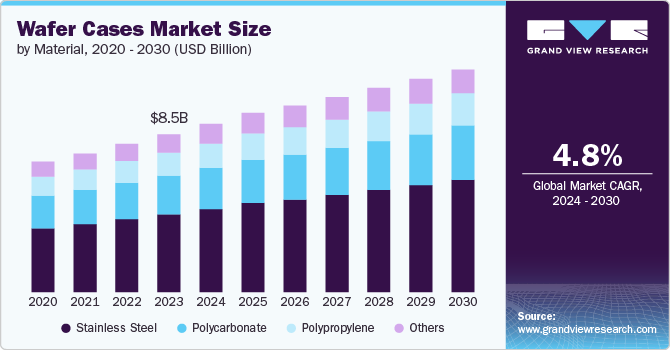

The global wafer cases market size was estimated at USD 8.54 billion in 2023 and is projected to reach USD 12.04 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. Primarily, the market is driven by the continuous growth and advancement of the semiconductor industry.

Key Market Trends & Insights

- Asia Pacific wafer cases market dominated and accounted for the largest revenue share of over 71.0% in 2023.

- China Wafer Cases market is primarily driven by its robust semiconductor industry and massive electronics manufacturing sector.

- By material, stainless steel segment dominated the market with a revenue market share of over 49.0% in 2023.

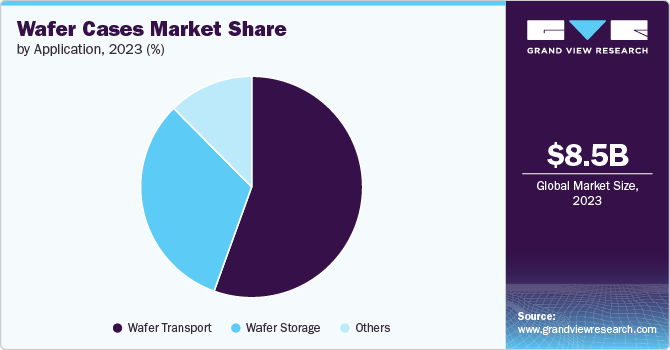

- By application, the wafer transport segment accounted for the largest revenue share of over 55.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.54 Billion

- 2030 Projected Market Size: USD 12.04 Billion

- CAGR (2024-2030): 4.8%

- Asia Pacific: Largest market in 2023

The increasing demand for electronic devices such as smartphones, computers, and IoT devices increases is creating the need for semiconductor wafers and their protective cases. Wafer cases play a crucial role in safeguarding these delicate components during transportation, storage, and handling processes. The rising adoption of 5G technology and artificial intelligence (AI) applications is significantly driving demand for advanced semiconductors, as these technologies require faster processing speeds, higher data capacities, and enhanced energy efficiency. 5G networks and AI-powered devices necessitate semiconductors with cutting-edge performance, such as those found in smaller node sizes and with more complex architectures. This surge in semiconductor production is fueling the wafer cases market, which plays a critical role in protecting fragile semiconductor wafers during transportation and storage.

Moreover, an increasing focus on quality control and contamination prevention in semiconductor manufacturing is triggering the growth of the wafer cases market. Wafer cases are designed to protect wafers from physical damage, electrostatic discharge, and environmental contaminants. As the semiconductor industry moves towards smaller node sizes and more complex chip designs, the need for high-quality, precision-engineered wafer cases becomes more critical. This trend is evident in the development of advanced materials and designs for wafer cases, such as those with anti-static properties or cleanroom-compatible construction.

Furthermore, the global network of semiconductor supply chains also contributes to the growth of the wafer cases market. As wafer production, chip manufacturing, and assembly often occur in different locations worldwide, the need for secure and efficient transportation solutions has surged on a global level. This has led to innovations in wafer case design, such as FOSB (Front Opening Shipping Box) and FOUP (Front Opening Unified Pod) systems, which offer better protection and compatibility with automated handling systems in fabrication facilities.

Material Insights

Stainless steel segment dominated the market with a revenue market share of over 49.0% in 2023 and is expected to witness robust growth with a CAGR of 5.1% over the forecast period. Stainless steel wafer cases are known for their durability, corrosion resistance, and ability to withstand high temperatures. They are widely used in industries requiring strict cleanliness and contamination control, such as semiconductor manufacturing and pharmaceutical production.

Furthermore, polycarbonate wafer cases offer excellent impact resistance, transparency, and lightweight properties. They are commonly used in applications where the visibility of contents is important, such as in research laboratories and electronic component storage.

Moreover, the adoption of polypropylene wafer cases is driven by their low cost, recyclability, and suitability for applications that don't require the high-performance characteristics of stainless steel or polycarbonate. The increasing focus on sustainable packaging solutions and the growth of small to medium-sized electronics manufacturers contribute to the demand for polypropylene cases.

Application Insights

The wafer transport segment dominated the application segment and accounted for the largest revenue share of over 55.0% in 2023. The increasing complexity and value of semiconductor wafers drive demand for specialized transportation cases. As chip manufacturing becomes more distributed across global supply chains, the need for secure long-distance wafer transport is growing significantly across the world. Additionally, the trend towards larger wafer sizes (e.g., 300mm and 450mm) requires new case designs to accommodate these dimensions while maintaining protection standards.

Wafer storage cases are used to safely store semiconductor wafers for extended periods, protecting them from environmental factors such as humidity, temperature fluctuations, and particulate contamination. These cases often feature hermetic sealing, moisture-absorbing materials, and precise climate control to maintain optimal storage conditions for the wafers. The increasing demand for long-term wafer storage solutions is driven by the need to maintain inventory flexibility in the semiconductor industry.

Regional Insights

North America, particularly the U.S., is a key driver in the wafer cases market due to its robust semiconductor industry and advanced technological infrastructure. The region consists of major semiconductor manufacturers and research facilities, such as Intel, AMD, and Texas Instruments, which consistently require high-quality wafer handling and storage solutions. The constant innovation and production in this sector create a steady demand for wafer cases to protect and transport delicate silicon wafers throughout the manufacturing process.

U.S. Wafer Cases Market Trends

Wafer cases market in the U.S. is growing due to the expanding semiconductor industry. Additionally, the U.S. government has been actively promoting domestic semiconductor production through initiatives such as the CHIPS Act. This legislation aims to boost American competitiveness in the semiconductor industry and reduce reliance on foreign suppliers. As a result, there's increased investment in new fabrication facilities and expansion of existing ones. Each new or expanded fabrication facilities requires a substantial number of wafer cases, further driving market growth in the country.

Asia Pacific Wafer Cases Market Trends

Asia Pacific wafer cases market dominated and accounted for the largest revenue share of over 71.0% in 2023. The rapid expansion of the semiconductor industry in countries such as China, Taiwan, South Korea, and Japan is fueling demand for wafer cases. These nations have become major hubs for chip manufacturing, with companies such as TSMC, Samsung, and SK Hynix leading the industry. As these firms increase their production capacity to meet global demand for electronic devices, hence, the need for high-quality wafer storage and transportation solutions is anticipated to grow proportionally, thus benefiting the wafer cases market.

China Wafer Cases market is primarily driven by its robust semiconductor industry and massive electronics manufacturing sector. As the world's largest producer of electronic devices, China requires a steady supply of wafer cases to protect and transport delicate semiconductor wafers during the manufacturing process. Major tech hubs such as Shenzhen, Shanghai, and Chengdu host numerous semiconductor fabrication plant and electronics assembly plants, which drives the demand for the wafer cases in the country.

Europe Wafer Cases Market Trends

Europe's strong focus on technological innovation and research & development contributes to the growth of the wafer cases market. Many European countries, such as Germany, France, and the Netherlands, have established technology hubs and research centers dedicated to advancing semiconductor technology. These initiatives often lead to the development of new, more advanced wafers that require specialized cases for handling and transportation, further boosting the demand for wafer cases in the region.

Germany wafer cases market focus on technological innovation and Industry 4.0 initiatives has further boosted the wafer cases demand for semiconductors, particularly in sectors such as automotive, telecommunications, and industrial automation. The country's automotive industry, known for brands such as BMW, Mercedes-Benz, and Volkswagen, is increasingly integrating advanced electronics and semiconductors in electric vehicles (EVs) and autonomous driving systems. This shift has accelerated the demand for semiconductor components, including the need for reliable wafer cases to ensure the safe handling of delicate wafers throughout the manufacturing process.

Key Wafer Cases Company Insights

The competitive environment of the wafer cases market is characterized by the presence of global and regional players, with companies competing based on product innovation and quality. Major players, including Entegris, and Shin-Etsu Chemical Co., Ltd., hold significant market shares due to their strong distribution networks, advanced manufacturing capabilities, and focus on offering highly durable and contamination-resistant wafer cases. Market leaders often invest in research and development to introduce wafer cases with enhanced protection features, catering to the growing demand in semiconductor manufacturing. Strategic partnerships, mergers, and acquisitions are also prevalent, as companies aim to expand their product portfolios and geographic presence.

Key Wafer Cases Companies:

The following are the leading companies in the wafer cases market. These companies collectively hold the largest market share and dictate industry trends.

- Entegris

- Shin-Etsu Polymer Co.,Ltd.

- MSE Supplies LLC

- H-Square Corporation

- Miraial Co.,Ltd.

- Palbam Class

- E-SUN

- 3S Korea

- Gudeng Precision

- Pozzetta

- Chung King Enterprise

Recent Developments

-

In June 2024, Shin-Etsu Chemical Co., Ltd., a major Japanese chemical company, announced the completion of its tender offer to acquire all shares of its affiliate Mimasu Semiconductor Industry Co.,Ltd. for approximately USD 431.0 million. The transaction increases Shin-Etsu's stake in Mimasu from the 43.87% to 100%. This strategic decision was intended to contribute significantly to the growth of its electronic materials business.

-

In December 2023, Entegris commenced the expansion of its Korea Technology Center (KTC) in Ansan-si, a city in South Korea, moving from its location in Suwon to the Hanyang University campus. This project aims to enhance collaboration with customers in the semiconductor sector. The expanded facility, covering 12,000 square meters, will serve as a center of excellence for various semiconductor processes and is designed to align with Entegris' sustainability goals, featuring a green roof and solar panels. The KTC is expected to be completed by late 2024, supporting Entegris' commitment to the local semiconductor industry.

Wafer Cases Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.11 billion

Revenue forecast in 2030

USD 12.04 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Entegris; Shin-Etsu Polymer Co.,Ltd.; MSE Supplies LLC; H-Square Corporation; Miraial Co.,Ltd.; Palbam Class; E-SUN; 3S Korea; Gudeng Precision; Pozzetta; Chung King Enterprise

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wafer Cases Market Report Segmentation

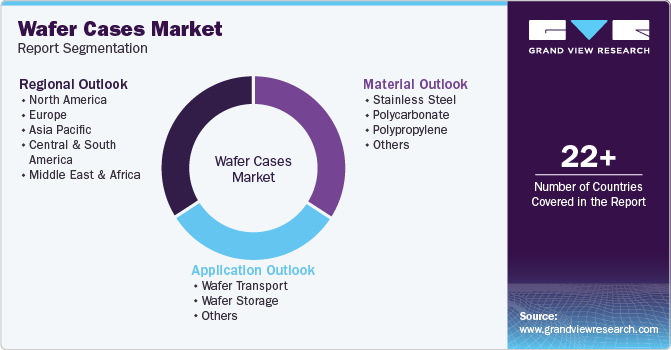

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wafer cases market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Polycarbonate

-

Polypropylene

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wafer Transport

-

Wafer Storage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key players in the market include Entegris, Shin-Etsu Polymer Co., Ltd., MSE Supplies LLC, H-Square Corporation, Miraial Co., Ltd.; Palbam Class; E-SUN; 3S Korea; Gudeng Precision; Pozzetta; and Chung King Enterprise.

b. The wafer cases market is primarily driven by the semiconductor industry's continuous growth and advancement. The increasing demand for electronic devices such as smartphones, computers, and IoT devices is creating the need for semiconductor wafers and their protective cases.

b. The global wafer cases market was estimated at USD 8.54 billion in 2023 and is expected to reach USD 9.11 billion in 2024.

b. The global wafer cases market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030, reaching around USD 12.04 billion by 2030.

b. Stainless steel dominated the overall market with a revenue market share of over 49.0% in 2023. Stainless steel wafer cases are known for their durability, corrosion resistance, and ability to withstand high temperatures. They are widely used in industries requiring strict cleanliness and contamination control, such as semiconductor manufacturing and pharmaceutical production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.